A standard program template for UK offshore decommissioning projects has been credited with heralding a step-change for the industry after being formally endorsed by the UK regulators and successfully trialled by three international operators for different types of asset.

Decommissioning industry body Decom North Sea (DNS) developed the template in partnership with the Department of Energy and Climate Change (DECC). The new template will help streamline and standardize the format for decommissioning programmes throughout the UKCS whilst still fully satisfying regulatory requirements.

The template is already allowing industry to compile decommissioning programs more quickly and easily by presenting information in a consistent and standardised format, reducing time spent on redrafts, improving efficiency and reducing costs.

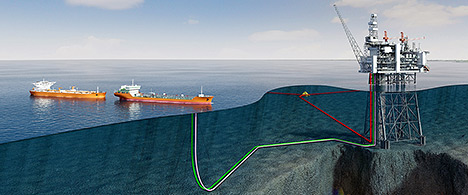

First to trial the template was BP with the Schiehallion Decommissioning Programme, whilst CNRI is currently trialling it to set out its plans for the Murchison Platform (Photo). Perenco is also using the template for the Thames Project. All of the operators had positive feedback on the template, noting significant changes and a reduced number of drafts.

First to trial the template was BP with the Schiehallion Decommissioning Programme, whilst CNRI is currently trialling it to set out its plans for the Murchison Platform (Photo). Perenco is also using the template for the Thames Project. All of the operators had positive feedback on the template, noting significant changes and a reduced number of drafts.

An initial draft of the workgroup’s template was circulated to government departments, industry and other stakeholders via DNS members, Oil & Gas UK and DECC. More than 50 responses were received and the comments were collated into a final draft document by DECC and DNS, which was reviewed again by the workgroup before being finalised.

The resulting template allows future decommissioning programs to be prepared and assessed in a more consistent fashion. Operators are being encouraged to trial it during 2013 and feedback from those users will be used to further improve the template. It is hoped that the template’s use for non-derogation cases will become mandatory in 2014. A streamlined template for derogation cases is also under development.

DNS Chief Executive Brian Nixon said: “We are delighted to have been instrumental in such a major project and the rapid uptake of the template by operators shows very clearly that the approach taken by DNS and partners was a success. We are now building on the collaborative working model to tackle other key industry challenges.

“The members of the working group gave generously of their time to design and deliver the template and this has been an excellent early example of DNS members working collaboratively with Government to deliver a substantial piece of work already showing significant demonstrable benefits. Ultimately, it will reduce costs to the public purse whilst maintaining the integrity and transparency of the decommissioning process.”

A DECC spokesman said: “This is a great example of DECC and industry working together on a project with the potential to achieve considerable savings and efficiencies to operators, the regulator, consultants and contractors.’’

Alistair Corbett, BP’s Decommissioning Projects Manager, said: “The Schiehallion Decommissioning Program was approved in June by DECC, using the new Standard Decommissioning Programme Template. Though it was only officially issued for use in January 2013, we were given permission in December 2012 to trial it.

“That meant seven months from initiation to approval, compared to up to three years in the case of Miller – also the document ended up only 42 pages in length. This equates to a major saving in man-hours and project delivery schedule and demonstrates the success of a joint oil industry and Governmental co-operation project.”

Roy Aspden, Decommissioning Projects Manager, CNRI, said: “We are delighted to have been part of the team responsible for producing the standard decommissioning template as well as pioneering its use.

“The template’s format has enabled us to set out our proposals for the Murchison platform clearly and concisely, making the decommissioning programme easily accessible to our stakeholders and significantly reducing the reading burden without compromising essential information. It has also provided a helpful focus for CNRI’s meetings with the regulator during the development of the program.

“Overall, the initiative to develop the new template is a great example of what can be achieved through teamwork. It represents a step-change in the simplification and standardisation of data vital to those considering and commenting upon decommissioning programs and augurs well for the future development of the decommissioning capability and cooperation across the range of interested parties.”

