Crude Prices Rise in March, Led by Syncrude and Bakken

Crude Prices Rise in March, Led by Syncrude and Bakken

Crude prices rebounded strongly in March, despite a large U.S. stock build, but the rebound may be short-lived. Syncrude and Bakken differentials surged, as oil sands upgrader maintenance approached a seasonal peak, but all northern grades should weaken in April — in part, the result of uncertainty surrounding the recent shutdown of Keystone pipeline. Following a minimal draw in March, Cushing crude stocks could see a small build in April, before stock draws begin in May and continue for most of the rest of the year.

Injection Season Coal-to-Gas Sensitivities

In light of elevated natural gas storage, U.S. gas demand in the power sector during the injection season will be of the utmost importance if physical constraints on storage facilities are to be avoided. To this end, PIRA undertook a series of simulations to illustrate the sensitivity of gas demand to different price levels. Flexing injection season NYMEX prices downwards by 25% results in an incremental ~3.0 BCF/D pick-up in gas-fired EG demand, or ~3.5 BCF/D more than PIRA’s current Reference Case, while flexing injection season NYMEX prices upwards by 25% results in a ~2.5 BCF/D decline in gas-fired EG demand (~27.0 BCF/D), or 2 BCF/D less than PIRA’s current Reference Case.

French-Italian Spreads Narrowing, but Largely Driven by Italian Weakness

Two fundamental factors are looking spooky for French price developments in the upcoming months: the sizeable increase in gas-fired dispatching and the gain in French imports from the Germany-Belgium. Under these conditions, the spread between summer and winter prices could further widen. The spreads between French and Italian prices have been narrowing, mostly because of a downward move on the Italian side. Terna has announced that the Sorgente-Rizziconi will be commissioned by June 2016, although we believe that the market may be too pessimistic regarding the impact of this interconnector on prices.

India Demand Growth Strong, But Is It Strong Enough?

Seaborne coal pricing mirrored global energy and equity markets last week, pushing lower early in the week, followed by a strong rally on Friday capping off the week. Despite the end of week rebound, coal prices finished the week in the red vis-à-vis the prior week ending April 1, with API#4 (South Africa) and FOB Newcastle (Australia) prices notably losing the most amount of ground. Demand growth globally remains somewhat soft, particularly as Chinese imports continue to pull back relative to prior-year levels. India’s electricity generation surged in March, but even a 15.3% year-on-year increase in coal-fired generation during the month did little to chip away at the historic high coal stocks at power plants.

CA Court Order Clarifies Timeline in CCA Auction Litigation, Narrows Issues

The California Court of Appeals has issued an order narrowing the issues that the Court is still considering and offering an updated timeline in which we can expect a decision. PIRA’s sense is that the Court’s request for supplemental briefing is generally a bullish factor for the auction’s validation. Final word is now expected from the CA Supreme Court in 2H 2017.

Underlying U.S. Economic Condition Is Solid; Japan Is Worrisome

A tracking estimate of the first quarter U.S. GDP growth has increasingly turned weaker. But concerns about a recession remain implausible. For one thing, the U.S. does not face the threat from broad-based economic imbalances. Traditional drivers of growth, such as housing and consumer purchases of durable goods, are also likely to supply sufficient momentum in the coming periods. The U.S. dollar’s recent weakness has generally been constructive for market confidence. The Japanese yen’s recent strength may reflect the market’s concern that the Bank of Japan may be running out of ways to ease policy.

Expanded Panama Canal to Change LPG Trade Flows

Spot VLGC tanker freight rates continue to decrease with prices on the benchmark Ras Tanura to Chiba route easing an additional 4.5% last week to under $27/MT. Spot freight from Houston to Japan fell to near $65/MT. These next months will likely see the last series of cargoes being fixed on the longer Horn of Africa route to Asia. The opening of the expanded Panama Canal in June should lead to the elimination of the longer route, as PIRA calculates that the canal voyage will save an estimated $1 million per round trip under current spot freight and fuel price conditions.

