Oceaneering International, Inc. (NYSE: OII) has reported record first quarter earnings for the period ended March 31, 2014 and that its Board of Directors declared a regular quarterly dividend of $0.27 per common share, an increase from its prior quarterly dividend of $0.22 per share. The dividend is payable June 20, 2014 to shareholders of record at the close of business on May 30, 2014.

Oceaneering International, Inc. (NYSE: OII) has reported record first quarter earnings for the period ended March 31, 2014 and that its Board of Directors declared a regular quarterly dividend of $0.27 per common share, an increase from its prior quarterly dividend of $0.22 per share. The dividend is payable June 20, 2014 to shareholders of record at the close of business on May 30, 2014.

On revenue of $840.2 million, Oceaneering generated net income of $91.2 million, or $0.84 per share. During the corresponding period in 2013, Oceaneering reported revenue of $718.6 million and net income of $74.8 million, or $0.69 per share.

|

Summary of Results

(in thousands, except per share amounts)

|

| |

Three Months Ended

|

| |

March 31,

|

Dec. 31

|

| |

2014

|

2013

|

2013

|

|

Revenue

|

$840,201

|

$718,552

|

$894,798

|

|

Gross Margin

|

189,491

|

160,375

|

197,805

|

|

Income from Operations

|

132,862

|

108,290

|

136,753

|

|

Net Income

|

$91,225

|

$74,849

|

$93,433

|

| |

|

|

|

|

Diluted Earnings Per Share (EPS)

|

$0.84

|

$0.69

|

$0.86

|

| |

|

|

|

Year over year, quarterly EPS increased 22% on profit improvements by all oilfield business operations. Sequentially, quarterly EPS declined, as anticipated, as a result of lower operating income from Subsea Products and Subsea Projects.

M. Kevin McEvoy, President and Chief Executive Officer, stated, "We are off to a good start to the year as our record first quarter EPS was above our guidance. All of our business segments performed well relative to our forecasts, and we continue to expect to achieve record EPS for a fifth consecutive year.

"Compared to the first quarter of last year, quarterly ROV operating income improved on an increase in days on hire, the expansion of our fleet, and an improvement in operating margin. Our fleet utilization increased to 86% from 83% a year ago. During the quarter we put 14 new systems into service and retired 4. At the end of the quarter, we had 314 vehicles in our ROV fleet, an increase of 20 from March 2013. For the balance of 2014, we expect to place 16 to 21 more new systems into service.

"Subsea Products operating income was higher due to improved demand for subsea hardware and an increase in umbilical plant throughput. Our Subsea Products backlog at quarter-end was $894 million, compared to $776 million at the end of March 2013 and $906 million at the end of December 2013.

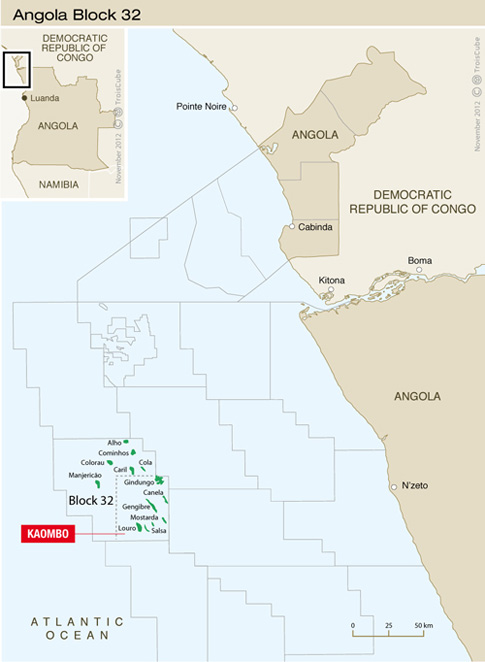

"Subsea Projects operating income increased on higher deepwater vessel activity in the U.S. Gulf of Mexico and offshore Angola. Asset Integrity operating income improved on increased service demand in the Middle East and the Caspian Sea area. Advanced Technologies operating income was lower on reductions in theme park project work and U.S. Navy submarine maintenance and engineering service activity.

"Our outlook for the rest of this year remains positive. We continue to project record EPS for 2014 in the range of $3.90 to $4.10. We anticipate sustained global demand growth for our services and products to support deepwater drilling, field development, and inspection, maintenance, and repair activities. We expect all our oilfield segments to achieve higher income in 2014 compared to 2013. For the second quarter of 2014, we are forecasting EPS of $0.97 to $1.01.

"Our liquidity and projected cash flow provide us with ample resources to invest in Oceaneering's growth. At the end of the quarter, our balance sheet reflected $106 million of cash, $90 million of debt, and $2.1 billion of equity. During the quarter we generated EBITDA of $186 million and for 2014 we anticipate generating at least $850 million of EBITDA.

"During the quarter we repurchased 500,000 shares of our common stock at a cost of about $35 million. Today we announced a 23% increase in our regular quarterly cash dividend to $0.27 from $0.22 per share. These actions underscore our continued confidence in Oceaneering's financial strength and future business prospects.

"Looking beyond 2014, we believe that the oil and gas industry will increase its investment in deepwater projects. Deepwater remains one of the best frontiers for adding large hydrocarbon reserves with high production flow rates at relatively low finding and development costs. With our existing assets and opportunities to add new assets, we are well positioned to supply a wide range of services and products required to support the safe deepwater efforts of our customers."

.

Jee Ltd

Jee Ltd VideoRay LLC

VideoRay LLC

VIKING

VIKING As previously announced,

As previously announced,  Ramform Titan

Ramform Titan NYC-based

NYC-based  InterMoor

InterMoor Leading subsea technology manufacturer

Leading subsea technology manufacturer  Oceaneering International, Inc.

Oceaneering International, Inc. BMT Group Ltd (BMT

BMT Group Ltd (BMT

Saipem

Saipem Tesla Offshore LLC, a leading survey service provider offering comprehensive Geophysical, Geoscience, Marine Construction and Marine Salvage support in offshore waters around the world, is celebrating its 10th year in business. In 2014, Tesla Offshore has also achieved a benchmark in its strategic plan for growth marked by the launch of its state- of-the-art Tesla Bluefin-21 AUV program (

Tesla Offshore LLC, a leading survey service provider offering comprehensive Geophysical, Geoscience, Marine Construction and Marine Salvage support in offshore waters around the world, is celebrating its 10th year in business. In 2014, Tesla Offshore has also achieved a benchmark in its strategic plan for growth marked by the launch of its state- of-the-art Tesla Bluefin-21 AUV program ( Noble Corporation

Noble Corporation