Overall U.S. Stocks Build While Crude Draw Disappoints

Overall U.S. Stocks Build While Crude Draw Disappoints

Commercial oil stocks built 5.2 million barrels this past week, sharply contrasting with last year’s 6.7 million-barrel inventory draw for the same week. The entire build was in NGLs but the expected large crude stock decline did not materialize onshore as crude imports were bloated by a drawdown of floating stocks. Floating crude and even onshore stocks in major entrepot areas pose a challenge to estimating onshore stocks in key price-setting markets. There is a huge surplus of inventory which will take time to eliminate. So while crude stocks are undoubtedly declining, declines might not show up in the weekly onshore data in a given week.

1Q16 U.S. Producer Survey Harkens Back to Better Times

In response to a fleeting improvement in market conditions, U.S. gas producers grew production once again in 1Q16. Appalachian producers led the change, delivering an additional 1.2 BCF/D versus 4Q15 through the utilization of infrastructure that had been built towards the end of last year. Yet, the combination of stronger production and weaker heating demand gave rise to record inventories by end March, necessitating a subsequent reversal in production as a means for rebalancing. Thus far, the trend in 2Q16 production data suggests that U.S. producers are taking heed of this requirement, establishing a definitive change in course for PIRA’s Survey Group.

Brexit Clouds Demand Outlook, Dark Spreads to Hold on Bearish EUAs

The Brexit vote starts a highly uncertain transition period for the U.K. and the rest of the European Union. This transition period will likely mean weaker economic growth, especially in the U.K., and with that, downside risks for demand. However, U.K. winter prices should be largely unaffected by the Brexit decision. We assume for now that a political contagion will remain in check, but the major risk to Continental power prices resides now in an even more bearish EU ETS. While the EU ETS could be severely wounded in the current environment, domestic carbon initiatives – the French carbon floor or the like – are likely to move forward.

Brexit Vote Stops Coal Pricing Rally

Global equity, currency, and commodity markets were dominated by the Brexit vote last week, coal included. Before the vote, coal prices has been volatile, although with a general upward trajectory. The decline in prices on Friday sent Atlantic Basin Prices into negative territory for the week, if only marginally, while FOB Newcastle (Australia) prices were able to manage to rise in the prompt, although deferred prices faded. With the vote kicking off a likely two-year negotiation period between the U.K. and the E.U., there are limited fundamental changes to the coal market over the short-term, aside from a prevailing sense of unease and a lower appetite for risk.

Fed-Centric Financial Markets Now Roiled by Brexit

Since March, Fed policy communications have generally supported market sentiment and kept the dollar’s value in check. However, U.K. voters unexpectedly chose to leave the European Union in the June 23 referendum, and this has placed financial markets in a new, uncertain phase. PIRA’s expectation is that the Fed will reassert its control over markets after the initial Brexit shock wears off. During previous episodes of financial stress and a stronger dollar, the Fed adjusted its message to alleviate market pressure; it should not act differently this time around.

Volatility to Remain High

After a trading week that included a limit down move in corn along with all the uncertainty of the Brexit vote, grain/oilseed markets should be staring at yet another volatile week as corn pollination inches closer and the “final” 2016 acreage numbers are released on Thursday, along with the 3Q16’s stocks of grain.

Latest Assessment of Nigerian Oil Supply Disruptions

The situation in Nigeria remains highly fluid. Reports of a 30-day ceasefire are conflicting, but at the very least suggest some kind of dialogue is taking place between the government and militants. Even if there is an agreement, disrupted volumes will not return immediately and the situation is likely to remain fragile. Fiscal problems will make it difficult for the Buhari administration to revive an amnesty program for Niger Delta militants, and it will be difficult for the government to go back on its anti-corruption campaign.

Ethanol-Blended Gasoline Manufacture Surges to Near Record

Inventories fell slightly the week ending June 17. Stocks in PADDs I and III increased.

Japanese Crude Runs Ease with Higher Crude and Product Stocks

Crude runs eased on the week as Hokkaido entered full turnaround. Crude imports rose and crude stocks built 2.7 MMBbls. Finished product stocks also rose by 0.7 MMBbls, with about half being kerosene. Gasoline demand was soft and stocks built slightly. Gasoil demand was stronger and stocks resumed drawing. Kerosene demand was seasonally low and the stock build rate remained about 50 MB/D. Refining margins have remained soft in June.

Supply Tempers Breadth of Rally Across Regions

The rebound in Henry Hub has buoyed all regional cash prices — but to considerably varying degrees. Indeed, the regional dispersion of CDDs accounts for some of the relative strength and weakness in prices/basis, but supply trends have also played a key role. The standout feature of this month’s regional price action is the need of further assistance from weather as the market awaits larger supply losses.

