Gasoline Strength Supporting Refining Margins

Gasoline Strength Supporting Refining Margins

Oil prices are expected move higher with ongoing rebalancing, with non-OPEC supply still declining and demand growth healthy. OPEC cuts are not necessary for rebalancing but they would accelerate the drawdown of surplus stocks. Relatively firm gasoline cracks are supporting margins and runs despite the season. The IMO decided to implement tighter global bunker limits beginning in 2020. Gasoil-fuel oil spreads, sulfur spreads, crude quality differentials and freight costs will all increase substantially but not until ~2019/20.

Winter Price Floor Gives Way on Supply Concerns

Natural gas futures are headed for the largest weekly decline since January, with week-to-date selling postponing $3/MMBTU prices until mid-2017. With most of the sell-off occurring in the front of the curve, the Dec 2016 contract is now more aligned with injection season prices. The Q1 2017 strip has fared little better, maintaining only a slight premium to 2017 injection strip. To be sure, the contraction in the Mar17/Apr17 widow-maker spread — trading at a mere 6 cents, or the lowest recorded price — is a testament of how little concerned the market is about the industry meeting upcoming seasonal demand. Given how U.S. balances have shaped up so far, the market’s reassessment is more than understandable, especially with the storage carry-in shifting from less than 3.9 TCF to more than 4.0 TCF.

Germany: Renewables Strike against Coal; Power Exports Not High Enough

In a week when the front-month baseload German contract prices temporarily reached €50/MWh on the back of a new EDF statement on further delays for the restart of five units, STEAG provided some additional details around the future of its coal fleet. STEAG plans to close the units at West 1 and 2, Herne 3, Weiher and Bexbach, for a total capacity of 2.3 GW (BNetZA data) before the end of 2017. These closures are on top of the two units at Voerde already planned for closure by April 2017, whose combined capacity is 1.4 GW. PIRA calculated the additional coal capacity across Germany, other than STEAG, that may be at risk of closure.

Coal Prices Remain on Upward Trajectory

The bullish march of seaborne coal prices continued this week, with 1Q17 FOB Newcastle prices rising by $7.00/mt from the end of last week, while API#4 and API#2 prices rose by $6.65/mt and $5.15/mt, respectively. With China's import demand remaining strong on a sluggish supply response to the strength in pricing, there are not many fundamental factors blocking further pricing increases. However, in a change from the past several weeks, the back of the forward curve gained more than the front, in a seeming acknowledgement of the view that the backwardation in the curve was too pronounced.

2015 CA Emissions Down Less Than 1% Year-On-Year, with Growth in Transport; Quebec Stationary Emissions Flat

California 2015 cap-and-trade emissions data released today showed a slight decline year-on-year in overall emissions. In their first year with a compliance obligation, broad-scope emissions were up. However, narrow-scope emissions dropped, with imported power emissions coming in strongly lower. PIRA estimates that the cumulative California market surplus reflects a few months of emissions. Quebec recently released 2015 emissions data, but only for the narrow-scope sectors, which were flat year-on-year. We are awaiting Quebec’s first-time reporting of covered transport emissions, which could impact market outlooks and prices.

Asian LPG Markets Outperform

For the second consecutive week, Asian LPG markets performed best globally. December propane eased less than 1% to $382/MT. Meanwhile January and February Saudi Propane CP futures made big moves lower – dropping 4.5% and 5.8% respectively in last week’s trading. These futures track market expectations for Saudi contract prices, and their move lower is in opposition to the mostly flat market structure seen in MT Belvieu C3 markets.

Global Equities Lower Again

Global equities generally were lower again on the week. In the U.S, all the tracking sectors lost ground. Materials and housing fared the best, while technology, retail, energy, and consumer staples were the weakest. Many of the sectors, now, have a cautionary tone. Internationally, all the indices also lost ground.

U.S. Ethanol Prices Increase

Ethanol prices rose to a four month high in October as the markets tightened. Manufacturing margins decreased slightly as co-product DDG values dropped while corn prices advanced. Brazilian ethanol prices soared but are leveling off as hydrous ethanol is becoming non-competitive with gasoline in most states.

