Asia's Refinery Cracking Capacity Additions Slowing, but India Continues to Upgrade

Asia's Refinery Cracking Capacity Additions Slowing, but India Continues to Upgrade

Oil rebalancing is slowing due to higher October OPEC output and lower China demand, but supply creation will become the market’s focus in 2017 as the market tightens. Asia’s refinery cracking additions are slowing, but India continues to upgrade and catch up with China's cracking capability. China’s crude imports are expected to recover from the low in October for the next two months as refineries return from maintenance to meet seasonal demand and utilize unused product export quotas. PIRA expects Asian cracking margins to stay healthy for the next couple of months, with prospects for better margins in 1Q17 assuming normal winter weather.

Rising Winter Heating Risks

The mild weather that has unfolded this month that extended the traditional injection season has placed an even larger premium on weather demand in the months ahead to help work off the expanding inventory overhang. Moreover, much is riding on conditions during December in particular. On that front, even if the industry manages to pull working gas in storage toward 3.4 TCF before exiting 2016, a more convincing stock reduction will still be required early in 1Q17 to propel prices decidedly into new high ground.

As Imports Dry Up from France, Risks Emerge for Higher Winter Prices in Italy

As French nuclear availability remains at historically lower levels, French total commercial flows collapsed by 94% year-on-year to a mere 420 MW so far in the fourth quarter. The impact of lower French nuclear to flows toward Italy is particularly interesting. Italian PUN prices have been settling only about €4 below France in October and November to date, although the NORD region has been coupling more often with France (45% of the hours in November to the 21, or about 227 hours, while in Oct. about 299 were coupled with France). More interestingly, the Italian forward curve is trading at a large discount relative to France for the balance of the winter, raising the broader question of whether this is really sustainable.

Coal Prices Stage Modest Recovery in a Roller Coaster Week

Forward coal prices had a volatile week this week, with the market posting several dollar moves on four out of five trading days. The net result was upward, with prices, particularly in the Pacific Basin, recovering a portion of the sizeable losses posted last week. The market continues to look for firm direction, with a bullish fundamental picture facing off against powerful interests (including the Chinese government and at least one major trading company) in keeping prices somewhat low. However, it appears as if the market, like PIRA, has become somewhat wary of such a downward move.

CA Auction Nearly Clears; Next Auction after Oral Arguments

The November WCI current vintage auction saw a much-improved coverage ratio and participation (80 unique registered bidders vs. 51 in August). Secondary market pricing remains above the $12.73 auction reserve price, which is poised to increase at next February’s auction. If subsequent auctions are fully subscribed, there may be minimal potential supply implications for CP2 (if CARB adopts amendments to move unsold allowances to the reserve). Oral arguments will be held January 24th in the CA auction litigation, with a decision expected in spring 2017 and an appeal to follow. The November Election results help prospects for a legislative fix should the auction be invalidated, but are not a guarantee.

Equity Market Booming

The equity market moved further into record territory, with the S&P 500 moving above 2,200. Volatility (VIX) continued to ease and the price of domestic high yield debt (HYG) rose. Emerging market debt (EMB) was little changed. The U.S. dollar remained strong, and commodities were higher. Bond yields continued to rise globally, particularly for longer-term maturities.

EPA Increases Biofuels Mandate

The EPA increased the mandate for biofuels to 19.28 billion gallons for 2017. The new mandate is up 6.5% from 8.11 billion in 2016. The total is also up from 18.8 billion proposed in May, but much less than the 24 billion gallons originally set forth in RFS2.

Soybean Rally Intensifies

Last week’s “working theory” on soybean strength came from those who said there was very little confidence the Chinese would be able to halt their currency slide anytime soon. The theory went on that end users, who were afraid the Yuan would continue to decrease in value, were buying up soybean supplies before their currency became “worthless”.

U.S. Commercial Stocks Roughly Flat

U.S. adjusted oil demand continues to be relatively strong, up 3.6% or 680 MB/D year-on-year in the latest four weeks. Gasoline stocks are building seasonally despite robust demand because of high imports and high production, with the latter inflated by butane blending. Distillate stocks built just slightly as increased heating demand supplemented the last bit of harvest demand.

