Oil Markets Are Tightening and Bullish Catalysts Ahead

Oil Markets Are Tightening and Bullish Catalysts Ahead

The global economic backdrop has improved. Oil markets are tightening and there are many bullish catalysts ahead. Demand growth is accelerating while supply growth is declining. Non-OPEC crude/condensate output has declined 1.9 MMB/D between its 4Q15 peak and 3Q16. This, combined with expected strong demand growth, more than offsets OPEC production struggling to increase despite Iran’s return from sanctions and higher non-crude liquids supply, forcing surplus stocks significantly lower in 4Q 2016. PIRA has raised its crude oil price forecast by $3/Bbl over the next 9 months. The downstream is also in the process of rebalancing with the upcoming refinery turnaround season expected to pull product stocks lower. Crude price differentials have been cycling and now call for less U.S. imports and more exports, a substantial change from the last two months.

Crosscurrents Grip Regional Prices

Henry Hub (HH) cash prices recently neared the $2.60/MMBtu mark — a level not seen since late June — before rebounding back towards $2.90 this week as even hotter weather still grips many regions this month. The concurrent forecasts that have extended the threat of additional above-normal cooling degree days (CDDs) into September are also fostering more downward revisions to weekly storage refill expectations, buoying NYMEX futures. Even so, for the month as a whole HH cash prices are still on track to be modestly lower than the July average of $2.80. The same can be said for most prices around the country outside of New England, and even more so in the case of price markers in western Canada.

U.K. Spark Spreads in Negative Territory as Wind Share Moves Above 15%; Solar Remains Marginal in U.K. Price Formation Thus Far

With around 14 GW of installed wind capacity, of which 9.7 GW connect to the high-voltage transmission network, and an estimated 10.7 GW of solar P.V. plants connected between distribution and lower level networks, renewables are now more influential in U.K. price formation. The historical analysis of the past four quarters shows spark spreads turn negative as wind share moves to 15% of demand and above. It appears that the increase in the solar share has so far limited implications on spot power prices on average, judging from the last four quarters.

Coal Pricing Relatively Steady Following Volatile Period

The coal market moved modestly lower for most of the week, with a slight downturn in the oil market and continued easing in Chinese buying activity weighing down pricing. After the sizeable rise in seaborne prices essentially since June stemming from the surge in Chinese demand, the market is questioning the ability for prices to continue to rise, particularly as the weather in China has become less destructive to production and less supportive to demand. The skepticism that market has had over the ability for the market to rise was the most evident by Glencore showing a $395 million loss by hedging coal output ahead of the price rise in 2Q16. After several years of prices falling, keeping coal supply in check, higher prices may incent some suppliers to bring tonnage back to the market. While PIRA is wary of supply returning to the market, we believe prices will be able to hold on to recent gains for several months, particularly if oil prices move higher.

CA Carbon Auction Undersubscribed; SB 32 Passed

The August WCI Current Vintage auction saw an improved coverage ratio, but no CA state-owned allowances were sold. This puts them at risk, under the proposed cap and trade amendments, of being moved to the Allowance Price Containment Reserve (APCR), accessible only at a very high price point. The State Assembly did not wait to see these results to pass SB 32, and the State Senate also passed companion bill AB 197. While chances are good that these bills make it to the Governor’s desk, they did not achieve the 2/3 majority that could have offered protections from legal challenges that consider cap-and-trade auctions as taxes. There was no explicit mention of continuing the cap and trade program in the bills.

Global Equities Ease Modestly

Global equities eased modestly, though Europe in the aggregate was higher. In the U.S, housing and banking posted gains as money was reallocated into some sectors that had lagged in the most recent up leg. Utilities, retail and energy were the laggards for the week, with energy down about 1.5%. Internationally, all the tracking indices other than Japan, lost ground.

U.S. Propane Stocks Surge Back to Surplus

The most recently reported EIA domestic propane inventory increase of nearly 2.4 million barrels comes as little surprise as decreased export volumes out of the United States have been noted by PIRA shiptracking efforts. This was the highest build for this particular week since 2010. Propane moved into a 411,000 Bbl surplus stock position versus 2015 levels.

U.S. Ethanol Prices Jump

U.S. ethanol manufacturing margins improve the week ending August 19. Renewable identification number (RIN) values also increase.

It's Not as Ugly as It Looks

Overall commercial stocks had their largest build in the last several weeks, up 6.6 million barrels with a surprising crude inventory increase of 2.5 million barrels. Most of the product build was once again in propane and other NGLs, a typical seasonal occurrence. Product demand remained strong, and this continues to be a regular feature in the current low price environment. For next week, crude imports are forecast to drop sharply, forcing crude stocks to decline. Light product demand remains strong, keeping major light product stocks roughly flat, despite somewhat higher crude runs.

