China's Pace of Refinery Capacity Additions Slowed, but the Rest of Asia Still Adding

China's Pace of Refinery Capacity Additions Slowed, but the Rest of Asia Still Adding

Global oil market rebalancing is underway and the process will quicken with any OPEC deal to cut production. The Asian kero/jet market is expected to tighten somewhat in 2017, with healthy demand growth. China’s refinery capacity additions are slowing, but the rest of Asia is still adding. Asia added cracking capacity more rapidly than primary distillation capacity over the past few years, but upgrading capacity additions will slow in 2017. China’s net exports of gasoil, jet fuel and gasoline are expected to increase by over 30% from last year to ~0.57 MMB/D this year, with further increases in 2017. India’s net exports of the three products have been steady this year but are expected to trend somewhat lower next year. Near-term Asian refining margins are to ease due to lighter refinery turnarounds despite stronger seasonal demand.

Industrial Users in Poland to Get Price Hike

Poland's biggest gas firm PGNiG said last Monday that the average gas price for its biggest customers will rise by 4% as a result of the energy market regulator's decision on new gas tariff. The new tariff was approved and will be binding by Dec. 31, 2016, PGNiG said. Due to the higher prices of crude oil and natural gas across wholesale markets in Northwest Europe for the fourth quarter of 2016, PGNiG's total cost of gas grew beyond the cost assumed for the calculation of the existing tariff, PGNiG said in a statement.

Rally Stalls as Market Awaits Signs of Tightness

The recent NYMEX strength that pushed the nearby contract beyond $3.35/MMBtu helped Henry Hub cash prices move decidedly above $3/MMBtu, despite the bearish weather conditions that have unfolded thus far during October. Yet, the possible continuation of the current warm trend appears to be causing the market to retrench back toward the psychological $3/MMBtu mark. U.S. temperatures this month are shaping up to yield the third warmest October on record. Moreover, gas weighted heating degree days will not only be decidedly below normal — by more than 25% — but also ~15% shy of October 2015. As a result, residential/commercial heating demand is on track to decline year-on-year by ~2.3 BCF/D.

Latest Chinese Data Reveal Strength and Potential Concerns

China’s third quarter GDP growth matched expectations, but other data contained surprises. For one, manufacturing activity showed resilience, even though the trade sector stayed in a slump. In the housing sector, home sales were very strong, and homes in some cities are fetching New York City-level prices. Consumer spending, meanwhile, remained solid, as gains in jobs and wages lifted households. The European Central Bank deferred a critical decision about quantitative easing until December.

Winter Buying Reprieve

Ahead of the faceoff between the new LNG supplies, the U.S. has been able to eke out margins due to weaker Atlantic Basin flows. Winter heating in Asia, along with nuclear outages proliferating around the world, will support gas demand.

Coal Market Moving Towards Balance

Several bullish factors have emerged for the U.S. coal market over the past month. U.S. natural gas prices have moved higher, and international steam and coking coal markets have surged, brightening prospects of stronger U.S. exports. PIRA takes a bullish outlook relative to current market forwards through the first half of 2017, but with our expectation of falling natural gas prices thereafter, we turn to a more neutral/bearish outlook for 2H17.

Changes Suggested to California Cap and Trade

CARB’s most recent workshop saw “potential design changes” to the California Cap and Trade program to address AB197 (which encourages direct facility reductions). CARB asserts that AB197 does not preclude Cap and Trade and offers three ways to address concerns that it does not reduce facility emissions: reduce allowed offset use, reduce free allocations to industry, and retire unsold allowances. These can address EJ issues, while sacrificing some flexibility and increasing costs. Changes would take effect post-2020 coordinated with WCI partners. Commenters cautioned that CARB is acting prematurely, as AB197 is aimed at the Scoping Plan process in general. Scoping Plan options, with and without Cap and Trade, will be discussed more on November 7.

U.S. Propane Stocks Drop

Total U.S. propane inventories fell by 1.2 MMB to 102.7 million barrels as seasonal demand improved. The annual surplus narrowed by 669 MB to 1.1 MMB. All PADDs showed declines except for PADD III. Last week’s inventory decline was the largest seen in the reference week in five years.

U.S. Elections: Minimal Near-Term Impact on Oil and Gas Production

In the run-up to the November 8 U.S. elections, presidential candidates Hillary Clinton and Donald Trump campaigned on dramatically different energy policy platforms. Even so, PIRA sees little impact to near-term domestic oil and gas production under either candidate. Clinton is unlikely to implement prohibitive new restrictions on fracking, although she has stated she will expand President Obama’s methane strategy. Trump advocates for fewer regulations and increased drilling on federal and offshore acreage, but current legislative and commercial realities will likely be limiting. Longer term, oil demand may be stronger under a President Trump, who is less likely than Clinton to continue Obama’s fuel economy standards and promote energy efficiency. Implications for the power sector could be meaningful, with Trump less supportive of regulating emissions and Clinton promoting renewable-friendly policies and major investments in the grid. Yet neither party appears likely to win a filibuster-proof Senate majority, which will make it difficult for the next president to implement the majority of proposed energy initiatives.

