NOAA has presented to the U.S. Coast Guard a new report that finds that 36 sunken vessels scattered across the U.S. seafloor could pose an oil pollution threat to the nation’s coastal marine resources. Of those, 17 were recommended for further assessment and potential removal of both fuel oil and oil cargo.

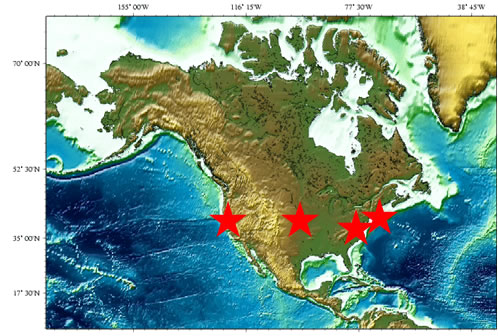

The locations of the 17 wrecks NOAA is recommending be considered for in water assessment and pollution recovery if necessary.

The sunken vessels are a legacy of more than a century of U.S. commerce and warfare. They include a barge lost in rough seas in 1936; two motor-powered ships that sank in separate collisions in 1947 and 1952; and a tanker that exploded and sank in 1984. The remaining sites are 13 merchant marine ships lost during World War II, primarily along the Atlantic Seaboard and Gulf of Mexico. To see a list of the ships and their locations, visit: http://sanctuaries.noaa.gov/protect/ppw/.

The report, part of NOAA’s Remediation of Underwater Legacy Environmental Threats (RULET) project, identifies the location and nature of potential sources of oil pollution from sunken vessels. Knowing where these vessels are helps oil response planning efforts and may help in the investigation of reported mystery spills--sightings of oil where a source is not immediately known or suspected.

“This report is the most comprehensive assessment to date of the potential oil pollution threats from shipwrecks in U.S. waters,” said Lisa Symons, resource protection coordinator for NOAA’s Office of National Marine Sanctuaries. “Now that we have analyzed this data, the Coast Guard will be able to evaluate NOAA’s recommendations and determine the most appropriate response to potential threats.”

“The Coast Guard is pleased to receive these risk assessments from our partner agency NOAA and looks forward to our continued coordination on the matter of potential pollution associated with sunken vessels in U.S. waters,” said Capt. John Caplis, the Coast Guard’s chief of marine environmental response. “Coast Guard federal on-scene coordinators receiving the risk assessments will carefully review the data and incorporate it into their area contingency plans.”

In 2010, Congress appropriated $1 million for NOAA to develop a list of the most significant potentially polluting wrecks in U.S. waters, including the Great Lakes, specifically addressing ecological and socio-economic resources at risk. Those funds were not intended for oil or vessel removal.

NOAA maintains the internal Resources and UnderSea Threats (RUST) database of approximately 30,000 sites of sunken material, of which 20,000 are shipwrecks. The remaining items are munitions dumpsites, navigational obstructions, underwater archaeological sites, and other underwater resources.

Initial screening of these shipwrecks revealed 573 that could pose substantial pollution risks, based on the vessel’s age, type, and size. This includes vessels built after 1891, when U.S. vessels began using fuel oil; vessels built of steel; vessels over 1,000 gross tons, and any tank vessel.

Additional research about the circumstances of each vessel’s loss narrowed that number to 107 shipwrecks. Of those, some were deemed navigational hazards and demolished, and others were salvaged. Most of the 107 wrecks have not been directly surveyed for pollution potential, and in some cases little is known about their current condition.

To prioritize and determine which vessels are candidates for further evaluation, NOAA used a series of risk factors to assess the likelihood of substantial amounts of oil remaining onboard, and the potential ecological and environmental effects if that oil spills. Risk factors include the total oil volume onboard as cargo or fuel, the type of oil, and the nature of the sinking event. For example, a vessel that was struck by multiple torpedoes would likely contain less oil than a vessel that sank in bad weather.

