OPEC Deal, Trump Election Boost Industry Outlook

OPEC Deal, Trump Election Boost Industry Outlook

WTI curve moves into backwardation for 2018, forming a “humped” pattern. Cushing stocks to rise again in December, with declines for 2017. Arbs moving to export mode for January, after closed Nov/Dec export arb. Improved outlook for pipeline projects with energy-friendly Trump administration. Light Canadian/Bakken differentials weak now, stronger by spring. Midland Sweet differential goes positive with all pipelines restored.

$4 in Reach — Inventory Shortfall Lifts 2017 Prices

Wintry weather and stalled supply has prompted yet another week of heavy buying, with the Jan’17 gas futures contract adding ~0.30¢ week-on-week. In a little over three weeks, the prompt contract has gained ~$1, and is now trading at a two-year high at ~$3.80/MMBtu on renewed expectation of wintertime rebalancing. The buying spree appears to be a testament that producers have finally reached a critical inflection point in restraining surplus shale supplies, with the related bullish price implications exacerbated by the acute cold now taking hold across a large swath of the U.S. Indeed, as of this week — to be reflected in the next EIA weekly storage report — the industry officially eliminated the year-on-year inventory surplus that emerged exactly two years ago.

French 1Q17 Dives, Has the Market Now Turned Too Optimistic?

This week saw French 1Q 17 contract price dropping significantly. While prevailing warmer weather has contributed as well, concerns over French nuclear availability have eased, following the French Regulator ASN’s updates on the reactors affected by the channel head anomaly. While the ASN announcement has been a bearish development, PIRA argues that the market may be now underestimating a number of bullish risks for the French market for 1Q 2017.

Coal Price Rollercoaster Continues, Chinese Import Demand Remains Bullish

The bearish trend from last week continued into the first half of this week, with 1Q17 FOB Newcastle prices falling from $80.00/mt to a low of $74.75/mt. A shift from cold temperatures to mild temperatures in Europe and in some areas of Asia, coupled with the restart of nuclear generation capacity in South Korea added further bearish impetus to pricing. However, after the release of China's import data for November, showing imports of nearly 27 MMmt, the market recovered strongly on Thursday into Friday, with FOB Newcastle prices recovering back to just under $78/mt by Friday. To PIRA, the pricing action of the past two weeks illustrates the battle that has been raging between market sentiment and fundamentals. On the sentiment side, the moves taken by the Chinese government to tamp down pricing (encouraging producers to sign term contracts with power producers and cracking down on speculation) has clearly spooked the market into a bearish turn. On the fundamental side, the reality on the ground is that Chinese domestic production is rebounding, but slowly.

Uncertainty Regarding SO2, NOx Emissions Regulations

A Trump EPA (with Scott Pruitt as proposed head) could exercise discretion in implementing older final rules but replacing them through standard regulatory procedure would be more difficult. Regs finalized after May (CSAPR Update, SO2 designations, Regional Haze Amendments) could be overturned under the Congressional Review Act. Inaction from Trump EPA will spur environmental lawsuits and petitions from states (MD already filed to force plants in upwind states to run NOx controls). The Obama EPA has moved to drop Texas from the CSAPR Annual programs but there are Haze implications; they also designated Texas coal/lignite plants for SO2 nonattainment. Emissions data indicate bearish CSAPR fundamentals. CSAPR seasonal NOx prices have fallen since the election and would collapse in the case of a CSAPR Update repeal.

Data Remain Healthy, and Economic Risks Look Manageable

In North Dakota, a major energy-producing state, two main surveys of the employment condition have produced conflicting estimates regarding labor market slack. The weight of evidence, at this point, suggests that the state’s labor market is relatively tight; the implication is that the state’s mining sector may not be able to increase hiring rapidly. Two main downside risks for 2017 are potential political surprises in Europe and possible negative spillovers of Fed tightening on emerging economies. For now, though, these risks look manageable. The U.S. and China reported encouraging data this week.

