U.S. Crude Market Flat in August, But Tightening Is Ahead

U.S. Crude Market Flat in August, But Tightening Is Ahead

Crude prices and regional differentials were nearly flat in August, but prices will improve through year-end, as an open export arb and closed import arb lead to a reduction in net crude imports and falling crude stocks. Production has returned to normal in Western Canada, but it continues to decline in the U.S. Midcontinent — except in the Permian Basin, where production is beginning to stabilize as the rig count rises.

Supply Declines Fail to Materialize

U.S. production was again impacted by temporary shut-ins. While the losses tied to Tropical Storm Hermine were minor, it marked yet another of many events that have limited production during the injection season.

As Italy-France Spread Narrow, Risks of Lower French Imports. Italy Supports German Power Prices via Switzerland

The large drop in French nuclear output so far this summer, by almost 7 GW year-on-year in September to date, is pushing gas plants to set French prices more often, and, in turn, this fact makes French prices naturally closer to its Italian counterparts, resulting in lower French flows to Italy. With the current Italy-France differential further narrowing for the upcoming winter months, we might not see a sustained flow from France. If the flows from France dry up, those from Switzerland, Austria and Slovenia might not be sufficient to fill the gap.

New England RECs: Adequate Supply for Now

New England REC pricing has moved well below ACP levels, indicating adequate supply for the highest value markets. Near-term pricing may respond to expected load growth later this year into 2017. Between now and 2020, REC requirements increase, but they also fluctuate according to MA solar carve-outs. New wind development is critical: although there is significant capacity in the queue, additional wind build (beyond what is under construction) is required to meet demand. Longer term, valuing RECs depends on RPS policy and the desire for strong REC price signals — and initiatives such as IMAPP call this into question. Policies such as the recent MA law increasing clean energy purchasing and encouraging offshore wind can diminish the importance of RECs in incentivizing renewables.

Global Equities Slump on the Week

Global equities were broadly lower on the week. In the U.S., only the energy tracking index posted a gain. Housing, consumer staples, and materials performed worse than the overall 2% decline. The international indices all did better than the U.S. The best performer was the Chinese tracking index, while Latin America was the worst performer.

Markets Poised for WASDE

For September, the markets should be focused on old crop/new crop soybean carry outs in the WASDE and new crop corn yield in the Crop Production report. How aggressive the World Board and NASS get in these two categories will set the tone moving forward, in our opinion. While both numbers should be objective, the bean carry out will certainly contain some subjectivity.

U.S. Ethanol Prices Climbed the Week Ending September 2

Manufacturing margins improved to the highest level in over five weeks. RIN values give back some of their recent gains.

Fuel Subsidy Policies to Be Tested in a Higher Price Environment

Over the past 12 months, several large oil-exporting countries have been forced to address their subsidy burden and raise domestic fuel prices. Major policy changes for this group of countries have the potential to slightly dampen future oil demand, as most oil exporters still price domestic fuels at a fraction of the global average. But political pressure and internal dynamics are likely to prevent a widespread move towards market pricing. Recent history suggests that any further reforms will continue to be modest and gradual, while rising oil prices will relieve some of the urgency to raise domestic fuel prices. In the rest of the world, the vast majority of countries price domestic fuels at or above market levels. PIRA maintains its view that the threat to future oil demand from subsidy reform is overstated.

Market Rally Stalls on China Coal Production Accord

Despite a sizeable rise in pricing on Monday and Tuesday (pushing FOB Newcastle prices above $70/mt for the first time since mid-2014), coal prices closed on Friday down week-on-week, in response to the agreement between the Chinese government and coal producers to lift output. While PIRA believes that there will be some stimulation in China's coal production from the summit this week, import demand will likely remain strong over the next 30-60 days due to winter stocking requirements. However, beyond this period, we believe that if coal producers are given some discretion to fluctuate output (as it appears as if they have), they will exercise some discipline, as many mining companies in China are just now moving out of the red into the black. If this proves to be correct, import demand could remain fairly robust, perhaps even upward trending year-on-year over the next six to nine months.