Another Week, Another Rally

Twice is certainly not a reliable pattern, more of a coincidence, but after gaining 16 cents last Monday, and jumping into a new trading range ($9.70 - $9.90) during last week, November soybeans are back it again this morning with a push towards $10.00. If history repeats itself, this week’s bean range will be $9.90 - $10.10.

U.S. Ethanol Values Strengthen

U.S. ethanol prices rose the week ending October 14th. Manufacturing margins were relatively flat as corn prices increased, while coproduct DDG values declined. RIN assessments decreased.

Another U.S. Stock Decline

Total commercial stocks decline again with this past week falling 3.6 million barrels, narrowing the year-on-year stock excess by another 5.1 million barrels. Distillate stocks drew 1.2 million barrels while gasoline inventories added 2.5 million barrels, but in both cases reported demand was likely substantially depressed by EIA re-benchmarking. Crude stocks surprised with a 5.2 million barrel decline this past week with imports making a new low for the year, while Cushing crude inventories fell 1.6 million barrels because of Basin pipeline maintenance. For this week, crude inventories build modestly (270 MB/D) as imports rebound and runs stay near turnaround season lows, but Cushing crude stocks decline again by 0.8 million barrels from continued low Canadian imports and less-than-full Basin pipeline flows as the pipeline ramps up. Light product stocks show big draws with reported demand rebounding, led by distillate’s 4.8 million barrel decline as farm use accelerates, nearing peak levels.

Increased Pipeline Flows Step In to Balance Increased Power Demand

Between French nuclear reactors producing 8 GW less than last October and power markets favoring gas over coal, a lot more demand for gas has emerged. And yet gas is still fighting an uphill battle in the power sector. Overall thermal generation has been on a steady decline over the last 10 years by around 3% per year. Within that shift lower, a recent countertrend shows gas gaining market share within what’s left of the thermal mix, taking market share from coal and fuel oil. However, several pressing items this winter will be superseding issues tied to coal vs. gas or thermal vs. renewable switching. These issues center on French and British power margins.

Financial Stresses Continue to Appear Low

The S&P 500 was higher on the week, with volatility noticeably lower, while high yield debt and emerging market debt moved higher in price. The dollar was generally stronger. For commodities, there continued to be a slight upward bias, but ex-energy appears lackluster. The precious metals complex has yet to gain renewed traction, while industrial metals have weakened. The agricultural complex has also shown a bit of strength of late, particularly coffee.

Fracking Policy Updates

Policy developments over the past quarter were largely negative for the shale industry. The federal government intervened in the construction of the Dakota Access pipeline, adding regulatory uncertainty to the 60% complete project. The EPA’s methane rules went into effect in August, new fracking regulations went into effect in Pennsylvania in October, and a record breaking earthquake struck Oklahoma in September, spurring the OCC and EPA to further curtail injected wastewater volumes. Going forward, there is much uncertainty with the direction of the next administration and Congress. Yet we expect state policies to remain mostly accommodating, although increased seismicity in Oklahoma may spur local action.

Golden Age in European Power Trading Returns as Nuclear Availability Increasingly Uncertain

With the French Nuclear Regulator imposing a three-month deadline to perform safety checks to five units potentially affected by the steam generator anomaly, the market focus has shifted from November to December and January prices. In fact, France will be facing lower nuclear availability even in the months of high peak demand, between December to mid-January. French January power prices appear aligned with the assumption that the hours of maximum demand, based on historical patterns, could require a full switch of France into a net importer, including the U.K., which is an interesting trading proposition, given the tightness in the U.K. market.

Coal Prices Continue to Defy Gravity

Coal prices continued to move upward rapidly over the past week, despite a midweek stumble. The front of the curve again moved notably higher than the back, making the backwardation in the market even more pronounced, particularly for API#2 and FOB Newcastle forwards. API#4 price forwards generally moved higher, although the gains paled in comparison relative to the other pricing points. Physical tightness in the prompt market continues to dominate price formation, as China's demand strength continues to signal that it is not yet abating. PIRA continues to assert that there is additional upside to the front of the curve, noting weather-related disruptions to supply that have already occurred, and the potential for other seasonal ones to develop (Australia) in light of La Niña conditions returning. We note that the last time there was a La Niña, disruptive flooding in Queensland and New South Wales sent prices soaring. If that were to occur this year, when the market is already tight, prices would certainly jump well beyond $100/mt, perhaps to the point where coal-to-gas switching emerges in several markets. Beyond the prompt, PIRA believes that the backwardation in the market is overstated in light of additional upside to China's import demand into 2017.

