Eni has started production of the giant gas field Perla, located in the Gulf of Venezuela in the Cardón IV Block. Perla is the largest offshore gas field discovered to date in Latin America and the first gas field to be brought to production offshore Venezuela.

- The largest offshore gas field in Latin America and the first gas field to be brought to production offshore Venezuela;

- Developed in 5 years only, an industry-leading time to market;

- Will produce 450 million cubic feet of gas per day in 2015 and 1200 million cubic feet in 2020. Eni’s net gas production will reach 40,000 barrels of oil equivalent per day in 2015 and 110,000 in 2020.

Eni has started production of the giant gas field Perla, located in the Gulf of Venezuela, 50 kilometers offshore. The first production well has been opened and is currently in the clean-up phase.

The field is located in the Cardón IV Block operated by "Cardón IV S.A.", a company jointly owned by Eni (50%) and Repsol (50%). Perla is the largest offshore gas field discovered to date in Latin America and the first gas field to be brought to production offshore Venezuela. This was achieved through close and successful cooperation between the Venezuelan Ministry of Petroleum and Mining, PDVSA, Cardón IV and its Shareholders.

Image courtesy: Repsol

Image courtesy: Repsol

Perla currently holds 17 trillion cubic feet (Tcf) of gas in place, which corresponds to 3.1 billion of barrels of oil equivalent (boe), with additional potential. The reservoir consists of Mio-Oligocene age carbonates with excellent characteristics, located at approximately 3,000 meters below sea level, at a water depth of 60 meters. The best wells are estimated to produce over 150 million standard cubic feet per day (Mscfd) each.

The development of Perla has been planned in three phases to optimize time to market and investment pace: Phase 1 (Early Production) has a production plateau of about 450 Mscfd (corresponding to approx. 40,000 boed net to Eni) increased from the 300 Mscfd initially planned, Phase 2 has a plateau of 800 Mscfd from 2017 (corresponding to approx. 73,000 boed net to Eni) and Phase 3 has a plateau of 1,200 Mscfd from 2020 (corresponding to approx. 110,000 boed net to Eni).

Eni CEO, Claudio Descalzi, commented: "Eni has reached another milestone with the production start-up of the Perla offshore field, in line with the timing presented to the market in March during the Strategy presentation. Perla was for Eni one of the most significant start-up projects of 2015, and the today result confirms the validity of our development model that allowed us to reach production in an industry-leading time to market".

The development plan includes four light offshore platforms linked by a 30‘ pipeline to a Central Processing Facility (CPF) located onshore at Punto Fijo (Paraguaná Peninsula) and 21 producer wells. In the CPF two treatment trains have been installed with the capability of handling 150 Mscfd and 300 Mscfd each.

The development of the field, discovered in late 2009, was completed in 5 years, an industry-leading time to market. This excellent performance was achieved thanks to an extensive use of pre-pack modules in the realization of the onshore gas treatment trains, in order to minimize construction works.

Cardón IV signed a Gas Sales Agreement with PDVSA for all three phases, until 2036. The gas will be mainly used by PDVSA for the domestic market.

Eni’s other operations in Venezuela include the Junín-5 heavy oil block (PDVSA 60%, Eni 40%), located in the Orinoco Oil Belt, which holds 35 billion barrels of certified oil in place. Junín-5 production started in March 2013. In addition, Eni holds a 26% stake in PetroSucre, the operating company which operates the offshore Corocoro oil field, (PDVSA holds the remaining 74%). Eni’s current net production in Venezuela is approximately 12,000 boed and is expected to exceed 50,000 boed by year end, mainly due to the increase in production from Perla.

Effective as of July 16, ConocoPhillips for its convenience provided a notice of termination for the three-year

Effective as of July 16, ConocoPhillips for its convenience provided a notice of termination for the three-year  In the beginning of May, the crew on Maersk Discoverer reached a great milestone when they finalized their latest well two months ahead of time. The well was another East Nile Delta success for BP, discovering 50 m of gas pay in high-quality Oligocene sandstones. On May 5, Maersk Discoverer completed the deepest well ever drilled in Egypt and the longest ever drilled in the Mediterranean Sea. What makes the well an even greater success is that it was drilled in 234 days, which was a staggering 62 days ahead of BP’s AFE target, thus creating a substantial cost saving. “The strong performance is a result of the dedicated use of the ‘Plan Do Study Act’ methodology in the planning and execution of the work. Also, a structured approach to applying lessons learned from the previous wells Geb and Salamat played an important role,” says Rig Leader Allan McColl.

In the beginning of May, the crew on Maersk Discoverer reached a great milestone when they finalized their latest well two months ahead of time. The well was another East Nile Delta success for BP, discovering 50 m of gas pay in high-quality Oligocene sandstones. On May 5, Maersk Discoverer completed the deepest well ever drilled in Egypt and the longest ever drilled in the Mediterranean Sea. What makes the well an even greater success is that it was drilled in 234 days, which was a staggering 62 days ahead of BP’s AFE target, thus creating a substantial cost saving. “The strong performance is a result of the dedicated use of the ‘Plan Do Study Act’ methodology in the planning and execution of the work. Also, a structured approach to applying lessons learned from the previous wells Geb and Salamat played an important role,” says Rig Leader Allan McColl.

Subsea 7

Subsea 7 Ivar Aasheim, head of field development on the Norwegian continental shelf, submitting the amendment to the PDO for the Gullfaks license to Minister of Petroleum and Energy, Tord Lien, on 30 June. (Photo: Ole Jørgen Bratland - Statoil)

Ivar Aasheim, head of field development on the Norwegian continental shelf, submitting the amendment to the PDO for the Gullfaks license to Minister of Petroleum and Energy, Tord Lien, on 30 June. (Photo: Ole Jørgen Bratland - Statoil) Image courtesy: Nigeria Energy Intelligence

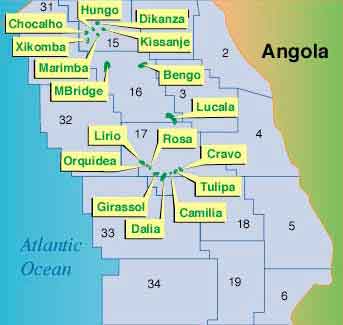

Image courtesy: Nigeria Energy Intelligence

Technip Samsung Consortium

Technip Samsung Consortium

Swire Oilfield Services

Swire Oilfield Services