Oceaneering International, Inc. (NYSE: OII) has reported record quarterly earnings for the second quarter ended June 30, 2014.

Oceaneering International, Inc. (NYSE: OII) has reported record quarterly earnings for the second quarter ended June 30, 2014.

On revenue of $927.4 million, Oceaneering generated net income of $110.3 million, or $1.02 per share. During the corresponding period in 2013, Oceaneering reported revenue of $820.4 million and net income of $98.8 million, or $0.91 per share.

Summary of Results

(in thousands, except per share amounts)

Three Months Ended Six Months Ended

June 30, March 31, June 30,

2014 2013 2014 2014 2013

Revenue $ 927,407 $ 820,372 $ 840,201 $ 1,767,608 $ 1,538,924

Gross Margin 218,215 201,864 189,491 407,706 362,239

Income from Ops. 161,311 146,337 132,862 294,173 254,627

Net Income $ 110,295 $ 98,811 $ 91,225 $ 201,520 $ 173,660

Diluted Earnings

Per Share (EPS) $1.02 $0.91 $0.84 $1.86 $1.60

Year over year, quarterly EPS increased on profit improvements from Subsea Products, Remotely Operated Vehicles (ROV), and Subsea Projects. Sequentially, quarterly EPS rose on higher operating income principally from Subsea Products and Subsea Projects.

M. Kevin McEvoy, President and Chief Executive Officer, stated, "Our quarterly EPS was slightly above our guidance, and was up 21% over the first quarter of this year and 12% over the second quarter of 2013. EPS for the first half of 2014 was 16% higher than the first half of 2013. We achieved record quarterly operating income from Subsea Products, and for the first time Subsea Products operating income exceeded that of ROV.

"Our outlook for the second half of this year remains positive and unchanged overall from last quarter. Given this outlook and our year-to-date performance, we are narrowing our 2014 EPS guidance range to $3.95 to $4.05 from $3.90 to $4.10. Relative to the first half of 2014, we expect to generate higher income from each of our operating segments during the second half, led by ROV and Subsea Projects. We continue to forecast year-over-year operating income growth for all of our oilfield segments in 2014.

"Compared to the first quarter, Subsea Products operating income rose on the strength of increased revenue and profitability from tooling and subsea hardware. Subsea Products backlog at quarter end was $850 million, compared to our March 31 backlog of $894 million and $902 million one year ago. During the quarter we announced one large umbilical contract for offshore Indonesia.

"ROV operating income was essentially flat, as operating margin declined due to higher repair and maintenance expenses, unanticipated startup costs associated with placing new systems in service, and lower fleet utilization. Revenue grew on increases in days on hire and revenue per day on hire. During the quarter we put 13 new ROVs into service and retired 4. At the end of June we had 323 vehicles in our fleet, compared to 296 one year ago.

"During the second half of this year, we expect to place at least 13 new ROVs into service, and we have contracts for all of these. When these new vehicles are placed into service depends upon the actual commencement dates of new drilling rig and vessel project work. We now anticipate adding 40 or more new systems to our ROV fleet in 2014.

"Sequentially, Subsea Projects operating income increased largely as a result of adding a vessel, the Bourbon Evolution 803, to our Field Support Vessel Services contract with BP for work offshore Angola and a higher profit contribution from the Ocean Alliance in the U.S. Gulf of Mexico. The Ocean Alliance was out of service for much of the first quarter undergoing a regulatory drydock inspection. Asset Integrity operating income improved slightly due to a seasonal increase in activity in Europe and the Caspian Sea area. Advanced Technologies operating income declined due to execution issues on certain U.S. Navy and industrial projects.

"For the third quarter of 2014, we are projecting EPS of $1.10 to $1.15. We expect sequential improvements in income from all of our operating business segments, led by ROVs.

"Our liquidity and projected cash flow provide us with ample resources to invest in Oceaneering's growth. At the end of the quarter, our balance sheet reflected $103 million of cash, $80 million of debt, and $2.2 billion of equity. During the quarter we generated EBITDA of $217 million, $403 million year to date, and for 2014 we anticipate generating at least $855 million.

"In June we increased our regular quarterly cash dividend by 23% to $0.27 from $0.22 per share. This underscores our continued confidence in Oceaneering's financial strength and future business prospects.

"Looking beyond 2014, we believe that the oil and gas industry will continue its investment in deepwater projects. Deepwater remains one of the best frontiers for adding large hydrocarbon reserves with high production flow rates at relatively low finding and development costs. With our existing assets and opportunities to add new assets, we are well positioned to supply a wide range of services and products to safely support the deepwater efforts of our customers."

The downing of flight MA17 has prompted calls for further sanctions on Russia targeted at its energy sector. Russia is the world's largest exporter of natural gas and second largest exporter of oil which together account for near 60% of its export earnings. Gazprom supplies 30% of Europe's gas - some 15% via Ukraine - and has warned exports will be affected if sanctions are expanded. But in its payments row with Ukraine Gazprom has already stated that it will "only be supplying the exact amount of gas requested by our European partners to the Russia-Ukraine border". Considering that Ukraine itself needs to draw gas supplies from the same pipelines, Europe is already threatened with gas shortages.

The downing of flight MA17 has prompted calls for further sanctions on Russia targeted at its energy sector. Russia is the world's largest exporter of natural gas and second largest exporter of oil which together account for near 60% of its export earnings. Gazprom supplies 30% of Europe's gas - some 15% via Ukraine - and has warned exports will be affected if sanctions are expanded. But in its payments row with Ukraine Gazprom has already stated that it will "only be supplying the exact amount of gas requested by our European partners to the Russia-Ukraine border". Considering that Ukraine itself needs to draw gas supplies from the same pipelines, Europe is already threatened with gas shortages. JDR

JDR NYC-based

NYC-based  To accommodate the future needs of the rapidly growing Angola offshore oil and gas industry

To accommodate the future needs of the rapidly growing Angola offshore oil and gas industry

Oceaneering International, Inc

Oceaneering International, Inc The Brasil Voyager, a tanker owned and operated by Chevron, was built with specific features for offloading oil from Papa-Terra.

The Brasil Voyager, a tanker owned and operated by Chevron, was built with specific features for offloading oil from Papa-Terra.

Asset Guardian Solutions Ltd (AGSL)

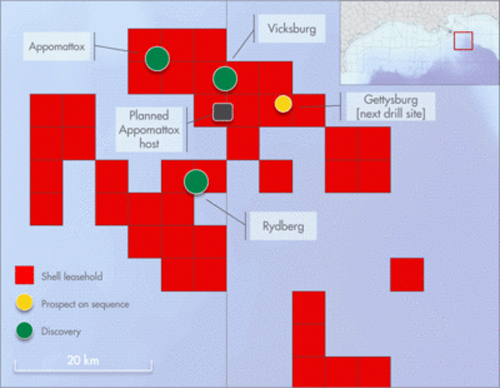

Asset Guardian Solutions Ltd (AGSL) Shell

Shell Danos

Danos  The Njord A platform in the Norwegian Seat. (Photo: Øyvind Nesvåg)

The Njord A platform in the Norwegian Seat. (Photo: Øyvind Nesvåg) Scaffolding used in the reinforcement process. (Photo: Ole-Andreas Nylund)

Scaffolding used in the reinforcement process. (Photo: Ole-Andreas Nylund) Claxton Engineering Services

Claxton Engineering Services Litre Meter has launched the second in its series of industry surveys on safety issues in the oil and gas sector.

Litre Meter has launched the second in its series of industry surveys on safety issues in the oil and gas sector.