Situated approximately 80 kilometres off the east coast of Trinidad and Tobago, this unmanned gas platform holds a special place in one major oil operator’s family. Since it went into production in 2009, it has become one of the largest net producers of natural gas in the operator’s global portfolio.

Situated approximately 80 kilometres off the east coast of Trinidad and Tobago, this unmanned gas platform holds a special place in one major oil operator’s family. Since it went into production in 2009, it has become one of the largest net producers of natural gas in the operator’s global portfolio.

The platform’s average production is around 600 million standard cubic feet of gas per day (or 600 MBTU per day) in addition to associated condensate, from four wells at a depth of approximately 300 feet (90 metres). These figures make the platform a significant revenue generator for the Trinidad and Tobago operation.

The challenge: sand and the sea

As with any asset, maintaining integrity to ensure optimum output and meet regulatory requirements is a priority – which presents its own logistical problems in an offshore, unmanned platform.

Sand erosion is a particular challenge and one that the operator was conscious of from the outset. Traditionally difficult to detect and evaluate, the rate of erosion is rarely linear over time, and intensifies rapidly with an increase in flow rates. Sand can remove metal and cause damage very quickly. Operators must therefore walk a careful line between conservative production rates, which lower revenues, or driving the assets harder and increasing the risk of unplanned outages or even loss of hydrocarbon containment.

Permanently mounted acoustic sand detectors and alarms were deployed on the stainless steel topside risers of the platform. These sensors could detect the presence and quantity of produced sand, and therefore indirectly indicate the likelihood of erosion taking place. However, they provide little information about the shape, size and hardness of the sand particles however – all of which can significantly affect metal erosion rates.

Intrusive methods, that place a sacrificial probe inside the fluid stream and measure its demise as it corrodes or erodes, are also able to indirectly detect periods of high wear. However, since they are not measuring the pipework, they do not give the operator an understanding of the actual asset condition. Intrusive methods also come with additional hazards, getting the worn probe out from inside the pipe is a skilled and dangerous activity. Safety concerns around online probe replacement are causing many operators to reduce their use, or not replace them once they have expired.

The acoustic sand detectors and intrusive probes were not able to measure the actual impact of the produced sand – metal loss - on pipework integrity as it happened. Instead of continuous monitoring of asset piping integrity during production, maintenance operatives had to take periodic manual wall thickness measurements and make incomplete extrapolations on erosion rates using very minimal data sets. The reliance on manual measurements was made more expensive by the hard-to-access site: a dedicated crew of four was helicoptered in every three months to inspect the integrity of the topside risers and pipe work. In addition, the acoustic sand sensors had to be recalibrated on-site every six months.

The operator also ran computational models to understand the impact of given levels of sand production. But the shortage of actual integrity measurements meant that the production rates were being throttled back substantially to avoid sand erosion issues.

The solution: continuous wall thickness measurements

As one of the most advanced and technologically sophisticated platforms in the operator’s estate, they wanted to ensure that production was optimised to maximise revenue and increase payback from the significant capex investment.

Tom Fuggle, Business Development Director at Permasense said, “The initial discovery well for this platform indicated that there was upwards of two trillion cubic feet of natural gas in place. For the client, sand erosion wasn’t solely a question of maintaining its assets, essential though that is. They also wanted to maximise output from this significant discovery. But increasing production without understanding the immediate effect on well integrity would be as reckless as driving blind in the Monte Carlo rally – with equally damaging consequences.”

The operator had previously worked closely with Permasense to develop a new method of measuring the level of erosion and corrosion within piping. Already installed in all of its refineries, a programme to roll out the technology to upstream assets was underway – and this platform was identified as a valuable target where the technology would offer significant advantages.

The Permasense solution uses proven ultrasonic principles for measuring the thickness of any fixed equipment. But instead of relying on inspection teams to periodically take these measurements and record them manually, permanently mounted sensors deliver their data wirelessly to existing communications infrastructure used by the onshore operations team. The team can then view and analyze the information without leaving their desks.

Implementation: targeted measurements and instant data

Permasense sensors were initially installed in areas of elevated erosion risk. This included areas experiencing the highest flow velocities in one of the producing wells that had the highest sand production rate. A cluster of sensors were installed in an array formation downstream of the first cushioned Tee and a circumferential ring of sensors was installed downstream of the choke.

Once the initial installation on a single well was complete and providing a regular supply of consistent and robust data, a similar system was installed on the additional producing wells. In addition, the operator was concerned that produced sand from this platform would carry over through the flow line to the neighbouring gathering platform, from where the produced gas is then pumped back to shore. A further 80 sensors were therefore installed in a grid formation on the inlet manifold of the carbon steel flow line from this platform on the neighbouring manned platform.

