Award-winning technology developed in the east of England is to be presented as a cost-saving solution for North Sea decommissioning at a major industry conference in Scotland this week.

Award-winning technology developed in the east of England is to be presented as a cost-saving solution for North Sea decommissioning at a major industry conference in Scotland this week.

Scour Prevention Systems will showcase how its patented scour prevention mats using end-of-life tires offer alterative effective protection for decommissioning oil and gas pipelines to delegates at this week’s Decommissioning: Technology Innovation Platform event hosted by Decom North Sea and the Oil and Gas Innovation Centre.

The company, based at OrbisEnergy, Lowestoft, is one of 10 companies chosen to present technology that has the potential to help companies achieve the 35% decommissioning cost reduction targeted by the Oil and Gas Authority (OGA).

Speakers at Thursday’s event at Aker Solutions’ building in Dyce, Aberdeen, include Colette Cohen, chief executive of the Oil and Gas Technology Centre, and Jim Christie, OGA head of decommissioning. Scour Prevention Systems’ John Best and Alistair Punt will explain to delegates the potential savings of tire mats compared to traditional methods such as concrete mattresses or rock armor.

They take less time to install, have no threat of pipeline damage and need no direct remedial works. Furthermore, with an increasing number of cables of offshore wind being installed, the mats provide an effective crossing bridge at an interface with a decommissioned pipeline, they will tell delegates.

“Our aim is to raise awareness that our product is out there as a proven, market-ready and cost effective solution to be considered when people planning decommissioning are evaluating solutions,” said Mr. Best. “Our technology of matrices of recycled vehicle tires has proved to be very successful and is something we believe potential users need to be made aware of so they have a wider choice.”

“When pipelines are being decommissioned, our mats’ design helps to reinstate seabed cover and leave the pipeline secure and protected in a non-obtrusive manner.”

“The product effectively stabilize the seabed over pipelines forming a secure protective layer, protecting the pipeline from exposure and damage, providing a cost effective and easy-to-install solution to pipeline decommissioning.

The mats have been trialed and successfully demonstrated in the North Sea and used to remediate and prevent further scour around offshore wind foundations, and protecting telecoms cables subsea infrastructure.

Lightweight and modular, they require one-off installation without divers or trenching and provide a smooth contour created by the unique properties of the patented design. The mats also protect the pipeline from dragged anchors, fishing equipment and hydrodynamic forces.

Scour Prevention Systems have developed their effective product range, consulting with industry, clients and with assistance from research bodies including expert advice from the Offshore Renewable Energy Catapult. They also secured a SCORE grant to help it take its technology to the next phase two years ago and support the development of appropriate lifting and decommissioning procedures

A new £6m SCORE program launched earlier this year at OrbisEnergy will help companies develop their innovations.

The tire mat invention was a previous winner of the East of England Energy Group’s (EEEGR) Innovation Award.

Mr. Best, a former EEEGR CEO, said: “I am particularly delighted that, in my previous role with EEEGR, Scour Prevention Systems’ mats was an innovation award winner and seeing it moving forward into the industrial deployment is particularly exciting.”

Award-winning technology developed in the east of England is to be presented as a cost-saving solution for North Sea decommissioning at a major industry conference in Scotland this week.

Award-winning technology developed in the east of England is to be presented as a cost-saving solution for North Sea decommissioning at a major industry conference in Scotland this week.

Driven by the increasing requirements for harsh environment

Driven by the increasing requirements for harsh environment  The

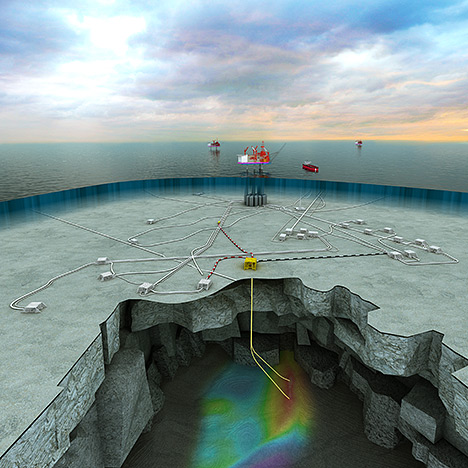

The  Stones is the world’s deepest oil and gas project, operating in around 2,900 meters (9,500 feet) of water in an ultra-deep area of the US Gulf of Mexico. Photo courtesy: Shell

Stones is the world’s deepest oil and gas project, operating in around 2,900 meters (9,500 feet) of water in an ultra-deep area of the US Gulf of Mexico. Photo courtesy: Shell SafeEx’ tablet-based inspection and maintenance software allows you to perform all routines in one procedure.

