Canadian Wildfires Tighten Onshore Markets in May

Canadian Wildfires Tighten Onshore Markets in May

Crude prices surged in April on market expectations of tightening fundamentals in the second half of the year. Dangerous wildfires in the oil sands town of Fort McMurray, Alberta, have caused substantial volumes of production to be shut in which will support Canadian differentials.

Seasonal Rally Stalls on Restocking Concerns

A “business as usual” approach to rebuilding inventories is simply not achievable in light of the record end-winter storage level. Moreover, a sustainable recovery in prices will simply not occur unless the weekly injections significantly trail the average. Toward that end, PIRA foresees the acceleration in production declines playing a key role to seasonal rebalancing — eventually moving prices back in line with levels that justify the lifting costs for producers.

Coal Demand Hammered in Europe, ex Germany; Bullish Policy Risks Surface

2016 is looking to be a difficult year for European coal-fired generation, with increasing hydro and renewable generation and more competitive gas pricing slashing coal burn and pushing coal generation to new multi-year lows. In contrast to the rest of Europe, German coal-fired dispatching is holding up quite well. While German gas units are up year-on-year, the bulk of German coal is finding support in a variety of factors, ranging from lower nuclear and inflexible lignite generation or even resilient power exports. In this context, it’s interesting German policymakers appear once again to be shifting toward an even tougher stance against carbon-intensive generation.

Oil Drags Coal Lower; Prompt API#2 Finds Some Support

Prompt seaborne thermal coal pricing was mixed last week, with API#2 (Northwest Europe) finding some support from the rise in NBP gas pricing and evidence of Colombian supply shifting into the Pacific Basin (discussed below), while FOB Newcastle (Australian) prices weakened marginally. Beyond the prompt market, all three pricing curves moved decidedly lower, with the decline in the oil market pulling coal prices lower. Looking ahead, much will depend on the strength of Pacific Basin coal demand and whether or not demand growth there will be strong enough to offset weakness in the Atlantic Basin and absorb excess supply moving east.

CA Carbon Burdened by Auction Lawsuit

Benchmark California Carbon Allowance contract prices have rebounded from April lows below the floor price, likely related to the auction lawsuit. PIRA expects the May auction to be undersubscribed, but ongoing buying works to push secondary market prices in line with the auction reserve. PIRA believes the auctions will be ultimately be upheld; in any case, they would not be halted until the CA Supreme Court rules in 2017. The market will continue to react to legal developments.

Military Progress in Yemen Could Lead to a Partial Resumption of Oil Production

Reports indicate that Yemen could export a crude cargo from its southeastern Ash Shihr terminal as soon as the end of May. Exports from Ash Shihr have been shut for over a year, but a restart became possible in late April when the Saudi-led coalition retook control of the facility from Al Qaeda. Ash Shihr handles all of the oil exports from Yemen’s Hadramawt province, where production reportedly totaled ~50 MB/D before port closures in April 2015. The cargo in question will most likely come from storage, but a production restart could potentially follow.

S&P 500 Eases

The S&P 500 eased again this past week. It was its second straight decline after a nice leg higher over the better part of two months. Despite the drop, high yield debt (HYG) improved, while emerging market debt (EMB) was flat. Volatility increased and the Russell 2000 eased. The yield on the BAA-rated corporate bond has continued to decline. The U.S. dollar was generally lower, and commodities were mixed on the week.

U.S. Ethanol Output Falls

Inventories built, rebounding from a three-month low the week ending April 29. Ethanol-blended gasoline manufacture fell from a 2016-high.

Uncertainty Rules

May and June WASDE’s rely on acreage from the Prospective Plantings (PP) report at the end of March and trend line yields established by the USDA at its annual Outlook Forum in February. With that history, plugging in the numbers should be pretty straight forward in estimating this week’s WASDE and June for that matter. That said, there seems to be a lot of consternation this month as far as estimates are concerned.

Refining Healthy, But Carefully Balanced

Tightening balances will push crude prices higher with fundamentals now passing their weakest point. The global stock surplus will start to decline in 2Q16, with a larger drop in 2H16. European refining margins will stay generally healthy and runs reasonably high through the summer before weakening. But product markets are carefully balanced, with strong demand growth offsetting high refinery production/stock levels. Gasoline cracks will stay seasonally strong, but lower than in 2015. Diesel cracks will only gradually recover, weighed down by high stocks.

Focus on the Gas Flows, Not Carbon Floors

The recent jump in spot gas prices reflects trader jumpiness more than a change in underlying fundamentals. Spikes in recent weeks have been assigned to proposed carbon floors, initially in France and potentially across the European Union. In first looking at the French proposal, PIRA outlined in our European Electricity Service that the impact of gas demand on the Continent may not look the same as the experience of the carbon floor in the United Kingdom. For the gas market to move up and remain up on these policy changes, asset players, like utilities, need to be buying these volumes for their hedging portfolios. Given that no policy has officially changed, PIRA sees most of this move up as speculative and not possessing strong legs.