LNG/Pipeline Switching in Southern Europe

While generally we’ve focused on optimization across all suppliers, recently a new form of optimization popped up in European trade: Algerian balancing between LNG and pipeline gas exports, which is further strengthening Europe’s connection to global gas pricing. This optimization play makes perfect sense, but it is just not something that has emerged on a month-to-month basis until quite recently.

Coal Stocks Virtually Flat Year-on-Year

Total U.S. coal stocks continue to normalize due to supportive weather conditions, as residual coal production cuts on an annualized basis draw inventories. Days burn has levelized, as the peak of the summer burn season has passed. In addition, coal burns remain off slightly year-on-year given growth in renewable capacity and coal unit retirements. Gas forwards (12-month-strip is just over $3/MMBtu) suggest further gas-to-coal switching for lower cost coals such as PRB, other western, and ILB coals (in that order) over this coming winter.

RGGI at a Crossroads

The RGGI Program is at a crossroads, as partners negotiate the post-2020 cap declines, with PJM states reportedly resisting the steeper reductions favored by New England. Allowance prices received a boost from the June Stakeholder Meeting, but declined on news of the NY nuclear subsidies in July. Average August prices are lower than July, but they have recently moved up towards the $5 mark. PIRA expects the Sept. auction to be dominated by compliance buying as the market continues to await a draft Model Rule, expected this fall. Longer term, it must be decided whether the RGGI price signal will be the primary mechanism to reach climate goals.

S&P 500, Commodities Lower

The S&P 500 was lower on the week, after having set record highs. As would be expected, volatility was higher, while high yield debt and emerging market debt indices declined. The dollar generally strengthened. It moved particularly higher versus the euro and yen, while only being modestly changed versus the British pound. It also strengthened against most of the commodity producers, including the South African rand, as commodities declined.

Stocks Build the Week Ending August 19

Stocks increased 392 thousand barrels to 20.817 million barrels, up 2.19 million from last year. Output dropped to 1,028 MB/D, just short of the record high 1,029 MB/D the prior week.

Japan Oil Balances Impacted by Summer Holiday

Two weeks of data were reported coming off the mid-August holiday hiatus. Crude runs dropped back slightly. Crude stocks built in the first week, but then dropped as expected. Gasoline demand was seasonally strong and performed as expected. There was a good stock draw, followed by a modest build. Gasoil demand was seasonally damped by the holiday and significant stock builds occurred in both weeks. Refining margins remain very weak with little overall improvement.

Russian Gas Prices on Hold

The Federal Antimonopoly Service (FAS) has no plans to revise the current wholesale price of gas before the end of this year, the head of Department of Regulation of Fuel and Energy Dmitry Makhonin told Interfax. According to the PIRA forecast, an increase in wholesale gas prices by 2% in July was scheduled, but that did not happen. Meanwhile, the regulator representative confirmed that a project on liberalization of prices for natural gas in three pilot regions can be implemented in the first half of 2017.

Cape Freight Rates Flat, But Improvements Are Expected

Cape freight rates are struggling to find momentum despite continued signs of expansion in iron ore trades, particularly to China. PIRA expects iron ore exports in August to increase from Brazil and hit record levels from Australia. Slow steaming makes economic sense in the current market even at relatively low bunker fuel prices, artificially inflating bulk demand. Speed switching is not expected in late 2017 unless rates push close to $26,000/day, but further structural gains beyond that level will be more difficult as the fleet accelerates.

Pace of U.S. Economic Growth Poised for Pick-up

U.S. GDP growth disappointed in recent periods, as the economy was hit by three separate negative influences: a slump in business investment a lengthy inventory adjustment process and the strong dollar weighing on trade activity. But PIRA’s expectation is that all three will reverse course soon, and GDP growth will strengthen meaningfully in the second half of 2016. This week’s July data releases on durable goods orders, trade, business inventories, and new home sales all had positive implications for the U.S. economic outlook.

Asian Demand Update: Slowdown in Growth About to Reverse

PIRA's latest update of Asian product demand shows a continued slowdown in demand growth. Our latest assessment of growth is now 640 MB/D versus year-ago. Data actuals cover the three month period May-July for China, India, and Korea, while Japan and Taiwan pick up data April-June. Our last assessment, in July, indicated growth of about 1 MMB/D. The slowdown in demand growth is along the lines expected, but that slowdown will reverse as we move increasingly into 4Q.

2017 Pipeline Additions: New Midstream Poses Downward Price Risks

2017 is poised to be a breakout year for pipeline development, with more than 40 BCF/D of additional capacity announced for next year. If just 15 BCF/D of these pipelines commence service, or those having FERC approval, the potential supply response would overwhelm nascent structural demand growth. Yet, downsizing the projects to just half the proposed capacity would still likely tip the fundamental balance back into surplus, raising valid concerns about the extent and duration of the forthcoming recovery.

Supply Intensifies Amid Demand Growth Uncertainty

We are entering a period when new supply is outpacing disruptions from existing producers, which means the balances will be stretched like never before. Now the issue will be whether newer buyers can grow faster than older ones are shrinking.