SafeEx’ tablet-based inspection and maintenance software allows you to perform all routines in one procedure. The development helps maximize production, in addition to boosting Troll C production and activities. (Photo: Øyvind Hagen)

The development helps maximize production, in addition to boosting Troll C production and activities. (Photo: Øyvind Hagen)

"This immediately accretive, bolt-on transaction strengthens our industry-leading position in the Gulf of Mexico and is a catalyst for the company's oil-growth objectives, with quality assets being acquired at an attractive price to create significant value," said Anadarko Chairman, President and CEO Al Walker. "We expect these acquired assets to generate substantial free cash flow,(1) enhancing our ability to increase U.S. onshore activity in the Delaware and DJ basins. Our current plans are to add two rigs in each play later this year, and to increase activity further thereafter, with an expectation of more than doubling our production to at least 600,000 BOE per day collectively from these two basins over the next five years. This increased activity would drive a company-wide 10- to 12-percent compounded annual growth rate in oil volumes over the same time horizon in a $50 to $60 oil-price environment, while investing within cash flows. Additionally, the transaction expands Anadarko's infrastructure in the Gulf, adds to our unmatched inventory of low-cost, subsea tieback opportunities, and bolsters optionality with new exploration prospects. The company's Gulf of Mexico position, with the addition of these properties, will have net sales volumes of approximately 155,000 BOE per day, comprised of approximately 85-percent oil."

