Disappointing EIA Data

Disappointing EIA Data

The large product stock build added to the market’s worry about excess light product stocks undermining crude demand and ultimately reducing the size of crude stock declines. While PIRA sees crude stock declines accelerating onshore U.S., with this week’s EIA data showing 630 MB/D stock decline, the market is, not surprisingly, skeptical given recent EIA reports and the crude weakness in Northwest Europe and Asia. Oil markets are stuck in a $43-$53/Bbl trading range, and visiting the lower end on occasion is to be expected, especially with lots of fear and data like the July 13 EIA report.

July Balances: Something for the Bulls and Bears

The market is having second thoughts about the industry’s ability to cope with surplus supply despite the atypical heat expected to persist well into the second half of July, as suggested by NYMEX futures brief expedition to ~$3.00/MMBtu and subsequent V-shape reversal back towards ~$2.70/MMBtu. Thursday’s relatively flat price action following a neutral-to-consensus stock build further reinforced the market’s at least temporary hesitation to push prices back toward those July highs. Indeed, weather forecasts and projected seasonal restocking in July certainly appear favorable to sentiment; a post-summer acceleration in refills has called into question the viability of $3.00/MMBtu gas during the upcoming shoulder season.

National Grid Confirms Tighter U.K. Winter, but Spark/Dark Spreads Move Off Recent Highs

U.K. winter power prices have jumped in response to the recent tumultuous development in NBP prices, but spark spreads have softened in the past 10 days or so, in spite of the latest Winter Outlook by National Grid confirming that the power market will remain exceptionally tight.

Coal Pricing Extends Rally, API#2 Above $60/mt

Coal prices shot up last week, with all three major forwards tacking on $3.00/mt or more across the curve. Higher oil pricing, more positive signals coming out regarding Chinese coal demand, and stronger European gas prices all factored into the strength in coal pricing last week. FOB Newcastle (Australia) prices rose by the greatest extent, perhaps due to increased buying activity out of China and weather-induced cuts to Indonesian exports. PIRA would not be surprised if the rally in pricing starts to fade, as additional support on the fundamentals side will be needed to keep prices on an upward trajectory.

EUA Price Rebound Expected Following Brexit-Inspired Drop

Near-term EU ETS fundamentals are poor, but no worse than they were before the Brexit vote. EUA prices rebounded after the January 2016 price decline (which was far more severe) and could do the same now. Auction demand data from June was somewhat positive, and there is historically a price bump in August, when auction volumes are lower. Also, the currency impact from the Brexit vote results in lower compliance costs for U.K. coal-fired generators, potentially supporting emissions demand. However, there is increased market uncertainty.

Solid Second Quarter Economic Performance by China and the U.S.

Chinese economic data for the second quarter surprised on the upside — GDP growth came in above expectations; the manufacturing sector appeared to be picking up steam; consumer spending expanded solidly; and the housing sector remained red-hot. Data on total social financing and local government debt indicated that policy makers have maintained an easy stance on credit creation. In the U.S., growth in consumer spending accelerated in a major way during the second quarter, but other sectors were more subdued. Industrial production disappointed, though capital-intensive manufacturing industries reported encouraging results. The latest inflation data did not set off an alarm bell.

Asian LPG Prices Fall

Asian LPG prices were lower last week, with front-of-the-curve contango spreads flattening, indicating that markets are less optimistic of autumn price gains than they had been previously. Cash continues to trade at a significant discount to paper, with August physical Far Eastern propane being called near $310/MT, some $15 below futures. Butane continues to trade narrowly above C3, ending this week at just $14/MT above propane — the tightest premium thus far this year.

Volume of U.S. Ethanol-Blended Gasoline Reaches All-Time High the Week Ending July 8

Manufacturing margins reach 18-month peak. RIN values soar.

Too Much of a Good Thing?

Traders inherently love this sort of volatility, but it’s plainly obvious that these moves, overnight especially, have many backing away. This should continue to be the case in corn until early August, when pollination is close to being finished. For beans, we expect the volatility to continue until at least the end of August as late-August/early-September moisture will make or break this year’s crop. PIRA always believes that fundamentals will win out, but it’s going to be a long and wild ride until true fundamentals take over once again.

Japanese Crude Runs Rose, Imports Eased and Stocks Built

Crude runs rose again on the week as maintenance continues winding down. Crude imports eased slightly, but crude stocks still built 0.3 MMBbls. Finished product stocks built 2.1 MMBbls, with increases in all the products other than gasoil and fuel oil. Refining margins have remained poor with little barrel support other than fuel oil and naphtha.

Japan Elections Usher in Uncertainties Regarding Nuclear Power

Last week’s regional election in Japan brought to power a decidedly anti-nuclear governor in the very region that houses the only two operating nuclear power reactors in Japan, reigniting questions as to the future of Japanese nuclear power generation. While this development is a decidedly bullish one for Japanese LNG imports, it is unlikely that even a completely nuclear-free Japan will result in a resurrection of Japanese gas demand for power generation.

