NYC-based PIRA Energy Group believes that Brent crude prices will average higher as global oil markets tighten. On the week, U.S. products continue to build, crude draws again. In Japan, turnarounds continue, crude stocks build. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group believes that Brent crude prices will average higher as global oil markets tighten. On the week, U.S. products continue to build, crude draws again. In Japan, turnarounds continue, crude stocks build. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

European Oil Market Forecast

Brent crude prices will average higher, in the $110-115/Bbl range for the third quarter, as global oil markets tighten. Urals differentials will firm over the next two months. Rising product exports from Russia, the U.S., and Saudi Arabia will be absorbed by demand increases in Latin America, Africa, and elsewhere in the Atlantic Basin, as well as by lower runs in Europe year-on-year.

U.S. Products Continue to Build, Crude Draws Again

Overview inventories increased this past week with product stocks increasing while crude stocks fell. It was the second consecutive weekly crude inventory decline, and declines should generally be commonplace in the weeks ahead. For products, the large inventory build reflected weak reported demand. It turns out last year’s stock build for the same week was more than twice the size of last week's reported inventory increase, thereby widening the year-on-year stock deficit. Most of the deficit is in crude and the two major light products.

Japanese Turnarounds Continue, Crude Stocks Build

Crude runs dropped back, and while crude imports also dropped, crude stocks built over 4 MMBbls for the second straight week. There have been two key delays in planned turnarounds, which will keep runs low for at least the next two weeks. Finished products drew slightly. Product demands showed only modest changes. Refining margins continued to decline with all the cracks, other than fuel oil, losing ground. Margins are deemed to be weak, despite ongoing refinery downtime.

International LPG Prices Mixed Last Week

Despite WTI crude oil prices rallying nearly 3% last week, U.S. propane prices were flat on another huge stock build. Butane prices fared only slightly better. High U.S. LPG inventories, which will soon be in surplus to the year-ago period, will pose challenges for domestic prices. European and Asian LPG prices proved to be far more susceptible to geopolitical supply risks than their American counterparts. Both European propane and butane surged with rising crude by 3% to $780/MT and $747/MT respectively. Asian prices were even stronger with propane’s weekly average up 3.1% to $919/MT, and butane up 3.3% to $921/MT. A lack of incremental European demand and tight competition with naphtha in Asia will continue to act as headwinds for international LPG prices. Record waterborne exports from all regions to Asia will ensure the region remains well supplied in June.

Ethanol Prices Decline

U.S. ethanol prices declined during most of the week ending June 6 due to greater production, rising inventories, and lower corn costs. Prices manufacturing margins fell, breaking three straight weeks of gains, as lower product and co-product prices outweighed the decrease in corn cost.

Ethanol Output and Stocks Increase

U.S. ethanol production increased for the fifth consecutive week the week ending June 6 to 944 MB/D, the highest level thus far in 2014. Inventories accumulated, building by 172 thousand barrels to a 14-month high 18.4 million barrels.

Iraq Update Conference Call with Dr. Kenneth Pollack and Dr. Gary Ross

Iraq is now in a state of sectarian civil war. The most likely situation is that Iraq will become mired in a Syria-like stalemate, with the population divided along ethno-sectarian lines. Kurdish independence looks more likely, but only if Turkey supports an independent Kurdistan. Northern Iraqi exports are unlikely to return, but the 2.6 MMB/D of current southern exports could remain relatively well-protected in Shia-dominated territory. However, periodic disruptions are likely, either from local extortionists or Sunni militia attacks. Right now, oil markets are firmly in a $110-$115/Bbl Brent price range, but even a temporary disruption in the south could quickly send prices into a $115-$120/Bbl range, where risks of an SPR release would increase. Forecast Iraqi production growth (in 2014, 2015 and beyond) is now called into question, providing more support to prices as the pressure on Saudi Arabia to cut production (in 2015+) is likely diminished.

The information above is part of PIRA Energy Group's weekly Energy Market Recap, which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

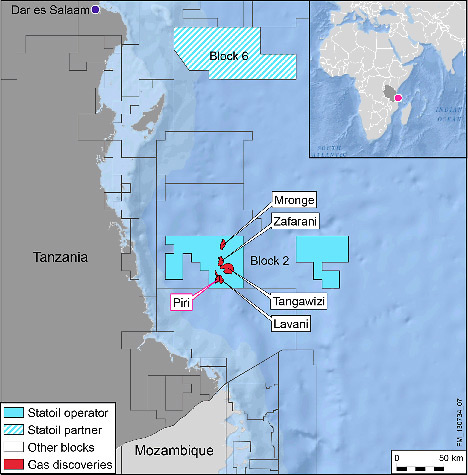

The discovery in the Piri prospect is

The discovery in the Piri prospect is  Foster Marketing, a full-service marketing communication firm serving the worldwide energy industry, has

Foster Marketing, a full-service marketing communication firm serving the worldwide energy industry, has  named Kathleen Murrill (left) as public relations account executive and Alex Mouton(right) as digital associate, President Tiffany Harris announced.

named Kathleen Murrill (left) as public relations account executive and Alex Mouton(right) as digital associate, President Tiffany Harris announced. Arnlea Systems (Arnlea)

Arnlea Systems (Arnlea)

NYC-based

NYC-based  The Damen shipbuilders

The Damen shipbuilders CGG

CGG Caterpillar Marine

Caterpillar Marine Oceaneering International, Inc

Oceaneering International, Inc James Fisher Defense,

James Fisher Defense, Adding to its fleet of 37 conventional and ASD vessels,

Adding to its fleet of 37 conventional and ASD vessels,  Aker Solutions

Aker Solutions  Marsol International,

Marsol International, Apache Corporation

Apache Corporation