NYC-based PIRA Energy Group believes that the oil market faces more price pressure and the rebalancing of the market faces headwinds. In Japan crude runs and imports declined and stocks drew. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group believes that the oil market faces more price pressure and the rebalancing of the market faces headwinds. In Japan crude runs and imports declined and stocks drew. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

More Price Pressure, While Rebalancing Faces Headwinds

The global economy is expected to remain resilient amid challenges. But a more positive macro setting is unlikely to offset the negative price impact of further stock building. Oil markets are likely to run out of onshore crude tankage in March/April. Oil markets have no price anchor with the back of the market broken and no OPEC supply regulation. There are significant headwinds to rebalance oil markets with currency depreciation, new projects and ongoing spending slowing supply destruction.

Greater Clarity on Weather Still Needed

This month’s net South Central storage draw will finally top the year-ago mark. Despite that gain, the end-month position will still exceed the record high for January set in 2012. Moreover, the resulting and still large year-on-year surplus puts a premium on heating demand in the region — as well as in the Midwest and Northeast — given the structurally greater supply exposure the South Central now has to Appalachia supply. Yet, the outlook for February, especially the second half of the month, remains unsettled. By comparison, fundamentals for the remainder of the heating season point to tighter balances in the West. As a result, more upside than downside risks exist for basis in this West, especially if warm weather again takes hold in the East.

Spark Spread Renaissance

The pricing picture in Germany has deteriorated to a point to compromise the operational patterns of the least efficient units during the summer. In fact, more competitive gas-fired units are depressing German summer peak prices, leading to a further narrowing of the base-peak spreads. In the meantime, French prices have also collapsed to levels that we believe are unsustainable. History shows that nuclear output was cut in periods of depressed prices or lack of demand (i.e. 2009). We expect French prices to stay firmer.

As Thermal Coal Pricing Settles, PIRA Adopts a Slightly Bullish View of 2017

The downshift in oil price and concerns over China’s economy have driven the coal market lower over the past month, although price declines have been somewhat tame relative to the drop in oil. This suggests that coal prices may be finding a modest amount of support at current levels. However, with China’s imports continuing to fall and seasonal buying about to fade, there remains limited upside to pricing in 2016. In the Atlantic Basin, with European coal demand structurally falling in 2016 and 2017, it will be difficult for CIF ARA prices to rise much at all in absolute terms and relative to Pacific Basin prices.

European LPG Prices Remain Soft; Demand Drags as Forecast Warms

The recent brief bout of colder weather was insufficient in drawing regional LPG stocks, leaving Europe well supplied as milder conditions return. Price gains underperformed last week, further crimping import arbitrage economics. February propane cargo futures rose an anemic 2.2% to $261/MT while cash butane cargo prices added only $9 to end the week near $280 Friday.

U.S. Supreme Court Upholds FERC Rule on Demand Response

A U.S. Supreme Court ruling cemented FERC's authority to implement demand response (DR) rules and compensation of DR in capacity and energy markets. It has varying implications for the different kinds of regional markets. For PJM, NYISO, ISONE— with downward sloping demand curves for capacity auctions — higher DR participation would allow for procuring higher reserve margins at lower capacity price points. For MISO— with a vertical demand curve for capacity— the effect of an increase in DR participation would be more pronounced.

U.S. GDP Growth Slows, but 2016 Strengthening Is Anticipated

The pace of U.S. GDP growth decelerated for the second consecutive time during the fourth quarter. PIRA’s outlook expects the U.S. economy to rebound and record moderate growth during 2016. The business investment sector, which has disappointed lately, holds the key to the future. The Bank of Japan surprised financial markets by deciding to apply a negative interest rate on bank reserves. Recent aggressive easing postures from Europe and Japan create pressure on the U.S. Fed to adopt a more dovish message.

Ethanol Output and Stocks Drop

U.S. ethanol production declined sharply last the week ending January 22. Ethanol inventories fell for only the third time since October.

Farm Economy Concerns

Against the backdrop of a continuing spirited conversation on how many acres will get planted with this or that, and how many will be put in the Conservation Reserve Program as producers “give up” on these prices, came some news from the Kansas City Fed on the health of the farm economy.

Gasoline Cracks Will Lead the Way but Not as Strong as in 2015

Growing crude stocks with higher Iranian exports and spring refinery maintenance will weigh further on crude prices in 1Q16. Brent-WTI differentials will widen. Light-heavy crude differentials widen. Margins stay healthy and runs fairly high through the summer. Gasoline cracks, while strong now, should pause or even retrench in Feb./March before increasing for the summer, but remain much weaker than last year. Diesel cracks will be slow to recover.

