U.S. Commercial Stocks Led Lower by Product Draw

U.S. Commercial Stocks Led Lower by Product Draw

Coming after a build the previous week, total commercial stocks commenced drawing, this week by almost 7 million barrels. Stocks have now declined for seven of the past eight weeks. Product stocks fell by 9.4 million barrels, while crude inventory added 2.4 million barrels. The four major products drew by 5.9 million barrels, led by gasoline off by 2.8 million barrels and distillate down over 1.9 million barrels. Colonial Pipeline’s gasoline line was restored to service on October 6th, as the outage prompted downstream product movement from primary storage.

4+ TCF Exit in November Weighs on Sentiment

Predominately warm weather forecasts have primed the market for a fourth consecutive weekly loss, with the nearby December futures contract targeting an 11¢ decline. The extended sell-off that began in mid-October is now approaching $1 in cumulative losses, with prices currently breaching key technical support levels. Indeed, the 50-day moving average has now fallen below the 100-day moving average. This indicator is also colorfully referred to as the ‘death cross’ and commonly signals the onset of a bear market on the horizon. Putting aside price data as a market barometer, current economics are likewise skewed negatively to price recovery. To be sure, the mild weather unfolding this month has extended the traditional injection season, placing an even larger premium on weather conditions in the months ahead to help work off the expanding inventory overhang.

Winter Delayed; Power Fundamentals Still Bullish

On-peak prices were mostly higher year-on-year in October as above normal temperatures supported demand across the south and gas prices rose (outside of the Northeast). Loads in the East increased by 0.7% with much of the gain in the south as cooling degree days increased year-on-year in every region. ERCOT loads were up by nearly 8%. Gas prices have eased sharply from October highs amid mild actual and forecasted weather. Adding to bearish pressures were latest gas production estimates. With normal weather, year-on-year stock deficiencies should emerge before year-end and cause prices to firm again. In contrast, eastern coal prices strengthened due to soaring international met and thermal coal markets. In our view, the only regions where coal stocks could tighten to near long-term averages are ERCOT and SPP. Sharp price increases in power prices are expected in all markets through Q1 due to rising space heating loads and higher gas prices (once withdrawals begin).

Bullish Rally for Coal Takes a Pause

The coal market moved decidedly lower this week along with the oil market in the wake of the uncertainty surrounding the aftermath of the U.S. election and on news that Chinese producers were signing term deals with major domestic consumers. For prompt pricing, FOB Newcastle prices retreated by the greatest extent, with 1Q17 prices falling by nearly $6.00/mt from the end of last week, while API#4 prices fell by $2.75/mt and API#2 prices only dipped marginally. Beyond the prompt market, the curves shifted $2.00/mt - $3.00/mt from the end of last week. While it is tempting to think that the bullish run prices have been on has run its course and the market is now starting to correct back lower, PIRA would caution against this view. While Chinese production is showing some signs of recovery and Indonesian output has also rebounded, coal demand in most markets is rising seasonally, and there are notable supply side risks within China and for seaborne supply from disruptive weather conditions.

European LPG Fundamentals Mixed

A more balanced European LPG market has led to its outperformance versus other regions last week. A dearth of U.S. large cargo arrivals over the next few weeks has tightened the supply situation, leading to a 3.4% gain in NWE propane coaster prices and an unchanged cash large cargo price of $343/MT. Butane prices in the region were affected by a possible strike at the Shell Moerdijk cracker complex. Cash coaster butane was called 7.4% lower week-on-week at $364/MT while larger cargoes eased $8 to $352.

U.S. Ethanol Prices Fall

The week ending November 4, U.S. ethanol values were pressured by lower corn and oil values and a sharp rise in output. Manufacturing margins were slightly lower week on week. U.S. ethanol exports soared in September, due to a shortage and high prices in Brazil.

Bearishness Abounds

Usually not advisable to sell slow markets but that’s not a good enough reason for optimism. Seasonally we do see year-end rallies with frequency in grains/oilseeds, only to be disappointed in January, but this year there’s more uncertainty than usual with the election of an outsider to the White House.