Massive U.S. Crude Stock Draw

Huge crude stock draw pulls overall commercial stocks down 13.7 million barrels this past week while the strongest reported product demand of the year limits product inventory build. Gasoline had its largest stock draw this summer as real demand was very strong, imports moderated and refiners substantially reduced refinery production. Crude stocks are forecast to decline again next week despite a rebound in crude imports with Cushing contributing 0.6 million barrels to the draw. Gasoline stocks to draw again, albeit at a much slower pace as seasonal demand weakness kicks in. Distillate demand should rebound, limiting its stock build in next week’s EIA data.

Flexible Demand Is Not Acting So Flexibly Anymore

Significant power sector gas demand is starting to creep into European gas balances. The problem remains that this demand is not coming in fast enough to replace even the declining demand from storage injectors. While the month is still young, we are seeing how in late summer/early winter it sometimes has to be producers or Mother Nature (temperature) who save market balances from loosening, not power demand. We had forecast far more German gas-fired power demand coming in this month relating to the profitable hedging possibilities of the spark spread for the full month of September; however, as of yet this has not kicked in.

EPA Finalized Regs: Higher Seasonal NOx Prices in 2017

The EPA finalized regulations limiting May-September NOx emissions to assist with non-attainment problems for Ozone. It is generally similar to the proposal from last fall, though aggregate state-level caps/budgets have been relaxed slightly, and North Carolina is no longer covered under the program. Critical for currently traded allowances, EPA has finalized provisions to transition the accumulated CSAPR seasonal allowance surplus/bank with a discount factor. Current seasonal CSAPR allowance pricing is in the range of EPA’s high-end estimates of the costs needed to induce existing SCR controls to run harder and the costs of turning on idled SCRs/installing additional combustion controls. Assumptions regarding the cost of ammonia/urea are critical.

S&P Falls, Commodities Rise

The S&P 500 moved significantly lower on the week as interest rates ticked higher and the market reflected on rising odds for a September rate hike by the FED. Volatility increased, but high yield debt and emerging market debt indices held firm. There was an uptick in longer-term interest rates in all the major countries we track, particularly Japan. The total commodity index was actually higher on the week, despite the decline in equities.

Increasing Seasonal Demand Propels U.S. LPG Prices

U.S. LPG prices gained as strong increases in propane demand led to a sharp drop in inventory gains. Mont Belvieu October propane futures prices improved by 2¢ or 4.4% to settle just above 49¢/gal Friday. Butane at the market center gained 4.6% to 65.2¢. Conway LPG prices outperformed those in TX, but remain about 3¢ lower on both species. Natural gasoline prices improved by 5.2%, easily beating out RBOB’s week-on-week gain. Ethane prices were also stronger, regaining a 20¢/MMBtu premium above Henry Hub gas –after dipping below it in recent weeks.

Ethanol Output Drops for the Third Straight Week to 998 MB/D the week ending September 2

The production of ethanol-blended gasoline increased to 9,271 MB/D. Total inventories fell by 272 thousand barrels to 20.7 million barrels.

2015/2016 Marketing Year Draws to a Close

Technically, the books will not be closed on the 2015/16 Marketing Year until the end of this month, when the September 1 Quarterly Stocks report is released. Through a combination of various USDA reports as well as Census Bureau statistics, which often contradict USDA numbers, an almost final picture of the 2015/16 Marketing Year is getting clearer.

Japan Runs Eased, Imports Little Changed and Stocks Drew Modestly

Runs eased only modestly, though maintenance should be gearing up. Runs will continue declining at an accelerating rate through much of the month. Crude imports remained little changed and a modest crude stock draw ensued. Finished product stocks built due to higher naphtha and kerosene. Demands were mostly lower. Refining margins have begun to improve from abysmal levels. For the most part, all the cracks improved on the week.

Poland and Russian Gas Companies Unlikely to Agree on Gas Prices

Poland’s state oil and gas company PGNiG does not foresee an out-of-court settlement with Russia’s Gazprom to reconsider natural gas prices, PGNiG Management Board President Piotr Wozniak said Sept. 8. PGNiG filed a lawsuit against Gazprom over gas prices last February, following its 2014 call for the energy giant to revise its gas price deal in line with recent gas market trends. Wozniak declined to disclose the terms acceptable for his company, saying that "only Gazprom knows the terms to which we will agree; it is not necessary to speak publicly about it."