Spare Supply Capacity Limited by Competition

North American spare production capacity is light this winter with dry powder largely limited to the WCSB and Appalachia. The dearth of heating demand over the past month has meant that Canadian imports have had to more aggressively compete with Appalachian for the limited market opportunities. Moreover, TransCanada’s withdrawal of its Long Term Fixed Toll plan suggests that the challenge to find a home for surplus WCSB production will continue.

Slow RGGI Program Review = Stagnant Market

RGGI pricing declined sharply following the elections, with the next auction on Dec 7th. PIRA does expect the auction to be fully subscribed, helped by required annual bank draws resulting from banking adjustments to the cap. Given unclear signals from the Program Review process, PIRA does not see significant price recovery until a draft Model Rule is released next year that clarifies cap declines post-2020 and price support mechanisms, such as banking adjustments and the proposed soft price floor “Emissions Containment Reserve.” Longer term, the RGGI price signal appears likely to take a back seat to individual state/regional clean energy policy initiatives. RGGI could play a more significant role, however, should these complementary policies face implementation challenges.

Markets Remain Strong on International Pull

Over the last month, eastern coal prices were pulled up by hot international markets for both metallurgical and thermal coal, a trend that is likely to remain in place in the near term and one factor leading us to adopt a bullish bias through 1H17. Even though natural gas prices have recently given back some gains, we still expect gas prices to rise over the heating season, tightening coal balances by mid-2017. Beyond that, our pricing views turn bearish as we forecast that gas prices will fall on increased drilling and we expect continued CCGT and renewables build out.

Global Equities Post Broad Gains to Record Levels

U.S. equity markets posted solid gains across the board and pushed into record territory. Among the tracking indices, retail, materials, and industrials did the best. Both growth and defensive tracking indices posted strong increases of about 2%. Internationally, those tracking indices also gained with emerging markets, Latin America, and China doing the best. Japan performance was the laggard and neutral.

U.S. Propane Stocks Build

Inventories grew by 1.8 MMB to 102.7 MMB, despite relatively high export volumes of 5.8 MMB for the week ending November 18. The deficit to last year narrowed slightly by 108 MB to nearly 3.5 MMB. Last year for this reference week, stocks rebounded by 1.7 MMB to 106 MMB. The following week, stocks declined by 2.1 MMB and largely continued drawing until mid-March.

Ethanol Stocks Build

U.S. ethanol stocks built the week ending November 18, following three consecutive weeks of decline. Production increased by 3 MB/D to 1,014 MB/D. Ethanol blended gasoline manufacture jumped to 9,100 MB/D from 8,955 MB/D the prior week.

EPA Jumps to 15 Billion Gallons

The EPA’s announcement last Wednesday that the 2017 biofuel quota will be raised to 19.28 billion gallons, including 15 billion gallons of corn-based ethanol, was more dramatic for soybean oil, which traded limit up on the news, than corn. While widely hailed as a victory for the ethanol lobby and U.S. farmers, should gasoline consumption in 2017 match projected 2016 consumption of 144 billion gallons, the 15 billion gallons of ethanol still results in a blend rate of just 10.4%.

Japanese Finished Product Stocks Set a New Cyclical Low

Crude runs eased slightly on the week and crude imports surged, thus building crude stocks 4.9 MMBbls. Finished products drew 1 MMBbls and set a new cyclical low. Gasoline demand was modestly higher. Stocks drew slightly. Gasoil demand was lower but a jump in exports left stocks little changed. Kerosene demand was little changed and remained seasonally normal.

Ethanol Prices Rise

U.S. ethanol prices rose the week ending November 18. Values were supported by higher corn and oil. Manufacturing margins increased, boosted by a strong demand for exports. RIN values rebounded in anticipation of final 2017 mandates and standards that were to be set by November 30.

LNG Remains Southern for the Moment, But Will Shift Northward

Shipped LNG has eluded Northwest Europe to a great extent since 1Q, in favor of higher deliveries to Southern Europe. Price is the main driver. With much of the spiking risk ending up on the isolated southern shores of Southern Europe – these markets certainly have made the better case so far. Spanish, Italian, and Southern French gas prices have all, at one time or another, made themselves price competitive on a global scale to try and attract volumes and have succeeded at the expense of the U.K. Instead, N.W. Europe has relied on pipeline supplies. Opting for pipeline gas in N.W. Europe instead of LNG has highlighted just how much pipeline suppliers have done to make their gas attractive.

