Another Substantial U.S. Inventory Recovery

Another Substantial U.S. Inventory Recovery

Total commercial stocks fell 5.1 million barrels this past week led by an almost 10 million barrel stock decline in products, with refinery turnarounds near peak levels. The 3.7 million barrel reported distillate stock decline was one of the largest this year, signaling the U.S. is in the heart of the harvesting season. Reported U.S. crude stocks now exclude lease stocks, which lowered them by roughly 30 million barrels, and week to week crude inventories built 4.8 million barrels largely because of low runs. Cushing crude stocks fell 1.3 million barrels this past week and are forecast to decline 2.3 million barrels next week because of Basin pipeline maintenance. Another large stock decline is forecast for distillate next week (-580 MB/D) with another strong pull from the farm economy, while gasoline inventories modestly build from weaker demand because of the Columbus holiday and the aftereffects of Hurricane Matthew.

Signs of Rising Import Dependency

Dependency on Lower 48 gas will likely increase next year as expanding domestic production losses leave a widening import gap to serve incremental demand growth. In particular, another round of PEMEX budget cuts has recently been approved, setting the stage for oil and gas production to fall by more than 10% year-on-year. Fortunately, a host of critical infrastructure projects is set to emerge in 2017, enabling imports to meet the organic demand growth within the power and industrial sectors.

China Steps Up on the Gas

With APLNG T2, the last train of the six coalseam projects in Australia, starting production, China plays a key role. Not only does it have 25% equity in two of these unconventional projects, the second largest equity stake of any Asian buyer in any liquefaction project to date, but is also a big buyer from these projects. With a slowly recovering gas demand, LNG faces competition from increased domestic production and pipeline supplies.

Australian Coal Prices Jump with Limited Short-Term Capping Mechanisms

Seaborne coal pricing was decidedly bullish this week, with continued tightness in the prompt market pushing forwards higher, particularly in Asia. 4Q16 and 1Q17 FOB Newcastle prices rose from last week as Chinese market players returned from the Golden Week holiday. FOB Newcastle prices are now up over 100% for the year. 4Q16 API#4 prices also jumped while API#2 prices finished the week down. Pricing in the Pacific Basin has shown virtually no signs of cooling off, particularly as coking coal price settlements have been confirmed at over $200/mt. With crossover supply moving into the coking coal market, there is not much prompt thermal coal supply that could come into the market to prevent further price gains.

Soft Landing for Global Aviation GHG Emissions Plan

The International Civil Aviation Organization agreed to adopt a market-based approach to cover global aviation GHG emissions, which requires acquiring and submitting carbon offsets to cover only the increases in international aviation emissions vs. 2019-2020 levels. Exact offsetting mechanisms eligible for compliance have yet to be specified, but the design of the program suggests that costs will be very low in the early years of the program. Voluntary country-level compliance begins in 2021, with mandatory compliance not starting until 2027. Efficiency initiatives also seek to reduce aviation fuel consumption, but PIRA expects aviation emissions to continue to grow, implying that increasing levels of offsetting will be necessary for compliance.

Fuels Rally; Winter Sparks Down Except in Northeast

On-peak prices weakened in New England/Mid-Atlantic and Ontario but firmed in most other Eastern Interconnect markets — primarily due to warmer-than-normal weather. Loads in the East edged up 0.5% year-on-year, while ERCOT climbed 4.7%. Henry Hub prices through October have shown remarkable strength, especially in the context of waning shoulder season demand. In contrast, Appalachian prices have inflected sharply to the downside. Looking ahead, heating season power prices will likely lag year-on-year gas gains outside of the Northeast, reducing margins.

Asian LPG Prices Improve; Petchem Usage Challenged

Regionally, Asian LPG markets performed best last week. Propane cargoes arriving in November were called 5% higher at $389/MT, and butane rose by the same amount in percentage terms to $418/MT. Butane’s discount to naphtha narrowed to just $27, a price at which it becomes increasingly non-competitive as a petrochemical feedstock.

S&P 500 Moves Lower

The S&P 500 moved lower on the week, with volatility up slightly, while high yield debt and emerging market debt moved a bit lower in price. The dollar was generally stronger. For commodities, there continued to be a slight upward bias, but ex-energy appears to have weakened a bit. There continues to be noted declines in the precious metals complex and an upward movement in long-term yields for a host of countries, with a lesser rise on the short end of the curve.