U.S. LPG Prices Trending with Crude

U.S. LPG markets continue to be driven mostly by the broader energy markets, with little catalyst to march to their own drumbeat. This may change in the months ahead, particularly if a colder winter presents itself and stocks begin to draw at substantially higher rates. Mt Belvieu propane prices gained 1.8% to 63¢/gal and butane improved less than a penny to 84.3¢.

U.S. Ethanol Prices Mostly Higher

Prices were supported by a robust export market. Manufacturing margins improved week-on-week. Brazilian ethanol is in short supply as mills in the Center-South region are shutting down for the inter-harvest period. The factories still operating are focusing on sugar production.

No Change at the Top

When domestic balance sheet changes are limited to soybean oil, you really need to dig deep to find anything noteworthy in the December WASDE. While the absolute lack of changes to corn, soybeans, and wheat was expected by many, the World Board’s demand passivity may offer a hint towards understanding what January’s “final” report, and beyond, will look like on the demand side.

What’s Next for the Dakota Access Pipeline?

On December 4, the U.S. Army Corps of Engineers announced it will not approve an easement for the 470 MB/D Dakota Access Pipeline, pending the exploration of alternate routes and an environmental assessment. At a minimum, the latest delay will push back final approval until the early part of President-elect Trump’s administration, with construction postponed by an additional 90-120 days. In a best-case scenario, the project would start up around mid-2017. However, the method through which the Trump administration will choose to approve construction remains unclear, and the high probability of legal challenges increases the uncertainty. More broadly, a galvanized environmentalist movement raises the odds of more organized pipeline protests and legal delays to future projects.

U.S. Stock Excess Widens

Light products built substantially this past week as reported demand weakened while crude stocks drew 2.4 million barrels. Cushing crude stocks showed a huge 3.8 million barrel build as Canadian shipments remained very strong and pipeline maintenance reduced flows south. For next week, crude stocks are expected to draw again but Cushing crude stocks build 1.8 million barrels as Cushing becomes a convenient holding point to reduce Gulf Coast end year inventory taxes.

Jump in Spot Prices Belies Reality of Supply Length + Emerging Demand Weakness

The supply shortfalls cited for the recent jump in Asian spot price assessments don’t hold up under close scrutiny in general: global supplies (delivered, not nameplate) were up by 60-mmcm/d as of last month and are on track to continue on a residual growth trend, even if no new trains start up over the winter. Shortfalls from Gorgon are real after a few months of steady output, but volumes were still in the early, pre-contracted ramp up phases and are thus not to be considered out and out losses.

Financial Stresses Remain Low as Markets Display Bullish Indicators

The equity market rose on the week and set another record high. Volatility fell and debt performance strengthened, particularly in the high yield and emerging markets. The U.S. dollar was generally stronger against the euro, British pound, and yen. It weakened, however, against the Russian ruble and a host of non-yen Asian currencies. On the commodity front, most of the changes were modest. Globally, bond yields continue to generally rise, particularly for longer-term maturities.

Tanker Rates Expected to Decline on OPEC Cuts

Tanker markets have benefited in 4Q16 from seasonal delays and record OPEC production ahead of planned cuts in January. But lower tanker rates in 2017 are likely in the face of lower OPEC output, rapid fleet growth, and the drawdown of excess stocks.

Increase in Inventories Was Less than Anticipated

Ethanol-blended gasoline manufacture fell sharply for the second consecutive week, plunging to a ten-month low 8,646 MB/D. U.S. ethanol production rose 11 MB/D to a near-record 1,023 MB/D. Inventories built by 82 thousand barrels to 18.5 million barrels, rebounding from an annual low.

RGGI Auction Clears Below Secondary Market; Bidding Interest Down

The December RGGI auction cleared well below September auction prices and below the secondary market. Demand for allowances exceeded supply, but the coverage ratio was down and the auction saw a sharp drop in participation. Of the registered bidders, a smaller than usual percentage participated in the auction, with almost all awarded allowances. Volumes won by compliance players continues to decline. The results reflect the lack of market price signals from the 2016 Program Review. Secondary market prices responded by dropping strongly toward the new clearing price in a flurry of trades. Price support will wait for the release of the Model Trading Rule next year.