Perenco’s Operations Manager Keith Tucker, added: “Perenco's experience of a recent submission of a draft decommissioning program on the standard template has proven very successful. It demonstrates a significant step change improvement on the previous process, achieved jointly by DNS and DECC collaboration.”

It is hoped that, in time, the template could also be adopted for use in other European countries (albeit with some minor alterations perhaps being needed), helping operators and contractors alike to standardise their efforts across the North Sea.

Building on the success, DNS has established a projects sub-committee looking to move forward similar projects. They are currently canvassing ideas from the membership.

The forum is also continuing its focus on synergy and knowledge share at its annual Offshore Decommissioning Conference, in partnership with Oil & Gas UK, at St. Andrews from 1-3 October. With a number of panel discussions and networking opportunities, the event will focus on collaboration and promoting knowledge share and best practices among decommissioning operators and supply chain members.

.

Subsea 7 S.A.

Subsea 7 S.A. contracted by ADNATCO-NGSCO to deliver ship performance monitoring solutions that will help to optimize vessel performance and subsequently aim to reduce fuel consumption and carbon emissions. The entire project will be carried out by Unique System FZE, acting as agents for the Iceland based energy management company Marorka ehf. Commissioning and technical support will be provided by Unique Marorka Support Services which is a joint venture set up by Marorka ehf and Unique System FZE.

contracted by ADNATCO-NGSCO to deliver ship performance monitoring solutions that will help to optimize vessel performance and subsequently aim to reduce fuel consumption and carbon emissions. The entire project will be carried out by Unique System FZE, acting as agents for the Iceland based energy management company Marorka ehf. Commissioning and technical support will be provided by Unique Marorka Support Services which is a joint venture set up by Marorka ehf and Unique System FZE.

First to trial the template was BP with the Schiehallion Decommissioning Programme, whilst CNRI is currently trialling it to set out its plans for the Murchison Platform (Photo). Perenco is also using the template for the Thames Project. All of the operators had positive feedback on the template, noting significant changes and a reduced number of drafts.

First to trial the template was BP with the Schiehallion Decommissioning Programme, whilst CNRI is currently trialling it to set out its plans for the Murchison Platform (Photo). Perenco is also using the template for the Thames Project. All of the operators had positive feedback on the template, noting significant changes and a reduced number of drafts.  FoundOcean,

FoundOcean, formation. The reservoir properties were as expected in both targets.

formation. The reservoir properties were as expected in both targets. The Mariner heavy oil field was discovered in 1981. Statoil entered the license as operator in 2007 with the aim of finally unlocking the resources.

The Mariner heavy oil field was discovered in 1981. Statoil entered the license as operator in 2007 with the aim of finally unlocking the resources. The Bureau of Safety and Environmental Enforcement (BSEE) and the

The Bureau of Safety and Environmental Enforcement (BSEE) and the Shell

Shell Seatronics Limited,

Seatronics Limited, As part of President Obama’s all-of-the-above energy strategy to continue to expand safe and responsible domestic energy production, the Department of the Interior’s Bureau of Ocean Energy Management on Wednesday held Western Gulf of Mexico Lease Sale 233, which offered 20.7 million acres and attracted $102,351,712 in high bids for 53 tracts covering 301,006 acres on the U.S. Outer Continental Shelf (OCS) offshore Texas. A total of 12 offshore energy companies submitted 61 bids.

As part of President Obama’s all-of-the-above energy strategy to continue to expand safe and responsible domestic energy production, the Department of the Interior’s Bureau of Ocean Energy Management on Wednesday held Western Gulf of Mexico Lease Sale 233, which offered 20.7 million acres and attracted $102,351,712 in high bids for 53 tracts covering 301,006 acres on the U.S. Outer Continental Shelf (OCS) offshore Texas. A total of 12 offshore energy companies submitted 61 bids.