U.S. Crude Stocks Decline on Favorable Import/Export Arb

U.S. Crude Stocks Decline on Favorable Import/Export Arb

US crude stocks fell in September, as prices between domestic and foreign grades incentivized crude exports while discouraging imports. Cushing stocks fell only about 1 million barrels, as a continuing narrow LLS-WTI differential limited flows from Cushing to the Gulf Coast.

New Supply Mix Creates More Risk Despite Higher Stock Levels

The fundamental basis for the recently sustained run up in NBP prices to the high side is tied to U.K. gas consumption in power, weak French nuclear output, and Norwegian gas exports that remained well below last year until this week. Throw in an early colder than normal forecast for the upcoming week and what you are left with is limited downside risk for the moment, but considerably more later on this winter if weather normalizes. High storage levels on the Continent will not yet deter the prices from remaining strong. The stocks are there, but not the will to use them. It is well known that storage holders are exceedingly reluctant to use storage early in withdrawal season and prefer to hoard storage until the first quarter.

Colder Weather Exposes French Tightness; Nuclear Outlook Remains Cloudy

With colder weather approaching and so much uncertainty surrounding nuclear availability, French power prices keep climbing. A signpost of improving availability for the upcoming winter months would be the restarts in the upcoming week. Among those, Chinon 1, affected by the channel head anomaly, should be reconnected on October 10. Such restart might impact market psychology, bringing an end to the upward trend for French prices.

Coal Market Rally Remains in Overdrive

The rally in seaborne coal prices that has been going on essentially since the beginning of 2016 has been accelerating over the past two weeks, with additional bullish developments exacerbating an already tight prompt market. For near term pricing, API#2 prices moved up by the greatest extent this week, rising by over $4.00/mt, and pushing over $75/mt for the first time since 3Q14. The force majeure declaration in Colombia and a further reduction in the European nuclear outlook was likely behind this rise in pricing. FOB Newcastle prices rose sharply as well, increasing by $3.35/mt, despite China's buying activity being subdued due to Golden Week. The most important factor for short-term pricing is how much supply can come into the market to tamp down this pricing run. After several years of extreme amounts of excess tonnage in the market, the move to rationalize supply (or at least minimize new supply), and an uptick in demand from China and elsewhere have strained the market.

U.S. Labor Market Data Remain Solid, While Encouraging News Abounds Regarding Fiscal Policy

The pace of U.S. job growth in September was about as expected. A continuing rising trend in the labor force participation rate, however, was something of a surprise. This is an important development, since it has the potential to reshape the Fed’s view of the labor market. In developed markets, fiscal policy options to stimulate economic activity are in the spotlight. In fact, Canada and Japan recently adopted the policy of larger government spending. Political winds in other areas suggest that more countries may join this trend.

U.S. Propane Stocks Increase, While NGL Stocks Decline

U.S. total propane stocks increased by 736 thousand barrels to 104 MMB. The annual stock surplus narrowed by 865 MB to 3.7 MMB. This surplus has been declining since the week ending September 18th. On the other hand, other NGLs have been registering small builds or draws as of late. The latest 2.6 MMB draw is the largest draw of the past five years for this particular week.

U.S. Ethanol Prices Peaked

U.S. ethanol prices peaked the week ending September 30, but ended the week to the downside. Manufacturing margins improved supported by higher corn and oil prices. RIN values increased.

U.S. Stocks Decline Sharply

Total commercial stocks experienced a huge stock draw of over 11.2 million barrels for the latest week, one of the largest of the year. Stocks were pulled lower by both products, down over 8.2 million barrels, and crude, which was almost 3 million barrels lower. Stronger product demand at about 20.6 MMB/D, up 1.3 MMB/D from the prior week, contributed to the draw. Crude runs fell by around 300 MB/D for the week to 16.03 MMB/D, the lowest weekly level in months. It is anticipated that runs will fall further to about 15.6 MMB/D as turnarounds increase sharply for the next week. For the next week crude stocks are expected to build by almost 2.7 million barrels as key light product inventory declines by over 3 million barrels.

Closer and Slower Voyages Mark an LNG Market in Transition

Slowly rising tanker rates over the past 6 months are offering an early warning mechanism for the bearish turn in the market's future. A steady increase in LNG tonnage on the water is underway – most of it is running ahead of the new trains to which it is dedicated. The tonnage represents the natural manifestation of two essential problems facing the LNG industry over the next five years; finding enough demand growth for new LNG supply and selling the LNG at a price that offers a reasonable netback. PIRA sees two distinct methods emerging to alleviate these problems, although by no means will they solve them completely. How well they will work will be a matter of waiting and seeing, but the process is already underway and offers some support to prices in the near term.