U.S. SPR Sales an Increasingly Popular Congressional Tool

On December 7, the Senate passed the 21st Century Cures Act, following overwhelming approval in the House last week. President Obama’s signature appears highly likely in the coming days. Notably for oil markets, the bill will be partially funded through 25 MMBbl of SPR sales between Fiscal 2017 and Fiscal 2019. This SPR provision is the latest indication of Congress’ attraction to non-emergency SPR sales to fund unrelated items. Collectively, three bills passed since November 2015 will require 149 MMBbl to be drawn down from the SPR between 2017 and 2025. A stopgap funding bill introduced on December 6 includes a provision to sell an additional $375 million (~6 MMBbl) in 2017, to upgrade SPR infrastructure.

Japanese Higher Demand Pulls Finished Product Stocks Still Lower

Crude runs rose again as turnarounds wind down. Crude imports increased such that stocks built. Finished product stocks drew to another new cyclical low. Compared to year-ago, the deficits on product and total commercial stocks widened; crude narrowed slightly. There were moderate stocks draws on gasoil, naphtha, and kerosene, and lesser draws on gasoline and jet. Margins and cracks eased slightly, and down from their November average. Margins remain statistically very good but have settled back to September and October averages.

Gas Demand Is Growing More Sensitive to Wind – A Preview of Times to Come

Despite the almost perpetual build in renewable output across Europe in recent years, 2016 marks the point when gas-to-power demand has finally been able to buck the sustained downtrend on thermal use and attain some very real growth. How long will it last? The short answer will come from a combination of policy changes (nuclear and coal shutdowns) and weather (temperatures and sun/wind availability). One thing is for certain: price volatility, as it relates to gas use in the power sector, is certainly here to stay and will increase.

Global Equities Moves to New Records

Global equity markets broadly surged on the week. In the U.S., among the key tracking indices, banking, housing, retail, and tech had very strong performances with gains of 4-6%. Energy actually lagged slightly, but still posted a good gain. Internationally, all the tracking indices were higher, other than Japan. Latin America and Europe outperformed.

Expect a Positive Outcome from Joint OPEC-Non-OPEC Meeting

Several non-OPEC countries are set to attend joint OPEC-non-OPEC meetings in Vienna on December 10 to commit to production cuts agreed upon at the November 30 OPEC meeting. OPEC’s pledge to cut 1.2 MMB/D is contingent on non-OPEC agreeing to another 0.6 MMB/D of cuts. Russia has already stated plans to reduce by 300 MB/D. PIRA expects the other non-OPEC members including Mexico, Kazakhstan, Oman, and Azerbaijan to announce reductions for the remaining amount. Cuts will be directionally in line with countries’ expected production declines. History suggests that compliance is not assured. But in our view, cooperation to meet the non-OPEC cut target will be sufficient to support prices.

U.S. Transportation Fuel Monitor

U.S. transportation indicators remain largely bullish. VMT growth still relatively strong through September. October VMT should show good growth, but then slow in November and December. Our expectation for 2017 is conservative. Gasoline demand growth is expected to slow into 1Q and then reaccelerate. Transportation diesel indicators suggest that distillate demand declines will continue to slow, then turn moderately positive in 1Q. Air travel data show cargo trends are influencing the strong growth seen in jet fuel demand.

India and China look to swap Russian Gas

India is in early talks with Russia to swap natural gas with China and Myanmar as an alternative to building world's most expensive pipeline costing close to $25 billion. The two nations had in October signed an initial pact for building a 4,500 km to 6,000 km long pipeline from Siberia to the world's third biggest energy consuming nation. ONGC Videsh Ltd Managing Director Narendra K Verma said talks are on with Russian gas monopoly Gazprom for an alternative swap.

