Likely OPEC Output Cut to Accelerate Rebalancing

Likely OPEC Output Cut to Accelerate Rebalancing

Reflationary wind is positive for the global economy. A flow deficit between global oil supply and demand already exists, reducing surplus stocks by an average of 0.7 MMB/D the last two quarters. This decline will accelerate in 4Q. Disruptions to supply have waned, but political risks are on the rise. Refinery margins should stay healthy for the season with gasoline helped by strong demand and increased pull, especially from Mexico, while normal winter weather supports distillate.

Assessing Winter Heating Risks

A warm start to the 2016-17 heating season has caused the market to reconsider earlier expectations of evolving winter tightness. Yet, given the relatively low bar for achieving year-on-year demand growth, the developing pessimism on the balance of the season is probably unwarranted. Given the demand fallout in October and rising bearish risks for November, PIRA has marked down its price forecast for the remainder of the year. But tighter U.S. balances should enable prices to reach new highs — maybe before year end — assuming weather conditions revert towards normal in December.

Risks Surge as Nuclear Set to Stay Low

France will need at least 4.0 to 5.2 GW of imports to balance during the time of maximum load in December and January, with this number growing significantly under extreme weather (five-year max as in Feb. 2012). We think that 4.7 GW could flow easily before resorting to imports from the U.K. With the U.K. market already tight, any reduction of flows from France increases the likelihood of utilization of the Contingency Balancing Reserve (CBR), starting from November. Beyond the short-term price risks, which now appear fully factored into current forward winter prices, the longer-term pricing picture does not appear to be mirroring any of the uncertainties over the need for replacement of anomalous components, and if there is such a need to replace the components, what’s the availability of the parts (or how long it may need to manufacture them). Finally, the presence of other anomalies could still extend the outage period of specific units.

Cape Freight Rates Expected to Strengthen in 2H17

The 180,000 DWT Cape tripcharter average weakened last week to close at just under $9,700/day. Meanwhile, Panamax tripcharter rates hit their highest level this year and Supramax rates strengthened slightly late last week. Soaring coking coal prices are encouraging steel mills to increase their use of higher grade iron ore and electric arc furnaces (using steel scrap), both of which could adversely impact Cape demand. Despite the potential downside in iron ore trade, Cape utilization is set to tighten in 2H17 and into 2018. This tightening underpins PIRA's view that monthly average Cape freight rates are expected to push over $20,000/day in late 2017.

Flat 2015 Emissions Expected in California Cap and Trade

The once-a-year release of annual cap-and-trade emissions data can be a market-moving event, though previous California data releases did not have a major short-term impact on CCA prices. In the past three years the release occurred on November 4th, and PIRA understands that it will take place in “early November.” 2015 emissions data will again include both narrow-scope and broad-scope sectors (facing compliance obligations for the first time in 2015). PIRA expects overall California 2015 emissions to be flat vs. 2014 levels. WCI partners Quebec and Ontario (joining in 2017) will likely release emissions data soon, which have a more substantial impact on CCA prices by offering first-time data and a chance to recalibrate emissions starting points.

Reflationary Wind Lifts Growth; EM Financial Stress Is Diminished

The U.S., the U.K., South Korea, and Taiwan reported third quarter GDP this week, and results were all better than expected. In the euro area, the latest business confidence surveys pointed to stronger activity in the coming months. Reflation in producer prices was a reason for better data globally. Even though a Fed rate hike is very likely in December, there are no major signs of financial market distress in emerging economies. Developments in China, India, and Brazil have been key.

U.S. Propane Stocks Fall into Deficit

Total U.S. inventories declined by 2.1 MMB to 100.6 MMB. All PADDs are in deficits to a year ago with the exception of PADD I.

U.S. Ethanol Prices Rally

For the week ending October 21, ethanol prices rose, supported by higher corn prices. Manufacturing margins remained strong. September RIN generation fell, and, as a result, prices increased.

Harvest Progress Slows

As the calendar turns to November tomorrow, North American farmers who have had some reported difficulty in getting crops to dry down in their fields will start to feel a bit more anxious about their standing crops. Transitional fall weather can be difficult at best to predict, but the near-term forecast for this week looks ideal for many to catch up on slowed harvests and relieve a sense of urgency.

Rebalancing: U.S. Playing Its Roll

Total commercial stocks drew 8.7 million barrels this past week, most of which was in products, though crude managed to decline a surprising 0.6 million barrels because of exceptionally low imports. Month-to-date U.S. domestic crude supply is down 840 MB/D year on year while four-week-average adjusted demand is up 800 MB/D, clearly a major contributor to global rebalancing. Both gasoline and distillate had healthy stock declines this past week and this should continue in this week’s data. Cushing crude stocks continued to draw last week, falling by 1.3 million barrels, but this week should see a 0.7 million barrel inventory build because of the Seaway outage. Crude imports should rebound sharply next week, but with higher runs, crude inventories are forecast to build just 290 MB/D, once again narrowing the crude stock excess to last year, which will fall below 20 million barrels.

