Cairn together with its joint venture partners is pleased to announce that the FAN-1 exploration well, offshore Senegal, has discovered oil.

Cairn together with its joint venture partners is pleased to announce that the FAN-1 exploration well, offshore Senegal, has discovered oil.

The well, located in 1,427 meters (m) water depth and approximately 100 kilometers offshore in the Sangomar Deep block, has reached a Target Depth (TD) of 4,927 m and was targeting multiple stacked deepwater fans.

Preliminary analysis indicates:

• 29m of net oil bearing reservoir in Cretaceous sandstones

• No water contact was encountered in a gross oil bearing interval of more than

500m

• Distinct oils types ranging from 28° API up to 41° API indicated so far from

number of oil samples recovered to surface

• Initial gross STOIIP estimates for the FAN-1 well range from P90, 250 mmbbls,

P50, 950 mmbbls to P10, 2,500 mmbbls and are broadly in line with pre-drill

STOIIP estimates

As stated prior to the commencement of operations there are no plans for immediate well testing. Further evaluation will now be required to calibrate the well with the existing 3D seismic in order to determine future plans and optimal follow up locations to determine the extent of the discovered resource.

Once operations are completed on the FAN-1 well, the rig will move to complete the second well, SNE-1 where the top hole has been drilled pending re-entry.

This Shelf Edge Prospect targeting a dual objective in 1,100m water depth is in the Sangomar Deep block.

The FAN-1 well was drilled using the semi-submersible drilling unit "Cajun Express". It is the third well in Cairn's North West Africa program and first in Senegal.

Cairn has a 40% Working Interest (WI) in three blocks offshore Senegal (Sangomar Deep, Sangomar Offshore and Rusifique) ConocoPhillips has 35% WI, FAR Ltd 15% WI and Petrosen, the national oil company of Senegal 10% WI. The three blocks cover 7,490 km2.

Simon Thomson CEO Cairn Energy PLC said;

"The oil discovered in the FAN-1 prospect is an important event for Senegal and the Joint Venture.

We have encountered a very substantial oil bearing interval which may have significant potential as a standalone discovery. Furthermore, this result materially upgrades the prospectivity of the block with a proven petroleum system and a number of deep fan and shelf prospects established.

Work is already underway with the Joint Venture partners to determine follow up activity which is targeted for 2015 onwards.

Cairn looks forward to working with the Government of Senegal and our partners to realize the full potential from this large acreage position off the West coast of Senegal."

Merakes is the first exploration well drilled by Eni in the East Sepinggan Block, which was assigned to the Company in 2012 following an International Bid Round.

Merakes is the first exploration well drilled by Eni in the East Sepinggan Block, which was assigned to the Company in 2012 following an International Bid Round.

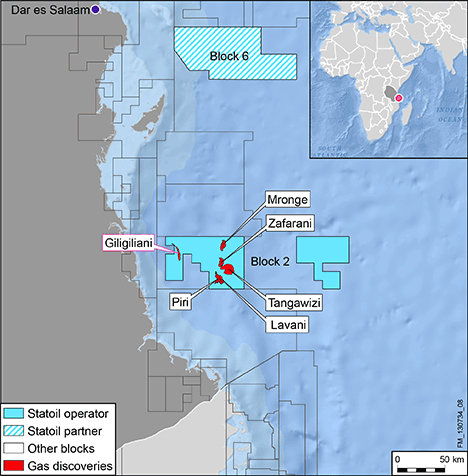

Statoil

Statoil

VAALCO Energy, Inc.