U.S. Prices and Margins Rise

The week ending April 1, U.S. ethanol prices rallied to the highest levels of the year. Production margins jumped as corn costs plunged.

Indiana

Friday’s route through west central and northwest Indiana saw much of the same as Ohio. Spring weather, if you can call it that, consisted of snow, sleet, rain, some sun, and more snow. Farmers were left looking at the sky and wondering if spring would ever arrive. Then again it was only the first week of April, but crop prices have every producer on edge and poor planting weather is just one more thing to worry about.

Healthy Seasonal Gasoline Cracks Will Outperform Diesel

Refining margins will stay generally healthy and runs reasonably high through the summer, propelled by firm gasoline cracks, before weakening in the autumn. Refiners are shifting yields from middle distillates toward gasoline. Product stock levels are high, but not uniformly, with Atlantic Basin gasoline stock coverage relative to local/export demand tracking on the low side, but distillate staying much higher than normal. Diesel cracks will only gradually recover.

Gorgon Sneezes; China Breathes a Sigh of Relief

The LNG market may not be flinching at this exact moment at the news of a Gorgon commissioning phase shutdown. After all, such issues are commonplace, as systems are tweaked and glitches sorted out. But what happens if the loss is sustained for a longer period of time?

PJM 2019/2020 Capacity Auction: The Party's Over … For Now?

Driven by large downward revisions to load forecasts, combined with continuation of the 80% Capacity Performance (CP) construct for the forthcoming 2019/2020 capacity auction, PIRA expects the RTO auction to clear at $130-$140/MW-day for the CP product (significantly weaker year-on-year). The EMAAC and ComEd LDAs should continue to clear higher, though not as strong as last year. These weaker results could be a temporary blip, however, as the subsequent auction (2020/2021) should again see stronger clearing prices with implementation of 100% CP.

Maryland GHG and Renewables Bills Advance

The Maryland legislature has passed a GHG bill (already signed into law) and a bill strengthening the state’s Renewable Portfolio Standards (RPS). Increases in the solar and Tier 1 RPS requirements will have direct impacts on the MD Solar REC market and MD and wider PJM REC markets as well.

Global Equities Retrench

Global equities fell back slightly on the week. In the U.S., all the tracking indices lost ground, other than energy, which gained 2.2%. Retail and banking were the weakest performers. Internationally, the tracking indices were mostly lower, though Japan posted a decent gain. Among specific markets, the Argentinian market posted a steep drop.

Production and Stocks Decline

About 808 thousand barrels were drawn from U.S. ethanol inventories the week ending April 1, lowering them to 22.2 million barrels. PADD I stocks plummeted from a four-year high, while PADD V inventories built for the first time in five weeks.

Western Ohio

40F with rain, sleet, and snow are not exactly conducive to planting, but those were the conditions that greeted us Thursday in central and southwest Ohio. Needless to say there wasn’t a lot of activity, but locals told us that a fair amount of anhydrous has already been applied this spring, so once the weather breaks, which looks like it’s about a week away, it will be all systems go.

Bullish U.S. Crude Stats

An increase in crude runs and a drop-off in crude imports drove an unexpectedly large crude stock draw. Total products had a net build, for an overall commercial stock build, to a new record high commercial stock level. With a larger total build this week last year, the surplus did narrow. Also of note, the week-to-week increase in total demand which was a function of the EIA using a sharply lower total assumed product exports estimate. Next week a decline in crude runs and an increase in crude imports should return the U.S. crude balance to a small build, while that same decline in crude runs and increase in real product exports drive draws for the three major light products.

Promising Signs of Supply-Side Balancing

Thursday’s EIA storage report revealed a new record end-March inventory level of 2,480 BCF, besting the previous record of 2,477 BCF set in 2012. Yet, the market’s foray back to ~$2/MMBtu suggests attention is shifting beyond the massive year-on-year surpluses in place — for the U.S. as a whole or for the even more ominous situation in the Gulf producing region, where inventories are at nearly ~80% of useable working gas capacity. Other considerations have apparently attracted the market’s attention, including late-breaking weather demand and early signs of a slowdown in domestic production.

