Key findings from this year’s Oil and Gas UK activity survey state that the annual average expected spend on decommissioning on the UK Continental Shelf (UKCS) over the second half of the decade has increased to £1.8billion from £1.5billion. With the low oil price, rising costs and ageing infrastructure, the huge task of removing redundant installations from the North Sea is gathering momentum.

With the pace of decommissioning activity accelerating, Mark Walker, Client Partner at Optimus Seventh Generation, a behavioral change consultancy, discusses the vital need for leadership to help ensure projects are as safe as possible.

With the pace of decommissioning activity accelerating, Mark Walker, Client Partner at Optimus Seventh Generation, a behavioral change consultancy, discusses the vital need for leadership to help ensure projects are as safe as possible.

With over 600 offshore oil and gas installations in the North Sea, of various sizes, and more than 10,000km of pipelines, wells and accumulations of drill cuttings, the biggest concern is how the infrastructure can be removed in a safe and cost effective manner.

In high hazard industries, and specifically the energy sector, we talk about safety culture and understand the importance of it but do not always understand how we can assess it and, therefore, how we can improve it.

Optimus Seventh Generation has developed an approach to safety culture assessment, drawing upon High Reliability Organisation (HRO) principles, seeking a diagnostic as a means of providing the assurance that things are as they should be. They ask the diagnostic to identify the most significant safety issues confronting the organization or site, gathering evidence of safety culture by a combination of observation and audit of work products and perception-based surveys and interviews.

The diagnostic seeks to establish the aspects of resilience that are present, i.e:

- The ability of the business to stop something bad from happening

- The ability to stop something bad becoming worse

- The ability to recover something bad once it has happened

Resilience is assured not just by the behaviors of people but also by the consistent application of processes and procedures as well as the functionality of safety critical equipment.

The diagnostic is also looking for what barriers there are and how many are in place, with the use of personal protective equipment (PPE) at one end of the scale as the weakest defence and the elimination of hazards at the other end of the scale as the strongest. Between these we would hope to see others that give the business the ability to detect hazards by fixed detection systems, hazard spotting and management processes, adequate planning and active monitoring.

The glue that would hold all of the above together is the leadership.

Many operators are seeking less expensive alternatives to deliver decommissioning work, but want to ensure that safety remains a priority. However there are needs to be the acknowledgement that there may be gaps in their safety culture that should be addressed to deliver successful, safe projects. Optimus Seventh Generation imparts the skills and capabilities to deliver incident-free projects by motivating the workforce to follow the rules and to intervene, while educating leaders so they understand the influence they have over their teams.

When we deploy our leadership and workplace safety coaches in the field, our clients and their workforce often ask; what does an authentic leader look like? How will we know them when we see them? Our coaches encourage our clients to turn that statement around and ask; what do followers want? One of the principal roles of a leader is to create an engaged workforce or, more simply expressed, to create followers. Without an engaged workforce, there is no relationship and no leadership.

At Optimus Seventh Generation, we have recognized that this poses challenges for our industry - to incorporate authenticity as an assessment criterion for our current and future leaders during selection and to re-design our leadership training to establish authenticity as an outcome of such programs.

Working with safety leaders in individual companies or in our open course – Leading Safety Performance ™ – we have witnessed many “light bulb moments” when leaders have realised what skills they require to be authentic and have left with a strong desire to be that authentic person and to lead based on their values.

It is clear that those organisations whose culture is underpinned by strong values will create a workforce willing to engage with new safety processes and will therefore be best equipped to protect both their people and their assets. If these values have been socialised within the business and are used by leaders at all levels in an authentic manner then the safety culture in our industry will create the resilience it needs.

Case Study

In May 2015, Optimus Seventh Generation was awarded its first decommissioning contract with a major North Sea operator to supply induction training, through its program Induction Plus™ and back to back health and safety advisors to support the safe decommissioning of a floating production, storage and offloading vessel in the North Sea.

When embedded by the presence of Optimus safety advisers, Induction Plus™ helps influence the decision-making of all involved, ensuring rules are being followed and incident-free projects are being delivered.

The four-hour induction is aimed at projects experiencing a large influx of new, often subcontracted, labour during decommissioning and construction projects or shutdowns. It educates the attendees on the company’s expectations with respect to compliance with the company’s safety rules, alongside a motivational element to engage the project team with ‘why’ compliance is important and how they can raise their awareness of the hazards specific to the asset.

Optimus worked with leaders to educate them with the understanding that their decision making is key in the project’s success, increasing workforce engagement, which helps ensure that the work force remained focused and motivated creating a safe environment.

The work scope is based in the North Sea, where fields continue to provide opportunity in the current climate with collaboration being key between operators, the supply chain and, more pertinent than ever right now, specialist safety professionals.

This is an exciting project for the team, and the North Sea operator will be able to take advantage of Optimus Seventh Generations’ 12 years’ of providing specialists safety support services to the energy sector to decommission the floating production, storage and offloading vessel, in a safe and environmentally responsible way.

