Ongoing drilling at Moosehead; field work at Fleur de Lys and Benton-Sokoman JV projects; visible gold found at Grey River

ST. JOHN’S, Newfoundland and Labrador--(BUSINESS WIRE)--#benton--Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to provide the following exploration update on its 100%-owned projects as well as Joint Venture Projects with Benton Resources Inc. (TSXV: BEX) in Newfoundland.

Highlights:

-

Moosehead: close to 20,000 m completed with two drill rigs; third drill rig expected in 2-3 weeks for the barge-based program; testing Footwall Splay/ Eastern Trend, South Pond and the new 75 Zone.

-

Fleur de Lys: ongoing till sampling program; multiple samples submitted for gold grain and heavy mineral analysis with initial results expected in 2-3 weeks.

-

Grey River JV: sampling in the vicinity of the historical 225 g/t Au sample site resulted in the identification of visible gold in a portion of the mineralized zone; samples submitted for assays; high-resolution airborne geophysical survey to begin shortly.

-

Golden Hope JV: initial reconnaissance mission completed; rock samples, stream sediment and C-horizon till samples submitted for assays; in the process of completing high-resolution airborne geophysical survey.

-

Kepenkeck JV: completed a high-resolution airborne geophysical survey; a prospecting program has begun; a detailed soil sampling program to commence shortly; first assay results from sampling deemed very encouraging.

Moosehead Project

Phase 6 drilling program is ongoing at Moosehead with two rigs. While there has been a delay in getting a third drill rig on-site due to the current shortage of the drill crew experienced by Sokoman’s preferred drilling contractor who knows the property area well, Sokoman has recently been advised that the third rig is expected to join the program in 2-3 weeks. The third rig will now be designated for the barge-based program which is awaiting final approval from the Department of Environment. The Company is looking at adding a fourth drill rig as soon as possible and will keep investors posted on the progress made in that regard.

Once the third rig is on site, Sokoman plans to be alternating the initial two drills in order to test regional targets that could easily lead to other discoveries in addition to extending currently known zones.

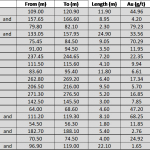

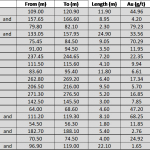

Just under 20,000 m of the proposed 50,000 m Phase 6 program has been completed and multiple strong intersections have been reported from this phase including the holes summarized as follows:

MH-21-115 (Footwall Splay – Eastern Trend) - 4.60 m @ 47.20 g/t Au; and 8.10 m @ 68.25 g/t Au

MH-21-163 (Footwall Splay – Eastern Trend) - 18.90 m @ 13.09 g/t Au

MH-21-141 (South Pond Zone 1) - 4.20 m @ 64.00 g/t Au

MH-21-123 (South Pond Zone 1) - 5.00 m @ 26.87 g/t Au

*Reported lengths are core lengths and are believed to be 70% to 85% of true thickness

The barge program could entail as much as 5,000 to 10,000 m, depending on success and depths, to target the Footwall Splay and as much of the Eastern Trend that can be accessed.

Drilling will continue at the South Pond target as well as on the nearby 75 Zone, which is an open-ended mineralized block lying 100 m northeast of the South Pond target, approximately halfway to the Eastern Trend, and which delivered MH-19-75 (5.80 m of 6.93 g/t Au, including a VG bearing vein grading 32.99 g/t Au over 0.80 m) and remains open. The 75 Zone drilling will help determine whether it is linked to any known zone or is a new splay. Currently a four-to-six-hole program is focused on this area. Once completed, the drill will be assigned to test some of the high-priority geochemical and geophysical targets elsewhere on the property while awaiting assays.

Fleur de Lys Project

The property-scale till sampling program is approximately 40% complete with 357 samples submitted for gold grain and heavy mineral analysis at Overburden Drilling Management (ODM) in Ottawa. The sample collection is being supervised by ODM utilizing contract crews. Results from the early sampling are expected in the next 2-3 weeks. Prospecting has been ongoing concurrent with the till sampling, and approximately 40 rock samples have been submitted for assay, many with disseminated pyrite and chalcopyrite, minerals linked to several gold-enriched deposits in the UK, including the six-million-ounce Curraghinalt deposit in Northern Ireland, with which the Fleur de Lys project shares many characteristics.