Japanese Crude Runs Declines, Imports Rose and Stocks Built

Crude runs were lower and crude imports rose, which produced a small crude stock build of 0.5 MMBbls. Finished product stocks drew moderately, with all the major products, other than kerosene, seeing lower levels. Gasoline demand increased strongly with much higher yield such that stocks drew only slightly. Gasoil demand was also modestly higher, with lower yield and a big surge in exports, thus stocks drew moderately. Kerosene demand declined seasonally and the stocks reverted back to building. Refining margins remain good. Naphtha and gasoline cracks remain strong, while heavier product cracks eased.

China Looks at Simplifying End-to-End Gas Prices

China may harmonize wholesale natural gas prices for residential and industrial users as early as this year in an effort to make pricing of the fuel more market based. The National Development and Reform Commission is discussing a plan to set a single wholesale gas price for all users in 2016 and let suppliers and customers negotiate rates around the benchmark. Industrial and commercial users in most regions pay a premium for gas compared to residential consumers.

Market Eases Back

After seven straight weekly gains, the market eased back slightly. High yield debt and emerging market debt both posted slight gains, while volatility (VIX) increased a bit. The yield of the BAA-rated corporate bond has continued to decline. The U.S. dollar has been generally weaker lately. Commodities, including total, energy, and ex-energy, again eased slightly this past week after having posted solid gains.

California Carbon Below Auction Floor

California carbon allowances are trading below the auction floor price. Although balances are not tight in the near term, the allowance bank is not particularly large. PIRA expects ongoing buying needs to bring secondary market prices in line with the auction reserve by the May auction. Regulatory actions later this year will provide clarity for post-2020. PIRA believes the auction is ultimately likely to be upheld by the courts.

January 2016 U.S. Crude Production Declined, Even as Domestic Crude Supply Increased vs. Last Month

The January 2016 Petroleum Supply Monthly showed another decline in U.S. crude production, although a revised swing positive in the balance item resulted in domestic crude supply being up 250 MB/D versus December 2015. Rail movements of crude continue to have substantial ongoing revisions, and those revisions flow through to PADD-level crude balances, going back to the start of 2014 in the latest release. EIA Crude production data reported using Form 914 have significantly fewer revisions than prior methods, but large and volatile balance items still imply uncertainty in the production data.

Italy Will Take More LNG, But at What Cost?

As the global LNG market looks for a home to park its growing oversupply, marketers and traders will need to compete hard for Italy’s burn. Despite being surrounded by illiquid markets like southern France, Switzerland, and Slovenia, Italy has developed a diverse supply mix. The country’s LNG suppliers include Algeria and Qatar, while the contracted pricing includes Norway, Russia, Libya, and Algeria. Between 2011and 2015, delivered LNG prices linked more closely to higher priced Italian contracted pipeline supply. However, since then LNG has been forced to link closer to Italian market prices (PSV) to move all its volume to Italy. We certainly expect this flow to continue into the future and to force down Italian premiums.

EIA Begins Reporting Rail Movements of Ethanol and Biodiesel, Driving Revisions to PADD Gasoline Demand

The EIA has begun publishing ethanol and biodiesel movements by rail, with the release of the January 2016 Petroleum Supply Monthly. The data extend back to January 2014. The data provide insight into the importance of rail transportation to biofuels, and it now drives PADD-level ethanol and biodiesel net receipts. Net-net, these changes to regional ethanol balance drive revisions to PADD gasoline demand, some significant. The revisions to PADD distillate demand are smaller.