Global Weather Update: Heating Season 2016-17

PIRA is kicking off its global weather monitor, which will track weather anomalies in the U.S., Europe, Russia, and Asia. PIRA has analytically tabulated daily degree day data for key countries and for Europe and Asia; they have been aggregated into regional measures. We look at a cumulative comparison to last heating season, and the 10-year normal, expressed as a percent deviation. We also look at daily degree days, relative to a 10-year range, including the norm and last heating season. Charts will be issued regularly on a weekly basis during the heating season.

Supply Takes Qatar/Demand Prospects in New Directions

The recent run up in Asian spot prices appears to have crested, as buyers are done with their winter planning. Adding more length does not seem to be in the cards, although the myriad of nuclear problems among Japan, Korea, and Taiwan is giving LNG a second and third life in the power sector. Japan continues to be largely nuclear free, while South Korea and Taiwan have also seen nuclear load factors collapse largely due to natural disasters (storms & earthquakes). Korea is seeing significant gains for LNG and coal burn, and Taiwan’s reserve capacity margin is extremely tight.

Atlantic Basin Gasoline Demand Outlook Through 2018

The decline in gasoline prices since mid-2015 has given a significant boost to gasoline demand on both sides of the Atlantic. While the lagged effects of this decline are expected to provide further support through 2018, U.S. gasoline demand growth is expected to slow to 0.5% in 2017 as crude oil prices recover. Faster economic growth in 2018 should lead to a pick-up in demand growth to 0.9% in 2018. In Europe, the end to dieselization of the car fleet in addition to the lagged price effect causes gasoline demand growth to accelerate to 1-1.5% in 2017 and 2018.

Chinese Wholesale Gas Prices Rise

State-owned energy giants PetroChina and China National Offshore Oil Corp. (CNOOC) have hiked their wholesale gas prices for non-residential users. The move reflects tighter supplies of the fuel and follows the end on Sunday of a one-year moratorium on price adjustments. PetroChina’s gas sales branch for northern China informed customers on 7 November that it would raise non-residential citygate prices by 15% from 20 November until 15 March 2017.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

The new DP Maintenance Refresher Course directly addresses the latest IMCA guidelines

The new DP Maintenance Refresher Course directly addresses the latest IMCA guidelines

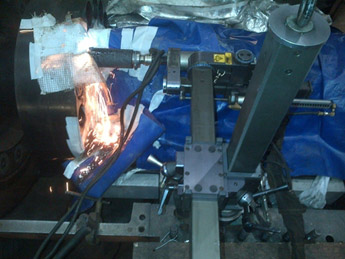

Removal of the coupling bolts on a 9E gas turbine using spark erosion technique. Photo credit: Unique Group

Removal of the coupling bolts on a 9E gas turbine using spark erosion technique. Photo credit: Unique Group Saipem

Saipem

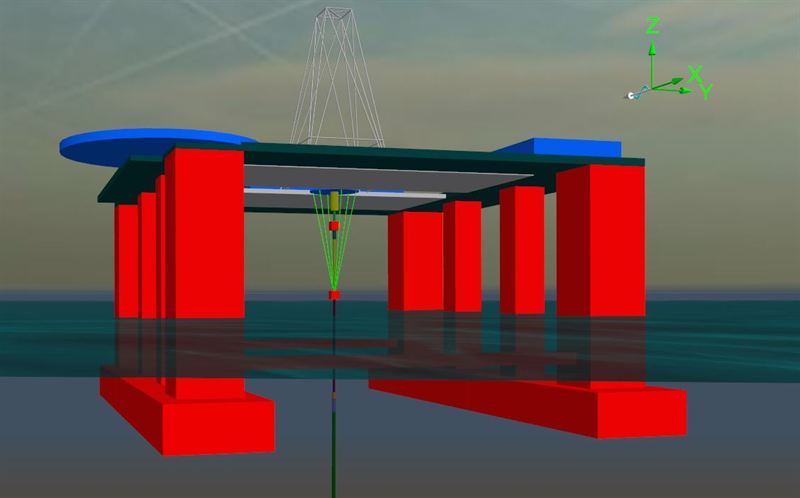

Riser Analysis team 2. Image courtesy: Trelleborg

Riser Analysis team 2. Image courtesy: Trelleborg Offshore accommodation and workspace solutions specialist

Offshore accommodation and workspace solutions specialist  The first major study of oil and gas workforce perceptions since the start of the global downturn has revealed which operators and service companies are rated highest by oil and gas professionals based on key issues including values, performance and pay rates.