Harvest Progressing Nicely

With fairly good weather last week, PIRA expects a 10-15% increase in both corn and soybean harvest numbers today. After posting a 35% completion rate as of last Sunday, PIRA expects that between 45% and 50% of the corn should have been harvested as of Sunday. In soybeans we expect a number close to 55% in this afternoon’s report against 44% last week.

Japanese Data Remain Supportive to Margin and Crack Recovery

Crude runs eased once again, with higher crude imports such that crude stocks built 2 MMBBls. Finished product stocks drew, across the board, on higher demands. Gasoline demand was modestly higher and stocks drew 0.3 MMBbls to a new 2016 low. Gasoil demand was also modestly higher and helped draw stocks. Kerosene demand was hyped by secondary and tertiary inventories pulling on primary inventories. Stocks posted their first seasonal draw of 37 MB/D. Margins and cracks eased on the week for all the major products, but they staged a bit of improvement in the last few days. Margins in September and into October have improved nicely from the abysmal levels seen in August. Levels are now judged acceptable and supportive of rising runs, post-turnaround.

Coal-Gas Correlation Picks Up Due to Power Economics

Coal-to-gas switching has been a big theme emerging in European energy since late last year, but only now are we seeing it come to a head. The switch has migrated from the U.K. to the Continent, which means a potentially larger swing in gas demand on a day-to-day basis. The major flag in recent weeks is that, despite a strong push in European gas prices of more than 50%, we haven’t seen gas-to-power demand disappear. Coal prices have also experienced similar, if not greater, strength due to supply reductions, and it looks like what was once a gas market that was desperate to encourage flexible demand with weak prices is now unable to jettison it.

U.S. Ethanol Prices Advance

U.S. ethanol prices rose the week ending October 7 after a bullish DOE report and support from higher corn and oil values. Manufacturing margins declined. D6 RIN values were higher as the EPA will finalize the 2017 margins soon.

California Carbon Awaits New Data, Court Decisions, Post-2020 Direction

Prices increased in September with continued weak trading, but they slipped in October, with the final auction at the 2016 reserve price a month away. Going into the November 1 partial surrender requirements, sources hold enough CP2 compliance instruments to cover emissions through 2016 and free allocations for 2017 are also on the way. A severely undersubscribed November auction could see unsold allowances go to the Reserve, reducing CP2 supply. The market may deem the federal Canadian carbon price proposal bearish, but PIRA believes it can be aligned with WCI cap and trade. Environmental justice concerns over cap and trade have intensified, the market awaits the auction court decision, and critical emissions data releases are expected in coming weeks (CA, QC, perhaps ON).

Permian Basin Pipeline Capacity Surplus to End by 2020 (or Sooner)

Permian Basin crude and condensate production growth, as in other U.S. tight oil plays, has slowed dramatically this year. But in contrast to other plays, growth is likely to remain positive, both in 2016 and 2017. In 2018, Permian crude and condensate production is projected to rise more than 300 MB/D. New pipelines out of West Texas have more than kept up with production growth so far. Nearly 1.5 million barrels per day of takeaway capacity have been added in the past four years, creating a pipeline surplus of around a half-million barrels per day this year. As production continues to grow, this pipeline surplus capacity will erode. The only new pipeline project currently planned is a 300 MB/D Enterprise Products line from Midland to Sealy, slated for completion in 2018.

Numbers Belie Appalachian Spare Production Capacity

The latest EIA Monthly Crude Oil and Natural Gas Production (914) report broadly reflects PIRA’s reference case, with all regions reported either flat or in month-on-month decline for July. However, the report fails to convey the complete narrative on real-time supply.

Auto Sales Spark Activity in World's Largest Vehicle Markets

In September, global auto sales rose to their highest level on record. In the U.S., vehicle sales remained at elevated levels and played a key role in the expansion of consumer spending. In Europe, a jump in car sales during September sent an encouraging signal about industrial production. In China and India, major growth in car sales is driving gasoline demand substantially higher.

Pakistan Ensures Fertilizer Feedstock Prices Remain Unchanged

Pakistan’s Oil and Gas Regulatory Authority (Ogra) has said that no increase in the gas price for domestic as well as fertilizer feedstock was proposed by the authority. A spokesman clarified that a news item — that claimed an increase in gas prices by 36% was forthcoming — was not true. The spokesman further explained that the Ogra had issued its decisions with respect to SSGCL and SNGPL’s petitions for determination of prescribed price for FY 2016-17 on October 6, 2016. In the case of SSGCL, Ogra determined the average prescribed price at Rs354/MMBtu ($3.37/MMBtu). In the case of SNGPL, Ogra had determined its average prescribed price at Rs480/MMBtu ($4.57/MMBtu).