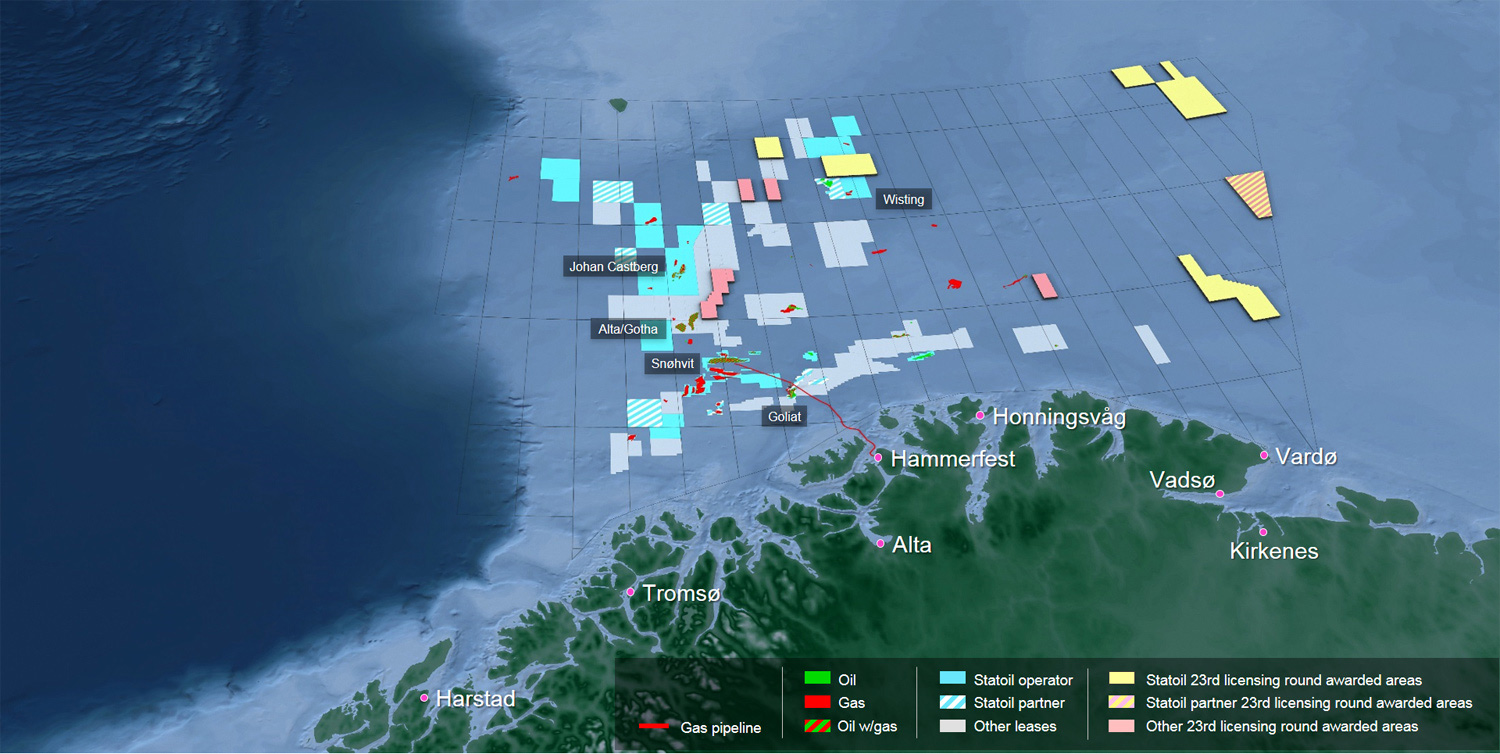

"This immediately accretive, bolt-on transaction strengthens our industry-leading position in the Gulf of Mexico and is a catalyst for the company's oil-growth objectives, with quality assets being acquired at an attractive price to create significant value," said Anadarko Chairman, President and CEO Al Walker. "We expect these acquired assets to generate substantial free cash flow,(1) enhancing our ability to increase U.S. onshore activity in the Delaware and DJ basins. Our current plans are to add two rigs in each play later this year, and to increase activity further thereafter, with an expectation of more than doubling our production to at least 600,000 BOE per day collectively from these two basins over the next five years. This increased activity would drive a company-wide 10- to 12-percent compounded annual growth rate in oil volumes over the same time horizon in a $50 to $60 oil-price environment, while investing within cash flows. Additionally, the transaction expands Anadarko's infrastructure in the Gulf, adds to our unmatched inventory of low-cost, subsea tieback opportunities, and bolsters optionality with new exploration prospects. The company's Gulf of Mexico position, with the addition of these properties, will have net sales volumes of approximately 155,000 BOE per day, comprised of approximately 85-percent oil." Image courtesy: Statoil

Image courtesy: Statoil

Claxton, an

Claxton, an  Maersk Drilling

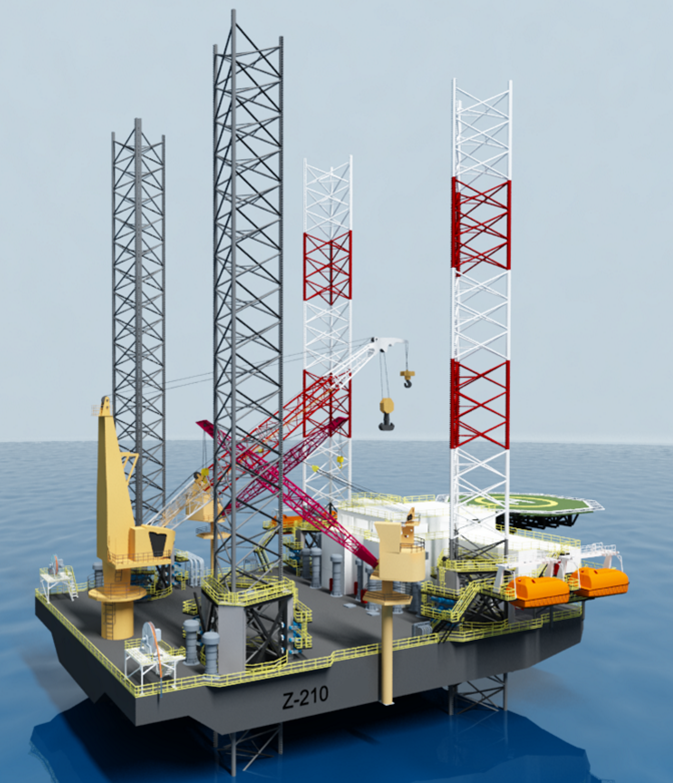

Maersk Drilling The Z-210 is a self-propelled, self-elevating, DP-2 capable, ABS Class, high-temperature (55 degrees Celsius) rated, four-legged mobile offshore unit.

The Z-210 is a self-propelled, self-elevating, DP-2 capable, ABS Class, high-temperature (55 degrees Celsius) rated, four-legged mobile offshore unit. Maersk Gallant. Photo courtesy: Maersk Drilling

Maersk Gallant. Photo courtesy: Maersk Drilling The Njord A platform being towed by the anchor handling tug supply vessel "KL Sandefjord". (Photo: Thomas Sola/Statoil)

The Njord A platform being towed by the anchor handling tug supply vessel "KL Sandefjord". (Photo: Thomas Sola/Statoil)