The UK subsea sector will have the opportunity to further bolster its international profile next month at the largest oil and gas exhibition in Australasia.

The UK subsea sector will have the opportunity to further bolster its international profile next month at the largest oil and gas exhibition in Australasia.

Industry body, Subsea UK, will be seeking to establish stronger links between Australian and British businesses to exploit the significant oil and gas developments at this year’s Australasian Oil & Gas Exhibition and Conference (AOG). The event, which takes place from 24-26 February 2016, will explore how new technology and better cooperation will help to drive the industry forward.

Celebrating its 35th year, AOG 2016 will have ‘collaboration’ as its theme, with over 100 experts from leading companies providing input on how industry, government and key stakeholders should continue to work closely together to reduce costs and improve productivity.

With a string of world class Australian LNG projects making the transition from the construction to operational phase, the UK subsea sector is well positioned to support province in meeting its target to become the world’s leading exporter of LNG by 2018.

Under the Subsea UK banner, two British companies, Schoolhill Hydraulic Engineering and James Fisher Excavation will get the chance to showcase their products and services to oil and gas companies, service providers, engineers, technical professionals and suppliers.

Subsea UK is once again supporting the Subsea Australasia Conference at the event, which will include a session chaired by Neil Gordon, chief executive of Subsea UK, on innovation, field development and the changing outlook for the global subsea sector.

Mr. Gordon commented: “Australia boasts an outstanding economic track record. As the fifth largest economy in the Asia-Pacific region, and the 13th largest economy in the world, the country is viewed as a dynamic and stable market which presents a pool of opportunities for the UK subsea sector.

“A recent report from the International Energy Agency (IEA) revealed that Australia and the Asia Pacific region have much to be positive about in the longer term, with LNG projects predicted to create thousands of jobs, export income and new revenues.

“It’s important that UK companies take full advantage of these opportunities, casting their nets further than the North Sea to explore ways of exporting their technology and expertise. As the industry body for the UK subsea sector, we will be representing all 320 of our members at the event and looking at ways in which we can help them break into the Australasian market.”

Expected to attract over 500 exhibiting companies from 25 countries, the conference is the largest event of its kind in the southern hemisphere and offers delegates an opportunity to debate key issues, encourage new ways of thinking and explore future subsea developments.

Each year, the conference highlights and defines the issues and challenges of subsea exploration and development on a national and international level. The 2016 conference program will include international keynote presentations, case study presentations, technical updates, one-to-one meetings and panel discussions over the three-day event.

“UK companies have the skills, technology and experience to meet demand for subsea expertise in the Americas, Africa and, increasingly, in the Asia Pacific region. Working in partnership with UKTI, Subsea UK is leading the delegation to AOG to showcase British subsea excellence,” Mr. Gordon added.

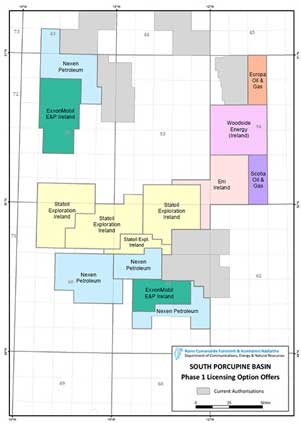

Statoil Exploration (Ireland) Limited has been awarded six Licensing Options in Ireland’s 2015 Atlantic Margin Licensing Round.

Statoil Exploration (Ireland) Limited has been awarded six Licensing Options in Ireland’s 2015 Atlantic Margin Licensing Round. Magne Viking, care of Viking Supply Ships.

Magne Viking, care of Viking Supply Ships. President Obama’s fiscal year (FY) 2017 budget request for the Bureau of Safety and Environmental Enforcement (BSEE) provides critically needed resources to further strengthen BSEE’s regulatory and oversight capabilities for oil, natural gas and renewable energy development on the U.S. Outer Continental Shelf, promoting a culture of safety and environmental protection by ensuring compliance with Federal regulations.

President Obama’s fiscal year (FY) 2017 budget request for the Bureau of Safety and Environmental Enforcement (BSEE) provides critically needed resources to further strengthen BSEE’s regulatory and oversight capabilities for oil, natural gas and renewable energy development on the U.S. Outer Continental Shelf, promoting a culture of safety and environmental protection by ensuring compliance with Federal regulations. Image courtesy: Technip

Image courtesy: Technip International manufacturer

International manufacturer  Photo credit: BOEM

Photo credit: BOEM Aker Solutions

Aker Solutions Bibby Offshore

Bibby Offshore GE Oil & Gas has signed a Master Service Agreement with Statoil for new subsea projects that will enable GE to continue to support the international energy company’s value creation in a low oil price environment.

