A new state-by-state analysis shows that Florida could add up to 10,736 jobs and $1.23 billion to the state economy in 2020 if federal restrictions on U.S. crude exports were lifted, said Executive Director of the Florida Petroleum Council (FPC) David Mica.

A new state-by-state analysis shows that Florida could add up to 10,736 jobs and $1.23 billion to the state economy in 2020 if federal restrictions on U.S. crude exports were lifted, said Executive Director of the Florida Petroleum Council (FPC) David Mica.

"The U.S. is poised to become the world's largest oil producer, and access to foreign customers will drive job creation here in Florida and around the country," said Mica. "When it comes to crude oil, the rewards of free trade are amplified wherever energy, manufacturing, and consumer spending drive growth. American energy exports mean new jobs, higher investment, and greater energy security."

The new report was conducted by ICF International and EnSys Energy. It provides a state-by-state analysis of economic benefits first outlined this March in a national report, which showed that lifting export restrictions could save consumers up to $5.8 billion per year, on average, between 2015 and 2035, as higher production and efficient markets help boost supplies and lower costs.

The latest report shows that Florida is among 18 U.S. states that could gain over 5,000 jobs each in

2020 from exports of U.S. crude oil. The study also forecasts that most states could see economic activity grow by hundreds of millions of dollars due to growing energy production and downward pressure on the prices at the pump. In addition:

Depending on global price trends, nine states – Florida, Michigan, Indiana, California, New York, Pennsylvania, Ohio, Texas, and North Dakota -- could see over $1 billion each in state economic gains in 2020, with slower growth through 2035 after new drilling plateaus.

Eight states – Illinois, Florida, New York, Pennsylvania, Ohio, California, North Dakota, and Texas – could gain over 10,000 jobs each in 2020.

Texas alone could gain up to $5.21 billion in added economic activity and 40,921 jobs in 2020.

North Dakota could gain 22,215 added jobs and $4.81 billion in state economic growth in 2020.

States with significant manufacturing and consumer spending, such as California, could add

23,787 jobs and $2.06 billion in economic activity in 2020. Illinois could add 10,033 jobs and $990 million in state income in 2020.

"Restrictions on exports only limit our potential as a global energy superpower," said Mica. "Additional exports could prompt higher production, generate savings for consumers, and bring more jobs to Florida. The economic benefits are well-established, and policymakers are right to reexamine 1970s- era trade restrictions that no longer make sense."

The FPC is a division of API, which represents all segments of America's oil and natural gas industry. Its more than 600 members produce, process, and distribute most of the nation's energy. The industry also supports 9.8 million U.S. jobs and 8 percent of the U.S. economy.

A new

A new  Aberdeen-based standby vessel operator

Aberdeen-based standby vessel operator  Jerome Shaw (left) has been named Vice President of Marine Construction for

Jerome Shaw (left) has been named Vice President of Marine Construction for  Replacing Jerome Shaw as HSEQ Director is Bo Ristic (right), who previously served as Executive HSEQ and Business Development Manager for Triton Diving Services. Ristic has more than 15 years experience managing complex projects and developing HSEQ action plans. He began his career as a diver and has since gone on to manage complex special projects for major clients around the world.

Replacing Jerome Shaw as HSEQ Director is Bo Ristic (right), who previously served as Executive HSEQ and Business Development Manager for Triton Diving Services. Ristic has more than 15 years experience managing complex projects and developing HSEQ action plans. He began his career as a diver and has since gone on to manage complex special projects for major clients around the world. Bristow Group Inc.

Bristow Group Inc.  CSA Ocean Sciences. (CSA)

CSA Ocean Sciences. (CSA) NYC-based

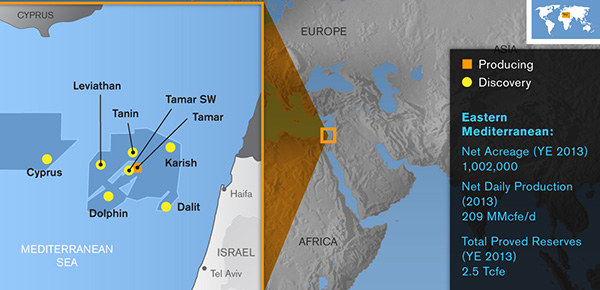

NYC-based  Noble Energy, Inc.

Noble Energy, Inc.  TETRA Technologies, Inc.

TETRA Technologies, Inc. owing of the first Gullfaks loading buoy.

owing of the first Gullfaks loading buoy. The new loading buoys are scheduled to come on line in June and mid-September.

The new loading buoys are scheduled to come on line in June and mid-September. New loading hose for Gullfaks.

New loading hose for Gullfaks. Oilfield service company

Oilfield service company  Superior Performance Inc. (SPI),

Superior Performance Inc. (SPI), UK-based

UK-based  Deep Casing Tools’ Aberdeen workshop

Deep Casing Tools’ Aberdeen workshop