CRUDE OIL

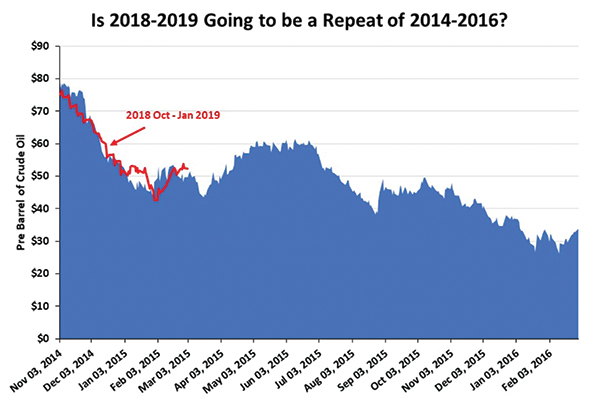

Crude oil prices are up in January. In fact, through the middle of the month, they have climbed by $6.70 per barrel for nearly a 15 percent increase since year-end. After falling over 40 percent from the beginning of October to the end of December 2018, any oil price increase is welcomed. Oil execs are feeling somewhat better as we start the new year, but the shock of last fall’s collapse has not been forgotten. That experience, coming as it did during oil company budget-setting time, will impact 2019 industry spending, at least for the first half. Still, the capital spending surveys show the industry boosting outlays by high single-digits this year.

Why would companies want to boost output if it would arrive just when oil prices might be at risk of declining? Take these capital spending surveys with a large grain of salt. They were compiled as oil prices were falling, but before the full extent of the decline and its ramification on company profitability and cash flow was understood. Additionally, investor pressure on managements to “live within cash flow” has executives thinking seriously about how they can achieve that goal, while not crippling their company’s growth.

Why would companies want to boost output if it would arrive just when oil prices might be at risk of declining? Take these capital spending surveys with a large grain of salt. They were compiled as oil prices were falling, but before the full extent of the decline and its ramification on company profitability and cash flow was understood. Additionally, investor pressure on managements to “live within cash flow” has executives thinking seriously about how they can achieve that goal, while not crippling their company’s growth.

We were asked about the conundrum facing industry executives by a private equity investor. Do you spend now to sustain production and possibly grow it, or do you live within cash flow and return excess funds to shareholders? Our response was that executives should embrace the demand, at least for the next few years, after which, if reserves and output have declined, a more compelling argument could be made to shareholders for a change in spending priorities in order to ensure the sustainability of the corporation. Oil company credibility with investors must be restored before managements can ramp up spending. If this philosophy is embraced, we likely would see less production growth, which would lift oil prices.

At the moment, the oil price increase is a reaction to the OPEC+ group’s production cut, along with the surprising cut mandated for Alberta, Canada producers and the continuing output problems in Libya, Nigeria and Venezuela. The challenge for industry executives is to understand these are temporary moves. Once they end, if demand fails to increase and U.S. shale production rises as forecast, then the oil market could slip back into an oversupplied condition by the end of 2019, creating a potential rerun of 2018’s fourth quarter debacle. At the moment, less supply has elevated oil prices. However, global growth projections are being trimmed, but optimistic production growth forecasts are at risk following the oil price decline. The interaction of these forces will drive oil pricing this year.