Markets Feel Tired

Much like Chicago Cubs fans, the markets felt a bit hung over to end the week. Poor late-week volume can be attributed to the lack of interested traders but there’s also the most bitter U.S. election to “look forward” to next week as well as the November WASDE. Funds have reduced their positioning to very little in corn while remaining bullish beans and especially the over-priced soybean oil market. Wheat shorts are heavy as usual.

Clarifying Current Iraqi Crude Production

Amid evolving OPEC talks, Iraq’s field-level accounting of its own crude production has garnered significant attention. The Iraqi oil ministry claims that September output averaged 4.77 MMB/D, over 300 MB/D higher than both the volumes estimated by the OPEC Secretariat’s secondary sources and PIRA’s own calculations. The accounting discrepancy comes from estimates for northern Iraq, where the ministry is double counting (and overestimating) production from two fields formerly operated by NOC. Specifically, the Bai Hassan and Avana fields, under KRG control since 2014, are included in Baghdad’s calculations for both NOC and KRG production.

Gasoline and Distillate Imports into Latin America Soar

Latin American gasoline demand is projected to grow slightly in 4Q16 while distillate demand is estimated to be ~50 MB/D lower than 4Q15. Brazilian gasoline demand is forecast to increase vs. 4Q15, stimulated by lower pump prices. On the crude side, Brazilian heavy crude exports are falling but medium crude exports are rising fast. Castilla Blend exports from Colombia were partially displaced by Basrah Heavy in the Indian market but have found a home in China. On the refining space, PIRA expects L. American crude runs to drop 370 MB/D year-on-year in 4Q16.

Power Favors Coal Again, But More LNG Will Bring Back Gas

Thanks to gas seasonality and increased power demand, spot gas pricing has risen 57% and is back over the coal switching price in Germany. Recently, coal has acted as a ceiling to gas pricing – this ceiling has finally been punctured. However, PIRA does not anticipate a huge divergence of gas over coal and expects this anchor to remain important and close to gas pricing for the moment. The shift north of the coal switching level has led to some declines in gas-to-power demand and is already relieving some pressure off of gas. Without gas rising drastically over coal and continued pressure on the European electrical grid relating to French nuclear outages, PIRA does not expect a major step back in gas-to-power demand.

Cheaper Residential Storage Offers Value for Distributed Solar by Addressing Peak Demand

Tesla introduced the residential storage Powerwall 2.0 unit, along with a new integrated rooftop solar design and updated specifications for its commercial-scale Powerpack product. The Powerwall 2.0, with a capacity of 7 kW-14 kWh, is double the size of the original Powerwall. The total installed price offers a 15% price reduction versus the original Powerwall system on a kWh basis. Although increasing the overall system costs, pairing storage with residential can also address ongoing changes to peak demand charges and net metering policies that may limit residential solar penetration.

CA Carbon Shows Unsteady Momentum

CA Carbon trading activity has picked up, but is well below prior levels, with pricing on a halting upward path. Reported 2015 CA emissions were down slightly year-on-year and the implied surplus/bank after 2015 is at about 4 months’ worth of emissions. First time broad scope QC emissions and ON emissions are still to be released. An undersubscribed Nov auction could see unsold allowances moved to the reserve reducing CP2 supply. Inflation indicators have been creeping up, pointing to an even higher 2017 reserve price Through the Scoping Plan, CARB is pursuing a preferred option based on cap and trade, with new refinery measures to help address environmental justice concerns.

Financial Stress Increases

The S&P 500 moved lower by about 2%, while volatility increased. High yield debt and emerging market debt both moved lower in price. The U.S. dollar was generally weaker, and commodities were mixed.

Tanker Rates Expected to Move Higher in 4Q16

Tanker rates are expected to improve seasonally in 4Q16 but weaken in 2017 as vessel supply growth outpaces demand.