2Q16 U.S. Producer Survey: Light at the End of the Tunnel

Long-awaited U.S. natgas production declines arrived in 2Q16, as the combined pressure of low rig counts, bloated storage, and poor prices finally caught up with U.S. producers. The E&P companies in PIRA’s Survey Group shrank volumes by 0.6 BCF/D, or about 1% compared to 1Q16. Most of these losses were concentrated outside the Northeast, but even Appalachia growth was essentially flat quarter-on-quarter. The recent subdued production levels (aided by transitory disruptions) together with the assistance of warm weather helped rebalance the market and push storage levels closer to seasonally normal levels. Looking ahead, producers seem optimistic about production growth resuming with forward-looking statements highlighting plans to ramp up drilling in time for the heating season and beyond.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

The development helps maximize production, in addition to boosting Troll C production and activities. (Photo: Øyvind Hagen)

The development helps maximize production, in addition to boosting Troll C production and activities. (Photo: Øyvind Hagen) Quest Offshore Resources, Inc.

Quest Offshore Resources, Inc. "Through this acquisition, our upstream oil and gas clients will be able to make better investment decisions through access to a unique understanding of availability, capability, and price in key offshore equipment and service markets," added Neal Anderson, president of Wood Mackenzie.

"Through this acquisition, our upstream oil and gas clients will be able to make better investment decisions through access to a unique understanding of availability, capability, and price in key offshore equipment and service markets," added Neal Anderson, president of Wood Mackenzie. Ashtead Technology

Ashtead Technology Photo credit: Tullow Oil

Photo credit: Tullow Oil Claxton, an

Claxton, an  Oil Markets Are Tightening and Bullish Catalysts Ahead

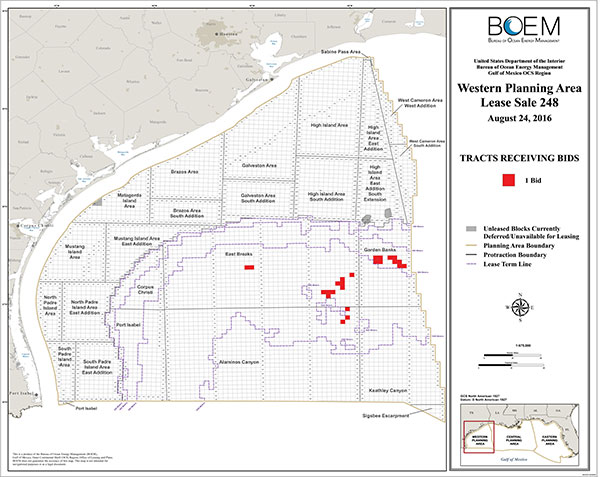

Oil Markets Are Tightening and Bullish Catalysts Ahead Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper announced that last week’s oil and gas Lease Sale 248 garnered $18,067,020 in high bids for 24 tracts covering 138,240 acres in the Western Gulf of Mexico Planning Area. A total of three offshore energy companies participated in 24 bids. The sum of all bids received totaled $18,067,020.

Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper announced that last week’s oil and gas Lease Sale 248 garnered $18,067,020 in high bids for 24 tracts covering 138,240 acres in the Western Gulf of Mexico Planning Area. A total of three offshore energy companies participated in 24 bids. The sum of all bids received totaled $18,067,020. Damen Shipyards Sharjah

Damen Shipyards Sharjah The Njord A platform being towed by the anchor handling tug supply vessel "KL Sandefjord". (Photo: Thomas Sola/Statoil)

The Njord A platform being towed by the anchor handling tug supply vessel "KL Sandefjord". (Photo: Thomas Sola/Statoil) Pressure is mounting on the global oil and gas industry to reduce environmental footprint at the same time as the industry is under significant cost pressure. Since business as usual is not an option, DNV GL has launched two papers to advise the industry on how and where to make impactful changes within financial constraints.

Pressure is mounting on the global oil and gas industry to reduce environmental footprint at the same time as the industry is under significant cost pressure. Since business as usual is not an option, DNV GL has launched two papers to advise the industry on how and where to make impactful changes within financial constraints. Last week, U.S. Department of the Interior Deputy Assistant Secretary for Land and Minerals Management Amanda Leiter and

Last week, U.S. Department of the Interior Deputy Assistant Secretary for Land and Minerals Management Amanda Leiter and

The GLOBAL PROVIDER, Maxum Petroleum's newest vessel is currently under construction at Jesse Co. in Tacoma, Washington and expected to enter service in January 2017.

The GLOBAL PROVIDER, Maxum Petroleum's newest vessel is currently under construction at Jesse Co. in Tacoma, Washington and expected to enter service in January 2017. Leading global deck machinery specialist,

Leading global deck machinery specialist,

Roger Esson, Decom North Sea Chief Executive

Roger Esson, Decom North Sea Chief Executive