Global Equities Were Modestly Lower, but Asia Higher

Global equities were modestly mixed on the week. In the U.S., the broad index fell back 0.6%, but banking and retail indices posted solid gains. Energy was neutral, while utilities was the weakest performer. Internationally, Latin America was the strongest performer, while Asia also had a good week, with China and emerging Asia posting gains.

Production and Inventories Fall

The week ending September 30, production dropped to a three-month low as plants outside the Midwest went through scheduled maintenance. There was a large drop in inventories to the second lowest level of the year. Ethanol blended gasoline rose after falling in seven of the prior eight weeks.

Japanese Commercial Stocks Have Become Increasingly Tight Relative to Seasonal Trends

On the week, total commercial stocks drew 6 MMBbls and have become increasingly tight, relative to seasonal trends. This has supported the recovery in Japanese refining margins over the last month. Runs dropped 186 MB/D as maintenance continues. Crude imports stayed sufficiently low to induce another crude stock draw. Finished product stocks also drew, with gasoline hitting its low for 2016. Aggregate demand improved by 161 MB/D and the current pattern looks improved. Margins were little changed on the week and remain acceptable.

Financial Stresses Remain Contained

The S&P 500 moved lower on the week, with volatility slightly higher, and high yield debt and emerging market debt moving a bit lower in price. The dollar was generally stronger, particularly against the Japanese yen and British pound. There was noted strengthening in the currencies of Russia, Mexico, and Indonesia, against the U.S. dollar. For commodities, a strong performance in energy and oil helped carry the overall index higher, but ex-energy moved definitively lower. Precious metals, including gold, silver, platinum, and palladium weighed on the ex-energy complex. Among industrial metals, aluminum moved higher.

New Indian Gas Prices Lower Costs for Fertilizer Producers

Following the implementation of the modified Rangarajan committee formula, the price of Indian domestic gas has been reduced around 18% for the six month period from Oct 1, 2016 to Mar 31, 2017. For the Fertilizer sector, the lowering of the domestic gas prices is expected to reduce the pooled prices during H2 FY2017 which should lead to subsidy savings of ~Rs.7-8 billion ($100-120-million) for the Government for H2 FY2017 (assuming the currency to remain stable).

Aramco Pricing Adjustments: More Generous, But Not Pushing Volume

Saudi Arabia's formula prices for November were just released. While cuts were made to most crudes in the key markets, they were less than the market expected. Saudi had additional barrels to sell in November due to lower crude burn and the Yasref refinery being down for maintenance. The price cuts were not aggressive enough to push those extra avails into the market. In Asia, the cuts were consistent with a modestly wider contango in Dubai structure, and in Europe they were consistent with a wider discount on Urals-Brent.

July 2016 U.S. Domestic Crude Supply Declines to Another Cyclical Low

EIA recently released their July oil balances. Domestic crude supply, which is domestic crude production plus the balancing item, again declined to a new cyclical low of 8.77 MMB/D. This is the lowest figure seen since March 2014. From the April 2015 peak, domestic crude supply has declined 1.19 MMB/D, or an annualized decline rate of -9.7%.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Frank’s expects that Blackhawk’s specialty cementation tools will augment its tubular running services business by providing Frank’s the opportunity to diversify its offerings and emerge as a leader in a new business line and a significantly larger addressable market. In addition to what Frank’s believes is a line of well-regarded, market leading, technically differentiated specialty cementation tools, Blackhawk also provides well intervention products through its line of brute packers and related products, and is continuing its development of products for onshore and offshore applications.

Frank’s expects that Blackhawk’s specialty cementation tools will augment its tubular running services business by providing Frank’s the opportunity to diversify its offerings and emerge as a leader in a new business line and a significantly larger addressable market. In addition to what Frank’s believes is a line of well-regarded, market leading, technically differentiated specialty cementation tools, Blackhawk also provides well intervention products through its line of brute packers and related products, and is continuing its development of products for onshore and offshore applications. Photo courtesy: Dresser-Rand

Photo courtesy: Dresser-Rand As announced on 23 June 2016, the Board of Directors has tasked the management of

As announced on 23 June 2016, the Board of Directors has tasked the management of  Fugro Aquarius

Fugro Aquarius Newton Labs has appointed C. A. Richards & Associate, Inc, a leader in the Gulf Coast Subsea market, as its exclusive sales representative. C.A. Richards & Assoc will represent Newton’s Underwater Laser Scanner Line in Houston, Louisiana and Mississippi.

