Decommissioning within the offshore environment is rapidly becoming a focused activity for the oil and gas industry. Latest figures from Decom North Sea suggest that there are, approximately, 470 offshore installations in the UK sector due to come out of service by 2030 with an associated cost of US$46.8 billion (£30 billion). With such a formidable undertaking ahead, oil and gas operators are developing their decommissioning plans.

Decommissioning within the offshore environment is rapidly becoming a focused activity for the oil and gas industry. Latest figures from Decom North Sea suggest that there are, approximately, 470 offshore installations in the UK sector due to come out of service by 2030 with an associated cost of US$46.8 billion (£30 billion). With such a formidable undertaking ahead, oil and gas operators are developing their decommissioning plans.

The effective management and mitigation of potential environmental impacts and risks is key to the success of this process. Integral to this are marine growth assessments which are increasingly being used to provide valuable information for decommissioning plans. Faron McLellan, Environmental Consultant, Dr. Dorota Bastrikin, Senior Consultant, and Dr Joe Ferris, Associate Director at BMT Cordah, a subsidiary of BMT Group, discuss the importance of these assessments drawing on a number of projects carried out both within the North Sea and overseas, and how they can assist the planning process, minimise the environmental impact and financial risks. An important environmental issue is the occurrence and spread of marine species on decommissioned structures outside their naturally occurring range with the risk of introducing an invasive species.

There are over 1,500 registered offshore oil and gas installations in the North Sea, 470 of which are in United Kingdom (UK) waters with more than 10,000 km of pipelines and circa 5,000 wells. Many of these structures are over 40 years old and are now coming to the end of their design life. Over the next couple of decades a growing number of redundant oil and gas installations will be taken out of service and decommissioned. As well as the physical removal of the component parts, decommissioning of offshore subsea structures must include the management and mitigation of any potential environmental impacts and risks. This includes the consideration of organisms that colonise submerged oil and gas structures referred to as ‘marine growth’. These colonies may form habitats from a range of species assemblages, the composition of which will differ depending on the structure’s depth, geographical location and age. Marine growth introduces a wide range of issues in the context of decommissioning, including the added weight to a structure, colonisation by protected species, the potential for transfer of invasive (non-native) species and management of marine growth waste. Existing literature indicates that the colonisation of offshore structures can commence within weeks of submergence, continuing until the time of decommissioning. Throughout that period, marine growth can colonise and re-colonise, sometimes with species different to those originally found on the structure. In some cases, facilities may have been in place since the late 1970’s, providing opportunities for colonisation by a succession of marine species.

There are two protected species in the North Sea that must be recognised during the decommissioning process: Lophelia pertusa, a cold-water coral and Sabellaria spinulosa, a reef building polychaete worm. The Department of Energy and Climate Change (DECC) Guidance Notes on the Decommissioning of Offshore Oil and Gas Installations and Pipelines under the Petroleum Act 1998 provide guidance on these. If either of these species is likely to be present, it is prudent to confirm or disprove their presence prior to undertaking decommissioning operations. Both of these species are listed under the Convention on International Trade in Endangered Species of Wild Flora and Fauna (CITES). This listing means that a CITES certificate is required if transporting Lophelia or Sabellaria between states.

Factors influencing the distribution and occurrence of marine growth colonisation include water temperature, salinity, depth, distance from shore or from other fouled structures, exposure to wave action and predation. Geographical differences in these parameters exist as demonstrated in the variation in marine growth between the northern, central and southern North Sea. For example, Lophelia has not been recorded on southern North Sea structures and is typically only observed in the northern and central North Sea in deep waters (>50 m) and colder conditions. Marine growth will develop at different rates, but it is not unusual for significant cover of marine growth to be established in as little as five years after installation. Lophelia has not historically been recorded within the first decade after installation. However, with an increasing number of platforms with Lophelia, these colonized platforms may provide a “stepping stone” effect and facilitating colonisation within the first decade. In the SNS Sabellaria has been reported growing on the exposed surface of pipelines in areas designated as conservation sites. The decommissioning options for these pipelines may be affected by the occurrence of this species.

The differences in species composition and distribution between areas of the North Sea can be demonstrated through two marine growth assessments carried out by BMT Cordah.

