Leading international oilfield services company, Expro, has strengthened its operations in the North Sea with $25m in contract wins secured in the UK and Norway, where it will officially open a new facility later this month.

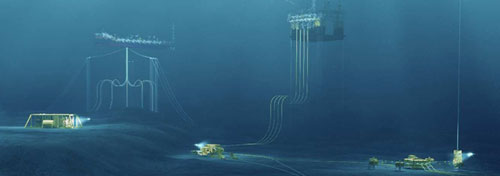

The company has been awarded a subsea contract for oil and gas producer, Wintershall Norway, in the Haltenbanken area of the Norwegian Continental Shelf (NCS). The five-year contract, for Wintershall’s Maria project, includes multi-well completions with two optional two-year extensions.

The scope of the contract includes the supply of a complete workover riser system including surface test tree and subsea landing string systems. Operations, maintenance and engineering support services will also be provided for the system including global riser analysis and life cycle fatigue monitoring.

The scope of the contract includes the supply of a complete workover riser system including surface test tree and subsea landing string systems. Operations, maintenance and engineering support services will also be provided for the system including global riser analysis and life cycle fatigue monitoring.

In the UK Central North Sea, the company has won a contract with Premier Oil plc for its Catcher development to provide surface well testing and fluid analysis services on 22 subsea wells for three years, with options for three one-year extensions.

Expro have been the leading supplier of well testing services to Premier Oil since 2009, and are currently undertaking work in the Solan field development, west of the Shetland Isles.

These wins have been followed by further contract extensions with key clients across the UK Continental Shelf for well test, clean-up and slickline services.

Expro’s work in Norway will be supported by a major new base in Tananger set to officially open later this year. The 19,000 sqm facility will house several of the company’s key product lines including Drill Stem Testing and Well Testing, and will comprise an office building, yard and workshop with the capability to rig-up four well test packages, and service a further six, simultaneously.

Neil Sims, Expro’s Vice President – Europe CIS (Commonwealth of Independent States) comments:

“These contract wins are testament to the strong relationships Expro maintain with key clients across Europe. Our flexible solutions, commitment to safety, customer service and quality field performance in the region ideally position us to support these contracts.

“Expro’s world-renowned subsea technology and fluids expertise have been applied in similar successful projects across the North Sea, and we have provided over 2,000 well tests and 150 well testing packages to the global oil and gas industry.

“In the UK, developments such as Catcher are integral to the future of the North Sea, and these contracts will see Expro utilise local expertise and the supply chain in Aberdeen and Great Yarmouth.

“In Norway, we have underlined our commitment to projects in the region with significant investment in our new base and technology – including over $10m in capital expenditure for new equipment to services well test projects since 2012.”

Expro will be exhibiting at the SPE Offshore Europe Conference & Exhibition in Aberdeen at Stand 2C130 from 8-11 September 2015.

Chief Executive Officer, Charles Woodburn, is this year’s Technical Chairman and will focus on the conference technical programme, whilst Alistair Geddes, Executive Vice President, will lead a technical session on ‘Developing Talent to Meet Demand – I’.

In combination with daily technical presentations, Expro will feature a range of integrated products and services including Subsea Safety Systems, Well Test, SafeWells, Fluids, Well Intervention, Meters, Wirless Well Solutions, DST/TCP and Production.

For more information, please click here.

Ovivo Inc.

Ovivo Inc. Bibby Sapphire in port during mobilization

Bibby Sapphire in port during mobilization  The

The

As part of President Obama’s all-of-the-above energy strategy to continue to expand safe and responsible domestic energy production, Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper announced on September 11, that the bureau will offer 40 million acres offshore Louisiana, Mississippi, and Alabama for oil and gas exploration and development in sales that will include all available unleased areas in the Central and Eastern Gulf of Mexico Planning Areas.