Quiet Summer RGGI Auction

The September RGGI auction cleared at $4.54, up one cent from June. Registered bidders numbered 50 — at the low end of the range for 2015/16. Players with compliance obligations picked up the majority of the allowances, but less than what was observed in recent auctions, suggesting that interest in speculative buying may be returning. Negotiations among RGGI partners regarding post-2020 caps have intensified, with some New England states favoring steeper reductions. Market players are still waiting for the next Stakeholder meeting date, scheduled for “early fall,” to get additional clues as to what the Model Rule could look like.

U.S. Refinery Turnarounds, September 2016 to December 2017

PIRA’s periodic survey of U.S. Refinery Turnarounds indicates that the next several months should see an above-average level of downtime. Planned crude unit outages are expected to amount to about 1.6 MMB/D in September, increasing to over 2.4 MMB/D for October. Outages are likely to be even higher because of unplanned events. On a weekly basis crude downtime peaks at around 2.6 MMB/D during early to mid-October. Upgrading unit downtime follows a similar but lower path, peaking at around 2.1 MMB/D in October. FCCs account for around one-half of the upgrading unit outages peaking in early October at about 900 MB/D. The first quarter of 2017 is also expected to be an active period for refinery turnarounds.

La Nina Offers Reprieve for Asia Winter Gas…If She Lingers

While last winter was characterized by energy demand losses due to the warming effects of El Nino, it's worthwhile to anticipate the reverse effects of the expected La Nina this winter, even though it may not be as strong as the stimulative 2010-12 La Nina. LNG demand outside of the growth markets of India and China is taking a hit on several fronts, not least of which has been caused by the weather.

Slowing in Chinese Investment Carries Both Risk and Reward

Year-on-year growth in China’s fixed asset investment has decelerated sharply in recent periods. Investment in the manufacturing sector (which accounts for about a third of the total) was a key contributor to the slowing. The slump in this category, in turn, was related to the government’s push to reduce industrial overcapacity. China’s provincial GDP data for the first half of 2016 also pointed to the cost of economic restructuring, as provinces like Liaoning (a major producer of steel) and Shanxi (famous for its coal production) reported sluggish results. In Europe, economic data in the post-Brexit vote period have generally been better-than-expected.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

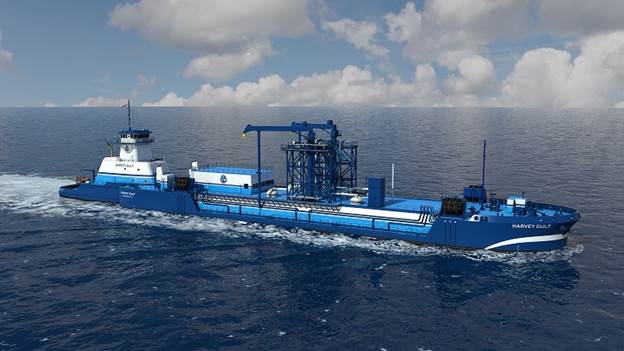

Photo credit: Harvey Gulf

Photo credit: Harvey Gulf A key theme at the SMM Conference in Hamburg last week (and highlighted in Douglas-Westwood’s keynote address) was the innovation within both the offshore (oil & gas and renewables) and marine markets aimed at reducing costs and improving operational efficiency. This is bringing more oil and gas projects over the economic threshold of viability and also moving the offshore wind nearer the point where it can compete directly with other power generation options such as nuclear.

A key theme at the SMM Conference in Hamburg last week (and highlighted in Douglas-Westwood’s keynote address) was the innovation within both the offshore (oil & gas and renewables) and marine markets aimed at reducing costs and improving operational efficiency. This is bringing more oil and gas projects over the economic threshold of viability and also moving the offshore wind nearer the point where it can compete directly with other power generation options such as nuclear.

The Sonardyne Marksman acoustic simulator equipment supplied to GE will help train the next generation of Brazilian DP Officers.