Oklahoma Earthquakes: How Much of a Threat to Oil Supplies?

The significant increase in earthquake activity in Oklahoma is becoming a growing concern for the state’s oil industry. There appears to be a strong link between increased saltwater disposal and seismic activity, which has caused regulators to impose restrictions on the disposal of produced water. While we do not believe that significant production is threatened, more regulations will likely be imposed if the frequency or magnitude of earthquakes continues to rise. There are multiple solutions (e.g. shallower injection formations, inject saltwater outside of the affected area, etc.) to alleviate the problem and operators are actively pursuing them, but they would add to costs. PIRA estimates that less than 30 MB/D of crude would be impacted, which could continue to be produced but at an additional cost of less than $1 per barrel to find water disposal alternatives.

$3.50/$9.70/$4.10

While not quite “lines in the sand,” these three resistance areas for corn, soybeans, and wheat all turned into support levels this past trading week, made more impressive for corn and soybeans by the fact that harvest weather cooperated for the most part and looks pretty wide open this week as well.

U.S. Transportation Fuel Monitor

U.S. transportation indicators remain largely bullish. VMT growth remains relatively strong through August, but odds favor slowing over the remainder of the year, while gasoline demand growth also tends to slow. Transportation diesel indicators have shown a degree of slowing, but a pickup is expected for the remainder of the year. PIRA expects distillate demand in transportation to transition from decline to moderate growth over the next several months. The peak in air passenger miles has coincided with the seasonal peak in jet-kero demand. Cargo tonnage performance continues to lag that in the passenger travel segment.

Crude and Product Excess? Not in Japan

Crude runs began to rise, with a very low crude import level, such that crude stocks drew a strong 2.8 MMBbls. Finished products also drew despite lower aggregate demand and higher runs. Gasoline demand was modestly lower, but stocks still posted a modest draw to another new 2016 low. Gasoil demand was also modestly lower, and stocks drew to their second-lowest level of the year. Kerosene demand was higher, due to a downward revision to the previous week. The initial seasonal draw seen last week was revised to a modest build. Margins and cracks improved on the week. Margins in September and into October have improved nicely from the abysmal levels seen in August. Levels are now judged acceptable and supportive of rising runs as we move out of turnaround.

PJM REC Prices Sliding, But Some Bullish Factors on Near Horizon

Pricing for high-value PJM RECs has come down significantly, most recently accompanied by strong trading volumes and open-interest gains. Apart from the PTC extension, bearish factors have included lower loads, capacity additions and higher renewable generation, the veto of MD RPS legislation and the close of true-up periods for certain states’ programs. Given REC oversupply, additional price drops are possible. But stronger loads going into 2017, the unfreezing of the OH RPS and a possible overturn of the MD veto could boost prices. Longer term, the need for additional wind capacity, the phase-out of the PTC, and increasing state requirements can pressure REC prices. Major transmission adds, e.g. the Grain Belt Express, are a major potential bearish factor.

Global Equities Stage a Positive Week

Global equities posted a positive week. In the U.S. the growth indicator had a positive gain, while the defensive indicator was unchanged. Over the last several weeks, growth sectors are outperforming defensive sectors. Banking and materials outperformed this past week, while energy matched the broad market. Internationally, Latin America again moved higher with a nice uptrend appearing to have taken root. The emerging market tracking index also had a good gain.

U.S. Ethanol Stockpiles Draw

In the week ending October 14th, ethanol-blended gasoline manufacture was up 89 MB/D (1 %) from 8,986 MB/D at the same time last year. U.S. ethanol inventories drew to the lowest values in almost a year. Production rebounded to a five-week high, 998 MB/D.

Asian Demand Growth: Acceleration Is on Track

PIRA's latest update of major country Asian product demand shows the first signs of demand growth acceleration. Our latest assessment of growth is now 534 MB/D versus year-ago. Our expectation is for demand growth to continue accelerating strongly through year-end (which will cover all of 4Q), with December growth pushing 1 MMB/D, and then growth will ebb in 1Q17. China demand growth remains a key driver, with gasoline demand growth providing fundamental support, while fuel oil demand growth in countries like Korea is also supportive to aggregate performance.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets

On Tuesday of last week, the British government announced its long-awaited decision on airport expansion, favoring the option of a third runway at Heathrow. Despite the clear and compelling economic benefits, it has taken nearly twenty years for the government to reach a decision on the now-critical requirement of increased capacity across the UK’s key airports; a decision that the Davies Commission estimates will deliver a GDP boost of $147bn over the next 60 years.