Early Implications of Trump Win On U.S. Energy Policy and Iran Deal

The election of Donald Trump as the next U.S. president, combined with Republican majorities in both chambers of Congress, signals potentially notable changes to U.S. energy policy and oil markets. Much remains uncertain at this point. PIRA laid out Trump’s energy policy platform in a prior piece. The more likely changes we can point to at this time are fewer regulations and more support of the oil and gas industry while pursuing a pro-growth macro agenda. Still, we see little impact to near term domestic oil and gas production, as states remain the primary regulator of fracking on private lands. President Trump is likely to approve the Dakota Access pipeline and rejuvenate Keystone XL. He may also revisit and ultimately moderate 2017 renewable fuel mandates planned to be issued by November 30. Oil demand will be stronger under President Trump from faster economic growth, and longer term because of a potential roll back in fuel economy standards. Foreign policy is more opaque. Questions have been raised about the future of the Iran oil deal. President Trump may attempt to roll back the suspension of Iranian financial and banking sanctions which would make it difficult for Iran to sell oil. Imposing effective new multi-lateral sanctions would be very hard given the lack of international support. Meanwhile, political discord in the U.S. may bring OPEC together to reach a deal on November 30, in a show of political unity as an organization.

Better Growth Prospects after Trump Win

On the whole, financial markets’ initial reactions to the unexpected outcome of the U.S. presidential election were positive for the economic outlook. Developments in U.S. equity markets were constructive. Long-term U.S. interest rates jumped, as markets anticipated the new administration to pursue reflationary policies. These policies, when enacted, will trigger substantially faster growth in the U.S, and there will also be positive spillovers through global economic linkages. This week’s currency market movements were not worrisome, but equity market actions in the emerging economies raised some concern.

Japanese Stocks Rose Despite a Run Rise

Crude runs rose with a vengeance by 371 MB/D, as refinery restarts entered the data. Crude imports rose from a very low 2.6 MMB/D to 3.6 MMB/D and stocks rose 2.3 MMBbls, despite the run rise. Finished products rose 0.7 MMBbls, with builds in gasoline, naphtha, and gasoil more than offsetting draws in jet-kero and fuel oil. Kerosene demand was again higher, and is still thought to be reflecting secondary and tertiary inventory pull on primary. The stock draw rate accelerated. Margins and cracks again improved on the week, with all the major product cracks showing gains.

Election Causes Major Shifts

In the wake of the U.S. election results, there were some major shifts in a number of key indicators. The broad market rallied strongly, with banking, financial, and industrial related drivers doing best. Many of the emerging equity markets did not participate in the broad equity rally. The U.S. dollar was generally stronger, while commodities were generally lower.

Stocks Were Near the Lowest Level of the Year

U.S. ethanol production declined 20 MB/D to 1,002 MB/D last week, giving back some of its recent gains. Inventories were drawn for the second consecutive week, falling by 510 thousand barrels to 19.2 million barrels. Ethanol-blended gasoline manufacture rose to 9,178 MB/D, up 5.3% from this time last year.

Dutch Storage Is Revitalizing Old Roles for the Netherlands this Winter

The loss of Dutch production has not only given a green light to Norway and Russia to sell more gas into Northwest Europe, but it has also given an important role to Bergermeer and other Dutch storage facilities to fill in those lost winter volumes. Dutch storage has taken the opportunity recently with net withdrawals this winter that are 480% higher than at the same point last year and this is linking well to gas exports from Holland. We are not talking small volumes either - according to the grid operator GTS, net Dutch gas exports to Belgium, Britain, and Germany reached 152 mmcm/d on November 8th. The market has not seen flow rates out of the Netherlands like that in November since 2013, when Groningen produced 5.8 BCM of gas.

U.S. Power Storage Poised for Growth – Market Outlook

PIRA’s first U.S. Power Storage Outlook examines recent developments in the power storage industry and provides a market penetration forecast through 2024. PIRA sees a convergence of technology, market, and policy factors that will propel substantial growth in the U.S. energy storage market, from 1.5 GW of installed non-pumped hydro storage capacity today to 5.0 GW by 2024. Power storage technologies are already reshaping ancillary services markets, deferring investment in transmission and distribution infrastructure, changing peak load profiles for large commercial users, and enabling greater behind-the-meter solar consumption.

Kazakhstan Ready to Grow Oil Production

With the recent start of production at the Kashagan field and the sanctioning of the new Tengiz field expansion, Kazakhstan is ready to start growing oil production. Long-term growth is expected to come primarily from these two oil fields. Kazakhstan has a very large resource base. However, the complicated conditions at Kashagan (reservoir, weather, sour gas), where most of the growth is expected, constrain larger or faster growth than what we have assumed.

