With OPEC Delivering on Cuts, Prices to Move Higher

With OPEC Delivering on Cuts, Prices to Move Higher

Reflation backdrop together with OPEC cuts are very bullish for oil prices. OPEC cuts and the momentum of supply losses will make it difficult for the supply chain to turnaround fast enough to avoid very low oil inventories in second half 2017. Geopolitical risks suggest downside to PIRA’s supply forecast. Refining margins to stay relatively healthy with help from increased light product pull by Latin America. Global bunker spec changes will be a game changer in three years, but will affect investment plans long before then.

Primed for Seasonal Recovery

Cash prices this month have been whipsawed by exaggerated NYMEX volatility, with abnormally mild weather the driving force. Yet, colder forecast changes on the horizon have restored a bid under cash prices, with further price appreciation waiting on December storage withdrawals.

History Lesson

There’s historical context attached to every comment in today’s report, and here’s one more. An old CBOT saying goes “Bulls feast on Thanksgiving, Bears feast on Christmas”. This year the bulls had a good Turkey Run in corn and beans while wheat lagged, setting up the possibility of the old adage coming true again.

U.S. Ethanol Prices Rise in November

Prices were supported by robust exports resulting in a large drop in stockpile. Manufacturing margins increased as product prices rose faster than corn costs. The EPA set the final biofuels mandates and standards for 2017. RIN prices soared.

Positive Data for Global Growth This Week, but with Asterisks

The November U.S. payroll report was constructive for the economic outlook, as most industries reported solid job growth. A separate household survey of the labor market, however, was potentially worrisome: the unemployment rate fell sharply, as a result of unemployed people dropping out of the labor force in significant numbers. How Fed policymakers assess this development will have a large bearing on monetary policy in the coming periods. In emerging economies, India reported solid GDP growth for the third quarter. Brazil’s activity data disappointed. China’s industrial confidence indicators continued to improve.

Coal Prices Range Bound in Mixed Week

Coal pricing was mixed this week, with the bullish rally that prevailed last week extended into Monday/Tuesday, although prices then moved lower over the balance of the week. The news that several major Chinese coal producers were signing term deals with consumers at the coal trade fair in Hebei this week gave the market a bearish push. Additionally, the chairman of the China National Coal Association stated this week that China's coal prices will stabilize in the 550-600 yuan/mt range ($80-$87/mt), further underscoring the push from China to deflate high coal prices. 1Q17 FOB Newcastle prices declined by the largest extent, falling by over $2.00/mt while API#2 and API#4 prices managed slight week-on-week increases despite downward pressure over the second half of the week. Looking forward, coal demand is on firm fundamental footing with recent cold weather boosting electricity demand and with hydro generation likely to remain soft into 1Q17. Additionally, seasonal risks to coal production and transportation have not yet peaked, which should prevent much further price erosion and may foster a pricing rebound.

Key U.S. Regs Continue to Be Issued; Many Face Likely Repeal

The Obama Administration is finalizing regulations, despite threats of Congressional Review Act repeal. EPA continues to work on the Clean Power Plan’s FIP and the model trading rules. Amendments to the Regional Haze Rule, are being finalized. Final GHG emission standards for heavy-duty vehicles were published, along with the CSAPR rule impacting power plant NOx emissions. RFS standards for 2017 and 2018 have been finalized but not yet published. EPA released a proposed determination not to revise CAFE standards for 2022-2025. DOI regulation of venting and flaring on federal lands has been published. Final rules after May 30, 2016, may fall under CRA review. Since mid-May, 49 "major" rules and 973 non-major rules have been received by GAO.

Outlook Brightens Following Weak November

Downside risks noted last month came to fruition in November, but they quickly dissipated as gas prices reversed course during the second half of the month and precipitation declined to below-normal levels. Precipitation above The Dalles averaged 56% of normal through November 25; the water year to date remains above normal, but runoff projections have been trimmed. Although implied heat rates remain down year-on-year through the first half of 2017 as the market digests solar capacity additions, higher gas prices, and increases in hydro supply (even after the markdown), we expect a rebound during the second half of the year.

Demand Strength Supports Refining Margins

Prices will move higher with ongoing rebalancing. Demand growth is healthy. Relatively firm gasoline cracks support margins. Light product stock levels are still high but declining. Product price spreads shift from favoring gasoline toward distillate but gasoline comes back quickly in 2017. Global bunker sulfur limits drop to 0.5%beginning in 2020. No near term impact on prompt prices, but it will affect forward curves and investment decisions; European sour crude refiners will need to adapt.