The compressor module before departure from Thailand. (Photo: Aibel)

The compressor module before departure from Thailand. (Photo: Aibel) Leading engineered servicing company for wellbore clean up and abandonment,

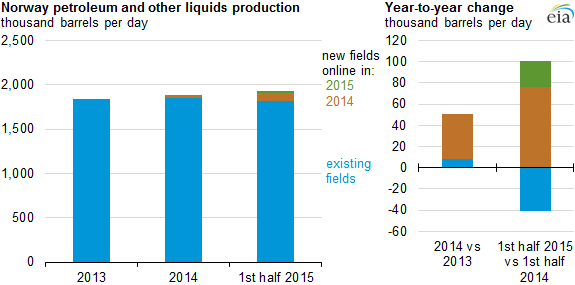

Leading engineered servicing company for wellbore clean up and abandonment,  Source: U.S. Energy Information Administration, based on Norwegian

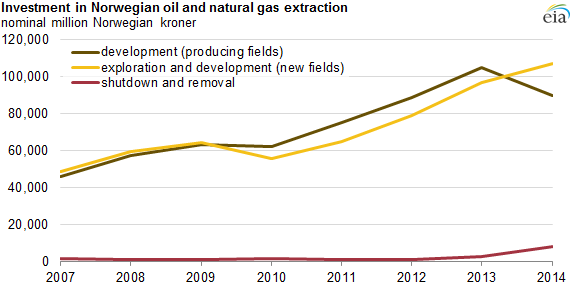

Source: U.S. Energy Information Administration, based on Norwegian  Source: U.S. Energy Information Administration, based on Statistics Norway

Source: U.S. Energy Information Administration, based on Statistics Norway  McDermott has been awarded a sizeable brownfield offshore project by Qatar Petroleum for the engineering, procurement, construction and installation (EPCI) of four wellhead jackets, similar to this file photograph. (Photo: Business Wire)

McDermott has been awarded a sizeable brownfield offshore project by Qatar Petroleum for the engineering, procurement, construction and installation (EPCI) of four wellhead jackets, similar to this file photograph. (Photo: Business Wire)  AOG Flowlines ready for shipment to a customer

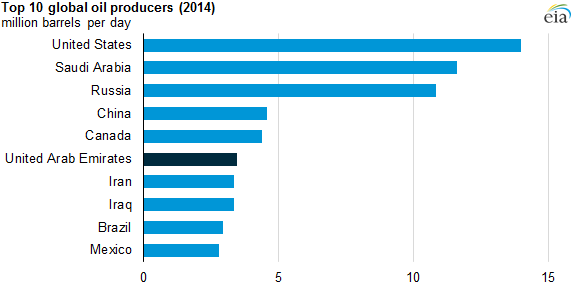

AOG Flowlines ready for shipment to a customer  Source: U.S. Energy Information Administration, International Energy Statistics

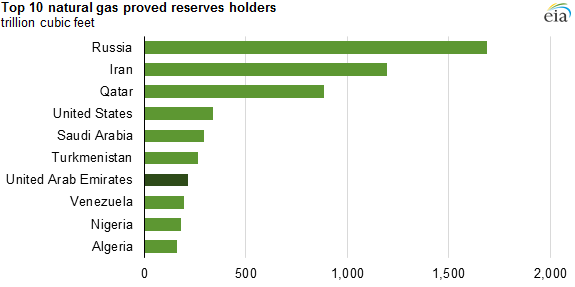

Source: U.S. Energy Information Administration, International Energy Statistics  Source: U.S. Energy Information Administration, International Energy Statistics

Source: U.S. Energy Information Administration, International Energy Statistics  DNV GL

DNV GL Claxton,

Claxton,  The Bureau of Safety and Environmental Enforcement (BSEE)

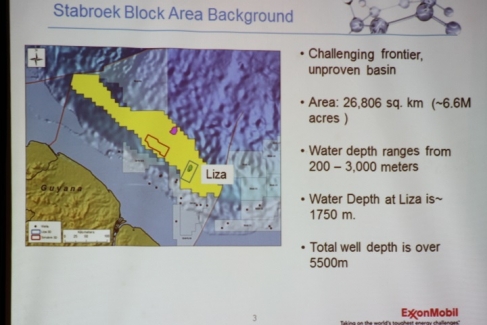

The Bureau of Safety and Environmental Enforcement (BSEE) With ExxonMobil reported to be moving the Liza discovery in deepwater Guyana into pre-Front-End Engineering Design (FEED) less than five months after confirming the find, the project has the potential to yield significant returns for investors, according to analysts with research and consulting firm GlobalData.

With ExxonMobil reported to be moving the Liza discovery in deepwater Guyana into pre-Front-End Engineering Design (FEED) less than five months after confirming the find, the project has the potential to yield significant returns for investors, according to analysts with research and consulting firm GlobalData. With the pace of decommissioning activity accelerating, Mark Walker, Client Partner at Optimus Seventh Generation, a behavioral change consultancy, discusses the vital need for leadership to help ensure projects are as safe as possible.

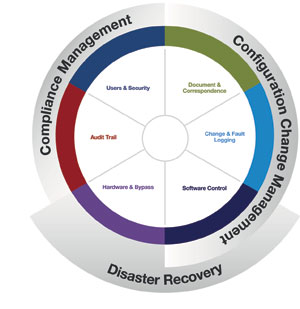

With the pace of decommissioning activity accelerating, Mark Walker, Client Partner at Optimus Seventh Generation, a behavioral change consultancy, discusses the vital need for leadership to help ensure projects are as safe as possible.  Asset Guardian Solutions Ltd (AGSL)

Asset Guardian Solutions Ltd (AGSL) The unmanned wellhead platform Tambar (BP) in the North Sea.

(Photo: BP)

The unmanned wellhead platform Tambar (BP) in the North Sea.

(Photo: BP)  The

The

On behalf of the Johan Sverdrup license,

On behalf of the Johan Sverdrup license,