Global Equities Ease Again

Global equities generally fell back again on the week. Defensive sectors did the best, with consumer staples and utilities posting gains and the defensive indicator being marginally changed. In the U.S., energy was down 3.3% and banking down 3.8%. Internationally, all the indices, other than Japan, which posted a gain, did worse than the U.S. Latin America and emerging markets were the weakest performers.

U.S. Ethanol Prices Advance

Ethanol prices rose during the week ending April 29. Prices were driven by a plunge in output, strong demand and declining stocks. Higher corn and petroleum values were supportive.

Wheat Tour Impresses

Tour findings suggest a Kansas wheat harvest of an amazing 382 million bushels, 19% higher than USDA estimates. Timely rains, not genetics, were the main catalyst. The Kansas crop is now considered by many to have the potential of “best ever.” The average field yield estimate was almost 49 bpa, up 13 bpa from last year. With yields like that, the “loss” of 7.6% of planted acreage just doesn’t matter.

Perhaps the Market Will Get a Little Short-Term Help It Needs Nows?

Unlike April, May is not a good seasonal month for crude oil prices going up. While fundamental data continues to point to ongoing rebalancing of oil markets, with for example U.S. oil inventories increasing at roughly half the typical rate in April, stocks are still increasing from an already high level. Prices have not surprisingly moved up faster than the improvement in supply/demand, but this is the way our market works and this will continue to be the case. But this does indeed pose risks to the front of the market with time spreads particularly exposed. Europe looks dodgy with prompt cargoes backing up, despite a healthy North Sea maintenance program in June and with especially strong futures time spreads. On our side of the Atlantic we have a big build coming up in next week’s EIA data in Cushing, partly related to Marketlink maintenance, but now the market is receiving help from the Canadian wildfires. While this is indeed cruel help because of the concerns about loved ones and the savagery of lost homes, there will be lost oil output. So far, it could be perhaps as much as 500 MB/D that is shut in and there are risks to much greater supply.

Global LPG Weekly Scorecard

U.S. Mont. Belvieu LPG prices faired marginally better than the broader energy markets: propane prices declined last week by only 1.5% to near 49 ¢/gal, while butane dropped 0.5%to near 63¢/gal.

U.S. LNG Storage Will Emerge as a Trading Asset

In the unchartered terrain of U.S. Gulf LNG production, with its unprecedented potential for massive gas demand swings, the relatively quiet realm of LNG storage is set to become a hotter commodity off which to trade. If Henry Hub prices are already being affected in some part by the on-again, off-again nature of 700-800 MMCF/D (19.8-22.7 MMCM/D) of gas flows to Sabine Pass, what kind of volatility can we expect a few years down the road when 8-10 BCF/D (227-283 MMCM/D) of gas flows are tied to U.S. LNG production?

February 2016 U.S. Domestic Production Decline Accelerates, Still Trails PIRA Estimates

DOE recently released its February oil balances. Domestic crude supply, which is domestic crude production plus the balancing item, fell 266 MB/D, month-on-month, and shows a year-on-year decline of 646 MB/D. In contrast, the weekly data posted a monthly equivalent decline of 195 MB/D, Feb. vs. Jan. This implies domestic crude supply was reduced 71 MB/D from what the weekly data had been showing. As PIRA has pointed out the DOE monthly collection methodology tends to overstate production since its survey universe lacks full coverage of smaller producers. It is the balancing item that reflects this bias and this is why PIRA adds it to reported production to estimate domestic crude supply. This was referred to in a PIRA Spotlight, posted March 3rd, titled, "Negative Balancing Item Points to Lower than Reported U.S. Crude Production."

Business Customers Gas Prices Under Review in France

France’s antitrust regulator has ordered power utility Engie SA to change its natural gas prices for non-residential customers to better reflect its costs. Acting on a complaint filed in October by rival Direct Energie, the regulator, Autorité de la Concurrence, said Engie, formerly known as GDF Suez, didn’t reflect all its costs in some of the individual offers made to large companies. The company’s price policy could threaten to push rivals out of the market, it said. Even though the probe isn’t complete, the regulator said it found enough evidence to force Engie to change its pricing policy immediately.

U.S. Labor Market Is Still Solid, But What About the Equity Market?

In April U.S. job growth came in below expectations, and the household labor market survey showed sluggishness. Meanwhile, the ISM business surveys and vehicle sales were constructive. Overall, the U.S. economy’s momentum has stayed intact in all likelihood, while the chance of the Fed staying put at the next policy meeting has become even greater. Other topics discussed in this report: the relationship between gasoline prices and U.S. consumer spending; the price-income ratio for U.S. housing; and a recent significant rise in the price-earnings ratio for the S&P 500 index.

Aramco Pricing Adjustments for June Suggest Willingness to Sell Less Oil

Saudi Arabia's formula prices for June were just released. The biggest change was a tightening in pricing into Asia. The changes to Asia suggest that Saudi is willing to see its liftings drop if customers so choose. In Northwest Europe, pricing was also tightened on all grades except for Arab Extra Light. The adjustments were in alignment with PIRA's European pricing model. Pricing for U.S. destinations was reduced $0.20/Bbl on all grades except for Arab Light, which was left unchanged.