The Sonardyne Marksman acoustic simulator equipment supplied to GE will help train the next generation of Brazilian DP Officers. LQT Industries, LLC

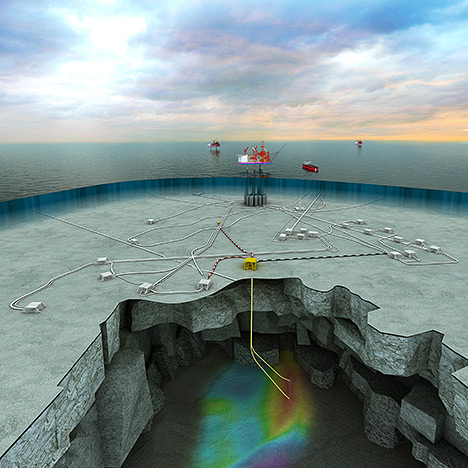

LQT Industries, LLC Stones is the world’s deepest oil and gas project, operating in around 2,900 meters (9,500 feet) of water in an ultra-deep area of the US Gulf of Mexico. Photo courtesy: Shell

Stones is the world’s deepest oil and gas project, operating in around 2,900 meters (9,500 feet) of water in an ultra-deep area of the US Gulf of Mexico. Photo courtesy: Shell Image courtesy: Kongsberg Maritime

Image courtesy: Kongsberg Maritime Harris CapRock Communications

Harris CapRock Communications The radio enables a fully secure, localized wireless data/voice network complete with traffic management. It provides first/last mile connection and can close links in excess of 160 km with appropriate heights. Licensed or unlicensed spectrum options are available with throughputs of up to 400 mbps. It is equipped with operating modes for Point-to-Point and Point-to-Multi-Point applications.

The radio enables a fully secure, localized wireless data/voice network complete with traffic management. It provides first/last mile connection and can close links in excess of 160 km with appropriate heights. Licensed or unlicensed spectrum options are available with throughputs of up to 400 mbps. It is equipped with operating modes for Point-to-Point and Point-to-Multi-Point applications. Last year’s Significant Contribution Award winner, Dan Purkis

