DNV GL, the leading technical adviser to the oil and gas industry, today published the first industry standard providing guidance on offshore personnel transfer by gangway. DNVGL-ST-0358 will contribute in documenting and securing safe operational performance of offshore gangway solutions and contribute to predictability and transparency within the industry.

DNV GL, the leading technical adviser to the oil and gas industry, today published the first industry standard providing guidance on offshore personnel transfer by gangway. DNVGL-ST-0358 will contribute in documenting and securing safe operational performance of offshore gangway solutions and contribute to predictability and transparency within the industry.

Offshore gangways are used as a bridge between two vessels or between a fixed object and a floating installation to transfer people, cargo or equipment. For offshore operations, offshore gangways provide a safe and cost effective alternative to personnel transfer by helicopter, basket transfer or boat landing.

The gangways can take many forms ranging from use for long duration personnel transfer between accommodation units and offshore production assets, to use for short duration transfer between service vessels and unmanned installations such as offshore wind turbines, offshore fish farms and similar installations.

“By addressing a complete set of requirement for materials, strength, safety and functionality as well as testing and recommended in-service follow-up, we have created a specific and dedicated standard to make gangway operation safer and more efficient,” says Per Arild Åland, Business Development, Offshore Classification, DNV GL – Maritime.

Until now, the ISO7061 standard from 1993 has partly served as a reference document by industry for offshore gangway applications despite only addressing ship-to-shore transfers. Next to the ISO07061, offshore gangways are also certified against man-riding crane standards. The limited relevance and lack of offshore specific requirements has driven the development for a dedicated offshore gangway standard providing in-depth and specific guidelines on offshore gangway operation.

In 2013, DNV GL gathered major industry players in a joint industry project to examine offshore gangway transfer operations. Experience gained through this W2W ("walk-to-work") project resulted in the publication of an industry guidance to assist offshore facility operators achieve safe and efficient personnel transfers to/from their facilities via a gangway system on a workboat, ship or semi-submersible.

The new standard, DNVGL- ST-0358, is the result of further development of this work and continuous DNV GL research. It covers the majority of gangway operations offshore including where there is controlled or uncontrolled people flow. The Standard for Certification of Offshore Gangways reflects the experience gathered on all relevant operating modes and will contribute to predictability and transparency, and at the same time help to reduce risk in personnel transport offshore.

“Finally we can base our work on a set of definite criteria. The industry has for some time needed a dedicated set of guidelines addressing the specifics of offshore personnel transfer through gangway solutions,“ says Christian Bernbo, Business Area Manager Gangway in Marine Aluminium, Norway.

“The new standard for offshore gangways is a welcome addition to DNV GL’s list of guidelines to improve quality, function and safety for offshore personnel. As a launching customer we believe this will be a crucial part in our development of the first compact mobile motion compensating gangway solution,” says Marcel van Meel, General Manager in L-bow Offshore Access Solutions BV, The Netherlands.

The new standard DNVGL-ST-0358 is launched today in a workshop at the London Offshore Accommodation Access conference, where leading industry experts gather to discuss practical guidance on ensuring safe and efficient crew transfer in difficult offshore environments.

Download the standard here.

Forum AMC wins multi-million dollars worth of new orders for its industry-leading rotational torque unit.

Forum AMC wins multi-million dollars worth of new orders for its industry-leading rotational torque unit. The 23,000-ton spar has been moored by nine Series III Ballgrab ball and taper mooring connectors attached to polyester mooring lines. The connector's male mandrels are manufactured in compliance with American Bureau of Shipping (ABS) 2009 Approval for specialist subsea mooring connectors.

The 23,000-ton spar has been moored by nine Series III Ballgrab ball and taper mooring connectors attached to polyester mooring lines. The connector's male mandrels are manufactured in compliance with American Bureau of Shipping (ABS) 2009 Approval for specialist subsea mooring connectors. Statoil

Statoil Freddy Gebhardt, Wild Well (left) and Mike Munro, NorSea Group (UK Wild Well Control’s WellCONTAINED System

Freddy Gebhardt, Wild Well (left) and Mike Munro, NorSea Group (UK Wild Well Control’s WellCONTAINED System Marred by corruption and market turmoil, Petrobras, the operator of key pre-salt projects for Brazil’s oil production over the next five years, is one of many Brazilian oil and gas companies facing a difficult financial future in the short term, according to an analyst with research and consulting firm

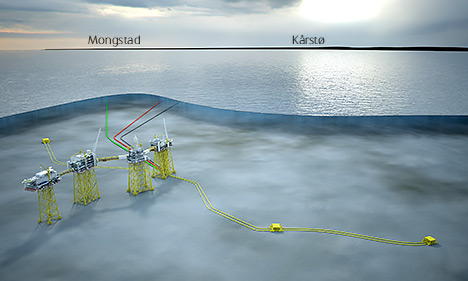

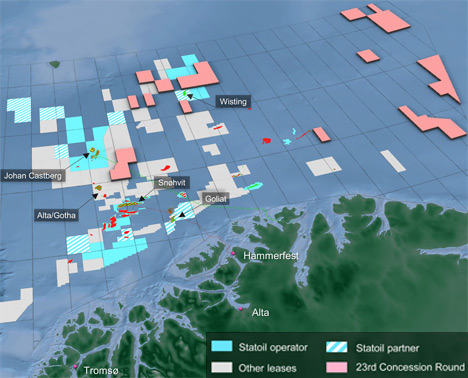

Marred by corruption and market turmoil, Petrobras, the operator of key pre-salt projects for Brazil’s oil production over the next five years, is one of many Brazilian oil and gas companies facing a difficult financial future in the short term, according to an analyst with research and consulting firm  The main supplier agreement lasts for six years, with a four-year option for extension. It covers the following licences and installations:

The main supplier agreement lasts for six years, with a four-year option for extension. It covers the following licences and installations:

Statoil

Statoil

DNV GL

DNV GL The Bureau of Safety and Environmental Enforcement (BSEE) has announced that offshore oil and gas lessees and owners of operating rights are now required to submit summaries of their actual expenditures for the decommissioning of wells, platforms and other facilities on the Outer Continental Shelf (OCS) as part of the final Decommissioning Costs Rule.

The Bureau of Safety and Environmental Enforcement (BSEE) has announced that offshore oil and gas lessees and owners of operating rights are now required to submit summaries of their actual expenditures for the decommissioning of wells, platforms and other facilities on the Outer Continental Shelf (OCS) as part of the final Decommissioning Costs Rule. Leading classification society

Leading classification society  Maintenance work on the Norne FPSO. (Photo: Rune Solheim)

Maintenance work on the Norne FPSO. (Photo: Rune Solheim)  Anadarko Petroleum Corporation

Anadarko Petroleum Corporation Pipeline development projects are becoming increasingly complex, spanning longer and deeper terrains. Pipelines must operate at higher pressures and temperatures, in harsher environments and to stricter regulatory requirements. Projects must also be feasible in a cost-constrained market. DNV GL is inviting industry players to take part in two Joint Industry Projects (JIP) to help the industry work more efficiently while maintaining safety.

Pipeline development projects are becoming increasingly complex, spanning longer and deeper terrains. Pipelines must operate at higher pressures and temperatures, in harsher environments and to stricter regulatory requirements. Projects must also be feasible in a cost-constrained market. DNV GL is inviting industry players to take part in two Joint Industry Projects (JIP) to help the industry work more efficiently while maintaining safety. By Julia Schweitzer

By Julia Schweitzer