U.S. Scorecard and Supply Report

U.S. ethanol production rose 31 MB/D to a nine-week high of 1,022 MB/D the week ending October 28, just 7 MB/D short of the record set earlier this year. Inventories fell by 180 thousand barrels to 19.7 million barrels following a large build in the preceding week. Ethanol-blended gasoline manufacture rose for the second consecutive week, reaching 9,160 MB/D, up 3.3% from this time last year.

Busy Week Ahead

A Republican or Democrat in the White House should make no difference to these markets in the near term; discounting a huge move in the dollar if the unexpected occurs. Then again grains, and especially oilseeds, have been disconnected from the expected inverse effect of the dollar for a while now.

OPEC Fiscal Breakevens Fall to $80/Bbl in 2017, But Deficits Add Pressure for a Production Cut

PIRA estimates the average OPEC budgetary breakeven price will fall to $80/Bbl in 2017, marking the third consecutive decrease in annual breakevens since the 2014 peak of nearly $110/Bbl. The gap between Brent oil prices and breakevens is poised to narrow. Breakevens have been coming down on fiscal reforms and higher net oil exports out of Iraq, Iran, and Saudi Arabia. Currency depreciation has also played an important role. Even so, most OPEC members still face significant budget shortfalls, which is driving material policy reforms. We have already started to see some major OPEC countries cut fuel subsidies, loosen resource control policies, and make moves to reduce economic dependence on oil. More immediately, we believe the pinch from low oil prices is behind OPEC’s newfound spirit of cooperation, and will likely facilitate a production agreement on November 30.

Cushing Stocks Fall; Bakken, Canadian Diffs Soften

While overall U.S. crude stocks rose in October, Cushing stocks declined 4 million barrels on reduced incoming flows from West Texas due to pipeline maintenance. The price of WTI climbed above $50/Bbl, before falling off at the end of the month. Differentials for Canadian and Bakken crudes declined, while Midland differentials strengthened.

A Higher NBP Opens Up the Window for Multiple Qatari and U.S. Options

Any possible concern about the profitability of sending cargoes into N.W. Europe has completely evaporated for the moment. European gas prices are spiking due to a combination of French nuclear problems, cross-border power constraints, below-normal temperature forecasts, and production problems in Norway. If there will ever be a moment to open the flood gates between the U.S. Gulf Coast and N.W. Europe, now appears to be the time.

U.S. Commercial Stocks Build as Crude Gains and Products Draw

Total commercial stocks built by 9.05 million barrels this past week, as crude stocks gained by 14.4 million barrels, partly offset by a 5.4 million barrel product draw. Highest weekly crude oil imports since 2012 of about 9 MMB/D led to the large crude oil stock build. Three major light product stocks declined by 5.5 million barrels. For the next week the key light product stocks are expected to continue falling. This week’s temporary outage of the Colonial Pipeline will lead to additional product imports in the following two weeks.

Egyptian Pound Float Playing Havoc with Gas Prices

The price of natural gas sold domestically to Egypt’s industrial sector increased by about 50% as a result of floating of the Egyptian pound against the U.S. dollar. Factories’ agreements for gas were signed according to the official market rate at the time. The price of the U.S. dollar currently stands at EGP 14, while at the time of signing the agreement the price was EGP 8.88. The source expected industrial sectors to request maintaining a fixed price for the US dollar in contracts signed with EGAS and lifting their products on the market to cope with the increase.

U.S. Economic Expansion Has Legs

In the U.S., after last week’s GDP data indicated solid growth for the third quarter, this week’s releases (job growth, business confidence, and vehicle sales) showed the momentum persisting in October. Medium-term drivers of economic growth pointed to further expansion in the future: the housing sector’s recovery still has a way to go; the recent pace of household formation has been constructive; and the labor market likely contains sufficient slack. The Fed is not likely to get in the way of continuing expansion.