Spain Sees Sharp Increase in CCGT Load Factor as Wind and Hydro Decline

One side effect of the ongoing French nuclear issues is the disruption of the historical interconnector flows across Europe. Those French flows with Spain are no exception. Last week, Spain turned into a net exporter to France, reaching a daily flow of 2 GW on Wednesday, a multi-year high in the fourth quarter. This amount of exports is occurring even in the context of relatively stronger demand in Spain (weather-adjusted loads are reported to be up 1.6% year-over-year), together with low hydro and wind output, supporting domestic Spanish thermal generation from both coal and CCGTs.

Mexico Aims at Resuming Exports of Maya to the USWC

The announcement of Mexico’s intention to export Maya to the USWC signals that the domestic refining system is struggling with operational issues and that the USWC could be an economically advantaged destination relative to Asia or Europe, the usual marginal Maya markets.

Ethanol Production and Stocks Plunge

U.S. ethanol dropped 22 MB/D to 962 MB/D the week ending October 7, the lowest since June as some plants continue their seasonal maintenance. Stocks fell by 784 thousand barrels to 19.4 million barrels, the lowest level thus far in 2016. Ethanol-blended gasoline value was relatively flat.

Large Gains in Chinese Car Sales Are Lifting Gasoline Demand

Chinese car sales rose at a fast pace this year, and gains were particularly strong in September. The number of cars on the road, therefore, continues to expand rapidly, and gasoline demand is rising accordingly. PIRA’s model, comprised of car fleet size, distance traveled, and fuel efficiency, pointed to recent demand growth of about 300 MB/D year-on-year, and this estimate was roughly in agreement with reported demand figures. Recent gains in truck sales were more modest, and pointed to a small increase in transport-related diesel demand.

Global Equities Move Broadly Lower

Global equities were broadly lower on the week. In the U.S., utilities posted a moderate gain and consumer staples were little changed, but all the other indices fell back. Energy basically matched the market decline of about 1%. Internationally, Latin America moved higher, but all the other tracking indices gave ground. Most of those declines exceeded that seen in the U.S. market.

October Weather: U.S. Warm, Europe and Japan Cold

The new heating season is off to a cold start in Europe and Japan while weather is warmer in the U.S. With half the month completed and a second half forecast, October is expected to be 6% colder than the 10-year normal and 7% warmer on a 30-year-normal basis.

EU Carbon Rebounds on Thermal Price Gains, Nuclear Outages

French nuclear outages are an ongoing factor, but EU carbon prices also rose in early October in sympathy with strong rises in thermal fuels prices. Continued gains in thermal fuels prices should support carbon prices in their current range for the balance of 2016. An EU Parliamentary committee (ITRE) approval of post-2020 market reforms seems positive, but a lack of substantive progress in a more important committee (ENVI) ahead of a December vote is concerning. PIRA is not currently building in additional 2016 policy support, but constructive negotiations ahead of ENVI’s vote can push prices upward. Neither the supply nor the demand side support 2017 price gains, at a time when Brexit negotiations add policy risk.

The Farm Economy

At its Annual Client Seminar, October 6-7 in New York, PIRA tackled the subject of a challenging farm economy. Here is the presentation.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Another Substantial U.S. Inventory Recovery

Another Substantial U.S. Inventory Recovery Global Maritime Consultancy & Engineering

Global Maritime Consultancy & Engineering SapuraKencana Petroleum Berhad

SapuraKencana Petroleum Berhad Fugro

Fugro In a move to increase foreign investment amid the nation’s worsening economic position, Brazil’s Congress has approved legislation that will remove state-controlled Petrobras’ obligation as sole operator on the country’s pre-salt developments. Discovered in 2007, these ultra-deepwater fields represent a huge opportunity – they are the largest group of offshore reserves discovered this century.

