The North Sea will see a rise in infrastructure deals this year, with private equity funds playing an increasing role in midstream assets, according to business advisory firm Deloitte.

The North Sea will see a rise in infrastructure deals this year, with private equity funds playing an increasing role in midstream assets, according to business advisory firm Deloitte.

Shaun Reynolds, Director, Transaction Services, Deloitte

Against the backdrop of a low oil price, more oil and gas companies are looking to rationalise their portfolios and divest non-core assets in the UK Continental Shelf (UKCS), the firm said – with private equity and specialist infrastructure funds likely purchasers.

Deloitte’s latest European Infrastructure Investors survey found that pipelines, in particular, have provided a solid and steady return over the last five years. The asset class was highlighted by investors as performing well compared with other infrastructure, including fuel storage, ports and renewables; the internal rate of return on pipelines reached 14% in the period 2013-2016.

Deloitte’s report also found that pipelines will remain a strong focus for infrastructure investors in the future, along with gas and fuel storage.

Shaun Reynolds, Director, Transaction Services, at Deloitte, said: “Historically, big oil and gas operators developed and owned what they needed, transporting their major discoveries through proprietary pipelines and refining it in their own processing plants. That’s largely remained the case, until the last two or three years.

“The ownership model has evolved, driven by the maturity of the basin and the low oil price. Established players are divesting to shore up their balance sheets, and infrastructure is comparatively less complex to value and sell, with a ready market at the right price.

“Private equity firms and specialist energy infrastructure funds are likely buyers – specifically those with a solid grasp of the UKCS. They’ll look to take a number of assets under management, create a portfolio, maximise their potential and then look to divest; most likely to a pension fund aiming for steady returns from a stable asset.”

In 2015, BP sold its stake in the Central Area Transmission System (CATS) to Antin Infrastructure Partners in a £324 million deal. Antin had bought BG Group out of its stake the previous year, giving it near-complete ownership of the asset.

The third party ownership model has been employed successfully in the US shale gas market for years, while oil and gas infrastructure in The Netherlands and Norway is commonly owned by private equity or pension funds.

Shaun added that the changing asset stewardship of North Sea infrastructure could be a positive development for the industry, with 20 billion barrels still recoverable in the basin.

Shaun commented: “It’s a positive step for the UKCS. Private equity will provide focussed management of the assets and ensure they are being used to their utmost potential. That can only be a good thing, particularly from a longevity perspective as we seek to make the most of the North Sea.

“Whatever the case, there’s a strong appetite from investors for North Sea infrastructure – but only at the right price. As the oil price continues to take its toll and pressure mounts on balance sheets, more operators will have to look at rationalisation and infrastructure tends to be a logical sale. Deals are brewing in the UKCS – and we’ll see more on the infrastructure front in the short- to medium-term.”

The North Sea will see a rise in infrastructure deals this year, with private equity funds playing an increasing role in midstream assets, according to business advisory firm

The North Sea will see a rise in infrastructure deals this year, with private equity funds playing an increasing role in midstream assets, according to business advisory firm

Derek Smith, chief executive at Optimus Seventh Generation

Derek Smith, chief executive at Optimus Seventh Generation  BP Egypt announced on June 9, another important gas discovery in the Baltim South Development Lease in the East Nile Delta.

BP Egypt announced on June 9, another important gas discovery in the Baltim South Development Lease in the East Nile Delta. BP

BP Photo courtesy: BSEE

Photo courtesy: BSEE Chet Morrison Contractors

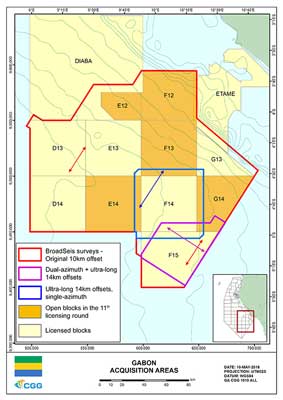

Chet Morrison Contractors Map showing available license blocks and coverage of new broadband 25,000-km2 multi-client survey and additional data being acquired in blocks F14 and F15. Credit: CGG

Map showing available license blocks and coverage of new broadband 25,000-km2 multi-client survey and additional data being acquired in blocks F14 and F15. Credit: CGG

Swiber Holdings Limited

Swiber Holdings Limited Materia Inc.

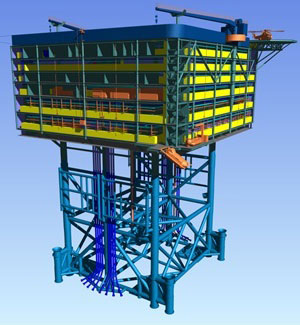

Materia Inc. In the Arendal Yard in Gothenburg, Sweden, Apply Emtunga is building the offshore accommodation modules to the oil rig projects Martin Linge and ETAP. As the living quarters are to be the safest place on a rig Apply Emtunga puts a lot of effort into creating maximum safety. One way to ensure safety is to use Roxtec cable and pipe transits.

In the Arendal Yard in Gothenburg, Sweden, Apply Emtunga is building the offshore accommodation modules to the oil rig projects Martin Linge and ETAP. As the living quarters are to be the safest place on a rig Apply Emtunga puts a lot of effort into creating maximum safety. One way to ensure safety is to use Roxtec cable and pipe transits. Semi subsea drilling vessel Polar Star: Photo courtesy: Gazflot

Semi subsea drilling vessel Polar Star: Photo courtesy: Gazflot Photo courtesy: Aker Solutions

Photo courtesy: Aker Solutions BP

BP Artist's impression of the BorWin gamma HVDC platform © Petrofac

Artist's impression of the BorWin gamma HVDC platform © Petrofac