Early Winter Draws on Bevy of Supplies, But Not LNG

European gas markets are demand focused at the moment — focusing on increasing gas-to-power demand and cooler-than-normal temperatures. Power demand across Central and Western Europe is up 70 mmcm/d year-on-year; however, the big shift, really happened in September. Much of the current increases in demand are seasonal. At the same time, heating demand for residential and commercial sectors is seeing the first higher-than-normal numbers in consecutive months for six years. The last time we saw this sort of continued cold was in 2010, which coincidentally was also a La Nina year.

Global Equities Consolidate from Record Levels

Global equity markets posted a degree of consolidation from record highs. In the U.S., among the key tracking indices, energy performed the best on the back of higher oil prices in the wake of the OPEC agreement to cut output. Banking and materials also outperformed, while housing was the weakest performer. Internationally, the tracking indices were mostly lower, with Latin American displaying the greatest retrenchment. Japan was modestly higher.

U.S. LPG Prices Pulled Higher by Crude, Fundamentals

U.S. LPG prices mostly rose in line with the broader energy markets. January Mt Belvieu propane prices gained 7.4¢ to settle at 62¢/gal Friday, the highest level yet in 2016. Similarly, n-butane at the market center gained 12.7% to 83.6¢. Cash isobutane continued to rally last week, encouraged higher by the latest EIA inventories, which for September put iC4 stocks at 8.3 MMB vs 9.5 in the year ago period. Isobutane prices ended the week at a strong 19¢ premium to normal. Ethane prices rose faster than Henry Hub natural gas, and thus C2’s premium to gas in BTU terms gained to 26¢ from 12¢ a week ago.

U.S. Ethanol Stocks Drop

The week ending November 25, U.S. ethanol stocks dropped to the lowest level since October 2015. Ethanol production decreased by 2 MB/D to a still-high 1,012 MB/D. Ethanol-blended gasoline manufacture fell to 8,998 MB/D, dipping below 9 MMB/D for only the second time over the last six months.

Very High Levels of Product Imports Move into Latin America Due to Restrained Refinery Operations

4Q16 Latin American gasoline demand is set to decrease by ~10 MB/D year-on-year while diesel consumption declines by ~50 MB/D year-on-year. 4Q16 Latin American crude runs are forecast to fall 335 MB/D year-on-year. Petrobras’ Brazilian automotive fuel pricing policy changed and will drive domestic ex-refinery prices to converge towards their respective opportunity costs. In the U.S., gasoline cracks have weakened but remain healthy for the season. Distillate cracks remain relatively soft but should rise in the short term as the heating season progresses.

The OPEC Cut and NW European Pricing: The Link Is Still Important

The OPEC production cut has sent Brent crude screaming up more than $11/bbl ($1.88/MMBtu) higher than recent lows. This increase will have strong implications for gas flows in the coming months due to the relative value of spot versus oil-indexed gas. Recently, the latter had been selling well under hub pricing in certain markets, enjoying a significant price advantage for many buyers — something that has never in modern times been consistently enjoyed by major supply contract holders. This advantage is withering quickly and the price response to the OPEC meeting will extend the effect well into 2017.

Testing System Adequacy

French nuclear availability for December has been further downgraded. While the outlook for nuclear in January and February 2017 is very similar to our prior monthly report, we still see risks of further outage extensions. This is to say that France will remain heavily dependent on imports to balance the system at on-peak hours during December and, almost certainly, January. The partial cut-off of France-U.K. interconnector availability through February/March enhances the risks of exceptional measures and/or systemic balancing failures on both sides. As French and U.K. prices will remain even more weather-driven, German peak prices are already factoring in a bullish market context, with price upsides only emerging under a scenario of poor wind availability for extended periods.

Bullish Rally Stalls; All Eyes on China

The rally in coal pricing continued into the early stages of November, although on news of supply contracts being signed in China, pricing dropped significantly. Prices have recovered in recent days, although remain well below last month’s peaks. Sort-term fundamentals remain strong, particularly with asymmetrical pricing risks to the upside from the potential of winter weather boosting demand and curtailing supply (production and transportation). PIRA remains bullish into 2017, although we note that some of the frictional factors boosting prices (misaligned supply/demand domestically in China) will evaporate over 2017, and 2018 will be a more bearish picture, particularly if the supply side cannot hold discipline.