In Spite of Thin spare Capacity, U.K. Playing an Increasing Role to Balance France, as RTE Prepares to Implement Exceptional Measures

The reduced system margins following the closure of a number of coal plants earlier in the year are adding an important premium to U.K. power prices and, in turn, are underpinning the spark spreads. In fact, the output of U.K. CCGTs has surged to levels not seen since January 2011. Looking at the Elexon data, week 49 looks particularly tight, with usable nuclear capacity in the U.K. reducing from Dec. 5 to 7 GW out of the nominal 8.9 GW. The latest RTE winter outlook, shows France is expected to be equally tight in the same week 49, and might need exceptional measures to balance the system with temperatures as cold as 3C below normal. The 2 GW interconnector between France and the U.K. is looking increasingly vital in balancing both markets, especially given the uncertainty over the German ability to export to France during the peak hours.

Global Equities a Bit Bimodal

Global equities, in the aggregate, staged a broad gain on the week. Developed / industrial market performance was strong, but emerging markets weakened. In the U.S, the stellar performer was banking, up 14% on the week, but industrials and retail indices were also very strong. Defensive and interest sensitive sectors, such as utilities and consumer discretionary, declined. Internationally, many of the individual emerging market equity markets declined. Latin America was particularly weak.

Korea Winter Weather Combines with Nuclear Losses to Offer Spot Price Support

Strong and stable winter pricing indicators out of Asia appear to have newfound fundamental support from Korea. Do not assume this support is sustainable post-winter, but it appears to be a fixture in the months to come due to weather- and power generation-based drivers.

World Refining Capacity Now Exceeds 100 MMB/D, with Utilization Close to 80%

World refining capacity (crude distillation plus condensate splitters) reached a milestone in 2016, moving beyond 100 MMB/D for the first time. Capability has been steadily increasing each year of this century gaining by an average of about 1.1 MMB/D per year to reach this benchmark. The capacity increases have outpaced the change in demand especially if factoring out the largely non-refinery production of biofuels and NGLs. As such, refinery utilization has been trending downward over the years.

Ukraine’s Industrial Gas Users to see More Price Increases

Gas prices for Ukraine’s industrial consumers will increase through mid-winter. A key role at the moment is, of course, a seasonal factor. Moreover, the dynamics of gas prices is largely similar to the dynamics of oil prices. A significant increase in Naftogaz of Ukraine natural gas prices for industrial consumers in November was caused by wider regional factors. As reported, Naftogaz of Ukraine from November 1, raised the price of gas supplied to industrial consumers, on a prepayment basis, by 16.3%.

Saudi Arabia: Less Financial Burn, Searching for that Financial Sweet Spot

PIRA notes that Saudi's finances have improved since earlier in the year due to a mixture of higher oil prices, a very successful $17.5 billion sovereign debt issuance, and a lower expenditure burden. This improvement has allowed it to lessen the burn rate on its foreign exchange reserves. A lot of financial flexibility still remains on a host of fronts that can be employed with measures designed to find that sweet spot with regards to setting oil policy, along with balancing fiscal and social pressures. We see the Kingdom on a stable and sustainable glideslope as they approach the next decade.

State Oil Companies Control over 60% of Oil Supply Volumes

State oil companies own around 64% of current crude and condensate supplies of 81 MMB/D and its share is expected to remain at that level for the next twenty years. They operate mostly large assets with lower base decline rates (2.5% versus 4% for oilfields held by public companies). As a result, they require less volume growth to increase net production. We estimate that 54% of future growth volumes will come from state companies. In addition, the cost to develop the new volumes is much cheaper than for public companies (81% of future growth at <$50/Bbl versus 55% for public companies). However, higher growth volumes from state companies are unlikely due to the political and economic constraints that they face.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Danos has successfully completed the fabrication of three boarding valve skids and one service line skid for Shell Offshore Inc.’s (Shell) deep-water Appomattox facility. Requiring approximately 12 months to complete, the project engaged four Danos service lines, including project management, fabrication, coatings, and automation.

Danos has successfully completed the fabrication of three boarding valve skids and one service line skid for Shell Offshore Inc.’s (Shell) deep-water Appomattox facility. Requiring approximately 12 months to complete, the project engaged four Danos service lines, including project management, fabrication, coatings, and automation.