(a) CNRI – Northern North Sea Murchison Platform

The Murchison platform is a northern North Sea (NNS) structure in a water depth of circa 156 m where the additional weight of marine growth was approximately 2,394 tons. Of note here is that the deep-water zone was dominated by Lophelia and anemones which can add a significant mass to an offshore jacket. Marine growth accounted for an additional 12% of the total weight of the steel jacket and secondary steel jacket (caissons, risers, etc.). Of the total weight of marine growth 202 tons was from Lophelia (8.4%), which only made up 3% of the marine growth coverage on the structure.

(b) ConocoPhillips – Southern North Sea Satellite Platforms

In contrast to Murchison, these platforms are situated in the shallower waters of the southern North Sea (SNS) in less than 34 m water depth. The added marine growth weight on the nine platforms averaged 39 tons, with a maximum of 72 tons and a minimum of 21 tons. Similar zonation patterns were observed in the shallow and mid-water zones across the platforms. No Lophelia were recorded on the SNS platforms since it is believed that they are situated in water too shallow for the coral to colonise and survive. The shallow-water zone of the SNS satellites showed more areas of bare member in contrast to Murchison which is most likely due to storm regime combined with the shallower water experienced in the SNS.

Considering the aforementioned factors, the importance of a marine growth assessment in the management of the decommissioning process to minimise potential environmental impacts and risks becomes more apparent. Whilst not a statutory requirement within UKCS decommissioning environmental impact assessments (EIA), marine growth assessments offer a practical and cost-saving option for its effective management. Furthermore, a marine growth assessment contributes to both the environmental and socioeconomic aspects of the EIA. At a minimum, these assessments can be used to provide a quantification of the weight of fouling organisms and identification of species, including those subject to protection. The weight of the structures to be decommissioned is a fundamental consideration when planning lifting, transportation and disposal operations. Marine growth, by increasing the structural weight, can increase costs and the complexity of lifting operations.

Current approaches to the management of marine growth include (i) offshore removal of marine growth by a Remotely Operated Vehicle (ROV) and/or divers in situ; (ii) onshore removal from cut jacket sections and subsequent landfilling; and (iii) land-spreading or composting of removed marine growth. All of these options bring with them potential environmental impacts which need to be considered Potential seabed impact from marine growth removed in situ will also be influenced by the species composition. The suitability of landfill or composting sites will depend on species composition. The EU Landfill Directive (1999/31/EC) includes an obligation for member states to reduce the amount of biodegradable waste, which includes marine growth destined for landfill. The UK targets, based on the 1995 waste quantities, are a reduction of 75% by 2010, 50% by 2013 and 35% by 2020. Therefore disposal in landfill may become a last resort for this waste.

Offshore structures brought to shore with marine growth have often resulted in complaints from local communities regarding the odour. The major sources of smell following removal of structures laden with marine growth are the biologically-emitted odors from dying organisms, disturbed anoxic layers and removal of putrefying organisms, particularly originating from highly productive areas. The intensity of smell can become a considerable nuisance to local communities. The platform location and time of year for planned removal should be taken into consideration when developing the decommissioning programme. Due to the seasonality of the productivity of fouling organisms, jackets and other subsea structures removed during the summer and autumn would be expected to emit a stronger odour for longer than those removed in spring from the same location.

A marine growth assessment also provides information on the presence of potentially invasive alien (non-native) species (species from outside of their natural range) which can threaten the diversity or abundance of native species, the ecological stability of infested waters and/or commercial, agricultural or recreational activities. Invasive species can often out-compete indigenous species, detrimentally affecting local ecosystems. Mobile structures, such as Floating Production Storage and Offloading (FPSO) vessels, could act as sources for the introduction of invasive species when taken to different geographical regions for decommissioning or reuse. The European Union (EU) Marine Strategy Framework Directive (MSFD) that came into force on 15th July 2008 aims to protect the marine environment across Europe by achieving and maintaining Good Environmental Status (GES) by 2020. It lists prevention of the adverse alterations to the environment by non-native species, as one of the vital elements of maintaining GES. In 2014, UK published Part Two of the Marine Strategy which focuses on a coordinated monitoring programme for the ongoing assessment of GES and includes invasive species. A new EU Regulation No. 1143/2014 on Invasive Alien Species came into force on 1st January 2015 and foresees three types of interventions: (i) prevention; (ii) early detection and eradication; and (iii) management. A marine growth assessment can satisfy requirements for detection and management.