Focus on Power Demand Obscures Plentiful Gas Supply

The gas market has put much of its focus squarely on power demand, but this is obscuring plentiful gas supply. Demand from the power sector will stabilize at close to current levels and has broadly spread across much of Europe. Of particular note is France and its neighbors, who will need to handle the nuclear shortfall that has stood at around 8 GW this month. But with 34% more than normal injected this year, the European storage fleet is well positioned to handle nearly any winter, which is providing an early test this year. However, seasonal forecasts are pointing to a return to warmer temperature anomalies further down the road. Between healthy storage stocks, increased competitiveness of pipeline supplies, and changes in Qatari LNG pricing around the world, there are growing hints at downward price pressure for Europe.

Downside Risks Proliferate

Mid-Columbia on-peak prices fell by $5/MWh in October as Pacific Intertie maintenance and strong hydro production displaced thermal generation. Southwest markets were flat (SP15 and PV) to slightly lower (NP15) as maintenance outages and reduced flows from the Northwest offset declining cooling loads. Implied heat rates fell year-on-year at all hubs, led by a 16% drop at Mid-Columbia. Heat rate declines continue through much of the forecast as higher gas prices revive coal-fired generation while renewables extend gains. Weaker gas prices and above-normal runoff present credible downside price risks.

Coal Stocks Move Steadily Lower

EIA data estimates for electric power sector stockpiles as of end-August came in higher than expected at 162.6 MMst, likely as a result of a greater draw from producer/distributer stocks than expected. However, this was the largest M/M draw for August since 2010, and stocks were only 6.0 MMst below prior-year levels as production cutbacks and marginally higher gas prices have drawn stocks from their peak of over 197 MMst in December. PIRA projects that U.S. coal stocks drew further since August and will have fallen 11.3 MMmt below prior-year levels by the end of October. This mirrors 86 days of forward demand based on our forecast of Nov./Dec. 2016 average coal burn (versus 109 days cover one year ago). By region, stocks range from a low of 57 days cover in the ERCOT/SPP region to a high of 286 days in the NPCC region. With U.S. power sector coal burn projected to rise year-on-year consistently through June 2017, further draws are a certainty.

Inventories of U.S. Ethanol Build

The week ending October 21 there was a large build in inventories, which increased in four of the five PADDs. Production fell slightly. Ethanol breached the 10% blend wall making up 10.07% of the gasoline pool.

Global Equities Mostly Lower

Global equities generally eased on the week. In the U.S, both the growth and defensive indicator were lower. Consumer staples and utilities did the best of any sector and posted good gains. Housing, retail, and energy were down and underperformed, with energy lower by 1.2%. Internationally, all the indices, other than Japan, moved lower on the week.

A Big Slug of Crude Arrives in Japan, But Few Surprises

Crude runs eased slightly, but crude imports surged, such that crude stocks ballooned 9.2 MMBbls. Finished products drew by 1.8 MMBbls and have clearly become increasingly tight as maintenance continues. There were moderate draws in naphtha, fuel oil, and the jet-kero complex. Gasoline stocks drew to their lowest level since before 2003. Margins and cracks again improved on the week, with all the major product cracks improving. The net gain in margin for the week was about $0.75/Bbl. Levels remain good and supportive of rising runs as we move out of turnaround.

Waiting on the Weather

Despite the rollercoaster ride NYMEX futures took in October, cash prices were mostly unchanged month-on-month. In the northeast, upstream and downstream prices alike were decidedly lower despite the relative weakness already in effect during September. On the positive side of the ledger, the real standout performers were Houston Ship Channel and south Texas prices. Western Canadian prices likewise moved higher in October; however, the monthly gains merely allowed NOVA/AECO-C and west coast basis to “normalize” following a long stretch of weakness.

The Return of $100/mt Coal

FOB Newcastle prices have surpassed $100/mt for the first time since April 2012, driven by strength in China's import demand and the continued pull of the even stronger coking coal market on thermal supplies. Despite prices being at such high levels, there is additional upside if there is any disruption to supply. Beyond the short-term, there is little doubt that prices will fall from current levels. However, we believe that the backwardation in the market is overstated, and we remain bullish relative to the forward curve.

S&P 500 Moves Lower

The S&P 500 moved lower on the week, with the corresponding indicators moving appropriately. Volatility was higher, while high yield debt and emerging market debt moved lower. The dollar was mixed, and commodities were little changed. There continues to be a trend rate rise in longer-term yields for many key countries, with a lesser rise also noticeable on the short end.

IMO Decides on 2020 Implementation for 0.5% Global Bunker Sulfur Spec

The IMO has decided to tighten global marine bunker fuel specifications to a maximum of 0.5% sulfur beginning in 2020. While the decision provides clarity so that stakeholders can plan for this changeover, PIRA’s analysis indicates that this early implementation date will be disruptive for bunker suppliers, refiners and shippers. In particular, refiners will have difficulty disposing of all of the high sulfur residual fuel previously used as bunker fuel, which will drive product spreads sharply wider (distillate up, HS fuel oil down). Shipping costs will increase for all trades as bunker prices increase. Atlantic Arbitrage Closes In as U.S. Volumes Open Back Up Sabine Pass is ramping back up after a five-week maintenance outage on both operating trains. The ramp up coincides with a noticeable downtrend in what buyers of marginal LNG in the Atlantic Basin are willing to pay and could exacerbate the pricing trend. The big premiums to U.S. Henry Hub have faded, even as Henry Hub itself has risen.

