Danelec Marine has announced the introduction of its third-generation marine Voyage Data Recorder (VDR).

Danelec Marine has announced the introduction of its third-generation marine Voyage Data Recorder (VDR).

The new Danelec DM100 VDR fully complies with the new International Maritime Organization (IMO) VDR standard, which comes into effect July 1, 2014. It also incorporates Danelec's revolutionary SoftWare Advanced Protection (SWAP) technology – a totally new approach to shipboard servicing of marine electronics.

SWAP Technology Saves Time and Costs in Shipboard Repairs

"Danelec's exclusive SWAP solution is nothing short of revolutionary when it comes to servicing shipboard electronics," said Danelec CEO Hans Ottosen. "It saves time by removing the repair from ship to shore, reduces labor costs for service calls, protects valuable shipboard data and eliminates in-port delays for repairs."

Danelec has designed the compact VDR data acquisition unit for easy plug-and-play replacement, with all system programming and configurations stored on a hot-swappable memory card. The service technicians bring a new unit when boarding the ship. They simply disconnect and remove the old unit, insert the new one in its place and slide the memory card from the old VDR into the slot on the front of the replacement. The old unit can then be taken ashore for repair without holding up the ship's departure.

"This is a paradigm shift in shipboard service," said Ottosen. "With traditional techniques, it can take days to make repairs to a ship's critical electronic systems. In some cases, Port State Control authorities may hold up the ship's sailing. Even if the ship is allowed to sail, it means another expensive service call at the next port to accomplish the repairs. With SWAP technology, the entire process is completed in hours, not days."

"We are incorporating SWAP into all our products moving forward," Ottosen added.

IMO Compliant – and Beyond

The Danelec DM100 VDR meets all the new VDR requirements as defined in MSC.333(90) and IEC 61996-1 Ed. 2, including a float-free capsule, 48-hour data storage in both the protective fixed capsule and float-free capsule, separate audio track for outdoor microphones, as well as data recording from the ship's ECDIS, both radars, AIS and inclinometer. All VDRs placed into service after July 1, 2014, must comply with the new standards.

"The DM100 VDR provides a solid, safe and simple solution for new ships, as well as retrofits to existing vessels," said Ottosen. "In addition to the minimum IMO requirements, we have designed our new-generation VDRs for the future, with new features such as playback software for real-time monitoring and replay of recorded data, along with remote access for maintenance, annual performance tests and remote data capture and analysis."

Danelec was one of the first companies to bring to market IMO-compliant VDRs and Simplified VDRs (S-VDRs) in 2002. More than 5,500 vessels today are equipped with a VDR or S-VDR designed and manufactured by Danelec. The company has an extensive service network with certified sales and service representatives in more than 50 countries worldwide.

.

NAVTOR

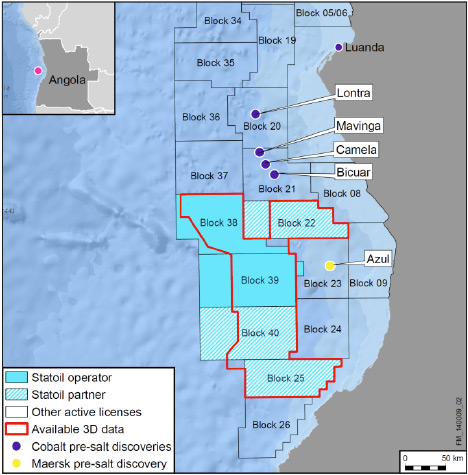

NAVTOR Statoil

Statoil  NYC-based

NYC-based  26th March 2014 marked the 25th anniversary of

26th March 2014 marked the 25th anniversary of As part of President Obama's Climate Action Plan to create American jobs, develop clean energy sources and cut carbon pollution, the Bureau of Ocean Energy Management (BOEM) has announced the publication of its environmental assessment (EA) of an application for a wind energy resource assessment lease offshore Tybee Island, Georgia.

As part of President Obama's Climate Action Plan to create American jobs, develop clean energy sources and cut carbon pollution, the Bureau of Ocean Energy Management (BOEM) has announced the publication of its environmental assessment (EA) of an application for a wind energy resource assessment lease offshore Tybee Island, Georgia. Songa Offshore SE

Songa Offshore SE Award-winning subsea installation contractor,

Award-winning subsea installation contractor,  Trelleborg's marine systems operation

Trelleborg's marine systems operation Ecopetrol America Inc. placed bids partnering with Murphy Exploration and Production Company -USA and Venari Offshore LLC

- With the results from this round, Ecopetrol America Inc. could raise its share to 149 blocks in one of the most attractive areas for exploration in the world

Ecopetrol America Inc. placed bids partnering with Murphy Exploration and Production Company -USA and Venari Offshore LLC

- With the results from this round, Ecopetrol America Inc. could raise its share to 149 blocks in one of the most attractive areas for exploration in the world On March 28,

On March 28,  Together with partner

Together with partner

Danelec Marine

Danelec Marine UTEC Survey

UTEC Survey  Chevron Corporation

Chevron Corporation