The first round of sensors were mounted onto threaded studs that had to be welded to the pipe. However, to overcome difficulties associated with qualifying a weld procedure for use in a live production environment, Permasense mounted the next group of sensors onto clamps designed to further simplify installation in an upstream production environment. Permasense has since developed a magnetically mounted sensor that can measure through external corrosion protection coatings to further ease installation.

Peter Collins, Permasense CEO says, “Once the locations for monitoring were selected, installation and commissioning of the Permasense system was very straightforward – and took just one day on the platform. When specifying and supporting the installation of the initial system, our team thoroughly understood the requirements of the client – and the system started to deliver data immediately and reliably to the desks of the operator’s onshore engineers.”

The results: production, safety, integrity

With the Permasense system installed, previously unavailable insights into the condition and capability of the fixed equipment on the platform have become available.

By default, the system transmits measurements on wall thickness back to shore every 12 hours. Although, onshore engineers have occasionally increased measurement rates during periods of elevated risk such as periods of high sand production or changes to production flow rates. Data management software within the system calculates the rate of wall loss and classifies the measurement locations by user-defined rate thresholds.

The data is mainly viewed and analysed by asset-integrity specialists at the operator’s office in the Port of Spain, but is also available for viewing from any PC on the operator’s network.

The Port of Spain team can instantly analyse data and compare it against historical trends. Graphical representations of the data indicate which sections of the infrastructure show signs of degradation. In effect, the system acts as an early warning which enables the Trinidad and Tobago operating team to monitor the impact of changes to production rates and adjust them as necessary.

With this new insight, they have increased production of the well by 12 per cent - confident that the impact on erosion rates is well within the safety parameters. This increase in production rate is equivalent to an increase in saleable gas of 30 million standard cubic feet of gas per day, or US$ 90,000 a day increase in revenue (at a price of three dollars per million standard cubic feet).

Jake Davies, Marketing Director at Permasense says, “The Permasense monitoring solution revolutionised the operator’s knowledge and management of sand erosion. We use trusted ultrasound technology, and the level of data, insight and analysis that this gives the operator is making a major contribution to optimising output at the site. Because of the safe increase in production, they saw payback in just days.”

The operator is now installing the Permasense system on other manned and unmanned gas production platforms in the region.

Summary

• Site: An unmanned natural gas platform in the Caribbean Sea.

• Challenge: to maximize output while minimizing sand erosion damage to the platform’s piping and other fixed equipment.

• Solution: gaining real-time visibility and insight into the effect of produced sand particles in topside risers and other fixed equipment using wall thickness monitoring sensors that wirelessly transmit data to onshore personnel in real time.

• Results: The operator was able to safely increase production by 12 per cent or 30 million standard cubic feet of gas per day from the first instrumented well, safe in the knowledge that resulting erosion rates were within acceptable limits.

• The operator was so satisfied with the results that it has since instrumented the solution on to other wells in the region

COSL Innovator

COSL Innovator International manufacturer

International manufacturer  Photo credit: BOEM

Photo credit: BOEM Horizon Geosciences

Horizon Geosciences The exploration rig Deepsea Atlantic. (Credit: Statoil. Photo: Marit Hommedal)

The exploration rig Deepsea Atlantic. (Credit: Statoil. Photo: Marit Hommedal) GE Oil & Gas has signed a Master Service Agreement with Statoil for new subsea projects that will enable GE to continue to support the international energy company’s value creation in a low oil price environment.

GE Oil & Gas has signed a Master Service Agreement with Statoil for new subsea projects that will enable GE to continue to support the international energy company’s value creation in a low oil price environment. Statoil

Statoil Subsea closeup illustration screen version. Credit: DNV GL

Subsea closeup illustration screen version. Credit: DNV GL Situated approximately 80 kilometres off the east coast of Trinidad and Tobago, this unmanned gas platform holds a special place in one major oil operator’s family. Since it went into production in 2009, it has become one of the largest net producers of natural gas in the operator’s global portfolio.