Capacity Mechanisms: EC Proposes to Set Stringent Emissions Limits for Capacity Payments, Primarily Penalizing Coal Plants

This week saw the European Commission publish the Winter Package, a set of proposals that aims at delivering on the global climate deal reached with the 2015 Paris Agreement. The package details the vision of the EC regarding the decarbonization of the energy sector with the integration of renewables, outlines energy efficiency targets by 2030 and 2050, and discusses the potential effects on the security of supply in the transition phase. While these may be seen as long-term issues, nevertheless we thought the documents offer some important medium-term implications for coal and other higher emitting capacities.

Qatari LNG Pricing: The True Global Benchmark Lingers below the Surface

This week’s OPEC meeting reminds us that while Saudi Arabia does not control the price of global crude markets, its underlying influence on the price of Brent and WTI is without question. And so it goes with Qatar and its influence on LNG prices. Qatari prices do not play an active role in the price of NBP or JKM, but without question, Qatari prices reflect the state of the market.

Equity Eases, Energy Gains

The equity market eased slightly off its record close from last Friday. Volatility increased, and debt performance weakened. All of the adjustments are seen as within the bounds of consolidation. Fears of the outcome of the Italian referendum over the past weekend did not appear to have rattled the markets too badly this past week. The big winner of the week was energy, due to the OPEC agreement to cut output and the subsequent rise in oil prices.

Small U.S. Commercial Build, With Products Leading the Gain

Total commercial stocks only added 0.5 million barrels for the latest week. Crude stocks drew by 0.9 million barrels as crude imports were flat. The four major products experienced a 7.6 million barrel stock build, led by distillate’s nearly 5 million barrel increase. The major product build was partly offset by the large declines in NGL storage. The net total product inventory gain was 1.4 million barrels. Next week’s EIA data is expected to see another crude stock draw. The three major light products are anticipated to build by 5.8 million barrels, led by a build in gasoline stocks.

Running of the Bulls: Prices Rise on Cold Forecast

A rather abrupt change in the weather forecast has unleashed heavy natural gas futures buying, with the current week on track to add yet another ~0.25¢ to the Jan 2016 contract. Since establishing a near-term low of $2.88/MMBtu back on November 17, the Jan 2016 contract has since recovered ~0.60¢ to ~$3.50/MMBtu as the forecast (initially heralding a warmer-than-normal start to December) has given way to a much cooler outlook. Yet, with the front of the curve now closing in on the calendar-year high established mid-October, there is a risk that these newly minted wagers on winter-time rebalancing could likewise prove premature.

Pakistan Approves Gas Price Reduction

Pakistan’s Economic Coordination Committee (ECC) of the cabinet approved a nearly 33% cut in prices of natural gas, the first such slash this year, for the industrial sector. A statement said that Ishaq Dar, minister for finance, chaired the ECC meeting, which “… approved reduction of gas price for industry. In accordance with Fertilizer Policy 2001, the industrial sector's gas sale price will also be applicable to the fertilizer sector and only for fuel and not feed stock,” it added.

Coal Stocks Decidedly Lower

EIA data estimates for electric power sector stockpiles as of end-September came in at 158.2 MMst, slightly higher than PIRA expected, but 4.4 MMst lower than August and 4.5 MMst lower than last September. As stocks generally build in September due to shoulder season weather, news of a September drawdown is positive for stockpile normalization. We maintain that U.S. power sector coal burn will rise year-on-year steadily through June 2017, and we will see stockpiles descend further toward normal levels.

Japanese Product Demand Continues to Rise Amid Higher Runs

Crude runs rose with turnarounds winding down. Crude imports fell back such that crude stocks corrected back down 2.4 MMBbls. Finished products built 1.1 MMBbls off their cyclical low. Compared to year-ago, the deficits on crude, finished products and total commercial stocks narrowed a bit. Both gasoline and gasoil stocks built, while the draw rate on kerosene stocks was cut from 72 MB/D to 31 MB/D. Margins and cracks eased slightly on the week, but remain statistically very good and still holding above averages seen in September and October.

Tertiary Home Heating Oil Storage

PIRA assigns coefficients to measure the effect of Heating Degree Days on distillate demand in many regions of the world. There are, however, no comparable coefficients for residential demand only, nor are there any estimates of heating oil inventories held by U.S. households as is the case with German tertiary gasoil inventories. This note estimates HDD coefficients for U.S. residential consumers and derives the profile of additions and withdrawals from home heating oil storage tanks.