The first major study of oil and gas workforce perceptions since the start of the global downturn has revealed which operators and service companies are rated highest by oil and gas professionals based on key issues including values, performance and pay rates.

Asia's Refinery Cracking Capacity Additions Slowing, but India Continues to Upgrade

Asia's Refinery Cracking Capacity Additions Slowing, but India Continues to Upgrade Danos has successfully completed the fabrication of three boarding valve skids and one service line skid for Shell Offshore Inc.’s (Shell) deep-water Appomattox facility. Requiring approximately 12 months to complete, the project engaged four Danos service lines, including project management, fabrication, coatings, and automation.

Danos has successfully completed the fabrication of three boarding valve skids and one service line skid for Shell Offshore Inc.’s (Shell) deep-water Appomattox facility. Requiring approximately 12 months to complete, the project engaged four Danos service lines, including project management, fabrication, coatings, and automation.

Findlay Moir, ATR Lifting Solutions Divisional Director

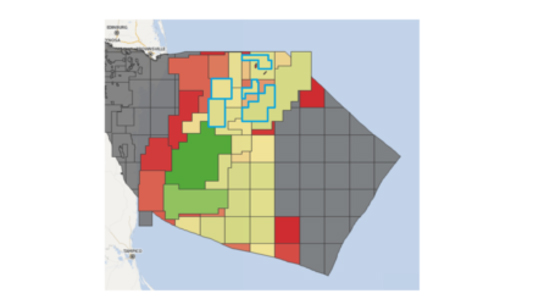

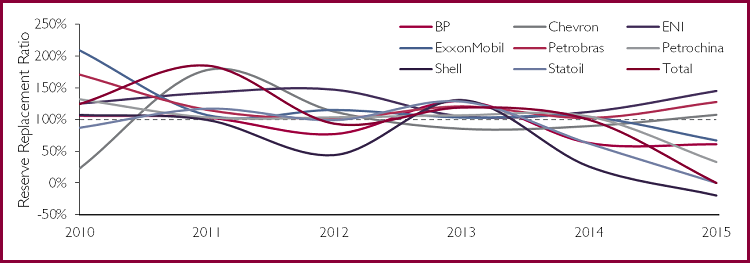

Findlay Moir, ATR Lifting Solutions Divisional Director E&P deepwater exploration and appraisal activity has dramatically declined. In line with falling E&A activity, Reserve Replacement Ratios (RRRs) have been declining for the majority of major E&P companies. This week, we highlight some of the positive newsflow from offshore E&A activity in recent times.

E&P deepwater exploration and appraisal activity has dramatically declined. In line with falling E&A activity, Reserve Replacement Ratios (RRRs) have been declining for the majority of major E&P companies. This week, we highlight some of the positive newsflow from offshore E&A activity in recent times.

BP

BP The tool, built on GE’s Predix operating system, was created as part of a development partnership the two companies announced in January. “BP gravitates toward new technologies, especially digital, and that makes working with them particularly exciting,” said Lorenzo Simonelli, president and CEO, GE Oil & Gas. “We are taking a big step forward together during this time of digital transformation, deploying what we’ve co-created over the past year to drive the kind of productivity improvements that the oil and gas industry needs. The global deployment is expected to be the largest-scale deployment of GE’s Predix-powered APM technology to date.”

The tool, built on GE’s Predix operating system, was created as part of a development partnership the two companies announced in January. “BP gravitates toward new technologies, especially digital, and that makes working with them particularly exciting,” said Lorenzo Simonelli, president and CEO, GE Oil & Gas. “We are taking a big step forward together during this time of digital transformation, deploying what we’ve co-created over the past year to drive the kind of productivity improvements that the oil and gas industry needs. The global deployment is expected to be the largest-scale deployment of GE’s Predix-powered APM technology to date.” Photo credit: Damen

Photo credit: Damen