Schlumberger has achieved SEMS certification to Center for Offshore Safety Program expectations and 30 CFR 250 Subpart S requirements. Schlumberger is the first service/supply contractor to achieve this voluntarily, further demonstrating their commitment to SEMS, assurance of their safety management system, and to ensure they know where is best to focus their continuing work on safety management.

Schlumberger has achieved SEMS certification to Center for Offshore Safety Program expectations and 30 CFR 250 Subpart S requirements. Schlumberger is the first service/supply contractor to achieve this voluntarily, further demonstrating their commitment to SEMS, assurance of their safety management system, and to ensure they know where is best to focus their continuing work on safety management.

SEMS is intended as a continuous learning and improvement system for safety and environmental management. A key feature of SEMS is the focus on establishing, managing and measuring barriers that protect against escalation to a major incident. The voluntary COS certification program for contractors that is delivered via Audit Service Providers (ASP) requires participation in a COS program SEMS audit using independent verification by third-party auditors that have been assessed and accredited by COS. COS focuses on the importance of combining SEMS Leadership and effective SEMS to deliver a good safety culture.

DNV GL Business Assurance USA, a COS-accredited (ASP), has approved Schlumberger for COS SEMS Certification based on the outcome of the COS SEMS audit. The audit scope included Schlumberger's Head Office, onshore manufacturing/service facilities, and verification of SEMS implementation at an offshore location where Schlumberger was active. A total of 12 locations were visited during the SEMS audit.

"While Schlumberger has had a comprehensive management system in place since the late 1980's, the SEMS certification audit provided a great opportunity to verify that our system meets the regulatory requirements of the US outer continental shelf. The exercise not only highlighted the numerous strengths of our organization but also identified opportunities for improvement. This process of continuous assessment and progression ensures that our system is maintained to the highest standards in the industry," said Rob Cummings, Schlumberger HSE Manager – North America Offshore.

Tom Teipner, Schlumberger President – North America, added, "While the current regulations apply only to operators on the outer continental shelf, I believe that voluntary participation in the SEMS audit process demonstrates Schlumberger's unwavering commitment to the safety and integrity of our industry. Leadership is about transforming a vision into a reality. This audit was another step forward in that vision of transforming the outer continental shelf into an area in which the safety of our people and respect for the environment is critical in everything we do."

"We are proud to work with Schlumberger on SEMS compliance," says Faith Beaty, President of DNV GL Business Assurance USA, Inc. "They have shown tremendous leadership in pursuing SEMS certification which — though mandatory for offshore operators — is not yet required for service providers. Clearly, they are making a move toward the future, and a strong statement about their commitment to safety and supply chain integrity."

"By successfully completing its SEMS audit, Schlumberger is sending a message to its customers and to the rest of the supplier community," says Chandran Ilango, Lead Auditor /Integrated Systems Sector Manager for DNV GL - Business Assurance. "Interest in SEMS is growing rapidly as a way of harmonizing audits among operators and service providers, to bring the industry toward a more uniform safety and certification platform that can boost confidence and ultimately increase safety performance across the board."

Charlie Williams, Executive Director for COS, stated "Schlumberger's voluntary COS SEMS Certification is an important achievement that indicates their continuing commitment and dedication to SEMS. Voluntary participation and certification of SEMS by a contractor like Schlumberger is a clear display of the importance they place on safety and environmental management and the relationship between contractors and operators. Contractors play a critical role in the SEMS process; therefore contractors who certify their management system provide numerous benefits to all stakeholders including operators and regulators. The COS hopes this trend continues to ensure continuous improvement in safety and offshore operational integrity."

The Center for Offshore Safety is an industry group that promotes continuous safety improvement for offshore drilling, completions, and operations through effective leadership, communication, teamwork, disciplined management systems, and independent third-party auditing and certification. The Center draws on expertise and input from the U.S. oil and natural gas offshore industry and the regulatory community.

For the ninth consecutive year,

For the ninth consecutive year,  Bibby Offshore’s

Bibby Offshore’s MOL Group has successfully completed a deal to acquire Ithaca Petroleum Norge

MOL Group has successfully completed a deal to acquire Ithaca Petroleum Norge Oil and gas industry skills organization

Oil and gas industry skills organization

McDermott International, Inc.

McDermott International, Inc.

Photo Caption: Jan Ward, Chair of AnTech’s Board of Directors

Photo Caption: Jan Ward, Chair of AnTech’s Board of Directors

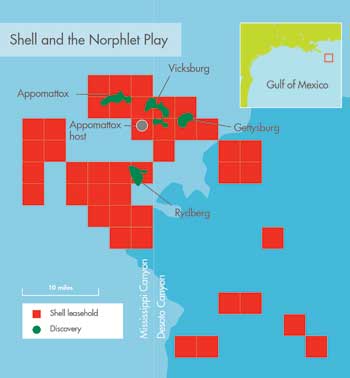

Royal Dutch Shell plc (Shell)

Royal Dutch Shell plc (Shell)