November Weather: U.S. Warm; Europe and Japan Cold

November weather for the three major OECD markets turned out to be 5% colder than the 10-year normal and the resulting oil-heat demand effects were 86 MB/D above normal. On a 30-year normal basis, the markets were 4% warmer.

September 2016 U.S. Domestic Crude Supply Falls Sharply

EIA recently released their September oil balances. Domestic crude supply, which is domestic crude production plus the balancing item, fell sharply, month-on-month by -470 MB/D, the largest monthly drop since supply peaked in April 2015. The year-on-year decline accelerated from -500 MB/D in August to -950 MB/D in September, and steeper than the previous steepest decline of -932 MB/D seen in April 2016. The September declines, both month-on-month and year-on-year, were about 50 MB/D steeper than PIRA's initial estimates.

U.S. September 2016 DOE Monthly Revisions: Demand and Stocks

EIA recently released its final monthly September 2016 (PSM) U.S. oil supply/demand data. September 2016 demand came in at 19.864 MMB/D. Overall demand was revised lower by only 92 MB/D, compared to the weeklies. Total product demand increased 2.3% versus year-ago or 450 MB/D, compared to the September 2015 PSA data, doubling the growth seen in August. End-September total commercial stocks stood at 1,352.5 MMBbls. Compared to final September 2015 PSA data, total commercial stocks are higher than year-ago by 76.3 MMBbls, versus an excess of 101.2 MMBbls seen at end-August and a 123.2 MMBbls excess seen at end-July.

Chinese Product Balances Not as Bearish as Indicated by Recent Surges in Product Exports

Chinese refiners have been exporting increasing volumes of key refined products such as gasoline, jet fuel and gasoil/diesel since 2012. However, it is important to note that Chinese refiners have also been importing increasing amounts of mixed aromatics and light cycle oil over the past two years, which are generally used as blending components for gasoline and gasoil/diesel, respectively. Taking these blending components into consideration, the product balance for total gasoline is more neutral (perhaps at times even bullish), and the product balance for total gasoil/diesel is only moderately bearish. PIRA expects China’s net exports of gasoil, jet fuel and gasoline (excluding blending components) to increase by another 10% in 2017.

Aramco Pricing Adjustments: Cuts in Allocations to Come

Saudi Arabia's formula prices for January were just released. The adjustments were in alignment with what the pricing drivers would dictate. This means Saudi will resort to cutting allocations to refiners and let the market tighten that way, as opposed to initially tightening differentials and reducing the competitive attractiveness of Saudi crude. Consequently, Saudi crude remains priced competitively from an economic standpoint, but less avails will be released to the market as refiner's allocations will fall short of their nominations. Specifically, Asian terms were made more generous in line with the change in Dubai structure, while pricing into Northwest Europe was tightened in line with the narrower discount on Urals vs. Dated Brent.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