GE Oil & Gas has signed a Master Service Agreement with Statoil for new subsea projects that will enable GE to continue to support the international energy company’s value creation in a low oil price environment. Statoil

Statoil The UK subsea sector will have the opportunity to further bolster its international profile next month at the largest oil and gas exhibition in Australasia.

The UK subsea sector will have the opportunity to further bolster its international profile next month at the largest oil and gas exhibition in Australasia. Offshore installation activities will take place from Fugro’s multi-role construction vessel, the Southern Ocean

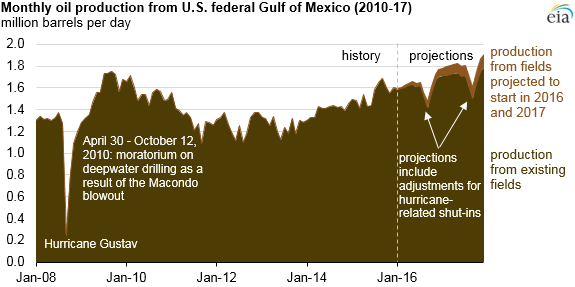

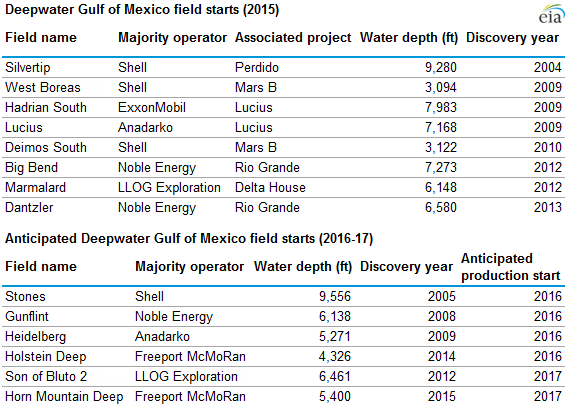

Offshore installation activities will take place from Fugro’s multi-role construction vessel, the Southern Ocean U.S. Gulf of Mexico (GOM) crude oil production is estimated to increase to record high levels in 2017, even as oil prices remain low. EIA projects GOM production will average 1.63 million barrels per day (b/d) in 2016 and 1.79 million b/d in 2017, reaching 1.91 million b/d in December 2017. GOM production is expected to account for 18% and 21% of total forecast U.S. crude oil production in 2016 and 2017, respectively.

U.S. Gulf of Mexico (GOM) crude oil production is estimated to increase to record high levels in 2017, even as oil prices remain low. EIA projects GOM production will average 1.63 million barrels per day (b/d) in 2016 and 1.79 million b/d in 2017, reaching 1.91 million b/d in December 2017. GOM production is expected to account for 18% and 21% of total forecast U.S. crude oil production in 2016 and 2017, respectively. Source: U.S. Energy Information Administration,

Source: U.S. Energy Information Administration,  Source: EIA

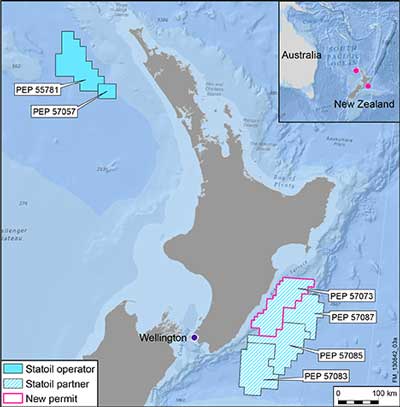

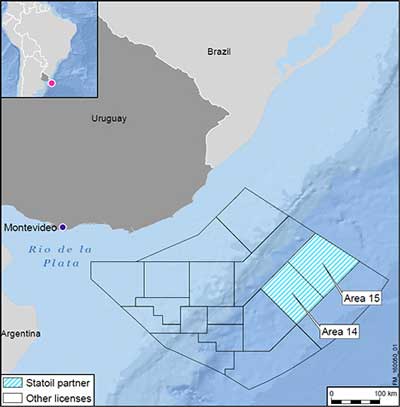

Source: EIA Map Image : Courtesy Statoil

Map Image : Courtesy Statoil Diamond Offshore Drilling, Inc.

Diamond Offshore Drilling, Inc. "To deliver a solution that improves drilling efficiency now and in the future, collaboration is essential," said Lorenzo Simonelli, President and CEO, GE Oil & Gas. "We are changing the game by building the new blowout preventer service model for the industry. With improved control, maintenance and servicing of our equipment, we are putting skin in the game and guaranteeing performance."

"To deliver a solution that improves drilling efficiency now and in the future, collaboration is essential," said Lorenzo Simonelli, President and CEO, GE Oil & Gas. "We are changing the game by building the new blowout preventer service model for the industry. With improved control, maintenance and servicing of our equipment, we are putting skin in the game and guaranteeing performance." Wood Group

Wood Group