Despite a recent oil price around the $45 per barrel range, Barclays Corporate Banking has predicted a rise to $50 by the end of 2015 and a further increase to $60 in 2016.

Despite a recent oil price around the $45 per barrel range, Barclays Corporate Banking has predicted a rise to $50 by the end of 2015 and a further increase to $60 in 2016.

The topic was discussed at a recent event hosted by the bank’s corporate FX team which invited influential industry professionals to discuss the current challenging market. The bank predicts that the expected increase in oil price will be spurred on by a sustained doubling of growth in global demand of up to four million barrels per day.

The group gathered by Barclays Corporate Banking considered the future of the North Sea which found that while the general short-term picture for the region may appear stormy, there are growing signs of hope on the horizon, which may trigger an eagerly anticipated recovery.

The group started by discussing the significant differences between the oil crash of the mid-1980’s to that of 2014/15. During the earlier period, OPEC’s spare capacity was between 14% and 16% of global oil demand, which meant it was in a much stronger position to influence supply. Today, OPEC’s spare capacity stands at less than 4%. While Saudi Arabia is producing close to record levels, it is not expected that the Saudis would break the 11 million barrels per day barrier, which creates a limitation on the amount of oil OPEC can produce, and therefore the influence it ultimately has.

Since OPEC decided against reducing production in November 2014, global oil demand has recovered strongly, unlike in the 1980s. Since then, global demand growth rate has tripled to 2.1 million barrels per day, due mainly to the elasticity in price and consumer reaction to price. It was explained that the industrial sector has played little part in this demand growth; the drive has come from the end consumer.

However, the positive story of a tripling in demand growth has been overshadowed by the extent of the increase in the oil supply with OPEC production up at 32 million barrels per day. Barclays forecasts that the excess supply situation will continue throughout 2015 with Saudi Arabia producing close to record levels at 10.3 – 10.4 million barrels per day, while Iraq continues to be a strong supplier.

The recently lifted Iran sanctions could also affect supply, as the country is now open to the international oil and gas industry. However the event heard that increased production activity in Iran is unlikely to stat until Spring 2016 or later as the region still has 45 million barrels of oil in tankers which will be releases first. Only after that time will the country boost global supply through new production.

The US shale industry, with its lower cost base and rapid set up characteristics, has taken over from Saudi Arabia as the new swing producer. The sector is very reactive to the price of oil and can adjust its production reasonably quickly. Despite initial resilience, Barclays anticipates a significant reduction in the supply of US shale in the fourth quarter of 2015 as well as the first half of 2016. This is where we can expect the industry to see the real battle between global supply and demand take place.

The event heard that a combination of these factors means that even with a low commodity price, a surplus of oil has continued to build despite the rapidly growing demand. Barclays’ data supports the view that demand has been under quoted despite in excess of a two million barrel per day growth in 2015. The bank forecasts per day increase in demand in 2016, making an estimated overall increase of four million barrels per day since the beginning of 2015.

The group also heard how the bedrock of a stable oil and gas industry is the need for a strong US dollar, and the currency remains the global outperformer. Barclays expects the greenback to overtake in the coming financial quarters owing to the US economy’s better return to capital, safety characteristics and superior growth outlook.

In the next year, the industry will see a draw down in oil supplies, which Barclays predicts will result in an average oil price of $60 per barrel. This price level is expected to incentivise the appropriate amount of US shale supply to grow: if the sector experiences negative growth it will leave the market very tight, but production levels will most likely reduce from one million barrels per day to 200,000 – 300,000 barrels a day growth rate.

A higher commodity price, for example of $70 a barrel, would trigger a further increase in the amount of shale supply into the market and would once again tip the balance towards over production.

Walter Cumming, head of oil and gas at Barclays Corporate Banking commented: “There is no doubt that the UK North Sea oil and gas industry is under pressure right now but we do feel that signs of relief are there, and the forecast for $60 oil in 2016 with oil demand growth above trend again is encouraging.

“In the difficult market we are operating in today, it was a very valuable experience to get such a wide variety of industry experts together to discuss the issues that matter most to our customers and ourselves.

“The detailed research that we have undertaken and shared at our Aberdeen meeting emphasises our message as a bank to our customers. We believe the North Sea still has a viable future and the expected increase in demand would support this. Barclays Corporate Banking is committed to investing in the region and it was clear from our event that those who attended shared our commitment to the North Sea and the belief that while business may be difficult in the current environment, there are grounds for optimism.”

Wild Well Control awarded

Wild Well Control awarded  On 20 April 2010, the Macondo blowout in the Gulf of Mexico killed 11 men, burned and sank the Deepwater Horizon drilling rig, devastated the Gulf of Mexico and caused unprecedented socio-economic and environmental damage to Louisiana and Texas. To unravel the cause of the blowout, the assessment of petroleum engineering data during the well's final hours has been critical.