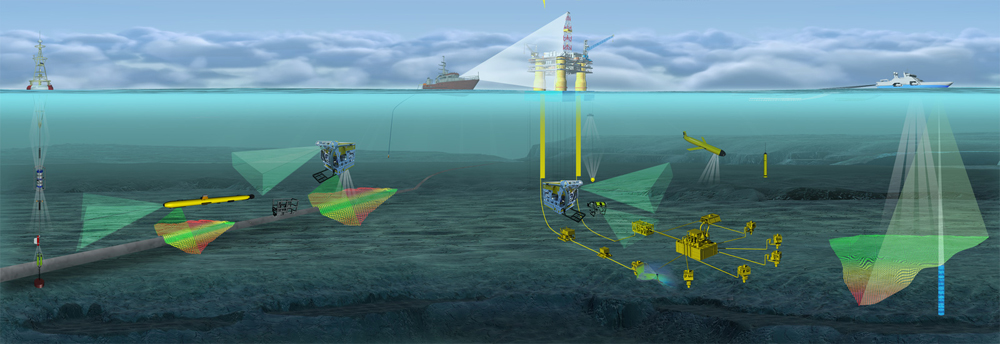

Image courtesy: Technip

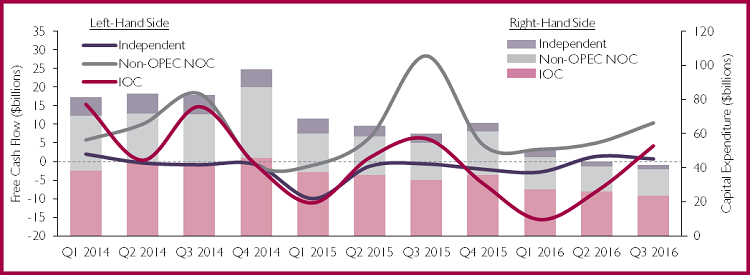

Image courtesy: Technip The end of one of the worst downturns in the history of oil & gas may be in sight, as OPEC’s November meeting looms large – bringing with it fresh hopes of a production cut and consequent market rebalancing. In this context, DW has recently undertaken analysis of 15 major upstream players, to understand prospects for the industry should we see a near-term upswing in oil prices.

The end of one of the worst downturns in the history of oil & gas may be in sight, as OPEC’s November meeting looms large – bringing with it fresh hopes of a production cut and consequent market rebalancing. In this context, DW has recently undertaken analysis of 15 major upstream players, to understand prospects for the industry should we see a near-term upswing in oil prices.

BP

BP The tool, built on GE’s Predix operating system, was created as part of a development partnership the two companies announced in January. “BP gravitates toward new technologies, especially digital, and that makes working with them particularly exciting,” said Lorenzo Simonelli, president and CEO, GE Oil & Gas. “We are taking a big step forward together during this time of digital transformation, deploying what we’ve co-created over the past year to drive the kind of productivity improvements that the oil and gas industry needs. The global deployment is expected to be the largest-scale deployment of GE’s Predix-powered APM technology to date.”

The tool, built on GE’s Predix operating system, was created as part of a development partnership the two companies announced in January. “BP gravitates toward new technologies, especially digital, and that makes working with them particularly exciting,” said Lorenzo Simonelli, president and CEO, GE Oil & Gas. “We are taking a big step forward together during this time of digital transformation, deploying what we’ve co-created over the past year to drive the kind of productivity improvements that the oil and gas industry needs. The global deployment is expected to be the largest-scale deployment of GE’s Predix-powered APM technology to date.” Photo credit: Damen

Photo credit: Damen EnerMech’s cranes. Photo courtesy: EnerMech

EnerMech’s cranes. Photo courtesy: EnerMech Technip’s

Technip’s Saipem

Saipem David Knukkel, Director of RIMS BV demonstrating the Elios Drone. Photo credit: RIMS BV

David Knukkel, Director of RIMS BV demonstrating the Elios Drone. Photo credit: RIMS BV Photo credit: DonaldJTrump.com

Photo credit: DonaldJTrump.com

The first major study of oil and gas workforce perceptions since the start of the global downturn has revealed which operators and service companies are rated highest by oil and gas professionals based on key issues including values, performance and pay rates.