French Carbon Floor Likely a Tax on Coal Units Only. Winter Prices Revised Lower, but Bullish Longer-Term Risks Remain

With the release of the report to the French minister Ségolène Royal on "Proposals for the Carbon Price," together with the Minister's press release of July 11, the French domestic carbon floor is now shaping up as a tax on coal. Assuming the policy starts from Jan. 1, 2017, which is looking optimistic, French 1Q 2017 baseload contract is well priced in the mid €30/MWh and the 2017 annual baseload contract is well priced in proximity of €32/MWh, or €2/MWh below our latest outlook, in line with current market quotes. In the medium term, the decision to penalize the coal units poses risks of earlier coal closures, making the French system more vulnerable during the winter months (similar to the U.K.). In addition, the revised policy still leaves unsolved the longer-term issue of the needed investments in EDF's existing nuclear units.

California’s Proposed Cap-and-Trade Amendments: Tempered Ambition

Draft amendments include a tightening of the cap post-2020, adjustments to the Price Containment Reserve and provisions for unsold allowances — and do not appear to send overly ambitious market signals. After 2020, the Price Containment set-asides are smaller, leaving more of the cap readily available to sources. The high single price tier for Reserve allowances demonstrates that CARB does not expect it to be a factor in regular pricing. The proposal to move unsold allowances to the Price Containment Reserve takes into account the quantitative limits on their return to auction. Quebec is, and Ontario soon will be, a partner in this market, and California policies are looking to serve the broader market.

Global Equities Move Broadly Higher

The S&P 500 set a new record on the week. The strongest gains were posted by the banking index, along with materials, while the “growth” indicator far surpassed the “defensive indicator." Only the defensively oriented utilities tracking index declined on the week. Internationally, all the tracking indices advanced, with Latin America, emerging markets, emerging Asia, China and BRICs all out surpassing the gains seen in the U.S.

Production Reaches Third-Highest Volume of the Year

Inventories draw, decreasing in four of five PADDs, but there was a large build in PADD I. Output of ethanol blended gasoline dipped to the lowest level in a month.

Corn Pollination in Full Swing

After jumping 17%, to 32% last week, corn silking should increase at least that amount again for the week ending Sunday, July 17th. The heat is on this week, but the percentage released this afternoon should have pollinated in fairly benign temperatures in the "I" states and Minnesota, according to mean deviation statistics for the first half of the month.

Failed Subsea Bolts Appear to Be Primarily a Drilling Concern

Recent press reports suggesting that bolt failures could cause significant production shutdowns appear to be overstated. There have been a number of failures of bolts that are used to connect blowout preventers, risers, and other subsea equipment in the Gulf of Mexico since 2003. A task force, with representatives from the U.S. Bureau of Safety and Environmental Enforcement (BSEE), API, oil industry and manufacturing companies, is currently reviewing the root causes of the failures and developing a strategy to fix the existing problems. For producing platforms/structures, fixing the problem may require shutting in production for several days to replace the defective bolts. However, it appears at this time that the issue affects primarily drilling operations and to a much lesser extent existing production.

U.K. Storage Woes Spread to Continent Where Gas Quality Issues Are Paramount

Both the Netherlands and the U.K. are shifting toward market balancing that will rely more on higher seasonal imports and working gas storage. As of now, the way these two markets are managing this inherently riskier position could not be more different. Operating problems in U.K. storage at Rough have created a vast winter risk premium, so vast that PIRA has a difficult time seeing it sustained on an outturn basis. The U.K. will certainly need to rely on more Continental, Norwegian, and LNG supply this winter. As we have emphasized in past years, the U.K. counting on Continental storage to balance some of its peak needs is often at odds with the mandate of Continental storage owners to place the home market as a greater priority no matter how full storage may be. This risk has been particularly egregious in the fourth quarter, given the Continent’s tendency to hoard storage volumes just in case the first quarter produces colder-than-normal weather. Add in real and perceived Brexit fallout and one has to assume the risks to the U.K. are somewhat greater.

Hot Weather Driving Fuel and Power Prices

Following temperatures and gas markets higher, June on-peak energy prices rose month-on-month in nearly every market in the Eastern Interconnect and ERCOT. Gas prices continued to rise through late June with Henry Hub spot topping the $2.90 mark as the July NYMEX contract expired. Eastern coal prices have also seen a modest advance, but western markets remain weak with supply rebounding. A gas price recovery over the balance of 2016 also implies that heat rates will likely struggle to keep pace with the high levels set in 2015. First half of 2017 is also likely to have lower gas burn and heat rates year-on-year in most markets.

Battery Raw Materials Not Expected to Constrain LT Strong EV Uptake, Though ST Issues Possible

In our 2016 Reference Case, PIRA increased its projections for BEV market growth which reflects greater progress in battery development. In this report PIRA analyzes lithium-ion batteries and examines lithium and cobalt, the raw materials crucial to lithium-ion battery production, and find that in the near term, supply shortages for lithium are possible, but long-term supply for lithium should be available at reasonable prices. Cobalt supply is more difficult to predict, but it appears more likely to be volatile than lithium in both the short term and the long term. Overall, PIRA’s expected EV market penetration rate should not be hindered by a lack of raw materials used in battery production.