Grey River Sokoman/ Benton JV Project

Airborne geophysical surveying totalling 1,099 line-kilometres is about to begin at the 324-claim (8,100 hectares – 81 sq km) Grey River JV in southern Newfoundland and will consist of a Heliborne High-Resolution Magnetic and Matrix Digital VLF-EM Survey flown by Terraquest Ltd. The results of the survey will help define structural targets that may be associated with the gold mineralization at Grey River. The property is targeting high-grade gold mineralization similar to that currently being mined at Pogo, Alaska with published reserves of 6.9 million ounces at 9.4 g/t Au (Northern Star Resources website March 31, 2021), as well as other styles of gold mineralization including shear zone and intrusion-related gold.

Management of Sokoman and Benton have visited the Grey River and the Golden Hope properties to establish priorities and to engage in sampling as many areas of known mineralization. The visit to Grey River was extremely successful in that sampling in the vicinity of the historical 225 g/t Au sample site resulted in the identification of visible gold in a portion of the mineralized zone. In addition, prospecting in the immediate area identified several other mineralized horizons that did not appear to be previously sampled. Assays are pending from a suite of samples collected from several locations on the property. The historical “Quartz Zone” reported by previous workers is impressive and extends for several kilometres in an east west direction (photos can be viewed on Sokoman’s website under the Grey River Project tab) and is up to 200-300 metres in width locally. Multiple gold showings are known along most of its length ranging from 100-200 ppb Au to 225 g/t Au, but no drilling has been carried out at any of the known gold occurrences. The companies have applied for drilling permits which will target these zones.

Golden Hope Sokoman/ Benton JV Project

Exploration has also commenced on the 3,176-claim (79,400 hectares – 794 sq km) Golden Hope Property in southwestern Newfoundland, including a 5,709-line-kilometre Heliborne High-Resolution Aeromagnetic & Matrix Digital VLF-EM Survey being flown by Terraquest Ltd. The survey will help provide an overall structural picture of the property and identify extensions of known gold-bearing structures as well as any previously unrecognized structures on the property. An initial reconnaissance mission at Golden Hope was completed earlier this month by management of Sokoman and Benton in order to get a firsthand look at the ground and to obtain samples in as many areas as possible (photos can be viewed on Sokoman’s website under the Golden Hope Project tab). Mineralization observed included multiple occurrences of structurally controlled quartz veins with variable amounts of pyrite, as well as a previously unknown zone of locally significant arsenopyrite and pyrite (as stringers and veinlets comprising up to 10% of rock volume), that was noted to be several dozen metres in thickness and of unknown strike length. Overall, approximately 50 rock samples as well as seven stream sediment and four C-horizon till samples were collected and submitted for assaying/processing.

Kepenkeck Sokoman/ Benton Resources JV Project

The Company has been informed by Joint Venture partner Benton that a Heliborne High-Resolution Aeromagnetic & Matrix Digital VLF-EM Survey totaling 1,984 line-kilometres has been flown by Terraquest Ltd. A prospecting program has begun, and a detailed soil sampling program will commence shortly. The Kepenkeck property lies in east-central Newfoundland, along trend from Canstar Resources’ Golden Baie project and immediately east of New Found Gold’s Queensway project. The target is high grade and quartz veining, hosted in graphitic shales similar to that of the New Found Gold property.

The companies have received the first assay results from 24 samples submitted. Gold grading from >5 ppb to 5,340 ppb have been obtained from localized float and outcrops. The companies are very encouraged by these early results, and follow-up has been planned to further these discoveries.

About the Flagship Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. At least five zones of significant gold bearing mineralization have been identified to date at Moosehead and multiple high-priority targets independent of the known zones remain to be tested. The Company has completed approximately 20,000 m of a current 50,000 m drill program at Moosehead.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one half submitted for assay and one half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh; the total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. In addition, random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with gold projects in Newfoundland & Labrador, Canada. The Company's primary focus is its portfolio of gold projects including the 100%-owned, high-grade, Fosterville-style Moosehead Project, and the Crippleback Lake (optioned to Trans Canada Gold Corp.), and East Alder (optioned to Canterra Minerals Corporation) Projects, all of which lie along the Central Newfoundland Gold Belt, as well as the 100%-owned, district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three large scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls independently, and through the Benton Alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Contacts

Timothy Froude, P. Geo., President & CEO

709-765-1726

This email address is being protected from spambots. You need JavaScript enabled to view it.

Cathy Hume, Director, Investor Relations

416-868-1079 x251

This email address is being protected from spambots. You need JavaScript enabled to view it.

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals