U.S. Crude Stocks Build Again

U.S. Crude Stocks Build Again

Crude stocks continued to build, rising by 2.3 million barrels this past week, as imports surged to a multi-year high while the inventories of the three major light products were about flat. For next week, PIRA sees lower crude imports, higher runs, and reduced production due to weather-related shut-ins, and causing a large crude stock decline. Cushing crude stocks declined 1.04 million barrels this past week, and lower Canadian imports should ensure another significant decline in next week’s EIA data.

Storm Premium Swept Away

On Tuesday, August 30, NYMEX October futures assumed prompt-month status and immediately saw a sharp bout of selling. In particular, prices have been in a steady state of erosion since topping ~$2.90/MMBtu to start the week, as Thursday’s outsized storage report and less supportive weather forecasts, showing potentially cooler temperatures aided by tropical storm activity, have weighed on sentiment.

August U.K. Coal Generation Sets New Low. When Will German Coal Switch off?

While the eclipse of coal in the U.K. comes with little surprise, the behavior of coal units on the Continent is now more intriguing. While older and inefficient units have clearly moved out of the money, a more interesting issue is at which point the most efficient coal units will start switching off. Generation data show gas trending higher in Germany, although steam coal is still generally dominating the German mix.

Coal Prices Remain Upward Trending Despite Weaker Oil Market

Forward coal pricing moved notably higher this week, with prices rising initially due to the suspension of loading activity at Puerto Bolivar, although after the suspension was lifted, prices rose to even loftier highs. In fact, 4Q16 prices for FOB Newcastle and API#2 are now just marginally below their recent highs. For prompt pricing, API#4 forwards generally underperformed relative to API#2 and FOB Newcastle, giving FOB the premium spot back. Continued strength in the Chinese market remains the driving force for pricing, as it is becoming increasingly apparent that the limitation of working days at Chinese coal mines will not be relaxed.

RGGI at a Crossroads

The RGGI cap and trade program is at a crossroads, as partners negotiate the post-2020 cap declines, with PJM states reportedly resisting the steeper reductions favored by New England and NEPOOL looking at an alternate wholesale market structure. RGGI prices received a boost from the June Stakeholder Meeting, but declined on news of the NY nuclear subsidies in July. August prices averaged lower than July, but were moving towards the $5 mark. PIRA expects the Sept. 7th auction to be dominated by compliance buying as the market continues to await a draft Model Rule, expected this fall. Longer term, it must be decided whether the RGGI price signal will be the primary mechanism to reach climate goals.

Global Equities Gain on the Week

Global equities posted another gain on the week. In the U.S., the “growth” indicator outperformed the “defensive” indicator. Banking, materials, and utilities, led the performance. Energy was down slightly, -0.4%. The international tracking indices also gained, with China, emerging markets, and Europe doing the best.

Tanker Market Outlook: Little Relief from Current Meltdown Until 4Q16

The seasonal meltdown in tanker markets in this year’s third quarter has been especially severe, and little relief is anticipated before 4Q 2016. OPEC production growth is slowing and is not adequate to offset rapid fleet growth this year or next. Nigerian production outages and competition from VLCCs have decimated rates in the Suezmax sector, which have been driven well below cash operating cost levels.

Asian LPG Prices Decline Less Than Crude and Products

Asian LPG markets were the standout winners last week with notable outperformance vs. broader markets. Prices in the destination market were buoyed by increases in Saudi contract prices from September FOB loaders. Cash and futures prices for propane converged to near $300/MT after 3% declines last week. Butane prices were mostly unchanged, being called near $328/MT on Friday afternoon.

U.S. Ethanol Production Remains over 1MMB/D for Fifth Straight Week

Stocks build to highest level in six weeks. Output of ethanol-blended gasoline dropped for the fourth straight week.

Cold on the Way

The first full week of metrological autumn will see both combines roll and a rather dramatic cool down in the NW Belt. Low temperatures will be in the mid-30’s as far south as Cedar Falls, Iowa, by Thursday, September 8 even though it would appear that freezing temperatures will not infringe on major growing areas.

Japanese Crude Stocks Were Marginally Lower

This week saw finished stocks draw 1.7 MMBbls, with noted declines in naphtha and gasoil stocks. Crude stocks were only marginally lower. Runs also eased slightly, but they will show more significant drops in the next few weeks. Gasoline demand remained strong, but stocks built slightly on higher yield and lower exports. Gasoil demand rebounded with lower yield and strong exports, and stocks began to correct a four-week rise. Kerosene stocks continued to build. Refining margins remain very weak, though there was some improvement in cracks in the last week.

German Spark Spread Surges: Gas More Competitive than Coal in September 2016

After a bottom for the year seen in July, a reversal in German gas generation is currently underway, and with 2.5 GW dispatched in August, gas is up by 37% month-on-month and 66% year-on-year. Lower power flows from historically cheaper France have been a major relief for German conventional/thermal generators, albeit August saw both higher solar generation (+1.1 GW), together with higher wind output (over 1 GW year-on-year), dampening the bullish impact of the lower French flows.

Gas Threatening Coal on the Continent More Broadly

While France has been seen shifting toward net importer status from Belgium and Germany, PIRA sees an unprecedented market context in Germany during September, when gas units will be more competitive against coal, and gas will potentially be able to meet — together with lignite — the entire need for fossil fuel generation. We have seen coal units ramping down during renewable-induced power prices collapses, but will coal switch off to allow gas to generate? German prices appear vulnerable to downsides in the shorter term, considering the resilience of coal-fired generation and further weakness ahead for gas prices. However, German winter prices are largely undervalued assuming our expected thermal demand (~36 GW on average). This level of thermal demand requires prices in the low €30/MWh, at current fuel prices.

U.S. Prices and Margins Improve in August

U.S. RIN values rise early in the month, but fall later. Brazilian ethanol output declines in the first half of August.

Repeat of 2014?

Corn yield comparisons to 2014 have given traders that déjà vu feeling all over again. Always searching for some sort of analog, the late-September/mid-December 50 cent corn rally in 2014 is starting to draw comparisons to 2016, although the Funds aren’t looking at it that way. With the 2016 rally a month earlier than in 2015, some are of the opinion that this year’s recovery can also be a month earlier than 2014.

U.S. Gasoline Demand Influenced by Public Holidays

We estimate that incremental gasoline demand over five U.S. public holidays averages about 290 MB/D. Downstream buying begins as early as two to three weeks before major holidays like the end-of-year Christmas/New Year period. Dealer buying for minor holidays appears to take place a week before or even in the same week.

As China Deals Receives the Spotlight, India Quietly Increases Volumes

Garnering perhaps more attention than the fact that YTD Indian LNG imports (uncontracted) of Australian LNG have registered 5 mmcm/d versus no first half buying in 2015, Chevron has announced the finalization of a long-sought supply contract with China's ENN for volumes from Gorgon. Although the volumes are, at just under 1-bcm/yr., low compared with previous China/Australia contracts, the contract is notable for several reasons.

Southwest Prices Edge Down as Loads Fade

Although on-peak prices remained volatile in August, weaker cooling loads in the Southwest reduced Palo Verde average prices by about $4/MWh from July. SP15 prices also edged lower, but warmer weather, lower hydro output and rising gas prices led to a small gain at NP15 and a sizable jump at Mid-Columbia (+$4). Implied heat rates have been supported this year by weak gas prices and strong cooling loads, but we expect heat rates to move lower through 2018 in response to a rebound in gas prices and rising solar capacity. Southwest coal and California gas retirements will not provide sufficient support to avert weakness.

Coal Pricing Rally Slows, Upside Remains

The Chinese market continued to be a sizably net bullish factor for seaborne coal prices despite the normalization of weather conditions. Domestic coal production continues to fall; thermal coal imports are comfortably above prior-year levels for the year-to-date. Seaborne coal supply growth will remain limited, while the demand side is showing some improvement. While the considerable pricing rally that has occurred over the past eight months has started to fade, we believe that there continues to be more upside to prices, with a bullish oil pricing outlook providing much of the stimulus.

U.S. Labor Market Is Healthy; Emerging Economies Stay Upbeat

U.S. August job growth fell somewhat short of market expectations, but it did not represent a disappointment. On a trend basis, the labor market has picked up pace considerably. In spite of a tightening in labor conditions, wage growth (based on average hourly earnings) has not accelerated. There are flickering signs, however, that this may soon change. Recent data from emerging markets (such as the August confidence readings from China, and July industrial production for South Korea and Brazil) were constructive for the outlook.

June 2016 U.S. DOE Monthly Revisions: Demand and Stocks

EIA just released its final monthly June 2016 (PSM) U.S. oil supply/demand data. June 2016 demand came in at 19.83 MMB/D, which was 100 MB/D better than PIRA had assumed in its balances. Demand grew 1.2% versus year-ago, or 242 MB/D moving back closer to the 296 MB/D average growth seen Feb.-Apr. Gasoline and kerojet outperformed the barrel average, with gains of 2.9% (273 MB/D) and 4.7% (77 MB/D), respectively. Gasoline performance was in line with the improved June VMT growth, which was 3.2% versus 2% in May. End-June total commercial stocks stood at 1,382.4 MMBbls, which were 7.6 MMBbl higher than the preliminaries, but 9.5 MMBbls lower than PIRA had assumed in its balances.

Argentine Gas Price Rise Process Starts Again

The Argentinian government is set to propose a lower price hike for residential gas following a rejection of original increase by the Supreme Court. The new price model was decided September 1, Infobae reported, without saying how it obtained the information. The government will submit the new price increase in a non-binding national public hearing scheduled for Sept. 16. S&P 500 Moves Higher The S&P 500 closed slightly higher on the week. As would be expected, volatility moved lower, while high yield debt and emerging market debt indices generally held firm. The dollar mostly strengthened, and the total commodity index fell back on the week.

June 2016 U.S. Domestic Crude Supply Declines to New Cyclical Low

EIA recently released its June oil balances. Domestic crude supply, which is domestic crude production plus the balancing item, declined to a new cyclical low of 8.81 MMB/D. This is the lowest figure seen since June 2014. From the April 2015 peak, the decline has been a cumulative 1.15 MMB/D, or about a 10%, annualized decline rate. Domestic field crude production also reached its lowest level since June 2014, and the year-on-year decline rate reaccelerated back to about 620 MB/D, or -6.6%.

Early-Bird Outlook for 2017

Broader fundamental considerations will drive prices beyond $3/MMBtu before year end. While such levels are likely to be sustained into 2017, there is an “expiration date” attached to such heights, especially if end-March storage is left near 2 TCF.

Aramco Pricing Adjustments: Not Pushing Increased October Avails

Saudi Arabia's formula prices for October were just released. With more crude available for sale in October due to refinery maintenance, pricing in Asia and the U.S. was made less generous to customers. This sends a constructive message to the market.

High Continental Stocks Reign Despite Supply Cuts

The Rough outage announcement in June sent storage spreads to levels unseen for several years, encouraging a full Continent to inject as much as possible to help the U.K. with its storage shortfall. Now that Rough is back, there is a lot of gas in storage that is hedged to withdraw in 1Q, and it could spell trouble for deliveries.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Norway-based boat system and davit-handling specialist

Norway-based boat system and davit-handling specialist  Trelleborg's offshore

Trelleborg's offshore Add Energy

Add Energy Shell Brutus oil platform. Photo credit: NOAA Ocean Explorer

Shell Brutus oil platform. Photo credit: NOAA Ocean Explorer SafeEx’ tablet-based inspection and maintenance software allows you to perform all routines in one procedure.

SafeEx’ tablet-based inspection and maintenance software allows you to perform all routines in one procedure. U.S. Crude Stocks Build Again

U.S. Crude Stocks Build Again Driven by the increasing requirements for harsh environment

Driven by the increasing requirements for harsh environment

Offshore surveys are a necessary precursor for both Oil & Gas (O&G) and renewable energy installations on the seafloor. Particularly for new projects in remote regions, surveys (oceanographic, geotechnical, geophysical etc.) are critical for successful project design and implementation. However, current market conditions are forcing all parties in the supply chain to rethink their approach.

Offshore surveys are a necessary precursor for both Oil & Gas (O&G) and renewable energy installations on the seafloor. Particularly for new projects in remote regions, surveys (oceanographic, geotechnical, geophysical etc.) are critical for successful project design and implementation. However, current market conditions are forcing all parties in the supply chain to rethink their approach. Nigel Less, Decom North Sea new chairman

Nigel Less, Decom North Sea new chairman CGG announced at ONS 2016 the launch of TopSeis™, the latest evolution in offshore broadband seismic, specifically designed to overcome the intrinsic lack of near offsets inherent in 3D towed-streamer seismic.

CGG announced at ONS 2016 the launch of TopSeis™, the latest evolution in offshore broadband seismic, specifically designed to overcome the intrinsic lack of near offsets inherent in 3D towed-streamer seismic. SapuraKencana’s fabrication yard at Lumut, Sparrows Group will collaborate with the firm across Malaysia.