Border Adjustability Blueprint: Potential Boost to U.S. Upstream, Hit for Refiners of Imported Crude

One of the components of the House GOP's Tax Reform Blueprint proposal, outlined by Speaker Paul Ryan and consistent with statements by President-elect Trump, is a border adjustment provision which would effectively eliminate the tax deductibility of expenditures on imported goods (and services) including imported raw materials used in manufacturing. If this were to become law it would effectively raise the cost of imported crude relative to domestic crude by the tax rate (say 20%) times the cost of crude. At today’s prices, that would be above $10/barrel. U.S. crude producers would benefit either because refiners would have a huge incentive to purchase domestic rather than imported crude, thereby bidding up the price to import equivalent, or by exporting to foreign markets thereby avoiding income taxes. Refineries dependent on imported crude would be disadvantaged under this plan. Moreover, all refiners would face higher feedstock costs and U.S. consumers would see higher retail prices.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Noble Bully II. Photo credit: Noble Corporation

Noble Bully II. Photo credit: Noble Corporation OPEC Deal, Trump Election Boost Industry Outlook

OPEC Deal, Trump Election Boost Industry Outlook Photo credit: BP

Photo credit: BP The 4,200 sq km BroadSeis 3D seismic survey offshore Morocco was acquired by the Geo Caspian.

The 4,200 sq km BroadSeis 3D seismic survey offshore Morocco was acquired by the Geo Caspian.

On January 26, 2017, Blake Moore, Shell Project Manager will make a presentation to the

On January 26, 2017, Blake Moore, Shell Project Manager will make a presentation to the  Shell’s Stones FPSO. Photo courtesy: Shell

Shell’s Stones FPSO. Photo courtesy: Shell

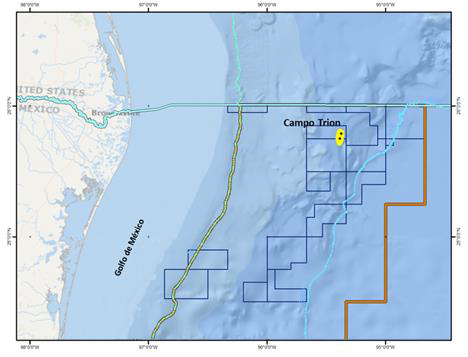

Map image: Courtesy: Statoil

Map image: Courtesy: Statoil The Bureau of Ocean Energy Management (BOEM) completed its required evaluation to ensure the public receives fair market value for tracts leased in Western Gulf of Mexico Oil and Gas Lease Sale 248, held on August 24, 2016.

The Bureau of Ocean Energy Management (BOEM) completed its required evaluation to ensure the public receives fair market value for tracts leased in Western Gulf of Mexico Oil and Gas Lease Sale 248, held on August 24, 2016.

Photo courtesy: BP

Photo courtesy: BP Oil production from the Organization of the Petroleum Exporting Countries (OPEC) for November rose for the sixth straight month to a record 33.86 million barrels per day (b/d), according to a survey of OPEC and oil industry officials by

Oil production from the Organization of the Petroleum Exporting Countries (OPEC) for November rose for the sixth straight month to a record 33.86 million barrels per day (b/d), according to a survey of OPEC and oil industry officials by

ROVOP deploys an ROV off the coast of Germany. Photo credit: ROVOP

ROVOP deploys an ROV off the coast of Germany. Photo credit: ROVOP Hyperdynamics Corporation (OTCQX: HDYN) announces that it has signed a definitive drilling services contract with a subsidiary of Pacific Drilling SA to engage the Pacific Bora drillship to begin a drilling campaign offshore the Republic of Guinea in the second calendar quarter of 2017.

Hyperdynamics Corporation (OTCQX: HDYN) announces that it has signed a definitive drilling services contract with a subsidiary of Pacific Drilling SA to engage the Pacific Bora drillship to begin a drilling campaign offshore the Republic of Guinea in the second calendar quarter of 2017.