Southeast Asia will be a hotbed for upstream mergers and acquisitions (M&A) in the next two years, with more than $5 billion of assets up for grabs, Rystad Energy research shows.

The bulk of these opportunities are in Indonesia, where upwards of $2 billion of assets are on the market, followed by Malaysia and Vietnam which have approximately $1.4 billion and $1 billion for sale respectively.

About $700 million of deals have already been completed in the region so far in 2023, the strongest start to Southeast Asia’s upstream M&A activity since 2019.

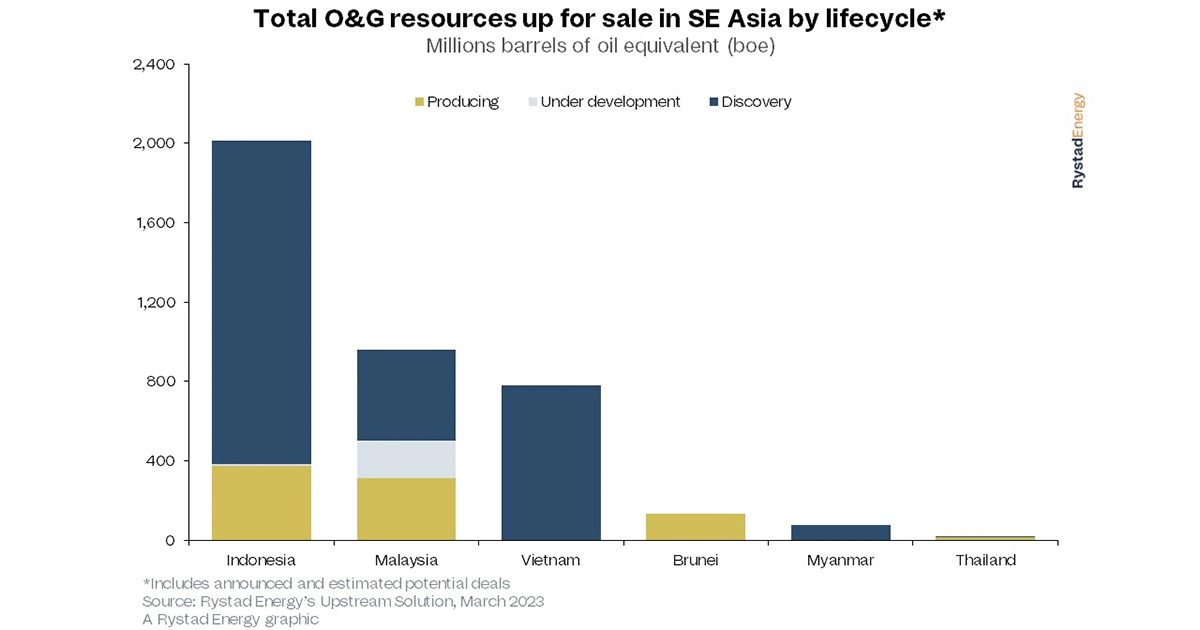

Of all the assets up for sale, 74% are in the pre-final investment decision (FID) stage, 21% already in production, and the remaining 5% or so already under development. Combined, they represent some 4 million barrels of oil equivalent (boe) in resources and around 270,000 boe of daily production with a gas-to-liquids ratio of 63:37, a lucrative proposition for prospective investors.

“There is a lot of money changing hands in Southeast Asia right now. The sheer magnitude of the oil and gas deals in the region will reignite the sector, reducing reliance on national oil companies (NOCs) and major players that has developed in recent decades. Southeast Asia presents an excellent opportunity for upstream players looking to strengthen their hydrocarbon portfolios,” says Prateek Pandey, vice president of upstream research, Rystad Energy.

Fiscal and regulatory frameworks play a significant role in encouraging M&A activity, helping to attract buyers and secure deals. The administrative updates that Malaysia, Indonesia and Thailand have implemented in recent years are boosting interest from energy majors and other new regional buyers as these countries benefit from successful exploration results. Other countries in the region – such as Vietnam and Cambodia – are looking with envy at their neighbors and trying to enact similar processes to attract investments and deals. As a result of this fiscal loosening, a host of diverse oil and gas players are looking seriously at Southeast Asia as a pillar of their portfolio expansion plans.

The M&A opportunities expected to change hands are spread across the entire lifecycle, including producing, under development and newly discovered resources. Malaysia leads the pack in terms of producing assets on offer with a 45% share of the regional total, with Indonesia the next largest at 27%. Discovered but not yet under development resources dominate the opportunities though, with almost 3 billion barrels of oil equivalent (boe) up for sale. Indonesia leads this category by quite some margin, boasting 1.6 billion boe of available resources, followed by Vietnam with 780 million boe and Malaysia with 460 million boe. Myanmar and Thailand also have discovered resources available for purchase, but these are greatly overshadowed.

In terms of the total oil and gas resources on offer, Indonesia leads with a 50% share, followed by Malaysia with 24% and Vietnam with around 20%. Given the significant size of resources on offer from Indonesia, it is also the leading country in terms of the total deal value of resources on offer at around $2 billion, followed by Malaysia at around $1.4 billion. Based on recent upstream transactions in Southeast Asia, the average production metric stands at between $17,000 and $20,000 of daily production and between $2 and $3 per boe of resources.

The global growing trend of majors reducing their interest in mature portfolios is creating a surge in new acquisition opportunities. They are leveraging the current momentum and strategically shifting away from expiring production sharing contracts (PSCs), as well as challenging developments in their portfolios. Southeast Asian’s M&A potential is also being fueled by regional NOCs’ desire to mitigate or reduce the vast capital expenditure required to maintain and operate mature blocks by bringing in technical partners to implement enhanced oil recovery (EOR) projects. Overall, the confluence of these factors is shaping the M&A landscape in the region and creating opportunities for strategic buyers to capitalize on shifting dynamics in the industry.

Decommissioning costs, PSC expiry and time-to-development for pre-final investment decision (FID) opportunities are all dominating buyers’ thoughts as they screen M&A opportunities in the region. The objective of upstream companies has shifted from just expanding the reserves base to looking for already producing assets, with a preference for gas resources in countries with fewer policy and regulatory hurdles.

M&A prospects that have the potential to support carbon capture and storage (CCS) and utilization efforts or facilitate decarbonization initiatives are expected to garner greater attention from large international players and local NOCs.

Regional experts and European independents will remain active participants in the market as they look to take advantage of deals on the table to expand their presence in Southeast Asia. Additionally, the allure of fiscal adjustments, exploration success, and concerns over energy security will likely stimulate the interest of global oil and gas players and international oil companies (IOCs).

Learn more with Rystad Energy’s Upstream Solution.