Large U.S. Product Build

Large U.S. Product Build Overall commercial stocks built by 6 million barrels for the latest week, as products led the way gaining about 7.1 million barrels. Distillate inventory added a quite large 4.6 million barrels as reported demand showed a big decline from the previous week. Total product demand dropped from the prior week falling around 1.1 MMB/D to 20.2 MMB/D. Key products are expected to experience stock draws next week led by distillate’s 1.7 million barrels decline. Crude runs are expected to continue falling as the turnaround season commences.

Southern Europe Pricing is Being Rewritten this 3Q

Southwestern Europe has been fed an array of problems recently that are rewriting how gas is priced in the region. Gas pricing in Southern France has traditionally traded versus spreads to Northern France. Recently, we’ve seen a dislocation due to physical constraints that not only indicate a potential shift, but reminds us that regional pricing does not have to mean national pricing.

Continued Hot Weather Stresses Generation

Most Eastern markets recorded strong gains in On-peak prices in August due to a combination of higher cooling demand and unplanned outages. Generator outages at St. Clair (MISO), Millstone (New England) and Watts Bar 2 (SERC) being a few cases. Loads in the East and ERCOT combined rose by 5.1% year-on-year (21.5 aGW) in August as cooling degree days increased by nearly 27%. PIRA continues to be bullish winter 2016-17 fuel prices due to stronger demand year-on-year and concerns about near term supply.

A Neutral Shift in 2017

While natural gas and eastern coal forwards have firmed recently, PIRA sees increasing signs that coal markets will tighten through this coming winter, but then face a subsequent deflation as natural gas prices ease during the latter half of next year.

EU ETS Sees Declining Power Emissions, No Clarity on Policy Support

Declining power emissions and rising auction supply suggest limited EUA price gains. An EU Parliamentary committee may propose stronger post-2020 market reforms, but PIRA is not assuming additional policy support absent a better sense of whether an ambitious proposal can actually be passed. An expected higher energy efficiency target provides a bearish policy signal. With modest price gains expected for thermal fuels this year, even a higher correlation with oil and gas prices may not provide much support for EUAs.

Cash Basis in Flux

Cash markets saw some wild swings last week as harvest gets rolling while the action in futures was pretty mundane. “Quick ship” premiums for new crop soybeans stretched to almost a $1.00 difference as compared to just a few weeks down the line. Farmers as far north as DeKalb, Illinois jumped on the opportunity if their early-planted beans were ready to go. Midweek saw a dramatic drop in CIF basis as the early week response filled immediate needs.

Global Equities Ease on the Week

Global equities were again lower on the week. The U.S. market did relatively well and was little changed. Technology led in performance, followed by utilities. Energy was the weakest of the tracking indices. Internationally, China performed the best, up modestly, while Latin America and Europe were the weakest.

U.S. Propane Prices Climb Higher

U.S. propane prices shrugged of a rather large two million barrel U.S. C3 inventory build, and embraced seasonality instead, gaining 1.7% to settle just below 50¢/gal (October futures) equating to a stronger 49% of WTI. PIRA’s forecast is for propane to price at 51% of WTI in October.

U.S. Ethanol Prices Continued to Rally the Week Ending September 9

Margins remain near the highest level in over six weeks. RIN values rose. Japanese Runs Dropped, Imports Declined and Stocks Drew Runs dropped sharply due to higher downtime, both planned and unplanned. Runs will continue declining through much of the month. Crude imports moved sufficiently lower to induce a 1.05 MMBbl crude stock draw. Finished product stocks built 1.6 MMBbls, with about half being in the jet-kero complex. Refining margins continue to improve from abysmal levels. On the week, all the major cracks posted gains.

September Fundamentals Buck Seasonal Trend

The market’s latest rally, supported by a one-two punch of stronger-than-expected pipeline deliveries to Sabine Pass and a seasonally substantial CDD count, will be tested by the inevitable acceleration in refills as underscored by yesterday’s reported relatively stout build. Yet, this month’s more constructive fundamentals that finally lowered PIRA’s end-October outlook more decidedly toward 3.9 TCF, should set the stage for another sustained price advance that bucks traditional seasonal trends.

