Oil Prices Are Supported by Surplus Stocks Declining

Oil Prices Are Supported by Surplus Stocks Declining

The economic backdrop will continue to be constructive, with growth improving in 2017. OPEC is unlikely to agree to any market action in Algiers, and this will put short-term downward pressure on prices. Winter supply/demand fundamentals are tight enough to generally keep crude oil prices in a $40-$50/Bbl range. Surplus stocks will continue to decline, which should be supportive to prices. Supply creation will become the market’s focus in 2017, and this will require higher oil prices. Product markets have been rebalancing, and upcoming turnarounds will help the process. Refining margin outlook is generally healthy for the upcoming season. U.S. crude price differentials and export incentives are encouraging U.S. exports for now. While supply disruptions have eased, political risks to supply will remain high.

Emerging Asian Supply Contrasts with Atlantic Basin Tightness

Outages continue to pile up in the Atlantic Basin, while Asian supply continues to climb at a faster rate than demand growth. Less and less Mideast LNG will be required to balance the Asian market, but if this gas continues to move to the East, the bearish impact on prices will begin to build.

As EDF Revises Down Its French Nuclear Output, French Spark Spread Surges

With French nuclear output set to remain below historical minima, the French dark and spark spreads have gained considerably in the last few days, moving even closer or even above Italian counterparts. A stronger spark spread for 1Q17 in France could be easier to justify in light of the likely introduction of the carbon tax on coal units (30 euro/MT), but less so in October and 4Q16, even assuming nuclear will remain at historically low levels.

Coal Market Stays Hot, with Few Short-term Supply Options

Seaborne coal prices continued to rally, with the market still adapting to the emergence of tightness in the prompt market, which has been absent from coal supply/demand balances for several years. It appears as though the Chinese government has activated the "Tier-1" plan, allowing 74 coal mines to increase output by 0.5 MMmt/day because prices hit 500 yuan/mt for two consecutive weeks. This development took an edge off of the rally in pricing this week. Interestingly, API#2 prices gained the most ground, with 4Q16 prices rising by nearly $2.50/mt while API#4 and FOB Newcastle prices rose by less, respectively. PIRA believes this upward adjustment in API#2 was due to a stronger outlook for coal burn from the French nuclear situation. In general, there is not much incremental supply that could be called upon quickly to deflate this pricing rally, particularly as crossover tons are being pulled out of the thermal market into the coking market.

Environmental Justice Advocates Take on California Cap and Trade

Environmental justice concerns were front and center at the hearing on the proposed Cap and Trade Amendments to promote a “cap and no trade” agenda focused on achieving localized reductions of criteria and air toxins (non-GHG) pollutants. A new report has linked the location of GHG emitters to disadvantaged communities and to particulate emissions, with little improvement in GHG emissions from CA entities since the start of Cap and Trade. The upcoming Scoping Plan will need to rigorously investigate alternative options to the Cap and Trade and must make the case for Cap and Trade in the context of environmental justice. PIRA expects related ongoing legal challenges and further market uncertainty.

Busy Week of Central Bank Communication from U.S. and Japan

The outcome of the Fed policy meeting was as expected. The central bank’s decision to stay put owed substantially to Fed policymakers’ shifting perspective on the economy’s long-run capacity. Specifically, in the last few years, meeting participants substantially reduced estimates for the potential GDP growth rate and the neutral policy interest rate. This shift means that (even though a rate hike in December appears to be a given at this point) the pace of tightening during 2017 will likely be slow. The Bank of Japan decided to target the yield of 10-year government bonds as a policy objective. The purpose of this move is to make the central bank’s quantitative easing program sustainable.

U.S. LPG Prices Rising

U.S. LPG price outperformance continues unabated. Mt Belvieu propane futures (Oct.) strengthened by 5.8% to 52.8¢/gal — a point at which it’s just about 50% of WTI value. Butane at the market center punched up by 4.1% to 68.5¢. Conway prices outperformed those in the gulf with C3 and C4 jumping 7.1% and 5.6% respectively. Conway butane ended the week at a narrow 2.75¢ discount to Belvieu, the tightest since May of this year.

