NorSea Group (UK) Limited has won North-east Scotland’s first major “small piece” decommissioning contract. Work has already begun on the six-month project which is being carried out at NorSea Group’s Peterhead facility on behalf of Endeavour Energy and involves safe disposal of subsea manifolds and associated pipework from the Renee and Rubie fields.

All materials from the fields, which lie 200km North-east of Aberdeen, are being delivered to Smith Quay which is operated by NorSea Group. An important element of the £0.5million contract was the requirement that reuse of returned material be maximised and NorSea Group will achieve a 100% recycling rate.

From left - Guy Cook and Hywel Evans of Endeavour Energy with Mike Munro, Operations Director, NorSea Group (UK) at Smith Quay, Peterhead

From left - Guy Cook and Hywel Evans of Endeavour Energy with Mike Munro, Operations Director, NorSea Group (UK) at Smith Quay, Peterhead

The returned material includes 1,000 tonnes of concrete mattresses which will be used as hard core and in road construction projects; 200tonnes of pipework and skid units which will be recycled as scrap metal; manifold valves which will be refurbished and reused and a 17 tonne crossover manifold which will be transported to the Underwater Centre at Fort William where it will be used for diver training.

The work will initially create up to six new jobs.

“This is our first decommissioning win and the first such project to be carried out in the North-east,” said Walter Robertson, MD of NorSea Group (UK). “We are primarily known as a logistics and base services company servicing the offshore industry but as part of our future growth strategy we are developing our decommissioning capability. In the current economic climate we anticipate that many more decommissioning projects will be coming forward and we are already involved in tendering for additional contracts in this area.

“In addition to Peterhead we have facilities at South Quay, Montrose capable of carrying out similar types of small piece decommissioning work, so we see great potential for servicing additional contracts there.”

Operations Director Mike Munro, who is overseeing the work, said Smith Quay and Embankment, was constructed by Peterhead Port Authority to service the DSV and Subsea vessel market and is ideally located to service the northern and central North Sea.

“With 200m of quayside and a draft of 10m, Smith Quay is ideal for the landing of small piece decommissioning works and can handle structures up to 4,000tonnes in weight. A laydown area in excess of 15,000m2 and our on-site crane with a 220t capacity makes us self-sufficient in the landing of most materials and larger capacity cranes are available at short notice.

“We also carry out rigorous testing of all decommissioning materials to detect the presence of NORM (Naturally Occurring Radioactive Material) and if it is present, we work with Scotoil Services, our specialist partnership company, to carry out decontamination at our on-site SEPA approved licensed premises.”

NorSea Group took on the operatorship of Smith Quay and Embankment at Peterhead on a 10-year agreement at Q3 2014. This is phase 1 of a 3 phase development that will see expansion onto Merchants Quay and provide 400m of deep-water quayside berthing supported by over 50,000m2 of quayside laydown area. NorSea also has a long term agreement with Scrabster Harbour Trust and a 15-year lease at South Quay in Montrose.

NorSea Group (UK) was established as the UK wing of its Norwegian parent company NorSea Group in 2013 when it opened its first office in Aberdeen. Since then there has been significant growth in the company’s business activity in the UK. In addition to establishing a presence in Aberdeen, NorSea Group acquired Danbor Ltd. the leading Danish offshore logistics company and their UK assets are now incorporated into NorSea Group (UK). In 2014, the company also moved to new premises at NorSea Group House in Altens, providing the company with its own 4,000m2 warehouse, 15,000m2 concreted yard and 800m2 of office space.

Global inspection, repair and maintenance (IRM) company

Global inspection, repair and maintenance (IRM) company  International oilfield support services company

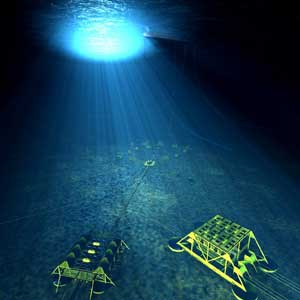

International oilfield support services company  This artist’s rendering shows the three units that will make up the Baoham fleet upon delivery of the newbuilds now on order.

This artist’s rendering shows the three units that will make up the Baoham fleet upon delivery of the newbuilds now on order.  McDermott deepwater rigid reel Lay Vessel 105 (LV 105) is slated to complete offshore installation in early 2016. (Photo: Business Wire)

McDermott deepwater rigid reel Lay Vessel 105 (LV 105) is slated to complete offshore installation in early 2016. (Photo: Business Wire)  The Extel Survey gathers the views and rankings of international research analysts for the world's largest publicly traded companies

The Extel Survey gathers the views and rankings of international research analysts for the world's largest publicly traded companies Blackford Dolphin

Blackford Dolphin These contract awards contribute significantly to increase the order backlog and earnings visibility of Odfjell Drilling during a tough market cycle. The employment of Deepsea Atlantic under a long-term contract in Norway and the increased market share for our platform drilling services in the North Sea are of great importance and inspiration to our whole organization, says Lieungh.

These contract awards contribute significantly to increase the order backlog and earnings visibility of Odfjell Drilling during a tough market cycle. The employment of Deepsea Atlantic under a long-term contract in Norway and the increased market share for our platform drilling services in the North Sea are of great importance and inspiration to our whole organization, says Lieungh. Cutting through complexity

Cutting through complexity

Leveraging its expertise to meet ultra-deepwater challenges

Leveraging its expertise to meet ultra-deepwater challenges  From left - Guy Cook and Hywel Evans of Endeavour Energy with Mike Munro, Operations Director, NorSea Group (UK) at Smith Quay, Peterhead

From left - Guy Cook and Hywel Evans of Endeavour Energy with Mike Munro, Operations Director, NorSea Group (UK) at Smith Quay, Peterhead  International oilfield services company,

International oilfield services company,

Most people know Alaska as the last frontier – a vast place where nature can be wild, unpredictable and uncooperative. Case in point: the Prudhoe Bay oilfields, where about half a million barrels of oil is extracted each day. One of the drilling sites is Endicott, located on a spit of land connected by the gravel Prudhoe Bay road system and normally accessible by truck. That is until recently, when the road was washed out. Faced with the dilemma of how to get workers, food and supplies to the work site, Hilcorp, one of the largest, privately-held exploration and production companies in the United States, turned to

Most people know Alaska as the last frontier – a vast place where nature can be wild, unpredictable and uncooperative. Case in point: the Prudhoe Bay oilfields, where about half a million barrels of oil is extracted each day. One of the drilling sites is Endicott, located on a spit of land connected by the gravel Prudhoe Bay road system and normally accessible by truck. That is until recently, when the road was washed out. Faced with the dilemma of how to get workers, food and supplies to the work site, Hilcorp, one of the largest, privately-held exploration and production companies in the United States, turned to