As part of President Obama’s all-of-the-above energy strategy to continue to expand safe and responsible domestic energy production, Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper announced on September 11, that the bureau will offer 40 million acres offshore Louisiana, Mississippi, and Alabama for oil and gas exploration and development in sales that will include all available unleased areas in the Central and Eastern Gulf of Mexico Planning Areas. Jotun is happy to confirm that “many millions of kilograms” of Jotachar JF750 have already been installed since launch, now protecting key assets. One recent project award will consume over half a million kilograms for a major Middle-East operator choosing Jotachar to protect two large offshore units against a broad range of fire scenarios, including jet fires.

Jotun is happy to confirm that “many millions of kilograms” of Jotachar JF750 have already been installed since launch, now protecting key assets. One recent project award will consume over half a million kilograms for a major Middle-East operator choosing Jotachar to protect two large offshore units against a broad range of fire scenarios, including jet fires. The scope of the contract includes the supply of a complete workover riser system including surface test tree and subsea landing string systems. Operations, maintenance and engineering support services will also be provided for the system including global riser analysis and life cycle fatigue monitoring.

The scope of the contract includes the supply of a complete workover riser system including surface test tree and subsea landing string systems. Operations, maintenance and engineering support services will also be provided for the system including global riser analysis and life cycle fatigue monitoring. The development of the largest new field discovered in the UK North Sea for a decade* has been approved by the UK Oil & Gas Authority. The Maersk Oil operated high pressure, high temperature (HPHT) Culzean field in the UK Central North Sea is expected to produce enough gas to meet 5% of total UK demand at peak production in 2020/21. Culzean is also the largest gas field sanctioned since East Brae in 1990*.

The development of the largest new field discovered in the UK North Sea for a decade* has been approved by the UK Oil & Gas Authority. The Maersk Oil operated high pressure, high temperature (HPHT) Culzean field in the UK Central North Sea is expected to produce enough gas to meet 5% of total UK demand at peak production in 2020/21. Culzean is also the largest gas field sanctioned since East Brae in 1990*. The project, which could potentially deliver a 40 to 50% cost saving for certification and qualification of subsea composite components, will seek to validate new advanced material models by experimentation, with the main focus on predicting chemical ageing.

The project, which could potentially deliver a 40 to 50% cost saving for certification and qualification of subsea composite components, will seek to validate new advanced material models by experimentation, with the main focus on predicting chemical ageing. Craig International’s research has revealed that typically oil company buyers spend 85% of their time on managing only 15% of their spend. This small percentage of overall spend is largely related to oilfield consumables including chemicals, oils and paints, pipe and fittings, tools, electrical and welfare items and services such as travel and accommodation, project management, data management and processing, hospitality, facilities management and general repair and maintenance.

Craig International’s research has revealed that typically oil company buyers spend 85% of their time on managing only 15% of their spend. This small percentage of overall spend is largely related to oilfield consumables including chemicals, oils and paints, pipe and fittings, tools, electrical and welfare items and services such as travel and accommodation, project management, data management and processing, hospitality, facilities management and general repair and maintenance. Andrew Wylie, Scotland Subsea Operations Manager

Andrew Wylie, Scotland Subsea Operations Manager

“The main aim of SCR is to reduce the risks from major accident hazards to the health and safety of those employed on offshore installations. It also aims to increase the protection of the marine environment against pollution and ensure the correct mechanisms are in place if such an event were to happen,” described Mackay.

“The main aim of SCR is to reduce the risks from major accident hazards to the health and safety of those employed on offshore installations. It also aims to increase the protection of the marine environment against pollution and ensure the correct mechanisms are in place if such an event were to happen,” described Mackay. Ahead of Tuesday’s congressional hearing in New Orleans, API highlighted the importance of offshore oil and natural gas development to the region's economic development.

Ahead of Tuesday’s congressional hearing in New Orleans, API highlighted the importance of offshore oil and natural gas development to the region's economic development. North Sea work has resulted in world firsts for Swagelining Limited

North Sea work has resulted in world firsts for Swagelining Limited