NYC-based PIRA Energy Group reports that Asian oil markets remain constructive. On the week, demand surge lessens U.S. stock build, while Japanese turnarounds build crude stocks. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group reports that Asian oil markets remain constructive. On the week, demand surge lessens U.S. stock build, while Japanese turnarounds build crude stocks. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

Asian Oil Markets Remain Constructive

Crude oil stock draws have begun and will continue through September. As expected, physical markets are now supported by relatively low stock levels and higher crude runs. The Atlantic basin has tightened first and Asia will follow. Supply disruptions remain near record highs, and while some return of shut-in supplies are assumed in PIRA's balances, they are by no means assured and can be accommodated if fully realized. Product demand growth trends remain positive as we move off the May lows to the summer peak.

Demand Surge Lessens U.S. Stock Build

Overall commercial inventories increased this past week, with nearly 1.0 million barrels of the build being in crude oil. It was the smallest stock increase in six weeks as reported demand surged. With a roughly similar sized build last year for the same week, the year on year inventory deficit narrowed marginally. Most of this deficit is in gasoline and distillate.

Japan Turnarounds Build Crude Stocks, Finished Product Stocks Rising, while Gasoil Demand Remains Weak

Crude runs eased slightly while crude imports rose such that stocks built 1.9 MMBbls. Finished product stocks also built 1.6 MMBbls due to builds in jet-kero, gasoil, and a modest rise in fuel oil. Finished product stocks have been rising steadily since mid-March. Gasoil demand was exceedingly weak, even post holiday. Refining margins were slightly higher but remain in the lower half of their statistical range.

Scenario Planning Quarterly Highlights

US shale liquids growth continues to outpace our forecast, but only slightly. A close examination of shale potential in Western Canada has led us to increase our outlook for crude and condensate although production costs in Canada appear to be higher than in the US. The developments in Ukraine increase the odds of greater investment in gas exports in the US and around the world in response to supply security concerns

Freight Market Outlook

The U.S. shale crude revolution is changing the dynamics of global crude and product trade, and there is now an active dialogue on whether to lift the ban on crude exports from the U.S. If exports of crude or condensate are allowed at some point, global crude trade and ton-miles would increase, as U.S. refiners import heavier grades more suited to their refinery configurations, while some lighter crude grades and condensates are exported to Europe and Asia. PIRA’s Reference Case outlook in a soon-to-be released multi-client study anticipates that some crude and condensate exports will be allowed but not until 2017, after the next presidential election.

Low Shoulder Season Demand Exacerbates Upcoming Inventory Builds

Large stock builds continue to weigh on prompt prices. As the year-on-year deficit continues to narrow, US LPG prices could come under additional pressure. Low shoulder season demand will only exacerbate upcoming inventory builds. Excess ethane due to surging production will leave ethane prices tied to natural gas prices for some time to come.

Ethanol Prices Rebound

U.S. ethanol prices bottomed early the week ending May 9 but rose sharply after the DOE reported that production and inventories both declined during the week ending May 2. Cash margins dropped for the sixth straight week.

Record Ethanol Blending

U.S. ethanol-blended gasoline manufacture rocketed to a record high 8,957 MB/D the week ending May 9, up 4.5% from 8,571 MB/D during the previous week, as gasoline output remained extremely strong. Ethanol production rose to 922 MB/D, the second highest output thus far in 2014

The information above is part of PIRA Energy Group's weekly Energy Market Recap, which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

.

In March 2011

In March 2011  Newbuild orders for Very Large Crude Carriers (VLCCs) are picking up in expectation of rising demand but risk putting the sector's recovery at risk, according to

Newbuild orders for Very Large Crude Carriers (VLCCs) are picking up in expectation of rising demand but risk putting the sector's recovery at risk, according to Supply Base Manager Alexander Pavlov (left) discusses planned upgrades

Supply Base Manager Alexander Pavlov (left) discusses planned upgrades Production from a subsea template at the Snorre B platform was shut down on 17 May following the discovery of an abnormal erosion of mass under the template.

Production from a subsea template at the Snorre B platform was shut down on 17 May following the discovery of an abnormal erosion of mass under the template. A starboard-side view of the Royal Thai Navy patrol boats.

A starboard-side view of the Royal Thai Navy patrol boats. BMT Group Ltd,

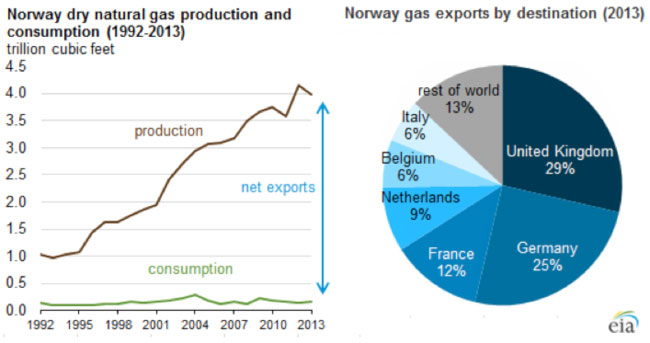

BMT Group Ltd, Western Europe will continue to rely on imported Russian gas into the 2020s as mature offshore provinces struggle for growth, while large-scale shale gas extraction looks increasingly unlikely in the medium term. Following Moscow's intervention in Ukraine and the resulting strained diplomatic ties with the West, it remains to be seen if North Sea production can rally to support any drop in gas flow from Russia.

Western Europe will continue to rely on imported Russian gas into the 2020s as mature offshore provinces struggle for growth, while large-scale shale gas extraction looks increasingly unlikely in the medium term. Following Moscow's intervention in Ukraine and the resulting strained diplomatic ties with the West, it remains to be seen if North Sea production can rally to support any drop in gas flow from Russia.

NYC-based

NYC-based

Ulstein SX165

Ulstein SX165 Rolls Royce UT 777

Rolls Royce UT 777 Shawn Bulgen, Project Director, (photo) said: "Our expansion into the north east of England is in response to the industry-wide skills shortage. For a number of years skilled engineering professionals have been commuting to Aberdeen based oil and gas companies on a weekly basis. Our expansion into Newcastle will make us well placed to attract talent from the strong engineering tradition in the region."

Shawn Bulgen, Project Director, (photo) said: "Our expansion into the north east of England is in response to the industry-wide skills shortage. For a number of years skilled engineering professionals have been commuting to Aberdeen based oil and gas companies on a weekly basis. Our expansion into Newcastle will make us well placed to attract talent from the strong engineering tradition in the region." Fueled by continuously increasing demand for complete integrated underwater system solutions,

Fueled by continuously increasing demand for complete integrated underwater system solutions,  Core Grouting Services,

Core Grouting Services,