On Tuesday of last week, the British government announced its long-awaited decision on airport expansion, favoring the option of a third runway at Heathrow. Despite the clear and compelling economic benefits, it has taken nearly twenty years for the government to reach a decision on the now-critical requirement of increased capacity across the UK’s key airports; a decision that the Davies Commission estimates will deliver a GDP boost of $147bn over the next 60 years. Aker Solutions

Aker Solutions Photo courtesy: Global Maritime

Photo courtesy: Global Maritime Leading global energy services company entrusts

Leading global energy services company entrusts

SpeedCast International Limited

SpeedCast International Limited CGG announces that it has been awarded a major contract by Pemex to deliver an orthogonal wide-azimuth integrated solution designed to optimize subsalt seismic imaging in the geologically complex deep waters of the Perdido area.

CGG announces that it has been awarded a major contract by Pemex to deliver an orthogonal wide-azimuth integrated solution designed to optimize subsalt seismic imaging in the geologically complex deep waters of the Perdido area. The first day of

The first day of  Seanic Ocean Systems (Seanic)

Seanic Ocean Systems (Seanic) Tugboat companies complying with Subchapter M regulations are required to have man overboard (MOB) procedures in place, including a way of retrieving crew who have fallen overboard. C-HERO has put together a package to help tug and barge workers fulfill this mandate, the MOB Total Solution. The system includes the

Tugboat companies complying with Subchapter M regulations are required to have man overboard (MOB) procedures in place, including a way of retrieving crew who have fallen overboard. C-HERO has put together a package to help tug and barge workers fulfill this mandate, the MOB Total Solution. The system includes the

Seven Borealis. Photo courtesy: Subsea 7

Seven Borealis. Photo courtesy: Subsea 7 China's Pace of Refinery Capacity Additions Slowed, but the Rest of Asia Still Adding

China's Pace of Refinery Capacity Additions Slowed, but the Rest of Asia Still Adding

Petrobras CEO, Pedro Parente, and the CEO of Total, Patrick Pouyanne. Photo courtesy: Petrobras

Petrobras CEO, Pedro Parente, and the CEO of Total, Patrick Pouyanne. Photo courtesy: Petrobras Image courtesy: Damen

Image courtesy: Damen Endeavor Management

Endeavor Management This TDP proposes to build a full scale system and undertake a series of tests including onshore FAT and land tests, shallow water test and, finally, a deepwater offshore trial in the Gulf of Mexico to demonstrate all aspects of the system’s operations. The TDP will deliver a field proven system to the industry.

This TDP proposes to build a full scale system and undertake a series of tests including onshore FAT and land tests, shallow water test and, finally, a deepwater offshore trial in the Gulf of Mexico to demonstrate all aspects of the system’s operations. The TDP will deliver a field proven system to the industry. A sustained low oil price environment is a challenging one, with ‘survival of the fittest’ being an undeniable reality of the sector. Upstream E&P operators, in the past two years, have scurried to re-evaluate their operational Business as Usual (BAU) practices, implementing a myriad of measures ranging from immediate cost cutting steps such as the downsizing of the workforce, the elimination of redundancies as well as the rebalancing of portfolios as they aspire to come out of this battle stronger.

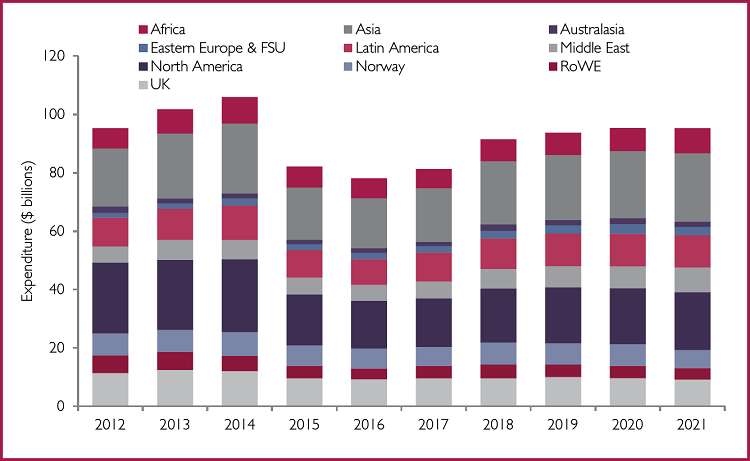

A sustained low oil price environment is a challenging one, with ‘survival of the fittest’ being an undeniable reality of the sector. Upstream E&P operators, in the past two years, have scurried to re-evaluate their operational Business as Usual (BAU) practices, implementing a myriad of measures ranging from immediate cost cutting steps such as the downsizing of the workforce, the elimination of redundancies as well as the rebalancing of portfolios as they aspire to come out of this battle stronger.