Japanese Product Stock Draws Continue, Crude Stocks Correct lower

Crude runs fell back to near the lows seen in early October as maintenance continues. Crude imports came in very low and crude stocks drew 2.1 MMBbls, after the large 9.2 MMBbl build the previous week. Finished products again drew. Gasoline demand was modestly lower and appeared to lack any uplift from the Culture Day holiday. Gasoil demand was fractionally lower, although stocks still drew. Margins and cracks again improved on the week with overall levels remaining very healthy.

China’s Light Cycle Oil Imports Are Growing, Increasing Gasoil/Diesel Apparent Demand Growth

China’s gasoil/diesel demand growth weakened over the past few years. Based on traditional apparent demand calculations, that slowdown continued into 2016 with gasoil/diesel apparent demand growth weaker versus last year. However, on a closer look at China Customs Statistics, imports of light cycle oil have increased sharply over the past two years.

Myanmar Fast Emerging as Oil Demand Center

The economy of Burma / Myanmar is going through a major transformation. After a long period of international isolation, political liberalizations in recent years have opened up doors for foreign investment in a major way. Oil demand growth has also picked up strongly in recent years, and there are no obvious reasons to expect a slowing.

Aramco Pricing Adjustments: Tightened to Asia and Europe

Saudi Arabia's December formula prices for Asia and Europe tightened. The pricing adjustments were largely within market expectations. Our Saudi market share calculations for Asia are at the low end of recent history. If restoring market share was a tactical goal at this time, less aggressive tightening would have been necessary.

Colonial Pipeline Fire Shakes the Market

The Colonial Pipeline Company is dealing with a halt of flows of gasoline supplies from the USGC to the North and South East due to a fire. This is the second incident involving Colonial’s gasoline line in less than 2 months.

October Weather: U.S. Warm; Europe and Japan Cold

October weather for the three major OECD markets turned out to be normal compared to the 10-year normal and the resulting oil-heat demand impacts were 46 MB/D below normal. On a 30-year-normal basis, the markets were 11% warmer.

August 2016 U.S. Domestic Crude Supply Rises, but Will Resume Fall

EIA recently released their August oil balances. Domestic crude supply, which is domestic crude production plus the balancing item, rose off its July cyclical low by 203 MB/D, while the year-on-year decline in supply lessened to -494 MB/D for August, from -871 MB/D in July. This jump in domestic crude supply is viewed as a one-month occurrence, rather than sustained trend change.

U.S. August 2016 DOE Monthly Revisions: Demand and Stocks

EIA recently released its final monthly August 2016 (PSM) U.S. oil supply/demand data. August 2016 demand came in at 20.13 MMB/D, very slightly below what PIRA had assumed. Overall demand was revised lower by 536 MB/D, compared to the weeklies. Distillate demand was raised 150 MB/D. Total product demand increased 1.0% versus year-ago or 201 MB/D, compared to the August 2015 PSA data, and a snap back from the -2.1%, or 414 MB/D decline seen in July. End-August total commercial stocks stood at 1,367.7 MMBbls, which was 4 .1 MMBbls lower than PIRA had assumed in its balances, with product stocks coming in 5 MMBbls lower than assumed. Compared to final August 2015 PSA data, total commercial stocks are higher than year-ago by 101.2 MMBbls, versus an excess of 123.2 MMBbls seen at end-July.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