VAALCO Energy, Inc. The Grane platform in the North Sea. (Photo: Harald Pettersen)

The Grane platform in the North Sea. (Photo: Harald Pettersen) Statoil

Statoil  Alba Northern Platform (photograph courtesy of Chevron North Sea Limited)

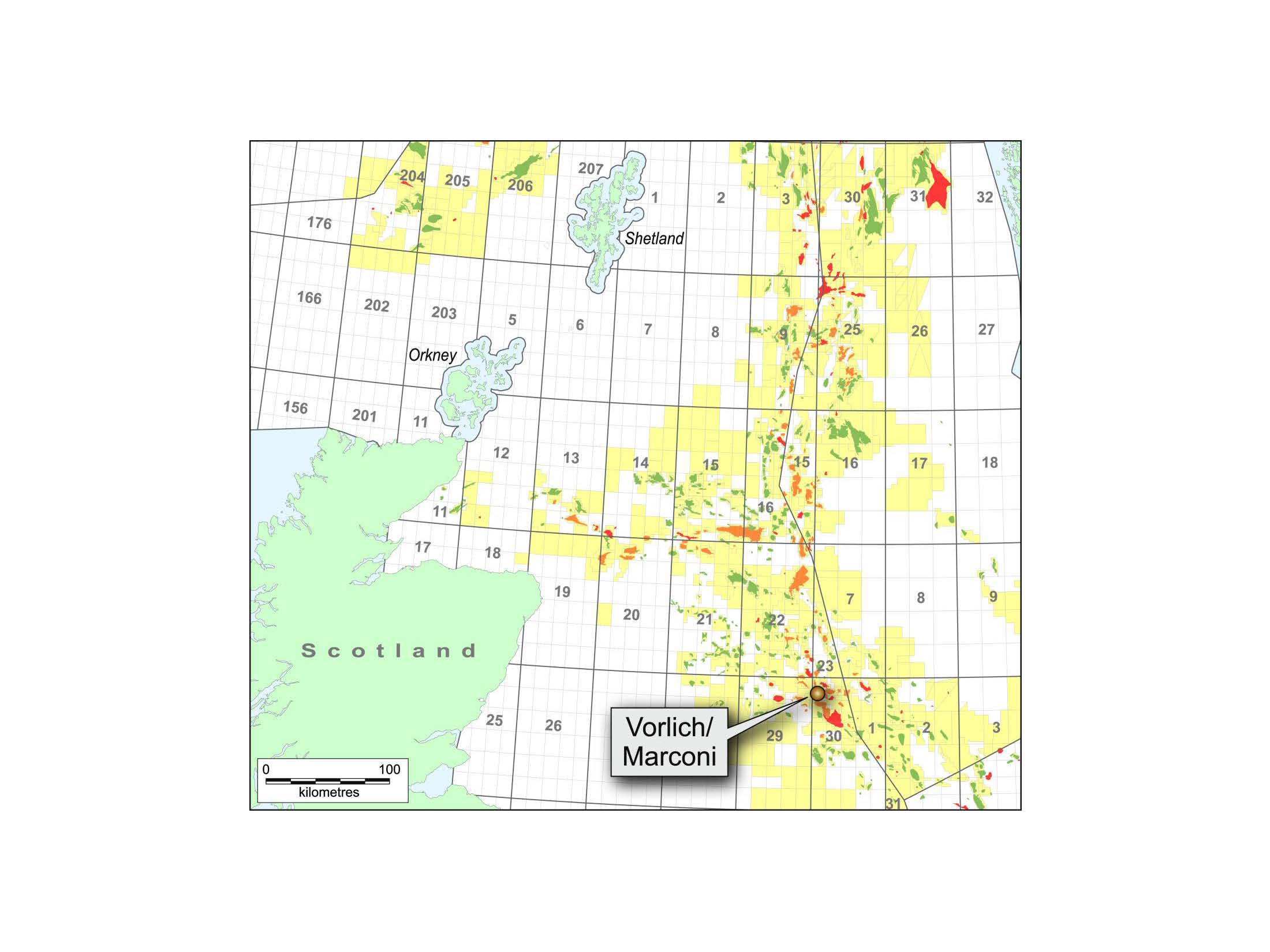

Alba Northern Platform (photograph courtesy of Chevron North Sea Limited) Left: Location map of Marconi/Vorlich CNS discovery

