Department of the Interior Assistant Secretary for Land and Minerals Management Janice Schneider and Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper announces that the March 23rd, oil and gas lease sales in the Gulf of Mexico garnered $156 million in high bids for 128 tracts covering 693,962 acres in the Central Planning Area of the Outer Continental Shelf offshore Louisiana, Mississippi and Alabama.

Department of the Interior Assistant Secretary for Land and Minerals Management Janice Schneider and Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper announces that the March 23rd, oil and gas lease sales in the Gulf of Mexico garnered $156 million in high bids for 128 tracts covering 693,962 acres in the Central Planning Area of the Outer Continental Shelf offshore Louisiana, Mississippi and Alabama.

A total of 30 offshore energy companies submitted 148 bids. The sum of all bids received totaled $179,172,819. No bids were received in the Eastern Planning Area.

“The Gulf remains a critical component of our nation’s energy portfolio and holds important energy resources that spur economic opportunities for Gulf producing states while reducing our dependence on foreign oil,” said Assistant Secretary Schneider. “Though these sales reflect today’s market conditions and industry’s current development strategy, they underscore the President's commitment to create jobs and home-grown energy through the safe and responsible exploration and development of our offshore energy resources.”

The Department of the Interior's Bureau of Ocean Energy Management (BOEM) offered nearly 45 million acres covering tracts in the Central and Eastern planning areas of the Gulf of Mexico.

Today’s lease sales build on the first eight sales held under the Obama Administration’s Outer Continental Shelf Oil and Gas Leasing Program for 2012-2017 (Five Year Program) that offered more than 60 million acres for development and has garnered, to date, $3 billion in bid revenues and awarded 1,071 leases. The Five Year Program makes available all offshore areas with the highest resource potential and includes 75 percent of the nation’s undiscovered, technically recoverable offshore oil and gas resources.

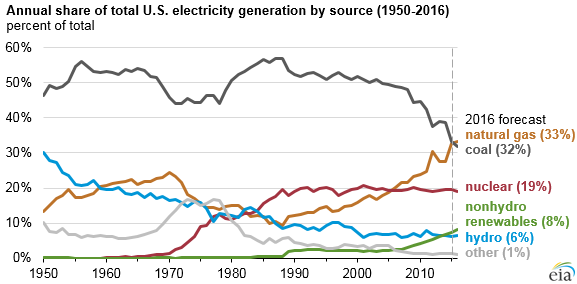

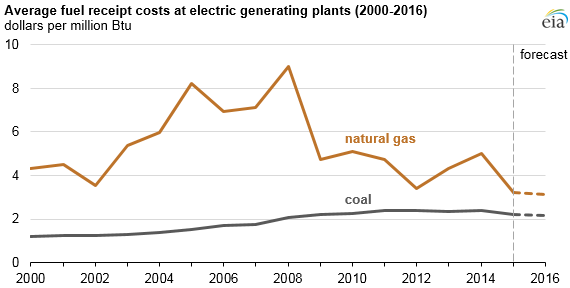

“As one of the most productive basins in the world, the Gulf of Mexico continues to be the keystone of the Nation’s offshore oil and gas resources,” Director Hopper said. “The decline in oil prices and low natural gas prices obviously affect industry’s short-term investment decisions, but the Gulf’s long-term value to the nation remains high and the President’s energy strategy continues to offer millions of offshore acres for development while protecting the human, marine and coastal environments, and ensuring a fair return to the American people.”

Central Planning Area (CPA) Sale 241 attracted $156,385,610 in high bids on 128 blocks covering 693,962 acres. A total of 30 offshore energy companies participated in submitting 148 bids totaling $179,172,819. The CPA encompasses 8,349 unleased blocks, covering 44.3 million acres, located from three to 230 nautical miles offshore Louisiana, Mississippi and Alabama, in water depths ranging from nine to more than 11,115 feet (three to 3,400 meters).

Sale 226, the second of two lease sales proposed for the Eastern Planning Area under the current Five Year Program, encompasses 162 whole or partial unleased blocks covering 595,475 acres in the Eastern Planning Area not subject to congressional moratorium. The blocks are located at least 125 statute miles offshore in water depths ranging from 2,657 feet to 10,213 feet (810 to 3,113 meters). The area is south of eastern Alabama and western Florida; the nearest point of land is 125 miles northwest in Louisiana.