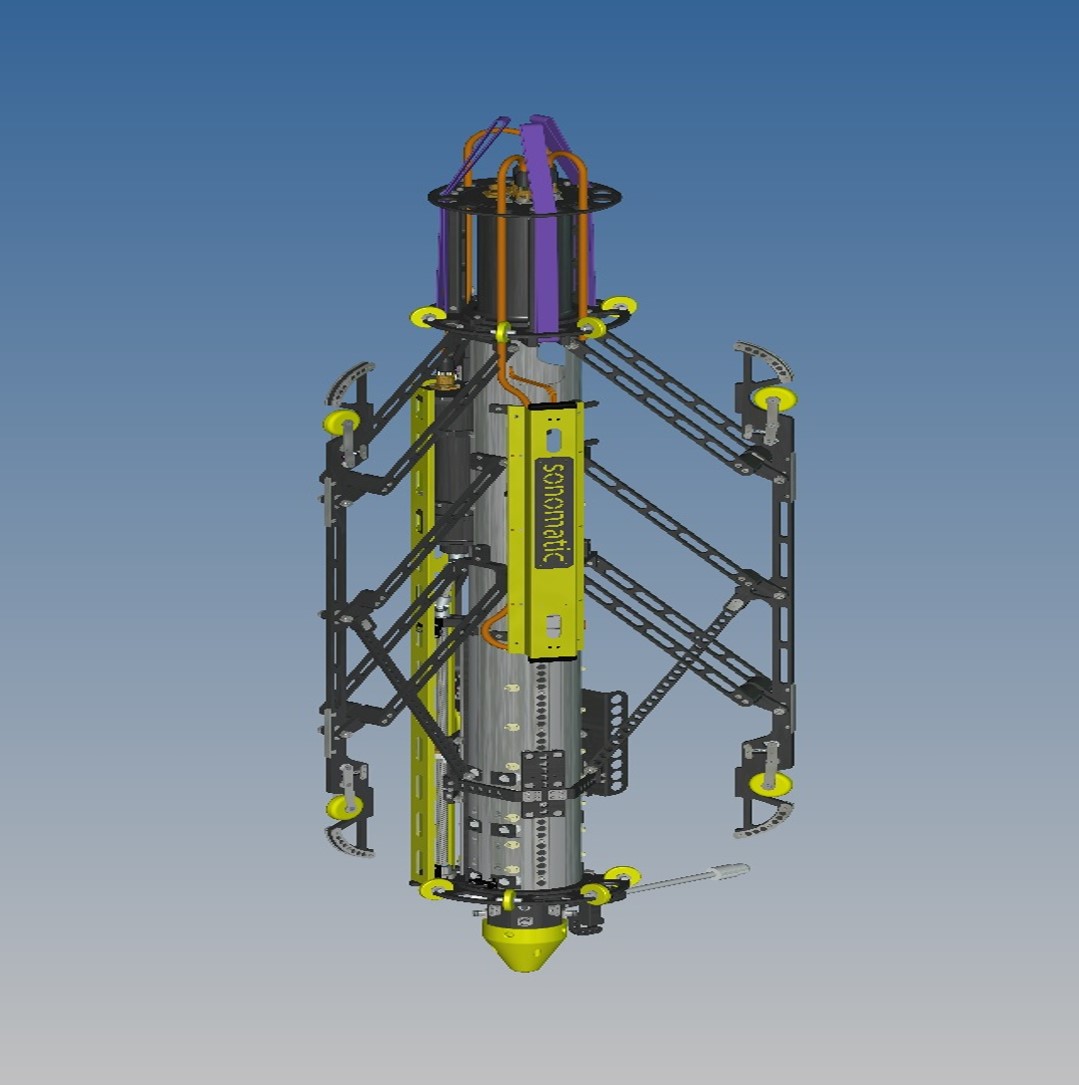

The first major study of oil and gas workforce perceptions since the start of the global downturn has revealed which operators and service companies are rated highest by oil and gas professionals based on key issues including values, performance and pay rates. Image courtesy: Sonomatic

Image courtesy: Sonomatic U.S. Commercial Stocks Led Lower by Product Draw

U.S. Commercial Stocks Led Lower by Product Draw Viking Lady. Image courtesy DNV GL

Viking Lady. Image courtesy DNV GL