Ethanol Prices Higher

U.S. ethanol prices were higher the week ending September 16. August RIN generation reached a record high. Manufacturing margins jumped.

Iowa Flooding

Filling sandbags replaced running a combine for some in Northeast Iowa over the weekend as the Cedar River crested Saturday night in Waterloo and is expected to peak at 23 feet Tuesday in Cedar Rapids. Levels on the river so far have been slightly lower than those seen in the historic floods of 2008 as the crest moves south towards Iowa’s second largest city and home to major area grain buyers, including Quaker Oats.

Regional Product Demand Is Soft, But Imports Remain High

Latin America 3Q16 gasoline demand is estimated at 2670 MB/D, down 15 MB/D year-on-year. Distillate demand is bearish at about 75 MB/D less year-on-year. Mexican gasoline demand at 805 MB/D in 3Q16 is marginally better than 3Q15. Brazilian 3Q16 gasoline demand is forecast to be 5 MB/D higher year-on-year, while diesel demand is projected to be 40 MB/D lower. PIRA expects the region to import ~900 MB/D of gasoline and components in 3Q16. Diesel imports in 3Q16 are estimated to be 950 MB/D. Brazilian exports of heavy crudes are trending down: expected to be 140 MB/D in 2017. Medium crude exports spike and will reach 740 MB/D in 2017. Latin American refinery crude runs in 3Q16 are forecast to be 5,190 MB/D, 470 MB/D lower year-on-year. The likely end of Brazilian incentives to import fuels and the completion of domestic refinery maintenance cycle will help increase refinery runs. Distillate cracks are expected to move upwards, pulled by higher demand for heating but capped by the very high stocks on both sides of the Atlantic.

Gas Prices See Widespread Enthusiasm

The Henry Hub (HH) cash price rally has carried the benchmark to $3.14/MMBtu — a high not seen since 1Q15 — as unseasonably warm weather and maintenance delays at Sabine Pass buoyed the call on supply. Accordingly, HH cash prices for the month may top $2.95, and post a M/M gain of more than 15¢. Cooling-degree days (CDDs) are on track to average a whopping ~30% above normal this month, a tally that would mark the second hottest September on record, rivaling last year’s atypical heat in the process. Consequently, gas-fired electric generation (EG) has outperformed prior estimates, with total EG loads outpacing the “norm” by ~4 BCFe/D. Given this backdrop, weekly storage refills have seen a noteworthy “pruning” month to date, and as a result, odds of a sub-3.9 TCF end-October U.S. storage carry have risen.

Ukrainian Industrial Gas Prices Go Back Up Again

National Joint-Stock Company Naftogaz Ukrainy from October 1 will raise the price of gas sold to industrial customers on a prepayment basis by 5.1%. According to a company release, the price is relevant for consumers buying gas in the amount of more than 50,000 cubic meters per month and who have no debts to Naftogaz. The price for other customers will rise by 5%. After the increase of gas prices for industrial consumers in August by 9.3%, Naftogaz decreased the price by 7.9% in September. Compared with July, gas prices in October will be higher by 5.6-5.8%.

Cape Freight Rates Hit Highest Level This Year

Cape freight rates have hit their highest level of the year as capesize fixing volumes have surged while bunker prices have remained largely flat. The 180,000 dwt Cape average has moved to over $15,000/day, well above the $5,000 - $10,000 range the market has been trading at for most of the year. On the supply side, Cape fleet growth remains positive as scrapping has decidedly slowed of late, although there is 5 MMdwt of Cape tonnage that was built in 2003 that is susceptible to scrapping as ships approach their third special survey in 2018 because of a need to retrofit to a BWM system under the IMO convention. We believe that Cape rates will show a second bounce in Q4 and will push above $20,000/day in late 2017.