UK Power Prices Skyrocket…And It's Not Even Winter Yet

U.K. power prices have been on a rollercoaster ride, with hourly spot prices reaching a multi-year high of £999/MWh on the evening of September 15, while accepted prices on the balancing market have been as high as £1,500/MWh in the last few days. Higher plant unavailability, coupled with low wind output, is now bringing to fore reliability concerns, which will be underpinning power generator margins in the upcoming months. Dark spreads have also widened to a point that may start to encourage more units to come back online.

Price Rally Resumes on China Heat, Tight Prompt Physical Market

The accord on raising China's coal production was not able to completely quell the upward momentum on seaborne coal prices this week, with sizeable gains shown for all three major forward curves. The prompt market is fairly tight, even in the Atlantic Basin, with limited availability of Colombian cargoes, high demand in China and rain-constrained output in Indonesia keeping the Pacific Basin market tight. Once the back of the winter is broken, this short-term tightness will ease. This is reflected in the steeper backwardation in current market forwards. PIRA believes that the current tightness in the market simply cannot last much longer and that the market is overly pessimistic regarding 2017 prices.

Washington State Joins the Club of Carbon Pricing States

Washington State has finalized its regulatory program to reduce GHG emissions in the state, with compliance to start in 2017 – even as the November elections and ballot initiatives can lead to significant changes. Unable to implement a typical cap and trade program, the policy design allows for compliance through different instruments, including those from out of state programs. Initial reduction requirements are low – and it is expected that there will be enough available low cost WA-eligible RECs and other supply to minimize/eliminate demand for California Carbon allowances.

Inflation Expectations Rise

The S&P 500 was only modestly changed on the week. Volatility, after rising early in the week, settled back and ended the week lower. High yield and emerging market debt, however, sold off in price. The dollar was generally stronger, while commodities were slightly lower. The Cleveland Fed released their inflation estimates for September, which showed a second consecutive monthly increase across all the major maturities.

Stocks Fall to the Lowest Level of the Year the Week Ending September 9

Ethanol output increased by 6 MB/D to 1,004 MB/D, breaking a string of three consecutive weekly declines. Ethanol-blended gasoline manufacture fell to a nine-week low 9,142 MB/D.

Harvest Slowed by Weekend Rains

A relatively light weekend as far as the number of harvest reports received although the theme of below 2014 corn yields and very impressive soybean yields continued. Six Iowa reports averaged 7.5 bpa better than last year in soybeans while one Illinois report was an astounding 17 bpa better than last year’s 57 bpa in the EC part of the state. Corn yields in Illinois remain 5-10 bpa below 2014.

Asian Demand Growth: Reversal of the Slowdown is Imminent

PIRA's latest update of major country Asian product demand shows a continued slowdown in growth. Our latest assessment of growth is now 483 MB/D versus year-ago. It is worth noting that there was improved growth in gasoline and gasoil/diesel demand, which should be a harbinger of things to come. In our assessment last month we pointed out that growth would pick up in 4Q, fairly significantly. That expectation is still on track. We estimate Asian demand growth bottomed in August. When September and October data begin to roll in, demand growth will begin to move noticeably higher.

Bulgarian Gas Prices on the Rise

Bulgargaz has proposed to increase natural gas price for consumers by 3.4% for the fourth quarter of 2016. The proposed increase, which will be first since the beginning of the year, is due to the expected higher prices of gas supplies in the fourth quarter and the weaker Bulgarian lev. Bulgargaz submitted a formal proposal for the increase to the Bulgarian water and energy regulator KEVR on September 10.

California Carbon Awaiting Emissions Data, Legal Rulings

Benchmark contract prices moved up to average $12.85 in August, above the auction reserve price. Trading volumes remain weak and open interest is down year-on-year, though call options were actively traded. The August auction was undersubscribed, with a low coverage ratio. Continued undersubscription in November could see allowances moved to the Reserve, leaving less supply for compliance. Concerns over the validity of the auctions and also the cap and trade program post-2020 linger. Near term emissions data releases and court developments regarding the auction litigation can move the market.

Vehicle Sales in U.S. and China Remain Key to Growth

Growth in vehicle sales has played an important role in the U.S.’s economic recovery over the last seven years. Worrisomely, however, there are indications that the vehicle sector may have begun to run out of breath. One sign is a sharp rise in the amount of auto loan outstanding, and another is the recent behavior of used car prices in the CPI data. In China, growth in industrial production accelerated during August, with large gains in auto production playing a role. Recent data on Chinese car sales corroborated the findings from gasoline demand statistics.