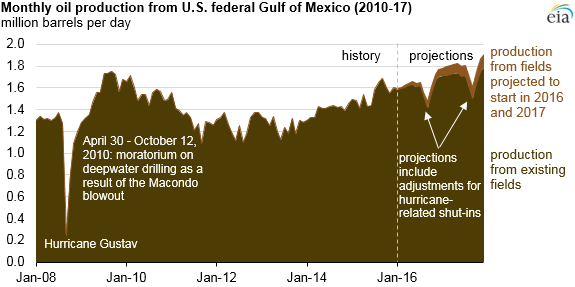

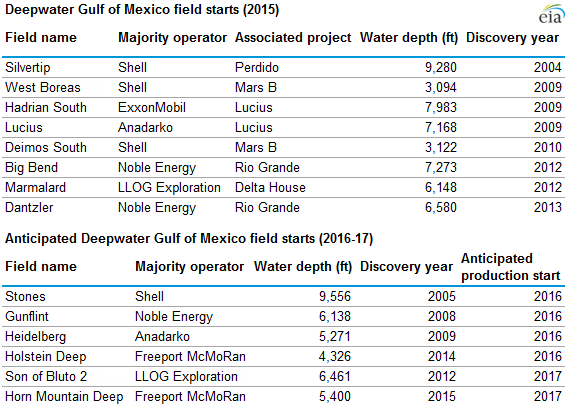

Situated approximately 80 kilometres off the east coast of Trinidad and Tobago, this unmanned gas platform holds a special place in one major oil operator’s family. Since it went into production in 2009, it has become one of the largest net producers of natural gas in the operator’s global portfolio. U.S. Gulf of Mexico (GOM) crude oil production is estimated to increase to record high levels in 2017, even as oil prices remain low. EIA projects GOM production will average 1.63 million barrels per day (b/d) in 2016 and 1.79 million b/d in 2017, reaching 1.91 million b/d in December 2017. GOM production is expected to account for 18% and 21% of total forecast U.S. crude oil production in 2016 and 2017, respectively.

U.S. Gulf of Mexico (GOM) crude oil production is estimated to increase to record high levels in 2017, even as oil prices remain low. EIA projects GOM production will average 1.63 million barrels per day (b/d) in 2016 and 1.79 million b/d in 2017, reaching 1.91 million b/d in December 2017. GOM production is expected to account for 18% and 21% of total forecast U.S. crude oil production in 2016 and 2017, respectively. Source: U.S. Energy Information Administration,

Source: U.S. Energy Information Administration,  Source: EIA

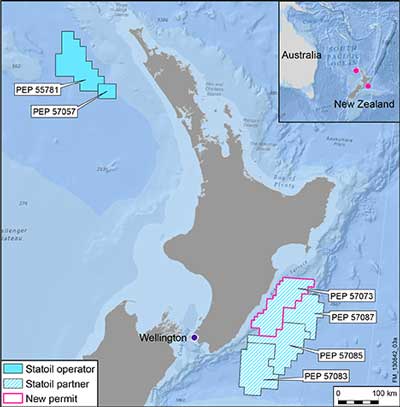

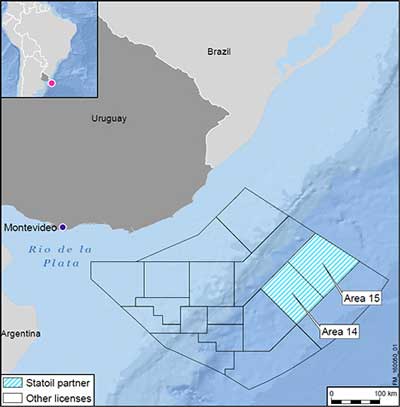

Source: EIA Map Image : Courtesy Statoil

Map Image : Courtesy Statoil 2H Offshore

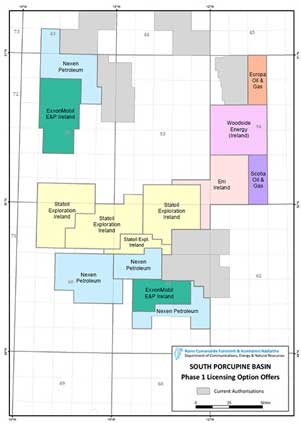

2H Offshore Statoil Exploration (Ireland) Limited has been awarded six Licensing Options in Ireland’s 2015 Atlantic Margin Licensing Round.

Statoil Exploration (Ireland) Limited has been awarded six Licensing Options in Ireland’s 2015 Atlantic Margin Licensing Round. Magne Viking, care of Viking Supply Ships.

Magne Viking, care of Viking Supply Ships. President Obama’s fiscal year (FY) 2017 budget request for the Bureau of Safety and Environmental Enforcement (BSEE) provides critically needed resources to further strengthen BSEE’s regulatory and oversight capabilities for oil, natural gas and renewable energy development on the U.S. Outer Continental Shelf, promoting a culture of safety and environmental protection by ensuring compliance with Federal regulations.

President Obama’s fiscal year (FY) 2017 budget request for the Bureau of Safety and Environmental Enforcement (BSEE) provides critically needed resources to further strengthen BSEE’s regulatory and oversight capabilities for oil, natural gas and renewable energy development on the U.S. Outer Continental Shelf, promoting a culture of safety and environmental protection by ensuring compliance with Federal regulations.