1Q16 Canadian Producer Survey: Persistent Producer Perseverance

Riding on continued efficiency gains and modestly improved prices, producers in Canada grew output by 4% quarter-on-quarter, or ~550 BCF in 1Q16. Production gains were strongest in Alberta and British Columbia; the former reached highs not seen since 2010, and the latter set new records in quarterly volumes. Both the companies within and outside of the surveyed “PIRA Group” grew production, although this quarter, the non-group significantly outpaced the survey group.

Record High for S&P 500

The S&P 500 set a new record high. Again, volatility declined and emerging market debt prices rose sharply. Financial stress continued to lessen post-Brexit. The dollar was mixed on the week.

UK Shale Could Get Support Post-Brexit

Britain's shale gas industry could get a helping hand from a falling pound and a supportive new prime minister just as it is gearing up for its first production this year, after facing economic and political challenges that slowed its start. The British pound's weakness since the Brexit vote has made it more expensive to import gas, helping the case for shale gas, which had been hurt in the past by weak oil prices and by opposition to planning approval from local campaigners.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

BP

BP The ‘Grand Canyon’ is designed to perform a broad range of subsea operations, with DP3-class station keeping for work in severe weather conditions. Grand Canyon features a 250 t heave compensated crane, facilities to launch up to five ROVs simultaneously, and a below-deck carousel lay system for installation of power cables, umbilicals, or tubular products.

The ‘Grand Canyon’ is designed to perform a broad range of subsea operations, with DP3-class station keeping for work in severe weather conditions. Grand Canyon features a 250 t heave compensated crane, facilities to launch up to five ROVs simultaneously, and a below-deck carousel lay system for installation of power cables, umbilicals, or tubular products. This year has seen US land drilling activities fall to the lowest levels on record. Globally we are seeing a very nuanced and regional reaction to the current oil price downturn. Examination of the global land rig fleet (which Douglas-Westwood tracks on a rig-by-rig basis) reveals some key themes.

This year has seen US land drilling activities fall to the lowest levels on record. Globally we are seeing a very nuanced and regional reaction to the current oil price downturn. Examination of the global land rig fleet (which Douglas-Westwood tracks on a rig-by-rig basis) reveals some key themes.

Fugro deploys deepwater geotechnical vessel, Fugro Voyager, for ONGC works offshore India’s east coast

Fugro deploys deepwater geotechnical vessel, Fugro Voyager, for ONGC works offshore India’s east coast North West safety seal manufacturer

North West safety seal manufacturer  Amec Foster Wheeler

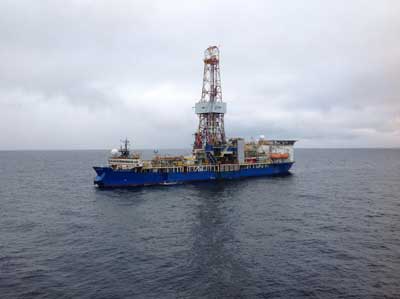

Amec Foster Wheeler The Noble Discoverer, a drillship operated by Noble Corp. under contract to Royal Dutch Shell, on position in the Chukchi Sea in August 2015. (Photo: Royal Dutch Shell)

The Noble Discoverer, a drillship operated by Noble Corp. under contract to Royal Dutch Shell, on position in the Chukchi Sea in August 2015. (Photo: Royal Dutch Shell) Wood Group

Wood Group The high quality ELA Offshore Containers are “Made in Germany” according to German quality standards and possess all necessary certifications such as DNV 2.7-1 / EN 12079-1, DNV 2.7-2, based on SOLAS, IMO FSS Code and MLC as well as CSC and are approved from several IACS-companies.

The high quality ELA Offshore Containers are “Made in Germany” according to German quality standards and possess all necessary certifications such as DNV 2.7-1 / EN 12079-1, DNV 2.7-2, based on SOLAS, IMO FSS Code and MLC as well as CSC and are approved from several IACS-companies. Danos

Danos The Bureau of Safety and Environmental Enforcement (BSEE) has announced that the maximum civil penalty rate for Outer Continental Shelf Lands Act (OCSLA) violations will increase from $40,000 to $42,017 a day for each violation. This legislatively mandated increase is contained in an interim final rule which is effective July 28, 2016.

The Bureau of Safety and Environmental Enforcement (BSEE) has announced that the maximum civil penalty rate for Outer Continental Shelf Lands Act (OCSLA) violations will increase from $40,000 to $42,017 a day for each violation. This legislatively mandated increase is contained in an interim final rule which is effective July 28, 2016. OneSubsea, a Schlumberger company, has been awarded an engineering, procurement and construction contract totaling approximately $300 million from Woodside Energy Ltd.

OneSubsea, a Schlumberger company, has been awarded an engineering, procurement and construction contract totaling approximately $300 million from Woodside Energy Ltd. Disappointing EIA Data

Disappointing EIA Data (Houma, La.) –

(Houma, La.) –  At chemical analysis laboratory of Gazprom VNIIGAZ. Photo courtesy: Gazprom

At chemical analysis laboratory of Gazprom VNIIGAZ. Photo courtesy: Gazprom