Measures of Reserves Becoming Increasingly Less Relevant to Forecasting Future Production

Oil resources and reserves can be developed into production and as a result the industry has followed these numbers closely as a guide to the source and volume of future production. However, common measures of the resource base have always had limited value in predicting future production growth. We are now at a point where essentially ALL of the future non-OPEC crude production growth to 2035 is seen as coming from sources that either were not in the resource base as little as 10 years ago (shale) or were not in US EIA's proved reserves 10-15 years ago (Orinoco and oil sands).

Costs to Produce and Replace Oil Supplies are About to Bottom

The current low oil price environment has made it cheaper to operate existing oil fields and to develop new supplies. Since 2014, the worldwide Brent Equivalent costs to operate current supplies have decreased by around 13% while full-cycle costs to develop new supplies have been reduced by 28% for U.S. shale and 16% for non-shale developments worldwide. However, in spite of these reductions, many new projects (deep water, Canadian oil sands) still require Brent prices well above $50/Bbl to become profitable. The ongoing rebalancing of oil markets points to inevitably higher crude prices which will increase operator profitability. However, historically, when oil prices increase so do costs and hence cost deflation is probably about to be over. We are likely to see cost increases starting in 2017 although they will not necessarily be uniform across oil plays.

Counter Balancing in Counter Seasonal Markets

The counter-seasonal buying patterns of countries in South America, the Mideast, and Asia have taken on much greater prominence this year. Both the US and Australia have ramped up export volumes, effectively leaving the market with even more volumes to absorb in the second and third quarters when global LNG demand is at a seasonal low.

Chinese Refiners Adapt to Structural Changes and Rising Competition in the Downstream Sector

The structural reforms occurring in the Chinese economy are leading to somewhat slower overall oil demand growth. But more pronounced is the shift to more rapid growth in light products and slower growth or even declines in gasoil and some heavier products. These changing trends are having their impact on the Chinese refining industry. In particular, Chinese refiners have increased gasoline yields and imported large amounts of mixed aromatics for blending into gasoline, and decreased yields for slower growing products. Also, as oil demand growth for refined products has slowed, this has led to an effective capacity surplus. Part of the solution will be to increase exports, rationalize inefficient capacity, and slow down new projects. The recent changes in China policy to grant crude import and product export quotas to independent refineries will move the industry in that direction by creating more competition among Chinese refiners and will remove inefficient refining capacity.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

U.S. Crude Stocks Decline on Favorable Import/Export Arb

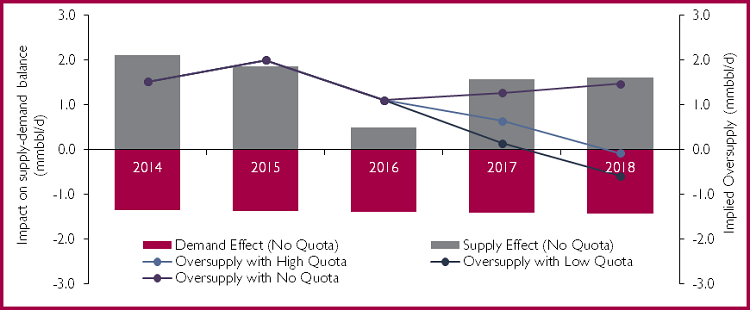

U.S. Crude Stocks Decline on Favorable Import/Export Arb Last week we covered the OPEC announcement on production cuts, a strategy to reduce over-supply in the market and give a much needed boost to oil prices. Without higher oil prices, many new projects are thought to be uneconomic. Or are they? Douglas-Westwood has recently reviewed over 250 upstream capital projects sanctioned in the last four years to assess how industry costs are moving. The results are remarkable.

Last week we covered the OPEC announcement on production cuts, a strategy to reduce over-supply in the market and give a much needed boost to oil prices. Without higher oil prices, many new projects are thought to be uneconomic. Or are they? Douglas-Westwood has recently reviewed over 250 upstream capital projects sanctioned in the last four years to assess how industry costs are moving. The results are remarkable.

Oil Prices Are Supported by Surplus Stocks Declining

Oil Prices Are Supported by Surplus Stocks Declining Large U.S. Product Build

Large U.S. Product Build