SapuraKencana’s fabrication yard at Lumut, Sparrows Group will collaborate with the firm across Malaysia. Photo credit: Damen Trading

Photo credit: Damen Trading Maersk Gallant. Photo courtesy: Maersk Drilling

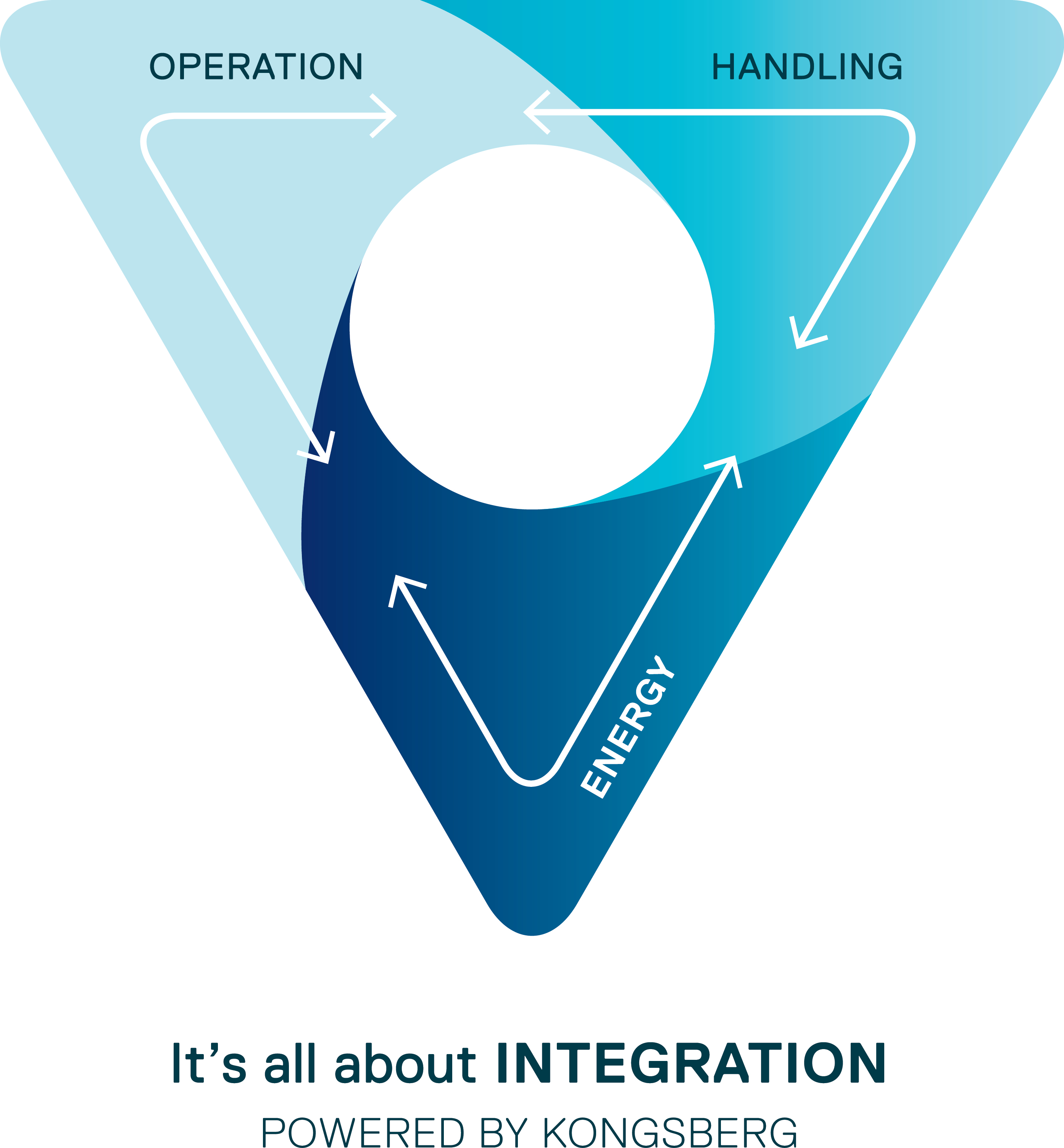

Maersk Gallant. Photo courtesy: Maersk Drilling Kongsberg Maritime’s energy, handling and operational technology solutions are to be further combined in complete vessel concepts under a new ‘Integration’ strategy introduced at ONS 2016. KONGSBERG is creating a new integrated platform to enable solutions that network seamlessly to provide tangible benefits with efficient operations on vessels and ashore.

Kongsberg Maritime’s energy, handling and operational technology solutions are to be further combined in complete vessel concepts under a new ‘Integration’ strategy introduced at ONS 2016. KONGSBERG is creating a new integrated platform to enable solutions that network seamlessly to provide tangible benefits with efficient operations on vessels and ashore.