After this third level of screening, 87 wrecks remained on the list developed for the Coast Guard’s area contingency plans. Among this group, NOAA determined that 36 shipwrecks are candidates for a “Worst Case” discharge event in which the shipwreck’s entire fuel oil and oil cargo would be released simultaneously, and recommended that 17 of these wrecks be considered for further assessment and feasibility of oil removal.

Six wrecks are potential candidates for a “Most Probable” discharge event, where a shipwreck could lose approximately 10 percent of its fuel oil or oil cargo. To date, known oil discharges from shipwrecks are typically in the “Most Probable” category or smaller.

The report, including 87 risk assessments, is not intended to direct Coast Guard activities, but rather provide the Coast Guard with NOAA’s scientific and technical assessment and guidance as a natural resource and cultural heritage trustee.

The Coast Guard, as the federal On-scene Coordinator for mitigating oil spills in the coastal marine environment, the Regional Response Teams, and local Area Committees, as established under the Oil Pollution Act of 1990, will review and incorporate the assessments into regional and area marine environmental response contingency plans. The individual risk assessments not only highlight concerns about potential ecological and socio-economic impacts, but also characterize most of the vessels as historically significant and many of them as grave sites, both civilian and military.

Funding for any assessment or recovery operations determined to be necessary is dependent upon the unique circumstances of the wreck. If a wreck still has an identifiable owner, that owner is responsible for the cost of cleanup. Coast Guard officials say that if no responsible party exists, the Oil Spill Liability Trust Fund would likely be accessed.

To view the report, 2012 Risk Assessment for Potentially Polluting Wrecks in U.S. Waters, visit http://sanctuaries.noaa.gov/protect/ppw/.

As America’s maritime first responder, the Coast Guard protects those on the sea, protects our nation from threats delivered by sea, and protects the sea itself. By executing our marine environmental protection responsibilities, the Coast Guard reduces the risk of harm to the marine environment by developing and enforcing regulations to prevent and respond to maritime oil spills and hazardous substance releases.

.

Crowley as vice president of Carib Energy, reporting to Jackson. Buffington will continue to develop and expand the company’s Caribbean and Central America opportunities for small-scale LNG applications. His experience is deeply rooted within the international propane gas industry where he spent 31 years in varying capacities. He was the founder of EFG Industries, an international supplier of liquefied petroleum gas (LPG) equipment, engineering and plant construction.

Crowley as vice president of Carib Energy, reporting to Jackson. Buffington will continue to develop and expand the company’s Caribbean and Central America opportunities for small-scale LNG applications. His experience is deeply rooted within the international propane gas industry where he spent 31 years in varying capacities. He was the founder of EFG Industries, an international supplier of liquefied petroleum gas (LPG) equipment, engineering and plant construction.

Qatar Petroleum International (QPI)

Qatar Petroleum International (QPI)  framework of Agreement whereby QPI will participate in Total E&P Congo through its subscription to a 15% share capital increase of this company. This participation reinforces Qatar’s commitment to invest in Africa and illustrates Congo’s willingness to welcome Qatar as a new partner. Furthermore, thanks to its subscription to the capital of Total E&P Congo, QPI will contribute to the company’s significant investment programmed in Congo, specifically the Moho North project.

framework of Agreement whereby QPI will participate in Total E&P Congo through its subscription to a 15% share capital increase of this company. This participation reinforces Qatar’s commitment to invest in Africa and illustrates Congo’s willingness to welcome Qatar as a new partner. Furthermore, thanks to its subscription to the capital of Total E&P Congo, QPI will contribute to the company’s significant investment programmed in Congo, specifically the Moho North project. BP

BP Cal Dive International, Inc

Cal Dive International, Inc

CGG

CGG

In the construction of a subsea project, one challenge is the long delivery time of large steel forgings used for key components. This is mainly due to compliance with oil companies’ individual requirements.

In the construction of a subsea project, one challenge is the long delivery time of large steel forgings used for key components. This is mainly due to compliance with oil companies’ individual requirements. Wood Group PSN (WGPSN)

Wood Group PSN (WGPSN) Gulfstream Services Inc (GSI),

Gulfstream Services Inc (GSI),