Newton Labs has appointed C. A. Richards & Associate, Inc, a leader in the Gulf Coast Subsea market, as its exclusive sales representative. C.A. Richards & Assoc will represent Newton’s Underwater Laser Scanner Line in Houston, Louisiana and Mississippi. “The Newton Underwater Laser Scanners capture precision metrology data and meet a growing demand from our customers in the Oil and Gas market,” said Chuck Richards, President C.A. Richards & Associates.

“The Newton Underwater Laser Scanners capture precision metrology data and meet a growing demand from our customers in the Oil and Gas market,” said Chuck Richards, President C.A. Richards & Associates. PSV Frigg Viking in Aberdeen Harbor. Photo credit: Jim Cargill

PSV Frigg Viking in Aberdeen Harbor. Photo credit: Jim Cargill QUAD204 – Schiehallion. Photo courtesy: BP

QUAD204 – Schiehallion. Photo courtesy: BP COSLInnovator

COSLInnovator U.S. Crude Stocks Decline on Favorable Import/Export Arb

U.S. Crude Stocks Decline on Favorable Import/Export Arb Erika Hamrick, Cat Marine Regional Sales Manager Americas officially recognizes Robert “Bobby” Webb, CEO at Louisiana Cat as the first Cat Propulsion Dealer in the Americas (left) Official document signing at the Reserve, La headquarters by Erika Hamrick and Bobby Webb. Also pictured is Mike Jennings, General Manager (right)

Erika Hamrick, Cat Marine Regional Sales Manager Americas officially recognizes Robert “Bobby” Webb, CEO at Louisiana Cat as the first Cat Propulsion Dealer in the Americas (left) Official document signing at the Reserve, La headquarters by Erika Hamrick and Bobby Webb. Also pictured is Mike Jennings, General Manager (right)

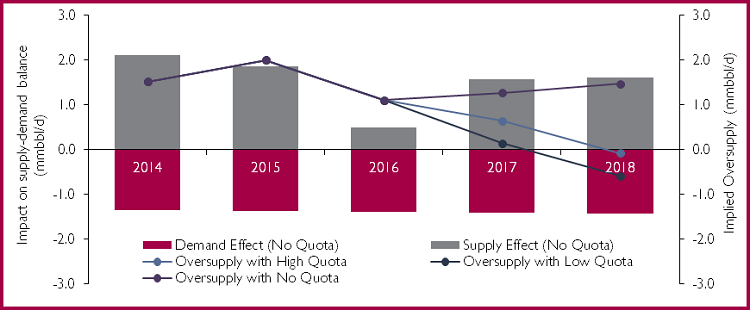

Last week we covered the OPEC announcement on production cuts, a strategy to reduce over-supply in the market and give a much needed boost to oil prices. Without higher oil prices, many new projects are thought to be uneconomic. Or are they? Douglas-Westwood has recently reviewed over 250 upstream capital projects sanctioned in the last four years to assess how industry costs are moving. The results are remarkable.

Last week we covered the OPEC announcement on production cuts, a strategy to reduce over-supply in the market and give a much needed boost to oil prices. Without higher oil prices, many new projects are thought to be uneconomic. Or are they? Douglas-Westwood has recently reviewed over 250 upstream capital projects sanctioned in the last four years to assess how industry costs are moving. The results are remarkable.

As human beings, we are creatures of habit. We quickly adapt to routines and like things a certain way, ordering our favourite dish off the menu to avoid disappointment for example. The same can perhaps be said of the oil and gas industry. We know this is a cyclical industry with peaks and troughs. For the past two years, we have been stuck in the trough part of the cycle, as oil prices have gone through a period of volatility. Still, at every level of an organization, we all need to focus on what we can control. Only then can we navigate through this challenging time and emerge stronger. As an industry, we need to increase efficiency while maintaining safety and keeping costs under control.

As human beings, we are creatures of habit. We quickly adapt to routines and like things a certain way, ordering our favourite dish off the menu to avoid disappointment for example. The same can perhaps be said of the oil and gas industry. We know this is a cyclical industry with peaks and troughs. For the past two years, we have been stuck in the trough part of the cycle, as oil prices have gone through a period of volatility. Still, at every level of an organization, we all need to focus on what we can control. Only then can we navigate through this challenging time and emerge stronger. As an industry, we need to increase efficiency while maintaining safety and keeping costs under control.

NAVTOR

NAVTOR