In a move to increase foreign investment amid the nation’s worsening economic position, Brazil’s Congress has approved legislation that will remove state-controlled Petrobras’ obligation as sole operator on the country’s pre-salt developments. Discovered in 2007, these ultra-deepwater fields represent a huge opportunity – they are the largest group of offshore reserves discovered this century. Ashtead Technology

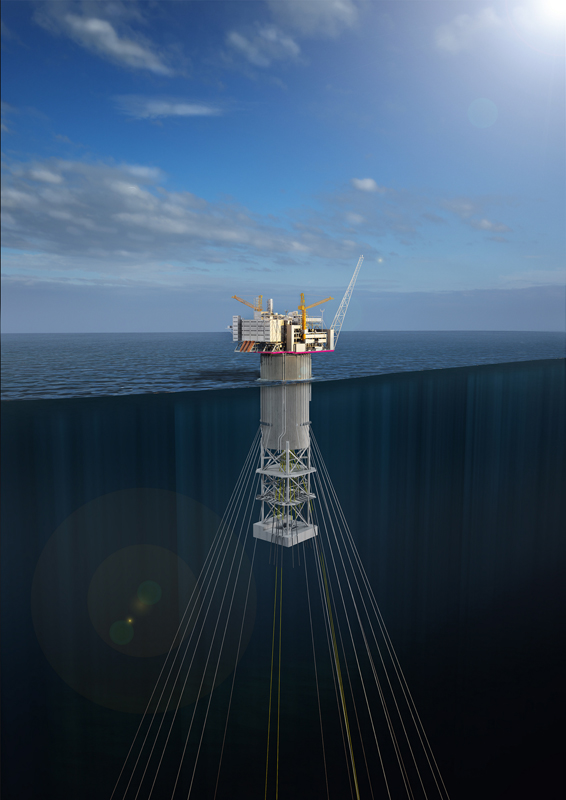

Ashtead Technology Illustration: The Aasta Hansteen platform will be the largest SPAR platform in the world. (Illustration: GeoGraphic / Statoil)

Illustration: The Aasta Hansteen platform will be the largest SPAR platform in the world. (Illustration: GeoGraphic / Statoil) DEA