U.S. Commercial Stocks Led Lower by Product Draw

U.S. Commercial Stocks Led Lower by Product Draw

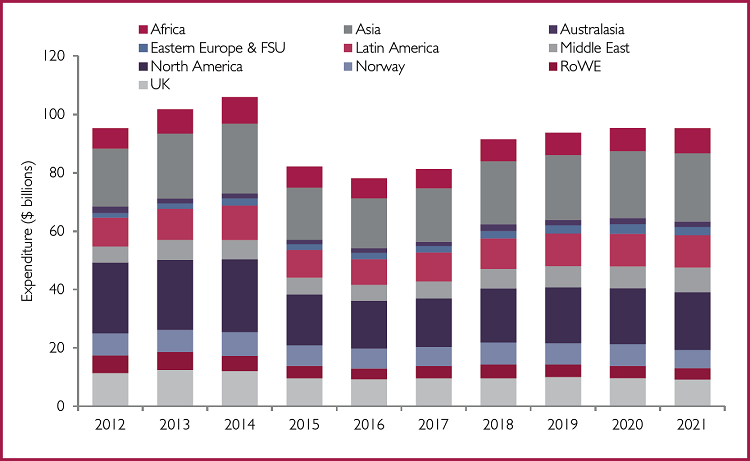

A sustained low oil price environment is a challenging one, with ‘survival of the fittest’ being an undeniable reality of the sector. Upstream E&P operators, in the past two years, have scurried to re-evaluate their operational Business as Usual (BAU) practices, implementing a myriad of measures ranging from immediate cost cutting steps such as the downsizing of the workforce, the elimination of redundancies as well as the rebalancing of portfolios as they aspire to come out of this battle stronger.

A sustained low oil price environment is a challenging one, with ‘survival of the fittest’ being an undeniable reality of the sector. Upstream E&P operators, in the past two years, have scurried to re-evaluate their operational Business as Usual (BAU) practices, implementing a myriad of measures ranging from immediate cost cutting steps such as the downsizing of the workforce, the elimination of redundancies as well as the rebalancing of portfolios as they aspire to come out of this battle stronger.

U.S. Crude Stocks Decline on Favorable Import/Export Arb

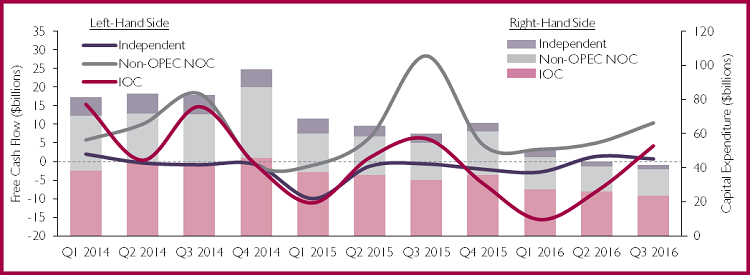

U.S. Crude Stocks Decline on Favorable Import/Export Arb The end of one of the worst downturns in the history of oil & gas may be in sight, as OPEC’s November meeting looms large – bringing with it fresh hopes of a production cut and consequent market rebalancing. In this context, DW has recently undertaken analysis of 15 major upstream players, to understand prospects for the industry should we see a near-term upswing in oil prices.

The end of one of the worst downturns in the history of oil & gas may be in sight, as OPEC’s November meeting looms large – bringing with it fresh hopes of a production cut and consequent market rebalancing. In this context, DW has recently undertaken analysis of 15 major upstream players, to understand prospects for the industry should we see a near-term upswing in oil prices.

Likely OPEC Output Cut to Accelerate Rebalancing

Likely OPEC Output Cut to Accelerate Rebalancing Leading international energy logistics group Peterson Offshore Group BV (“Peterson”),has announced its consolidated results for the 12 months ending 31st December 2015.

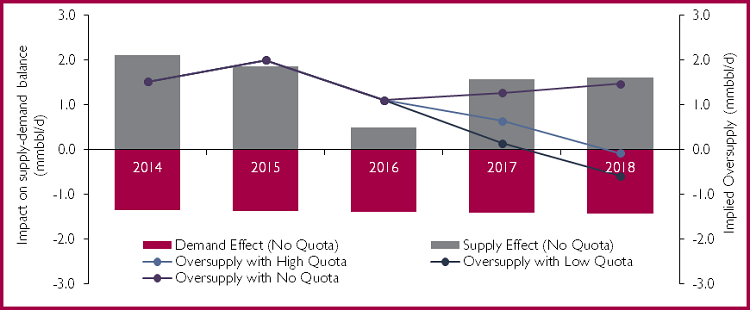

Leading international energy logistics group Peterson Offshore Group BV (“Peterson”),has announced its consolidated results for the 12 months ending 31st December 2015. Last week we covered the OPEC announcement on production cuts, a strategy to reduce over-supply in the market and give a much needed boost to oil prices. Without higher oil prices, many new projects are thought to be uneconomic. Or are they? Douglas-Westwood has recently reviewed over 250 upstream capital projects sanctioned in the last four years to assess how industry costs are moving. The results are remarkable.