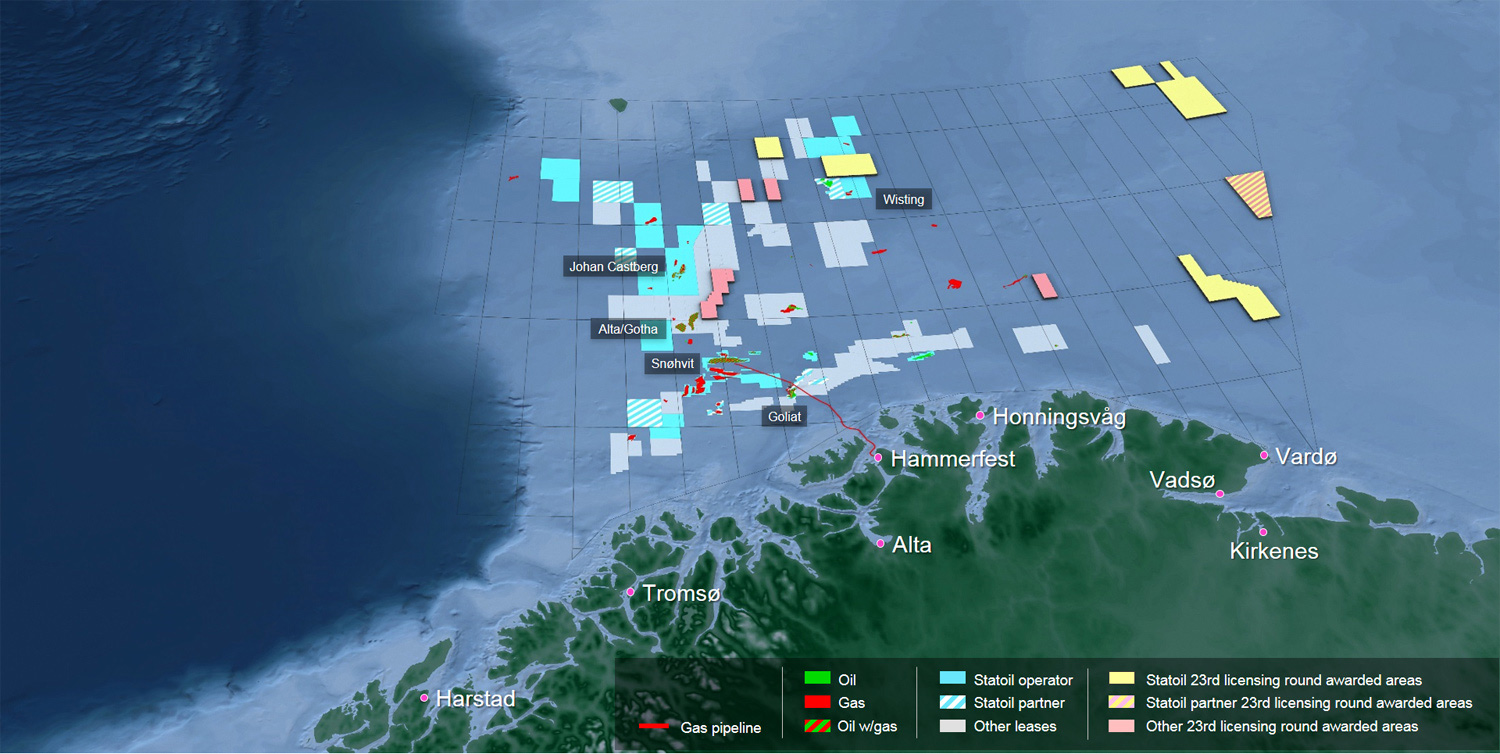

Last year’s Significant Contribution Award winner, Dan Purkis Image courtesy: Statoil

Image courtesy: Statoil CGG

CGG U.S. Crude Market Flat in August, But Tightening Is Ahead

U.S. Crude Market Flat in August, But Tightening Is Ahead

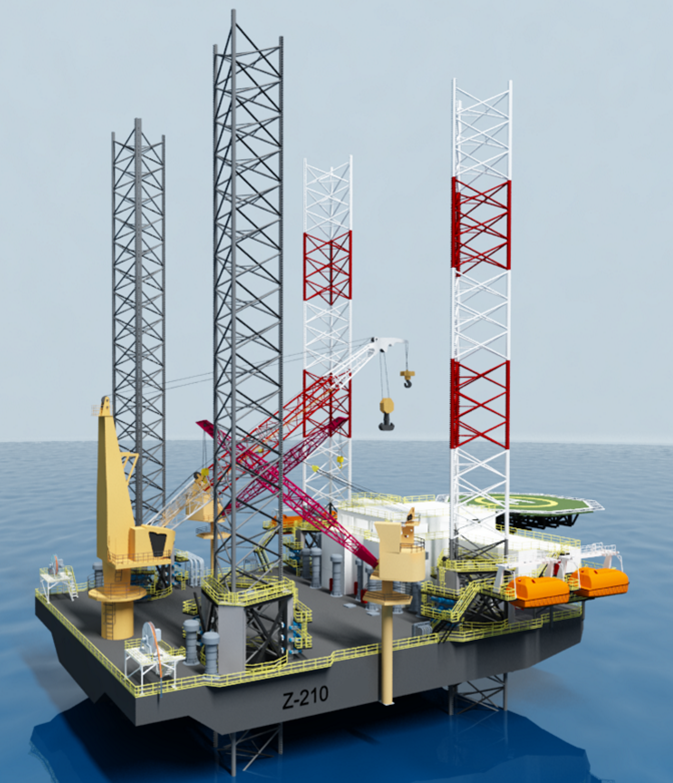

The Z-210 is a self-propelled, self-elevating, DP-2 capable, ABS Class, high-temperature (55 degrees Celsius) rated, four-legged mobile offshore unit.

The Z-210 is a self-propelled, self-elevating, DP-2 capable, ABS Class, high-temperature (55 degrees Celsius) rated, four-legged mobile offshore unit. The McMurdo SmartFind and Kannad SafePro EPIRBs will be the world’s first distress beacons that can support each of the four frequencies used in the search and rescue process: 406MHz and 121.5MHz for beacon transmission; GNSS for location positioning; and AIS for localized connectivity. This multiple-frequency capability will ensure faster detection, superior positioning accuracy, greater signal reliability and ultimately, accelerated rescue of people or vessels in distress.

The McMurdo SmartFind and Kannad SafePro EPIRBs will be the world’s first distress beacons that can support each of the four frequencies used in the search and rescue process: 406MHz and 121.5MHz for beacon transmission; GNSS for location positioning; and AIS for localized connectivity. This multiple-frequency capability will ensure faster detection, superior positioning accuracy, greater signal reliability and ultimately, accelerated rescue of people or vessels in distress.