U.S. January 2016 DOE Monthly Revisions: Demand and Stocks

DOE released its final monthly January 2016 (PSM) U.S. oil supply/demand data last week. January 2016 demand came in at 19.06 MMB/D, which was 150 MB/D lower than what PIRA had carried in its monthly balances. Compared to the DOE weeklies, total demand was lowered 550 MB/D. Distillate was revised higher by 344 MB/D. Year-on-year demand declined in January 2016 by 194 MB/D, or -1% led by weak distillate demand, declining almost 10%, or 419 MB/D. End-January total commercial stocks stood at 1,345.4 MMBbls, which was very close to what PIRA had assumed. Relative to the final January 2015 data, total commercial stocks are higher than year-ago by 162.1 MMBbls.

Aramco Pricing Adjustments for May — Remaining Market Competitive

Saudi Arabia's formula prices for May were just released. U.S. differentials were raised across the board. The move was consistent with the trend currently being seen and expected in the refining margins on competing domestic grades in PADD III. In Asia, the two lightest grades were raised, while Arab Light was cut $0.10/Bbl, Arab Medium was left unchanged, and Arab Heavy cut $0.35/Bbl. Here too, it was consistent with key pricing drivers. In Asia there has been strength in gasoline and naphtha cracks, along with weaker fuel oil cracks. In Europe, extra-light was raised $0.60/Bbl, while both of the heaviest grades were cut. Arab Light was left unchanged, which was very close to what our pricing model had forecast.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Hydro Group’s new facility Photo credit: Hydro Group

Hydro Group’s new facility Photo credit: Hydro Group Buckthorn Partners and the Arab Petroleum Investments Corporation (APICORP) have acquired

Buckthorn Partners and the Arab Petroleum Investments Corporation (APICORP) have acquired  John Anderson, Exceed commercial director

John Anderson, Exceed commercial director

Seanic Ocean Systems Inc. (Seanic)

Seanic Ocean Systems Inc. (Seanic) Aker Solutions'

Aker Solutions' • One Year after Receiving Nautical Institutes Class A Certification, GE’s Houston Training Center for Mariners Receives Accreditation for Sea Time Reduction (STR) Course

• One Year after Receiving Nautical Institutes Class A Certification, GE’s Houston Training Center for Mariners Receives Accreditation for Sea Time Reduction (STR) Course The MAY 2016

The MAY 2016  Following their recent announcement of a partnership that will install over 17,000km of new subsea cable directly connecting Angola, Brazil and the United States, Angola Cables has affirmed and praised

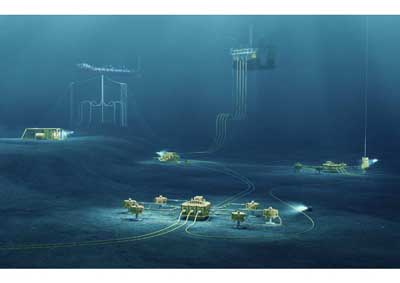

Following their recent announcement of a partnership that will install over 17,000km of new subsea cable directly connecting Angola, Brazil and the United States, Angola Cables has affirmed and praised  Subsea illustration Credit: DNV GL

Subsea illustration Credit: DNV GL Materia’s Proxima® resin technology delivers a broad range of products that increase reliability and performance for high pressure, high temperature applications in deepwater oil and gas exploration and production.

Materia’s Proxima® resin technology delivers a broad range of products that increase reliability and performance for high pressure, high temperature applications in deepwater oil and gas exploration and production. Crude Prices Rise in March, Led by Syncrude and Bakken

Crude Prices Rise in March, Led by Syncrude and Bakken

Radio Holland

Radio Holland Whilst 2016 has so far seen much discussion surrounding the oil price, oversupply and the almost daily mini-rallies that appear as fickle as my two-year old’s breakfast selection, not a great deal of attention has been paid to the gas outlook.

Whilst 2016 has so far seen much discussion surrounding the oil price, oversupply and the almost daily mini-rallies that appear as fickle as my two-year old’s breakfast selection, not a great deal of attention has been paid to the gas outlook.