With the transportation of offshore structures comes an increased potential risk to the marine environment of the introduction of invasive species. This is particularly important if the structure is to be transported out of the North Sea. This risk is determined by the:

Presence and abundance of invasive alien (non-native) species and/or species that have the potential to become invasive;

Period of air exposure of the marine growth during transport and resultant mortality of the species; and

Capacity of alien organisms to colonize, survive and out-compete native species along the transport route and at the final destination.

Case Study – FPSO, Southwest Atlantic

In 2014, BMT Cordah was commissioned to conduct a marine growth assessment for the decommissioning of an FPSO located in the southwest Atlantic. During the assessment, the presence on the hull of an invasive, non-native sun coral species, Tubastraea coccinea was reported. With a high tolerance range to environmental conditions and a prolific reproductive capacity, the sun coral readily out-competes native corals and other species. Tubastraea can also reproduce by fragmentation, making it a potentially dangerous species to carry through waters where it is not present should any part of the coral fall off in transit to the selected decommissioning site.

The major considerations when deciding the movement of the FPSO and geographical location of the decommissioning yard were:

Identification of the suspected invasive coral;

Consideration of remedial options for in situ removal; and

Assessment of existing international regulations and compliance with the transportation and deposition of non-indigenous species in international waters.

An assessment of the marine growth on offshore structures is an important component of decommissioning programmes. The implications of additional weight and the occurrence of protected or invasive species are key drivers in lifting operations and final disposal. These must be considered to ensure the decommissioning process is completed safely, cost-effectively and within the frameworks of both best practice and relevant legislation.

BMT Cordah

BMT Cordah is a leading multi-disciplinary environmental consultancy with extensive experience in providing support to decommissioning programmes. Having been involved in many offshore programmes since 1994, we have successfully delivered a range of services, including; preparation of environmental scoping reports; full EIAs; detailed estimates of energy usages and gaseous emissions; Comparative Assessments of pipelines and BPEOs; in-depth environmental support to decommissioning engineering teams; Comparative Assessments of options for decommissioning structures that are candidates for derogation under OSPAR 98/3; prepared PONs, PWAs, and Consents to Locate; and compiled full Decommissioning Programmes for Consultation before facilitating the submission of formal Decommissioning Programmes to the Secretary of State. The company is based in Aberdeen

Anadarko Petroleum Corporation

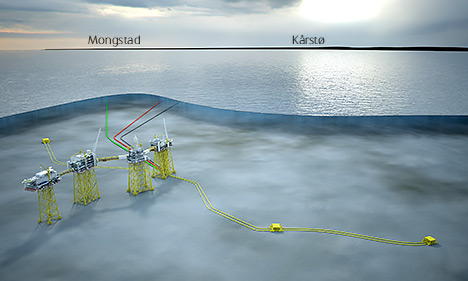

Anadarko Petroleum Corporation Pipeline development projects are becoming increasingly complex, spanning longer and deeper terrains. Pipelines must operate at higher pressures and temperatures, in harsher environments and to stricter regulatory requirements. Projects must also be feasible in a cost-constrained market. DNV GL is inviting industry players to take part in two Joint Industry Projects (JIP) to help the industry work more efficiently while maintaining safety.

Pipeline development projects are becoming increasingly complex, spanning longer and deeper terrains. Pipelines must operate at higher pressures and temperatures, in harsher environments and to stricter regulatory requirements. Projects must also be feasible in a cost-constrained market. DNV GL is inviting industry players to take part in two Joint Industry Projects (JIP) to help the industry work more efficiently while maintaining safety. By Julia Schweitzer

By Julia Schweitzer

Statoil

Statoil Freddy Gebhardt, Wild Well (left) and Mike Munro, NorSea Group (UK Wild Well Control’s WellCONTAINED System

Freddy Gebhardt, Wild Well (left) and Mike Munro, NorSea Group (UK Wild Well Control’s WellCONTAINED System With the oil and gas industry forced to work harder to extract oil around the globe and an increasing reliance on reserves in difficult to reach locations, the resurgence in floatover installation practices continues. In its new whitepaper, The Floatover Forecast, Trelleborg’s engineered products operation recounts the lessons learned, changes in technologies and materials; as well as the trials and errors that have contributed to developments in the field.