Left: Location map of Marconi/Vorlich CNS discovery

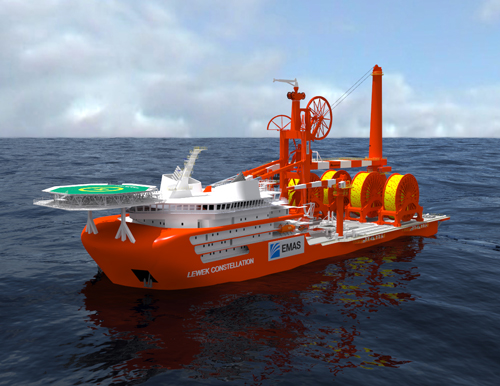

EMAS AMC, the subsea services division of

EMAS AMC, the subsea services division of  Eni's

Eni's  2H Offshore,

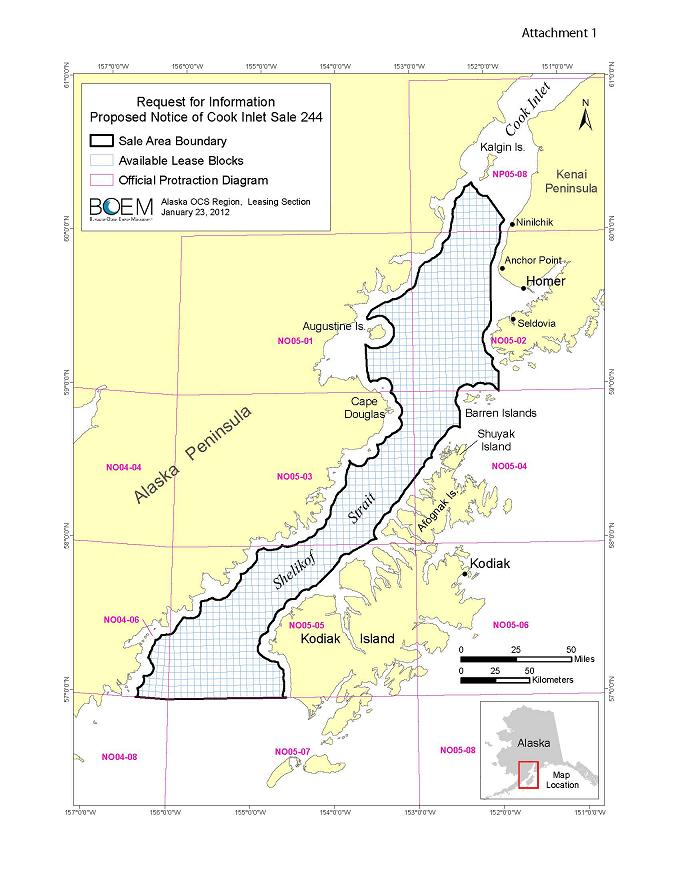

2H Offshore, The Bureau of Ocean Energy Management (BOEM) has announced that it will prepare an Environmental Impact Statement (EIS) in support of a potential oil and gas lease sale in Cook Inlet, off Alaska's south central coast.

The Notice of Intent to Prepare an EIS, which will be published in the Federal Register on Oct. 23, 2014, will open a public comment period extending through Monday, Dec. 8, 2014. During this time, BOEM will hold public scoping meetings and accept comments through

The Bureau of Ocean Energy Management (BOEM) has announced that it will prepare an Environmental Impact Statement (EIS) in support of a potential oil and gas lease sale in Cook Inlet, off Alaska's south central coast.

The Notice of Intent to Prepare an EIS, which will be published in the Federal Register on Oct. 23, 2014, will open a public comment period extending through Monday, Dec. 8, 2014. During this time, BOEM will hold public scoping meetings and accept comments through  SBM Offshore

SBM Offshore

Claxton, an Acteon company, has released an

Claxton, an Acteon company, has released an