With the oil & gas industry's push into new energy frontiers, the offshore pipeline industry is faced with greater technical challenges relating to pipelines and the expectation that it will optimize solutions to be cost effective. DNV GL is launching three new Joint Industry Projects (JIPs) to help the industry address these challenges.

With the oil & gas industry's push into new energy frontiers, the offshore pipeline industry is faced with greater technical challenges relating to pipelines and the expectation that it will optimize solutions to be cost effective. DNV GL is launching three new Joint Industry Projects (JIPs) to help the industry address these challenges.

The first JIP will make pipeline free span intervention less costly, the second will result in faster and more consistent pipeline repair and the last will optimize the design of pipeline components faster.

"Offshore pipelines are the veins on an offshore field development and represent a large part of the total investment and the value of the transported product can be enormous. DNV GL is committed to supporting the industry to work smarter, safer and greener. All three cooperation projects present an opportunity for the industry to work more efficiently, either through optimized and more reliable design, faster execution of projects, or safer and more robust operation", says Asle Venås, Global Director for Pipelines in DNV GL.

Free Spans in Trenches JIP

Gaps between the seabed and pipeline, known as free spans, can lead to vibrations which may damage the pipeline. "Lack of knowledge about the extent of vibrations in small gaps that typically occur on sandy seabeds means the industry is conservative and is potentially over-dimensioning designs and conducting unnecessary interventions. The DNV GL JIP aims to address this problem by developing improved free span assessments which will lead to fewer interventions and reduced cost," says Olav Fyrileiv, Project Manager, DNV GL – Oil & Gas.

The project comprises computational fluid dynamic analysis combined with a significant test program and the outcome will be an extension of DNV GL's Recommended Practice for Free Spanning Pipelines (DNV-RP-F105). DNV GL has already partnered with Dutch pipeline operator BBL Company V.O.F. and is now inviting other pipeline operators to also join the project.

Pipeline Repair JIP

Maintenance and modification technology on offshore pipelines is developing to accommodate deeper and harsher environments and reduce downtime. Technology and operational experience have been developed through several projects, such as remote pipeline operations using hyperbaric welding and Statoil's successful Hot Tap operations in the North Sea.

"DNV GL is inviting the main players in the pipeline repair equipment sector to collaborate with us in reviewing recent developments in pipeline repair and maintenance. We plan to develop formalized criteria and procedures in an updated version of DNV GL's Recommended Practice on Pipeline Subsea Repair (DNV-RP-F113). The aim is to reduce the time and cost spent on the design and execution of pipeline repairs," says Dag Øyvind Askheim, Project Manager, DNV GL – Oil & Gas.

Design of Pipeline Components JIP

Today, internationally recognized standards and recommended practices cover the limit state design of subsea pipelines. However, such design codes only provide high level guidance on how to consider pipeline components within a pipeline system.

Currently, there is not a consistent and unified approach to the design of pipeline components. With modern pipeline standards, the pipeline design is optimized and this gap becomes even more pronounced. The objective of this JIP will be to develop an approach, based on industry experience and best practice, to pipeline component design that is compatible with a modern pipeline limit state design code such as DNV-OS-F101. "The aim is to help prevent project delays, increased costs and, in some cases, compromised safety, which can happen when the interpretation of codes is stretched. We are inviting major players working with pipeline systems and components," says Jonathan Wiggen, Project Manager, DNV GL – Oil & Gas.

2H Offshore,

2H Offshore, Songa Dee (photo)

Songa Dee (photo) The Bureau of Safety and Environmental Enforcement (BSEE) published an Advanced Notice of Proposed Rulemaking today in the Federal Register Reading Room soliciting public comments on improving the safety of helideck and aviation fuel operations on fixed offshore facilities. This notice is the most recent step in BSEE's continued efforts to strengthen safety on the Outer Continental Shelf (OCS).

The Bureau of Safety and Environmental Enforcement (BSEE) published an Advanced Notice of Proposed Rulemaking today in the Federal Register Reading Room soliciting public comments on improving the safety of helideck and aviation fuel operations on fixed offshore facilities. This notice is the most recent step in BSEE's continued efforts to strengthen safety on the Outer Continental Shelf (OCS). The COSL Pioneer drilling rig.