When Will LNG Balances Hit the Tipping Point?

The temporary loss of existing LNG production is masking the rise of new LNG production in much the same way that oil production disruptions around the world in 2014 delayed the bearish price effect of the rise of shale in the U.S. In late 2014, that tipping point on oil was reached when global disruptions crested even though U.S. shale production continued to rise. For LNG markets, the tipping point will occur late in the first quarter of 2017.

Energy Efficiency Puts Downward Pressure on U.S. Power Demand and Gas Growth

PIRA downgraded its latest long-term U.S. power demand forecast from a 0.83% compound annual growth rate (CAGR) between 2015 and 2035 to a 0.54% CAGR. A significant portion of this downgrade is due to anticipated load destruction from end-use electricity savings arising from recent developments in energy-efficient technologies, product efficiency standards, and state-level efficiency programs, as well as a lack of weather-adjusted load growth in essentially five years. These developments suggest additional headroom for savings beyond previously modeled energy efficiency potential, particularly in areas like lighting and space cooling in the commercial and residential sectors. PIRA expects this load destruction will be most acute for gas burn and new gas plant builds, which are also under increasing pressure from renewables.

Freight Rates Hold Steady as Cape Fleet Growth Picks Up

While the Brexit vote has added significant uncertainty regarding dry bulk demand growth in Europe and potentially elsewhere, there have been some fundamental developments in the sector of late, such as Winning International hauling 15 MMmt of Guinean bauxite to China this year using Capes loaded by floating transfer equipment. Continued growth in fleet supply will keep rates in check over the next several months, although PIRA has a tighter outlook going into 2017.

U.S. Ethanol Production Reaches All-Time High

The output of ethanol reached a record the week ending June 10. This essentially ended the rally in prices that began in February.

Old Crop Soybean Supplies in Focus

Validated moisture events will have a negative effect on new crop prices, so PIRA is bullish old crop/bearish new crop at the moment, after being bearish beans for a few weeks. As July heads into first notice day next week, focus will shift to the August/November spread as an indication of dwindling old crop supplies.

Global Equities Decline on Brexit Outcome

Global equities were broadly lower on the week. The U.S. market was down 1.6%, Friday-to-Friday. The growth indicator underperformed, and banking was the weakest single sector, down 3.4%. Consumer staples and utilities faired the best, while energy also outperformed, down only 0.5%. Internationally, many, but not all, the tracking indices were lower. Europe was the weakest. Latin America managed to post a gain, while China and the BRICs also outperformed and only posted modest changes for the week.

Energy Implications of the Brexit Vote

The IMF has recently developed two scenarios to gauge the economic impact of Brexit. PIRA estimates that in the "Limited" scenario, world oil demand in 2017 would be about 100 MB/D lower than in the IMF's Base Case, with the largest impact in Western Europe. In the "Adverse" scenario, world oil demand in 2017 would be 200 MB/D lower than the IMF Base Case. There would also be noticeable impacts on gas and coal demand. These impacts on energy demand might slow, but not reverse, the oil price recovery PIRA projects.

Can Norway Step in to Take Rough's Role this Winter? Will It?

Centrica’s decision to shut the Rough storage facility until August 3rd caused a huge spike in winter ‘16 prices and a weakening in the spot/front month pricing. The opportunity cost of injection over this period is around 1 BCM and will need to be made up whether from Rough itself or somewhere else. PIRA suggested that with a Rough maintenance coming up in September, a shortening or cancellation of this maintenance may be possible and would help relieve some of this pressure. Looking to the power side for some demand relief this winter seems to be a lost cause. While power demand tends to be very sensitive to price, recent strong developments in gas prices have been outperformed by spark spreads for this winter. Another way some or potentially all of this lost storage volume can be made up is by higher Norwegian volumes, which are very tied to NBP-TTF spreads.

Shale Rig Activity Has Likely Bottomed, But Production Declines To Continue

Production declines accelerated in the first quarter but output still came in above guidance. Shale operators raised 2016 production guidance to a 6.1% year-on-year decline (up 1.7% points from guidance given during 4Q15 calls). And with the increase in prices from February lows, operators began to detail plans to increase activity. Many operators indicated that at $45-50/Bbl rigs will be added in the Permian, while the Bakken and Eagle Ford will require $50-60/Bbl. In line with this guidance, the horizontal oil rig count appears to have bottomed in mid-May; rigs are up 7% in the past five weeks. Despite this, PIRA still expects production to decline for the remainder of the year as it will take time for the slowdown in activity to show up in production. 1Q16 costs continued to decline (down 25-30% since the downturn), but the pace slowed markedly. Much of the savings were attributed to service price concessions, and are likely to reflate as activity ramps up.