Final Obama EPA Regs Focused on GHGs, Ozone Implementation

As the clock continues to wind down on the Obama presidency, attention is shifting to finalizing what has been begun rather than new proposals. While the Clean Power Plan is on hold, EPA continues work on the rules for implementation, projected for December — despite opposition from Congress. An endangerment finding for aviation GHG emissions was finalized in July, with GHG standards for heavy duty vehicles following in August. The final Cross State Air Pollution Update Rule for seasonal NOx imposes tighter caps and higher allowance prices in 2017, while a proposal for implementation of the 2015 Ozone NAAQS is forthcoming. The new regional Haze strategy, proposed in May, is expected to be finalized by year end.

Key Indexes Gain

The S&P 500, High Yield Corporate Bond Index, Russell 2000 and EMB Index all gained on the week, despite falling slightly on Friday, and VIX receded significantly. Total commodities and commodities excluding energy were both higher on the week. Precious and industrial metals gained. Agricultural commodities fell slightly at the end of the week, though it was higher on a weekly average basis. Long-term interest rates were generally lower (especially the U.S. Baa corporate bond yield).

Ethanol Production Declines to a Three-Month Low

Output fell 23 MB/D to 981 MB/D the week ending September 16. Inventories drew to a 10-month low of 20 million barrels. Manufacturing of ethanol-blended gasoline dropped to a 15-week low 8,118 MB/D.

U.S. Stock Comparisons to Last Year Continue to Improve

Overall commercial oil inventories fell 6.0 million barrels this past week, entirely in crude oil. East Coast (PADD I) gasoline stocks had an historic stock decline (-8.5 million barrels) because of the Colonial Pipeline outage and likely panic buying, while PADD III gasoline stocks not surprisingly built (+4.8 million barrels). Reported oil demand fell 800 MB/D, largely because the EIA revised up product exports by 1.4 MMB/D, 1.2 MMB/D of which was in products other than the four major products. Cushing stocks built 0.5 million barrels this past week but should revert back to drawing next week. Overall crude stocks also decline but at a much more modest pace of 1.2 million barrels versus this past week. Strong distillate demand pulls stocks down next week by 350 MB/D, while gasoline inventories build modestly (80 MB/D) because of much weaker demand.

Seasonal Demand Is Coming, But Also Greater Gas Demand Volatility Due to Wind

4Q is traditionally the most volatile gas demand period of the year, and PIRA expects this year not to deviate from this pattern. If anything, the introduction of more wind capacity is creating even more volatility in the gas demand outlook. As October and 4Q arrives, we experience steady and ever-increasing gas demand build. For Europe as a whole, average demand growth between now and the end of the year is 1,000-mmcm/d.

Japanese Runs Declined, Imports Rose and Stocks Built

Data were delayed two days because of a national holiday. Crude runs declined on the week. Runs will continue declining through much of the month. Crude imports rose and a crude stock build of 2.37 MMBbl ensued. Finished product stocks rose 0.6 MMBbls, with most of it being in the jet-kero complex. Gasoline demand was lower as were yields. Exports, on the other hand, rose and stocks built slightly. Gasoil demand, yields, and exports were higher and stocks drew slightly. Kerosene stocks continued to build. On the week, all the cracks gained, with gasoline and naphtha doing the best.

U.S. Diesel Use Will Increase Substantially Over the Harvest Period

Unlike previous years, when farmers pre-stocked their diesel requirements well before the start of planting and harvesting, this year farmers are buying fuel on as-needed basis. During the planting season earlier this year, this hand-to-mouth buying created a bulge in diesel demand during May and June. With this fall's harvest just underway, farm demand for diesel should pick up substantially once again.

Iraq Oil Monitor, 3Q16

Baghdad and the KRG agreed to resume 150 MB/D of shipments from NOC fields to the Kurdish export pipeline. Flows are currently capped at 100 MB/D due to technical limitations, and greater uncertainty will surface upon the deal’s expiration in 2017. In the south, fiscal problems and delayed FIDs will likely prevent a notable near-term increase in production capacity. A military offensive to retake Mosul appears increasingly likely this fall. The involvement of Shiite militias will stoke sectarian tensions and create large security challenges down the road.