On 20 April 2010, the Macondo blowout in the Gulf of Mexico killed 11 men, burned and sank the Deepwater Horizon drilling rig, devastated the Gulf of Mexico and caused unprecedented socio-economic and environmental damage to Louisiana and Texas. To unravel the cause of the blowout, the assessment of petroleum engineering data during the well's final hours has been critical. Commenting ahead of his SPE Distinguished Lecturer presentation, ‘Assessing and Applying Petroleum Engineering Data from the 2010 Macondo Blowout’, Mr Turley said: “Investigating the circumstances surrounding the cause of the blowout is essential, so we can then apply lessons learned from the incident to future well work in deep water, shallow water and onshore.

Commenting ahead of his SPE Distinguished Lecturer presentation, ‘Assessing and Applying Petroleum Engineering Data from the 2010 Macondo Blowout’, Mr Turley said: “Investigating the circumstances surrounding the cause of the blowout is essential, so we can then apply lessons learned from the incident to future well work in deep water, shallow water and onshore. Statoil (U.K) Limited

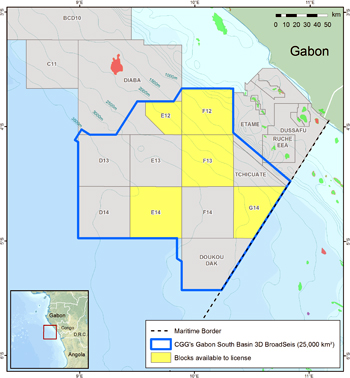

Statoil (U.K) Limited CGG

CGG Despite a recent oil price around the $45 per barrel range,

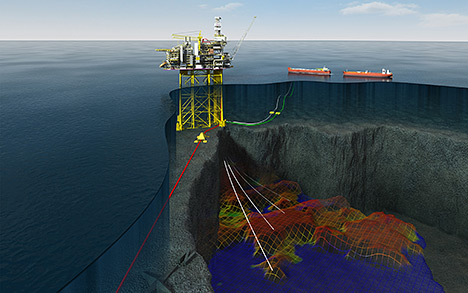

Despite a recent oil price around the $45 per barrel range,  OPTION (Optimizing Oil Production by Novel Technology Integration) aims to significantly improve simulation tools for the prediction and control of the flow between the horizontal wells and the reservoir – with a focus on enhancing oil recovery.

OPTION (Optimizing Oil Production by Novel Technology Integration) aims to significantly improve simulation tools for the prediction and control of the flow between the horizontal wells and the reservoir – with a focus on enhancing oil recovery. Chevron Corporation

Chevron Corporation TWMA men at work

TWMA men at work  Alexander MacLeod, founder of Cambla

Alexander MacLeod, founder of Cambla The Haven jack-up accommodation rig. (Photo: Sondre Steen Holvik)

The Haven jack-up accommodation rig. (Photo: Sondre Steen Holvik) Also announces Humpback well results offshore the Falkland Islands

Also announces Humpback well results offshore the Falkland Islands Brazil will lead global growth in the Floating Production, Storage and Offloading vessel (FPSO) industry despite the country’s national oil company, Petrobras, recently facing allegations of corruption, says research and consulting firm GlobalData.

Brazil will lead global growth in the Floating Production, Storage and Offloading vessel (FPSO) industry despite the country’s national oil company, Petrobras, recently facing allegations of corruption, says research and consulting firm GlobalData. The Middle East faces a substantial challenge to ensure hundreds of ageing offshore oil and gas structures operate safely beyond original design life.

The Middle East faces a substantial challenge to ensure hundreds of ageing offshore oil and gas structures operate safely beyond original design life. McDermott International, Inc.

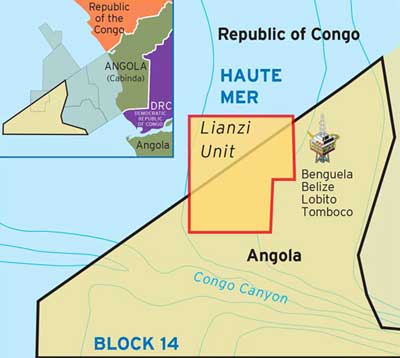

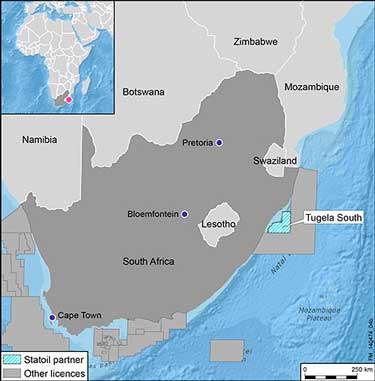

McDermott International, Inc. Statoil

Statoil Songa Trym (Photo: Kjetil Larsen - Statoil)

Songa Trym (Photo: Kjetil Larsen - Statoil)