Canadian Wildfires Hit Oil Sands Production

Wildfires continue to ravage the Fort McMurray area, compelling oil sands operators to shut facilities or curtail volumes to allow workers to evacuate. PIRA estimates current production losses to be around 1.0 MMB/D and expects the cumulative loss to be between 10 to 15 million barrels in our Reference Case scenario. No oil sands facilities have so far been damaged, but the situation is obviously unpredictable. Production losses are expected to result in strengthened western Canadian differentials, with Syncrude-WTI expected to rise from $1.45/Bbl in April to $3.50/Bbl in May and WCS-WTI expected to strengthen from a discount of $12.40/Bbl in April to $11.75 in May.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

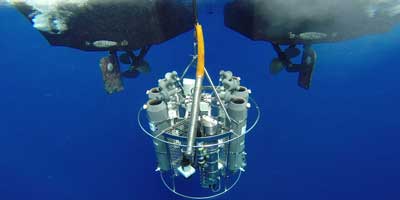

TRDi ADCP, Flotation and Acoustic Releases Ready for Deployment. AXYS WatchMate Behind. Credit: Metocean

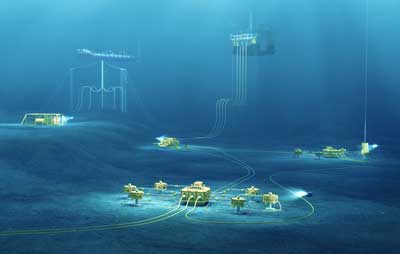

TRDi ADCP, Flotation and Acoustic Releases Ready for Deployment. AXYS WatchMate Behind. Credit: Metocean The Culzean gas field project is on track within budget and according to plans.Image courtesy: Maersk Group

The Culzean gas field project is on track within budget and according to plans.Image courtesy: Maersk Group Right cut drilling and well illustration. Credit: DNV GL

Right cut drilling and well illustration. Credit: DNV GL The end of March saw a resolution reached between Kuwait and Saudi Arabia for the resumption of production from the Khafji field – located in the Arabian Gulf. The project was shut-in by the Saudis in October 2014 due to environmental regulation breaches, March’s initial agreement was backed by senior Riyadh officials. However, Deputy Crown Prince Mohammed bin Salman recently brought an abrupt halt to proceedings, moving to block the addition of oil from Khafji to global markets – highlighting potential discordance in Saudi Arabia’s oil policy.

The end of March saw a resolution reached between Kuwait and Saudi Arabia for the resumption of production from the Khafji field – located in the Arabian Gulf. The project was shut-in by the Saudis in October 2014 due to environmental regulation breaches, March’s initial agreement was backed by senior Riyadh officials. However, Deputy Crown Prince Mohammed bin Salman recently brought an abrupt halt to proceedings, moving to block the addition of oil from Khafji to global markets – highlighting potential discordance in Saudi Arabia’s oil policy. Image credit: DNV GL

Image credit: DNV GL Fugro Wavescan buoys. Photo courtesy: Fugro

Fugro Wavescan buoys. Photo courtesy: Fugro Software that enables acoustic data to be streamed in real-time from subsea structures as they are installed has helped to reduce non-production time (NPT) for independent oil and gas producer, INPEX, and its survey contractor, Neptune Geomatics, during construction of the Ichthys gas field, offshore Western Australia.

Software that enables acoustic data to be streamed in real-time from subsea structures as they are installed has helped to reduce non-production time (NPT) for independent oil and gas producer, INPEX, and its survey contractor, Neptune Geomatics, during construction of the Ichthys gas field, offshore Western Australia. Procurement specialist 80:20,

Procurement specialist 80:20,  CSA Ocean Sciences Inc. (CSA)

CSA Ocean Sciences Inc. (CSA) SeaRobotics Corporation

SeaRobotics Corporation There is something about Italian products, from consumer goods to industrial objects, that carries a stylistic flair. This is well represented in the cruise ships of the Fincantieri Shipyard, such as the 2015-delivered Britannia. More recently this flair for design and quality construction is evident in the 2016-delivered fast supply vessel Blue Brother from Cantiere Navale Vittoria SPA of Adria, on the Canal Bianco which connects to the Po River in the province of Rovigo,Italy.

There is something about Italian products, from consumer goods to industrial objects, that carries a stylistic flair. This is well represented in the cruise ships of the Fincantieri Shipyard, such as the 2015-delivered Britannia. More recently this flair for design and quality construction is evident in the 2016-delivered fast supply vessel Blue Brother from Cantiere Navale Vittoria SPA of Adria, on the Canal Bianco which connects to the Po River in the province of Rovigo,Italy. Bibby Offshore

Bibby Offshore The Edward Grieg platform. Photo courtesy: Lundin Petroleum

The Edward Grieg platform. Photo courtesy: Lundin Petroleum Hornbeck MPSV

Hornbeck MPSV Canadian Wildfires Tighten Onshore Markets in May

Canadian Wildfires Tighten Onshore Markets in May Forum Subsea Rentals, a subsidiary of

Forum Subsea Rentals, a subsidiary of