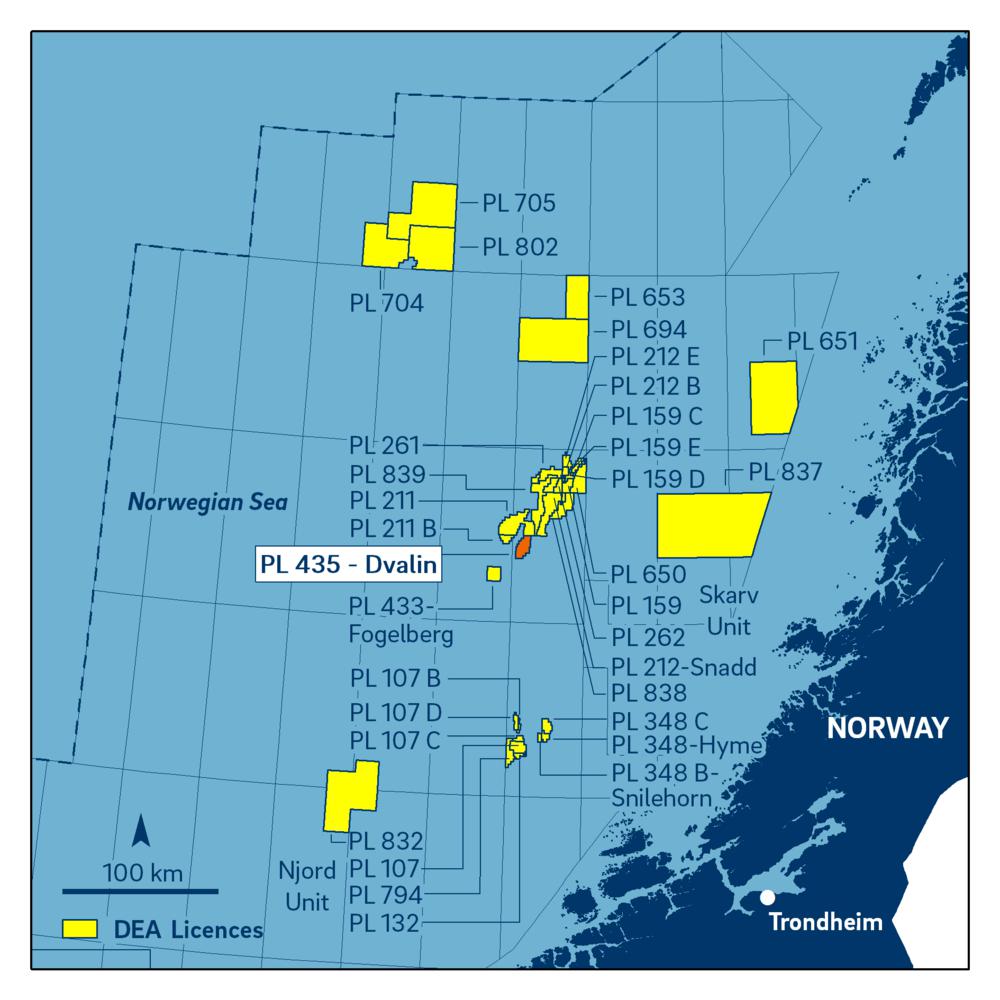

DEA The contract includes the fabrication of smaller structures, the 12/16-inch pipe-in-pipe production flowline, the 12-inch gas export pipeline and the installation of pipelines as well as all subsea structures and umbilical for the Dvalin field.

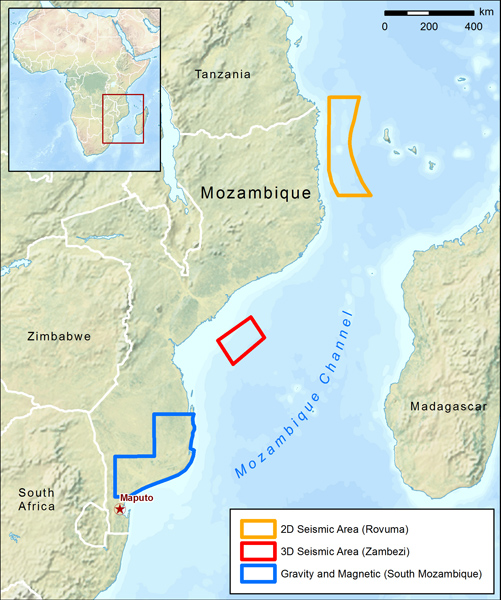

The contract includes the fabrication of smaller structures, the 12/16-inch pipe-in-pipe production flowline, the 12-inch gas export pipeline and the installation of pipelines as well as all subsea structures and umbilical for the Dvalin field. The program includes a 2D survey of over 6,550 km in the offshore Rovuma basin, including blocks R5-A, R5-B and R5-C, and a large 3D survey over the Beira High in the Zambezi Delta. The 3D survey is expected to be up to 40,000 km², subject to pre-commitment. It will cover blocks Z5-C and Z5-D and surrounding open acreage in this deltaic area which is believed to be prospective. CGG has also been awarded an onshore airborne gravity and magnetic survey in the Southern Mozambique Basin.

The program includes a 2D survey of over 6,550 km in the offshore Rovuma basin, including blocks R5-A, R5-B and R5-C, and a large 3D survey over the Beira High in the Zambezi Delta. The 3D survey is expected to be up to 40,000 km², subject to pre-commitment. It will cover blocks Z5-C and Z5-D and surrounding open acreage in this deltaic area which is believed to be prospective. CGG has also been awarded an onshore airborne gravity and magnetic survey in the Southern Mozambique Basin. BP

BP Cybercrimes cost energy and utilities companies an average of USD 12.8 million each year in lost business and damaged equipment1. Platform operators need confidence that countermeasures can deal with bigger and more sophisticated cyber-attacks. DNV GL is now collaborating with Shell, Statoil, Lundin, Siemens, Honeywell, ABB, Emerson and Kongsberg Maritime to develop best practice in addressing this threat. Other companies are still welcome to join.

Cybercrimes cost energy and utilities companies an average of USD 12.8 million each year in lost business and damaged equipment1. Platform operators need confidence that countermeasures can deal with bigger and more sophisticated cyber-attacks. DNV GL is now collaborating with Shell, Statoil, Lundin, Siemens, Honeywell, ABB, Emerson and Kongsberg Maritime to develop best practice in addressing this threat. Other companies are still welcome to join. Shell’s Prelude FLNG

Shell’s Prelude FLNG The container is equipped with a Pronomar Drying system suitable to dry suits, gloves and boots

The container is equipped with a Pronomar Drying system suitable to dry suits, gloves and boots Image courtesy: DEA Group

Image courtesy: DEA Group The Maersk Resolve has finalized the planned work scope for DONG Energy at the Hejre field in the Danish sector of the North Sea, and

The Maersk Resolve has finalized the planned work scope for DONG Energy at the Hejre field in the Danish sector of the North Sea, and  Airborne Oil & Gas

Airborne Oil & Gas