With the oil and gas industry forced to work harder to extract oil around the globe and an increasing reliance on reserves in difficult to reach locations, the resurgence in floatover installation practices continues. In its new whitepaper, The Floatover Forecast, Trelleborg’s engineered products operation recounts the lessons learned, changes in technologies and materials; as well as the trials and errors that have contributed to developments in the field. Aker Solutions

Aker Solutions

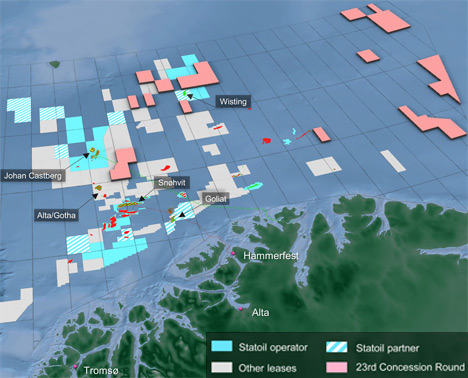

Statoil

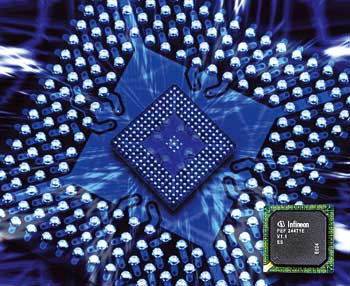

Statoil With the exploitation of new cost-effective operational concepts, use of digital technologies and increased dependence on cyber structures, the oil and gas industry is exposed to new sets of vulnerabilities and threats. Cyber-attacks have grown in stature and sophistication, making them more difficult to detect and defend against, and costing companies increasing sums of money to recover from.

With the exploitation of new cost-effective operational concepts, use of digital technologies and increased dependence on cyber structures, the oil and gas industry is exposed to new sets of vulnerabilities and threats. Cyber-attacks have grown in stature and sophistication, making them more difficult to detect and defend against, and costing companies increasing sums of money to recover from. Statoil and its partners were the successful bidders for six exploration licenses in the Flemish Pass Basin, offshore Newfoundland, and two licenses offshore Nova Scotia.

Statoil and its partners were the successful bidders for six exploration licenses in the Flemish Pass Basin, offshore Newfoundland, and two licenses offshore Nova Scotia. The Bureau of Safety and Environmental Enforcement (BSEE) has announced that offshore oil and gas lessees and owners of operating rights are now required to submit summaries of their actual expenditures for the decommissioning of wells, platforms and other facilities on the Outer Continental Shelf (OCS) as part of the final Decommissioning Costs Rule.

The Bureau of Safety and Environmental Enforcement (BSEE) has announced that offshore oil and gas lessees and owners of operating rights are now required to submit summaries of their actual expenditures for the decommissioning of wells, platforms and other facilities on the Outer Continental Shelf (OCS) as part of the final Decommissioning Costs Rule. Leading classification society

Leading classification society  International oilfield services company,

International oilfield services company,  Decommissioning within the offshore environment is rapidly becoming a focused activity for the oil and gas industry. Latest figures from Decom North Sea suggest that there are, approximately, 470 offshore installations in the UK sector due to come out of service by 2030 with an associated cost of US$46.8 billion (£30 billion). With such a formidable undertaking ahead, oil and gas operators are developing their decommissioning plans.

Decommissioning within the offshore environment is rapidly becoming a focused activity for the oil and gas industry. Latest figures from Decom North Sea suggest that there are, approximately, 470 offshore installations in the UK sector due to come out of service by 2030 with an associated cost of US$46.8 billion (£30 billion). With such a formidable undertaking ahead, oil and gas operators are developing their decommissioning plans.