Supply Glitches Keep Legs Under Spot Prices for Now

LNG markets remain balanced at relatively high spot prices of $5/mmBtu thanks to supply disruptions from existing producers and delays emerging from new supply. The quality of buyer is dropping when it comes to bearable price, which is a sure sign that the overhang may be delayed, but it is inevitable.

Brexit Rattles Markets

The UK’s vote to leave the EU rattled financial markets on June 24th, setting back gains that had been made Monday through Thursday. While many weekly averages were higher, Friday-to-Friday data showed a steep drop in most key indicators.

Freight Market Outlook

Tanker markets are starting to suffer from the influx of new vessels with few offsetting deletions and the anticipated start of the slow drawdown of excess inventories which have built up over the past two years. The drip feeding of new tonnage and the withdrawal of excess stock from the supply chain will result in a pattern of lower peaks and deeper troughs in tanker rates as the year progresses.

Amid the Chaos, LPG Markets Strengthen

LPG traded on fundamental supply and demand factors last week, leading to strong gains across the complex. July Mt Belvieu propane futures added a solid 3.7% to bring its value to 47% of WTI. Butane outperformed, adding 5.1% to settle near 69¢ /gal Friday. Ethane futures ripped 7% while natural gasoline prices managed to hold near unchanged despite weaker broader markets.

Ukraine Confirms Default Industrial Gas Prices

Naftogaz Ukraine has published quotations for natural gas for industrial consumers and other economic entities, which will operate from July 1, 2016 as stated in the press release of the company. “The proposed price of natural gas from the resource companies can vary depending on the volume of purchases, payment terms and the status of previous calculations of “Naftogaz”. Levels of the final price for industrial consumers and other economic entities, depending on the specified conditions, compared to June prices remained unchanged (taking into account tariffs for transportation via trunk and distribution pipelines and VAT).”

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

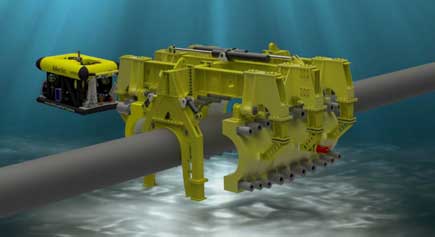

Photo courtesy: Maersk Oil

Photo courtesy: Maersk Oil Fugro Gauss. Photo credit: Fugro

Fugro Gauss. Photo credit: Fugro Seventy one accounts of incidents that took place in 2014 on 54 vessels were submitted for the annual ‘Dynamic positioning station keeping incidents: Incidents for 2014’ (M 231) report produced by the

Seventy one accounts of incidents that took place in 2014 on 54 vessels were submitted for the annual ‘Dynamic positioning station keeping incidents: Incidents for 2014’ (M 231) report produced by the  Overall U.S. Stocks Build While Crude Draw Disappoints

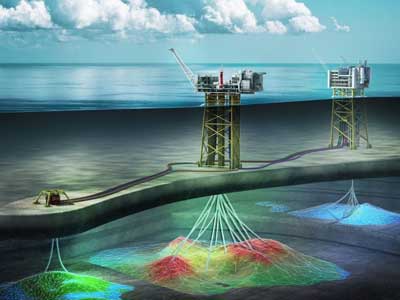

Overall U.S. Stocks Build While Crude Draw Disappoints Peregrino field. Photo courtesy: Statoil

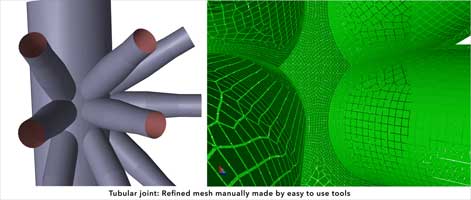

Peregrino field. Photo courtesy: Statoil Photo credit: Subsea Innovation

Photo credit: Subsea Innovation

The decision by 52% of the voters in the EU referendum last week to vote to leave the EU has had far-reaching impact across the globe. The oil and gas sector, bruised from nearly two years of low oil prices, is bracing itself for the fall out.

The decision by 52% of the voters in the EU referendum last week to vote to leave the EU has had far-reaching impact across the globe. The oil and gas sector, bruised from nearly two years of low oil prices, is bracing itself for the fall out. West Pegasus. Photo credit: Tom Burns, Global Maritime

West Pegasus. Photo credit: Tom Burns, Global Maritime

LQT Industries, LLC

LQT Industries, LLC Laura Tyler, Chief of Staff, Head of Geoscience. Photo credit: BHP Billiton

Laura Tyler, Chief of Staff, Head of Geoscience. Photo credit: BHP Billiton Ivar Aasen, Det Norske

Ivar Aasen, Det Norske Søren Skou. Photo credit Maersk Group

Søren Skou. Photo credit Maersk Group