(Photo: Ole Jørgen Bratland)

The COSL Pioneer drilling rig.

(Photo: Ole Jørgen Bratland) Claxton, an Acteon company, has released an

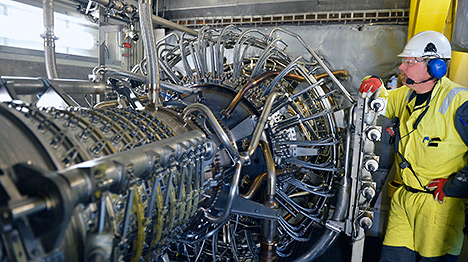

Claxton, an Acteon company, has released an  The compressor will help boost recovery rate and accelerate production on the Kvitebjørn field. (Photos: Harald Pettersen)

The compressor will help boost recovery rate and accelerate production on the Kvitebjørn field. (Photos: Harald Pettersen)

Production is now underway from the Cardamom development, the second major deep-water facility

Production is now underway from the Cardamom development, the second major deep-water facility  Bechtel

Bechtel Global energy company Repsol has selected

Global energy company Repsol has selected  Illustration: The Aasta Hansteen platform will be the largest SPAR platform in the world. (Illustration: GeoGraphic / Statoil)

Illustration: The Aasta Hansteen platform will be the largest SPAR platform in the world. (Illustration: GeoGraphic / Statoil) With the oil & gas industry's push into new energy frontiers, the offshore pipeline industry is faced with greater technical challenges relating to pipelines and the expectation that it will optimize solutions to be cost effective.

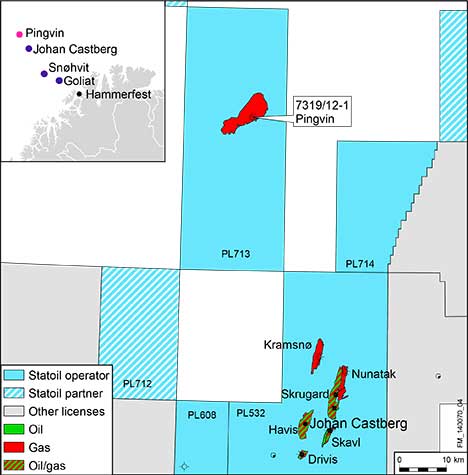

With the oil & gas industry's push into new energy frontiers, the offshore pipeline industry is faced with greater technical challenges relating to pipelines and the expectation that it will optimize solutions to be cost effective. The discovery well 7319/12-1, drilled by the drilling rig Transocean Spitsbergen, proved a 15-meter gas column in the well path. Statoil estimates the volumes in Pingvin to be in the range of 30-120 million barrels of recoverable oil equivalent. The discovery is currently assessed as non-commercial.

The discovery well 7319/12-1, drilled by the drilling rig Transocean Spitsbergen, proved a 15-meter gas column in the well path. Statoil estimates the volumes in Pingvin to be in the range of 30-120 million barrels of recoverable oil equivalent. The discovery is currently assessed as non-commercial.

Leading oil and gas experts are lined up to present at the 20th

Leading oil and gas experts are lined up to present at the 20th  McDermott subsea construction vessel NO102 installed umbilicals totaling 65 miles along with other related subsea structures. (Photo: Business Wire)

McDermott subsea construction vessel NO102 installed umbilicals totaling 65 miles along with other related subsea structures. (Photo: Business Wire) Statoil announces a small discovery in its Martin prospect located in the Gulf of Mexico (GoM). Statoil does not consider this to be a commercial discovery. The well has been drilled efficiently and plug and abandonment operations (P&A) are now ongoing.

Statoil announces a small discovery in its Martin prospect located in the Gulf of Mexico (GoM). Statoil does not consider this to be a commercial discovery. The well has been drilled efficiently and plug and abandonment operations (P&A) are now ongoing. The Stena Carron drillship (photo-right) will soon move to block 38 to spud the exploration well Jacaré-1.The Angolan pre-salt is a frontier play where Statoil will participate in eight commitment wells across five blocks.

The Stena Carron drillship (photo-right) will soon move to block 38 to spud the exploration well Jacaré-1.The Angolan pre-salt is a frontier play where Statoil will participate in eight commitment wells across five blocks.