Last week we covered the OPEC announcement on production cuts, a strategy to reduce over-supply in the market and give a much needed boost to oil prices. Without higher oil prices, many new projects are thought to be uneconomic. Or are they? Douglas-Westwood has recently reviewed over 250 upstream capital projects sanctioned in the last four years to assess how industry costs are moving. The results are remarkable.

Gasoline Strength Supporting Refining Margins

Gasoline Strength Supporting Refining Margins On Tuesday of last week, the British government announced its long-awaited decision on airport expansion, favoring the option of a third runway at Heathrow. Despite the clear and compelling economic benefits, it has taken nearly twenty years for the government to reach a decision on the now-critical requirement of increased capacity across the UK’s key airports; a decision that the Davies Commission estimates will deliver a GDP boost of $147bn over the next 60 years.

On Tuesday of last week, the British government announced its long-awaited decision on airport expansion, favoring the option of a third runway at Heathrow. Despite the clear and compelling economic benefits, it has taken nearly twenty years for the government to reach a decision on the now-critical requirement of increased capacity across the UK’s key airports; a decision that the Davies Commission estimates will deliver a GDP boost of $147bn over the next 60 years. Another Substantial U.S. Inventory Recovery

Another Substantial U.S. Inventory Recovery Oil Prices Are Supported by Surplus Stocks Declining

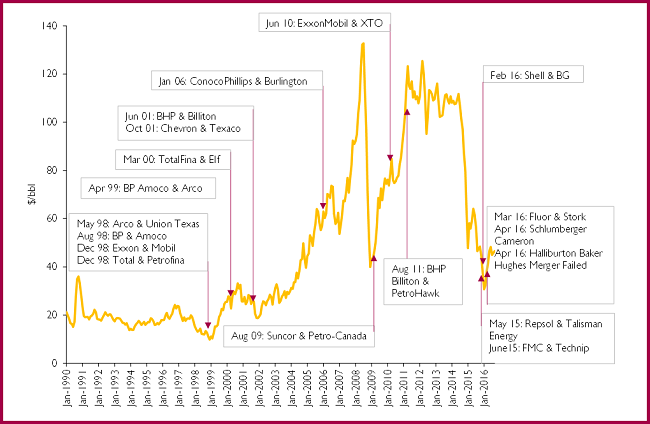

Oil Prices Are Supported by Surplus Stocks Declining Historically, the oil & gas industry has witnessed merger and acquisition (M&A) activity through cycles, as companies try to create value in volatile oil price environments. The current downturn has resulted in a number of M&A opportunities for suitably placed players, as illustrated below.

Historically, the oil & gas industry has witnessed merger and acquisition (M&A) activity through cycles, as companies try to create value in volatile oil price environments. The current downturn has resulted in a number of M&A opportunities for suitably placed players, as illustrated below.

China's Pace of Refinery Capacity Additions Slowed, but the Rest of Asia Still Adding

China's Pace of Refinery Capacity Additions Slowed, but the Rest of Asia Still Adding In a move to increase foreign investment amid the nation’s worsening economic position, Brazil’s Congress has approved legislation that will remove state-controlled Petrobras’ obligation as sole operator on the country’s pre-salt developments. Discovered in 2007, these ultra-deepwater fields represent a huge opportunity – they are the largest group of offshore reserves discovered this century.

In a move to increase foreign investment amid the nation’s worsening economic position, Brazil’s Congress has approved legislation that will remove state-controlled Petrobras’ obligation as sole operator on the country’s pre-salt developments. Discovered in 2007, these ultra-deepwater fields represent a huge opportunity – they are the largest group of offshore reserves discovered this century. Large U.S. Product Build

Large U.S. Product Build