Global Equities Were Broadly Stronger

Global equities moved broadly higher on the week. All the U.S. tracking indices gained, with utilities, industrials, and housing being the best performers. Retail posted the weakest gain, while energy underperformed. All the international tracking indices also gained and outperformed the S&P 500. Latin America and Japan posting the largest gains, while the ex-U.S., and emerging markets tracking indices also did well.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

ITF CEO, Dr Patrick O’Brien

ITF CEO, Dr Patrick O’Brien Offshore accommodation and workspace solutions specialist,

Offshore accommodation and workspace solutions specialist,  Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper has announced that the bureau will offer approximately 47 million acres offshore Louisiana, Mississippi, and Alabama for oil and gas exploration and development in a lease sale that will include all available unleased areas in the Central Planning Area (CPA).

Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper has announced that the bureau will offer approximately 47 million acres offshore Louisiana, Mississippi, and Alabama for oil and gas exploration and development in a lease sale that will include all available unleased areas in the Central Planning Area (CPA). Hydrographic survey and diving equipment specialists, Unique Group, has selected subsea vehicle positioning and navigation technology from Sonardyne International Ltd, to add to its expanding equipment rental pool.

Hydrographic survey and diving equipment specialists, Unique Group, has selected subsea vehicle positioning and navigation technology from Sonardyne International Ltd, to add to its expanding equipment rental pool. The United States Coast Guard (USCG) has confirmed that Norwegian ballast water treatment (BWT) specialist

The United States Coast Guard (USCG) has confirmed that Norwegian ballast water treatment (BWT) specialist  Paul Shrieve, CEO, Bureau Veritas

Paul Shrieve, CEO, Bureau Veritas Johan Castberg field. Image courtesy: Statoil

Johan Castberg field. Image courtesy: Statoil  CGG

CGG Add Energy

Add Energy Trelleborg’s extensive range of innovative solutions is taking performance to new levels

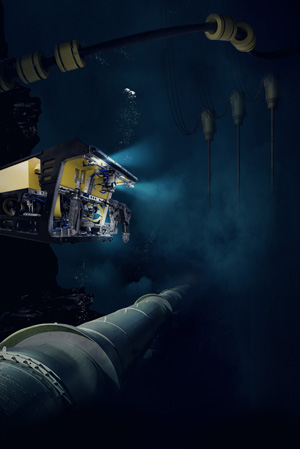

Trelleborg’s extensive range of innovative solutions is taking performance to new levels The Deepwater Horizon oil spill Natural Resource Damage Assessment Trustees will hold a public meeting on September 28, 2016, at the Renaissance New Orleans Pere Marquette French Quarter Area Hotel. The Trustees will present an update on their work since the historic settlement with BP and describe current and future restoration planning activities and opportunities for public engagement. The settlement with BP included a provision for up to $8.8 billion in damages for injuries to natural resources.

The Deepwater Horizon oil spill Natural Resource Damage Assessment Trustees will hold a public meeting on September 28, 2016, at the Renaissance New Orleans Pere Marquette French Quarter Area Hotel. The Trustees will present an update on their work since the historic settlement with BP and describe current and future restoration planning activities and opportunities for public engagement. The settlement with BP included a provision for up to $8.8 billion in damages for injuries to natural resources. Statoil

Statoil Oil Prices Are Supported by Surplus Stocks Declining

Oil Prices Are Supported by Surplus Stocks Declining Harris CapRock Communications

Harris CapRock Communications 451 wells have been drilled on the field, and more than 40 years after the field was discovered new profitable wells are still being drilled. (Photo: Harald Pettersen)

451 wells have been drilled on the field, and more than 40 years after the field was discovered new profitable wells are still being drilled. (Photo: Harald Pettersen) At work on Ocean Endeavor

At work on Ocean Endeavor