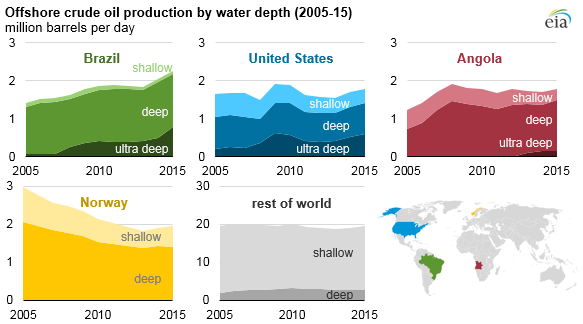

Brazil's Changing Regulatory Regime Bullish for Production

There has been cautious optimism surrounding the future of Brazilian oil production since the discovery of massive fields Sapinhoa, Lula, Lapa, and Libra. The finds in the “pre-salt polygon” are world class in terms of resource size and well productivity, but economic troubles, scandal, and stringent nationalist regulations imposed in 2010 have limited foreign investment and hindered development. In recent weeks, regulatory moves have been lifting the prospects for Brazil’s pre-salt. Brazil is removing the sole operatorship mandate for Petrobras in the pre-salt. There are plans to relax local content requirements. Both changes make the pre-salt more accessible and attractive to foreign players. Combined with the quality of the resources and expected improvement in Petrobras’s financial position and operational efficiency, these developments are positive for medium-term production. Doubts remain, however, as Brazilian oil has a history of not living up to high expectations. PIRA maintains our view that Brazil crude and condensate production will grow from 2.5 MMB/D in 2016 to 3.2 MMB/D in 2025.

Too Soon to Throw in the Towel on Winter

Toward the end of the injection season, weekly EIA inventory releases begin to hold less sway on the direction of futures prices. In large part, this disregard naturally occurs because the net inventory builds are often simply too slight to matter. Moreover, fine-tuning of overall stock levels conveys very little about the heating season ahead. Consequently, after taking a brief hiatus during the fall, short-term weather forecasts begin to make a comeback, moving to center stage in setting the direction for prices.

Permian Volumes Keep Growing Despite Low Oil Prices

Permian production has defied the collapse in prices and continues to grow. Permian shale crude and condensate production has nearly doubled since mid-2014 to 1.1 MMB/D today. The substantial increase in Permian production is the result of a prolific resource, efficiency gains, and costs savings, which together have reduced breakevens by 42% since 2014 to a current average of $41/Bbl. The Permian is the most economic shale play in the U.S. and not surprisingly has been the primary beneficiary of incremental rig activity since May lows. Operators and investors are especially bullish on the play and this is reflected in recent transactions, with deals year-to-date averaging $28,000/acre. PIRA is optimistic about future Permian shale growth and expects crude and condensate production to almost triple by 2025 to 3.2 MMB/D (12% CAGR).

Ukraine Industrials See Price Rise in November

NJSC Naftogaz Ukrainy from November 1 will raise the price of gas for industrial customers on a prepayment basis by 16.3%. According to a company press release, the price is relevant for consumers buying gas in the amount of more than 50,000 cubic meters per month and who have no debts to the holding. The price for other industrial consumers will increase by 15.3%. The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets

Phoenix International Holdings, Inc. (Phoenix)

Phoenix International Holdings, Inc. (Phoenix) Exxon Mobil Corporation

Exxon Mobil Corporation Ocean Intervention III. Photo courtesy: Oceaneering

Ocean Intervention III. Photo courtesy: Oceaneering Hyperdynamics Corporation

Hyperdynamics Corporation

“We were looking for a selling and servicing partner for our ICAF and ICCP systems, and we found that partner in Separator Spares & Equipment” said Eric Bouman, Sales Manager at MME Group. “The driving force behind the agreement is the shared commitment, of both companies, to increase the availability of MME Group products and services to North American Customers.”

“We were looking for a selling and servicing partner for our ICAF and ICCP systems, and we found that partner in Separator Spares & Equipment” said Eric Bouman, Sales Manager at MME Group. “The driving force behind the agreement is the shared commitment, of both companies, to increase the availability of MME Group products and services to North American Customers.”

GE (NYSE:GE) and

GE (NYSE:GE) and

In the event, the Ministry of Mines and Energy also advocated lower payments of royalties for small and medium-sized onshore companies

In the event, the Ministry of Mines and Energy also advocated lower payments of royalties for small and medium-sized onshore companies Penspen

Penspen The Integrated Monopile Installer – developed by

The Integrated Monopile Installer – developed by  Aker Solutions

Aker Solutions Trelleborg

Trelleborg Artists impression of the ‘Hrönn’

Artists impression of the ‘Hrönn’

Photo courtesy: BP

Photo courtesy: BP Likely OPEC Output Cut to Accelerate Rebalancing

Likely OPEC Output Cut to Accelerate Rebalancing