Statoil and its partners last week put the first subsea gas compression facility on line at Åsgard in the Norwegian Sea. Subsea compression will add some 306 million barrels of oil equivalent to total output over the field’s life.

This subsea technology milestone opens new opportunities in deeper waters, and in areas far from shore.

“This is one of the most demanding technology projects aimed at improving oil recovery. We are very proud today that we together with our partners and suppliers have realized this project that we started ten years ago,” says Margareth Øvrum, Statoil’s executive vice president for Technology, Drilling and Projects.

Recovery from the Midgard reservoir on Åsgard will increase from 67 percent to 87 percent, and from 59 percent to 84 percent from the Mikkel reservoir. Overall, 306 million barrels of oil equivalent will be added.

“Thanks to the new compressor solution we will achieve increased recovery rates both at Midgard and Mikkel, extending the reservoirs’ productive lives until 2032,” says Siri Espedal Kindem, senior vice president for Åsgard operations.

Demanding technology development

Demanding technology development

As a field gets older, the natural pressure in the reservoir drops. In order to recover more oil and gas, and get this to the platform, compression is required. The closer to the well compression takes place, the more oil and gas can be recovered.

Traditionally compression plants are installed on platforms or onshore, but this plant is located in 300 meters of water.

Due to the challenging location, quality in all parts of the project has been essential, and will help ensure high regularity, maximum recovery and robust production.

The project started in 2005, and the plan for development and operation (PDO) was approved in 2012.

An estimated eleven million man-hours have been spent from the start until completion. More than 40 new technologies have been developed and employed after prior testing and verification. Some of this work has taken place at Statoil’s Kårstø laboratory in Western Norway.

Overall, project cost were just above NOK 19 billion. Many small and big suppliers have helped to develop the sophisticated underwater compressor system.

Establishing the necessary support functions onshore has been an important and substantial part of the project. A spare compression train will be stored in custom designed halls at the onshore supply base Vestbase in Kristiansund.

“High-quality, regular maintenance of the subsea modules will also be performed here, helping ensure operational excellence for Åsgard,” says Espedal Kindem.

Technology for the future, and new potentials

The Midgard and Mikkel gas reservoirs have been developed using subsea installations. The two gas compressors now installed on the seabed are located close to the wellheads.

Moving the gas compression from the platform to the wellhead substantially increases the recovery rate and life of the fields. Prior to gas compression, gas and liquids are separated out, and after pressure boosting recombined and sent through a pipeline some 40 kilometers to Åsgard B.

In addition to improving recovery subsea gas compression will be more energy efficient than the traditional topside solution. The technology reduces significantly energy consumption and CO2 emissions over the field’s life.

Today almost 50 percent of Statoil’s production is recovered through some 500 subsea wells. Statoil’s subsea expertise is essential to successful production efficiency improvement and increased oil recovery efforts.

“Subsea gas compression is the technology for the future, taking us a big step closer to our ambition of realizing a subsea processing plant, referred to as the subsea factory”, says Øvrum.

Such a plant will facilitate remotely controlled hydrocarbon transportation. Current topside operations will thus be moved to the seabed, allowing oil and gas to be recovered that would not otherwise be profitable. This is an important element of increased recovery on the Norwegian continental shelf.

On 2 October 2015,

On 2 October 2015,

Demanding technology development

Demanding technology development  Aqueos Corporation

Aqueos Corporation Registration totals exceeded expectations as 13,500 global exploration and production professionals gathered at the

Registration totals exceeded expectations as 13,500 global exploration and production professionals gathered at the  Shell

Shell Claxton

Claxton The oil and gas industry is by nature one of the most challenging environments in the world, so a high level of business integrity is critical to safely keep operations up and running. As a result of its commitment to continuous improvement in the industry, Trelleborg’s offshore operation in England has been awarded an International Organization for Standardization (ISO) / Technical Specification (TS) 29001:2011 certification.

The oil and gas industry is by nature one of the most challenging environments in the world, so a high level of business integrity is critical to safely keep operations up and running. As a result of its commitment to continuous improvement in the industry, Trelleborg’s offshore operation in England has been awarded an International Organization for Standardization (ISO) / Technical Specification (TS) 29001:2011 certification. ABS

ABS “Troll oil is a story that summarizes the best our operations and the opportunities on the Norwegian continental shelf,” Dahl-Stamnes continues.

“Troll oil is a story that summarizes the best our operations and the opportunities on the Norwegian continental shelf,” Dahl-Stamnes continues. Source:

Source:  Shell Nigeria Exploration and Production Company Ltd (SNEPCo)

Shell Nigeria Exploration and Production Company Ltd (SNEPCo) Deep Down, Inc.

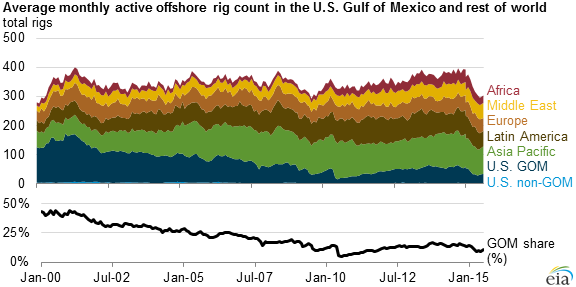

Deep Down, Inc. Mexico needs to attract significant interest to salvage a bidding round hampered by delays and low oil prices, with Phase 4 of the current Round 1 licensing process offering the country’s first deepwater assets, says research and consulting firm GlobalData.

Mexico needs to attract significant interest to salvage a bidding round hampered by delays and low oil prices, with Phase 4 of the current Round 1 licensing process offering the country’s first deepwater assets, says research and consulting firm GlobalData. A well head platform on the Peregrino field (Photo:Statoil)

A well head platform on the Peregrino field (Photo:Statoil)