Though the sale did not receive any bids, continued interest in this area is evidenced by ongoing and planned activity on existing leases from past sales as well as from similar activity on existing leases immediately adjacent to this area within the Gulf's Central Planning Area.

Most of the Eastern Gulf of Mexico Planning Area (EPA) cannot be offered for lease until 2022 as part of the Gulf of Mexico Energy Security Act of 2006.

BOEM established the terms for these sales after extensive environmental analysis, public comment and consideration of the best scientific information available. These terms include measures to protect the environment, such as stipulations requiring that operators protect biologically sensitive features as well as providing trained protected species observers. The observers would monitor marine mammals and sea turtles to ensure compliance with protective measures and restrict operations when conditions warrant.

The lease terms also include a range of incentives to encourage diligent development and ensure a fair return to taxpayers.

Following the sales, each bid will go through a 90-day evaluation process to ensure the public receives fair market value before a lease is awarded.

Statistics for Lease Sale 241 are available. Statistics for Lease Sale 226 are available.

BOEM oversees 160 million acres on the OCS in the Gulf of Mexico. Approximately 24 million acres (4,348 blocks) are leased for oil and gas development; and 4.1 million of those acres (840 blocks) are producing oil and natural gas.

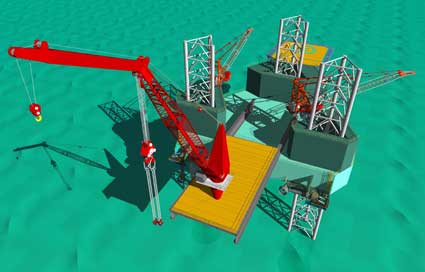

Materia’s Proxima® resin technology delivers a broad range of products that increase reliability and performance for high pressure, high temperature applications in deepwater oil and gas exploration and production.

Materia’s Proxima® resin technology delivers a broad range of products that increase reliability and performance for high pressure, high temperature applications in deepwater oil and gas exploration and production. Songa Offshore

Songa Offshore The proprietary Delmar Quick Release (DQR) was successfully installed and activated on a traditionally moored semi-submersible MODU in the US Gulf of Mexico. Eight DQRs were installed in an offshore mooring systems and deployed for over 160 days in approximately 7800' of water.

The proprietary Delmar Quick Release (DQR) was successfully installed and activated on a traditionally moored semi-submersible MODU in the US Gulf of Mexico. Eight DQRs were installed in an offshore mooring systems and deployed for over 160 days in approximately 7800' of water. Department of the Interior Assistant Secretary for Land and Minerals Management Janice Schneider and Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper announces that the March 23rd, oil and gas lease sales in the Gulf of Mexico garnered $156 million in high bids for 128 tracts covering 693,962 acres in the Central Planning Area of the Outer Continental Shelf offshore Louisiana, Mississippi and Alabama.

Department of the Interior Assistant Secretary for Land and Minerals Management Janice Schneider and Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper announces that the March 23rd, oil and gas lease sales in the Gulf of Mexico garnered $156 million in high bids for 128 tracts covering 693,962 acres in the Central Planning Area of the Outer Continental Shelf offshore Louisiana, Mississippi and Alabama. The MAY 2016

The MAY 2016  Photo credit: BSEE

Photo credit: BSEE The next

The next  William Jacob Management Inc. (WJM)

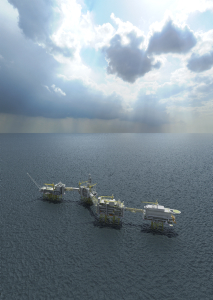

William Jacob Management Inc. (WJM) Johan Sverdrup platform. Credit: Statoil

Johan Sverdrup platform. Credit: Statoil Johan Sverdrup is by far the largest ongoing project on the Norwegian Continental Shelf for the next few years. Credit: Statoil ASA

Johan Sverdrup is by far the largest ongoing project on the Norwegian Continental Shelf for the next few years. Credit: Statoil ASA  TAQA Eider Platform

TAQA Eider Platform Fraser Moonie, chief operating officer of Bibby Offshore

Fraser Moonie, chief operating officer of Bibby Offshore Seagull Oil & Gas

Seagull Oil & Gas