NATURAL GAS

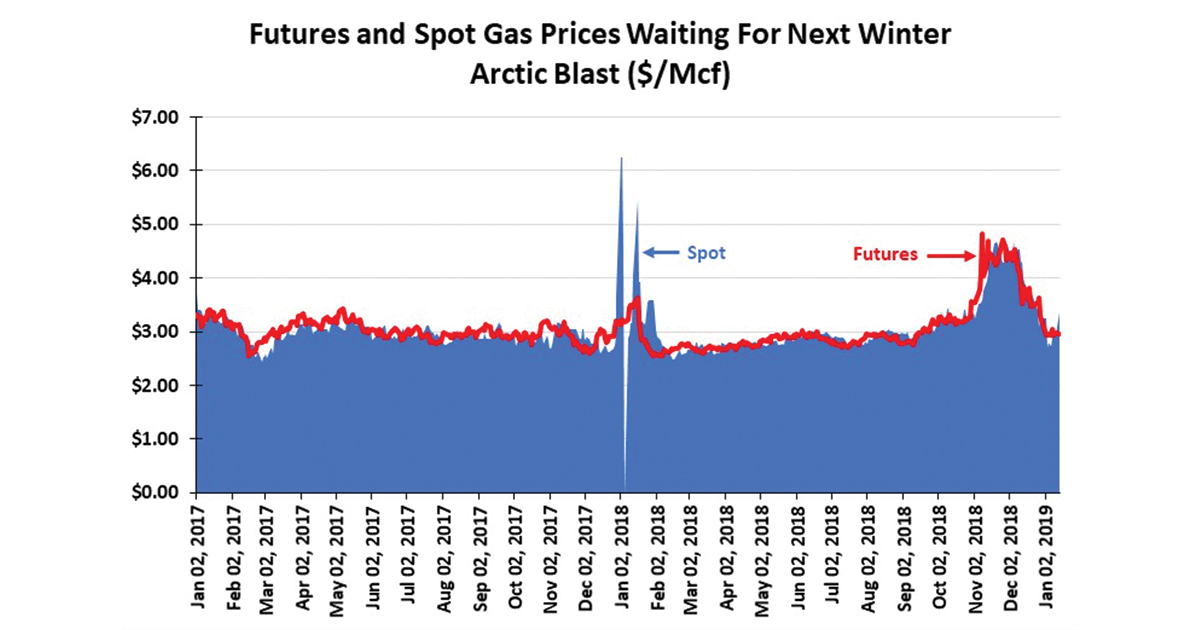

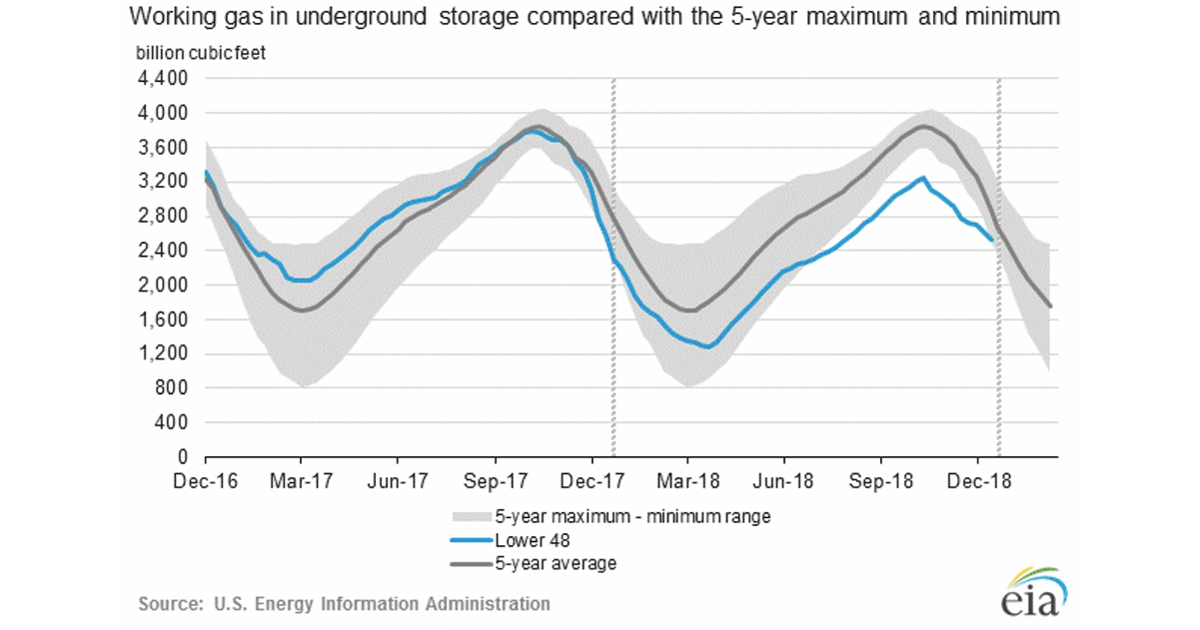

Natural gas price volatility continues. Gas prices are tethered to winter temperature forecasts. Given the low volume of natural gas in storage, every bout of cold temperatures brings a spike in gas futures prices. To understand why this is the case, one only needs to compare the relationship between weekly gas storage volumes relative to their 5-year average for this January versus the same two weeks in 2018. Last year, given the absence of cold weather, natural gas futures prices bounced in a range between the high $2.90s to low $3 per thousand cubic feet (Mcf). At that time, weekly storage held steady at about 88 percent of the 5-year average.

This winter, temperatures have not been materially colder than last year, although the recent Arctic Vortex that swept deep into the U.S. drove gas futures prices up by 50-cents/Mcf. Prior to that jump, gas prices had been hovering around $3/Mcf, very similar to last winter’s pricing. This year, weekly gas storage reports have shown significantly greater volatility.

For the first week of January, storage equaled 85 percent of the 5-year average, but due to a warm subsequent week, the ratio increased to nearly 89 percent, even though there was a large withdrawal. The volatility in that ratio reflects the sensitivity of storage to year-over-year relative temperature differences. It will be interesting to see where weekly gas storage volumes sit compared to the 5-year average in early February once the projected January Arctic Vortexes have passed.

For the first week of January, storage equaled 85 percent of the 5-year average, but due to a warm subsequent week, the ratio increased to nearly 89 percent, even though there was a large withdrawal. The volatility in that ratio reflects the sensitivity of storage to year-over-year relative temperature differences. It will be interesting to see where weekly gas storage volumes sit compared to the 5-year average in early February once the projected January Arctic Vortexes have passed.

The forces that shaped the domestic natural gas market in the recent past remain in place. The Energy Information Administration reports that domestic natural gas production averaged 83.3 billion cubic feet per day and is projected to increase to 90.2 Bcf/d in 2019 and 92.2 Bcf/d in 2020. A projected 8.3 percent increase in gas output this year will likely impact on gas futures prices, unless heating and electricity demand, as well as gas exports grow. But it also assumes gas output continues rising as predicted, an assumption starting to be questioned.

Exports are the key driver for gas demand. The flow of gas to Mexico has surged since early 2018, as pipeline capacity expanded. More capacity is needed, so Texas Congressional representatives introduced legislation to expand the North American Development Bank’s capacity to fund cross border pipelines. Since 2012, the flow of gas to Mexico has tripled, now at more than 6 Bcf/d, or 7 percent of total U.S. natural gas production. That growth comes as the U.S. ramps up liquefied natural gas exports. New terminals will enable more cheap U.S. gas to enter the global market. Despite healthy export demand, coupled with more gas for electricity generation, cold temperatures are what will influence prices over the next 60 days. Baring an extended deep freeze, the domestic gas market will likely see prices settling around $3.00/Mcf, but with plenty of daily volatility to keep the speculators happy.

By G. Allen Brooks | Author, Musings From the Oil Patch | www.energymusings.com