With OPEC Delivering on Cuts, Prices to Move Higher

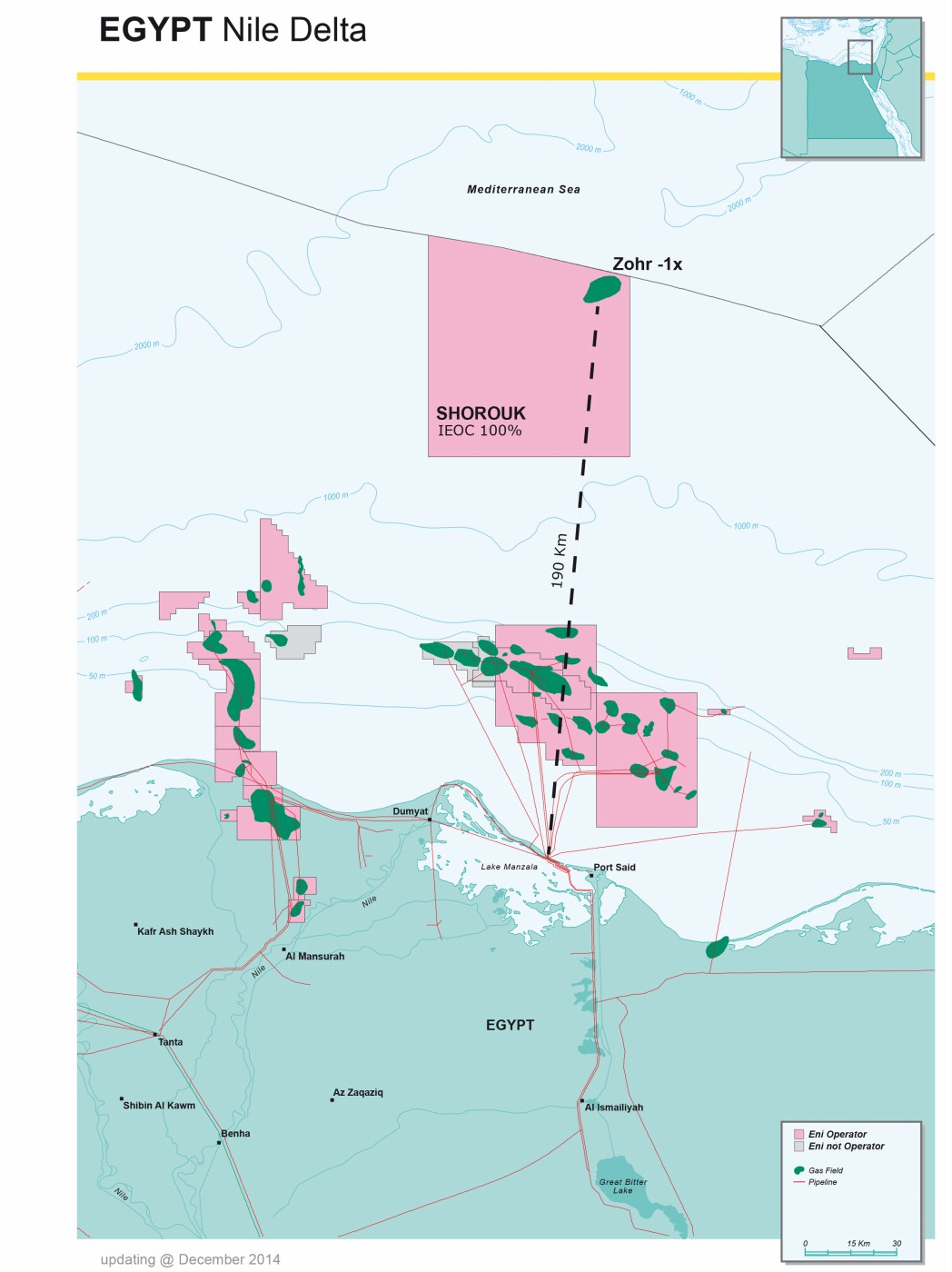

With OPEC Delivering on Cuts, Prices to Move Higher Eni has agreed to sell to BP a 10% participating interest in the Shorouk Concession, offshore Egypt, where the supergiant gas field Zohr is located. Eni, through its subsidiary IEOC, currently holds a 100% stake in the block.

Eni has agreed to sell to BP a 10% participating interest in the Shorouk Concession, offshore Egypt, where the supergiant gas field Zohr is located. Eni, through its subsidiary IEOC, currently holds a 100% stake in the block. Asia's Refinery Cracking Capacity Additions Slowing, but India Continues to Upgrade

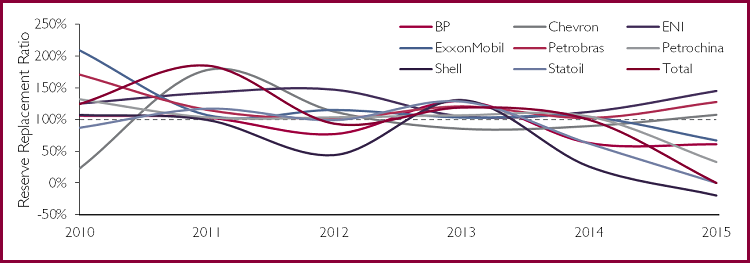

Asia's Refinery Cracking Capacity Additions Slowing, but India Continues to Upgrade E&P deepwater exploration and appraisal activity has dramatically declined. In line with falling E&A activity, Reserve Replacement Ratios (RRRs) have been declining for the majority of major E&P companies. This week, we highlight some of the positive newsflow from offshore E&A activity in recent times.

E&P deepwater exploration and appraisal activity has dramatically declined. In line with falling E&A activity, Reserve Replacement Ratios (RRRs) have been declining for the majority of major E&P companies. This week, we highlight some of the positive newsflow from offshore E&A activity in recent times.