Demand Brightens, but Price Impact Will Be Limited

The January resurgence in European gas demand is coming from two major sources: residential heating and power generation. The former relates to temperature and the latter relates to price. The combination has been strong enough to support spot gas prices relative to other fossil fuels and other gas markets, but support will be hard to repeat for the balance of the quarter, as the average number of heating degree days begins to wane in the second half of the month.

Western Grid Market Forecast

Spot on-peak power prices recorded modest gains at Mid-Columbia in January compared with December. Southwestern hub prices were little changed despite rising gas prices as gains in nuclear and hydro output displaced gas-fired generation. As of late January, California cumulative precipitation and snowpack for the water year to date are above normal, and we have revised up generation projections accordingly. Despite lower seasonal demand, with hydro output remaining down year-on-year through March we look for Mid-Columbia implied on-peak heat rates to be supported in the low-mid 9,000s. Reduced inflows from the Northwest and weaker gas prices year-on-year are expected to support modest gains in heat rates at the Southwest hubs through March. Thereafter, these conditions begin to reverse and, along with rising CA hydro output, lead to weaker heat rates year-on-year.

Weak Freight Rates Are Increasing the Viability of Ship Layups

In December, freight rates collapsed across the full spectrum of dry markets with record tripcharter lows for the month. Bunker fuel prices have continued to tumble, adding further downward pressure on spot rates. Both Australian and Brazilian iron ore exports recorded an end-year surge, but loadings then slowed in January. Weakness in China’s housing market and industrial sector, combined with an unprofitable steel industry, is hurting China’s appetite for raw materials, and coal trading activity is expected to slow. The sheer scale of the recent slump in freight rates has brought into focus the option of laying up ships on a longer basis.

Global Equities Continue to Post Gains

Global equities generally posted another positive week. In the U.S. all the tracking indices gained for the week. Energy, utilities, and industrials posted the strongest gains, while materials and housing lagged. Internationally, with the exception of China, all the tracking indices posted definitive gains. Latin America and emerging markets were the strongest performers. Global performance for the first month of the year is down 6.4% versus end-year 2015, but it's an improvement from what had been seen in the first half of the month.

Shocking Commitment of Traders

More than a few post-close beverages apparently were dropped to the floor Friday afternoon after the Commitment of Traders showed a surprising, some would say shocking, change in corn ownership. For the week ending January 26th, the Non-Commercial net short decreased by a total of 74.1K contracts, far more than anyone had expected.

Ethanol Values Jump as the Market Tightens

U.S. ethanol values climbed in the second half of January as manufacturers reduced output due to collapsing margins late last year and in early January.

Big U.S. Product Stock Decline; Crude Build

A large U.S. crude stocks build, almost entirely in PADD III, was more than offset by a large product stock draw, for a total commercial stock draw. A noticeable exception to the product draw was gasoline. A combination of strong demand and a sharp drop in crude runs drove the overall product stock draw. Next week the demand impact of the recent U.S. East Coast snowstorm and continued refinery outages should drive a crude, gasoline, and jet stock build, and a smaller distillate stock draw. Gasoline stocks could reach a new weekly record high next week and have certainly gained ground on distillate stocks since late last year.

Argentina Is Considering Raising Natural Gas Prices to Boost Production

Omar Gutierrez, governor of the gas-rich Neuquen province, said he is working on the plan for higher prices with Guillermo Pereyra, a national senator who also runs the Union of Private Oil and Gas Workers in the southwestern provinces of La Pampa, Neuquen and Rio Negro. Gutierrez said they have taken the proposal to national Energy Minister Juan Jose Aranguren and will meet with him again. "Neuquen has a very significant opportunity to provide the larger gas supplies that the country needs," Gutierrez said in a statement.

U.S. Coal Stockpile Estimates

Power sector coal stocks have drawn modestly this month as more seasonal weather conditions in the eastern U.S. have lifted coal burn month-on-month, and fuel deliveries have slowed. PIRA estimates U.S. electric power sector coal stocks will reach 190 MMst by the end of this month, a record level for January.

Some Relief Apparent for Financial Markets

Financial stress remains elevated, but some relief was very apparent this week. The S&P 500 posted a gain on the week and a very strong rally on Friday. The other key indicators, such as VIX, high yield debt (HYG) and emerging market debt (EMB), also staged impressive performances. Commodities had a better week, while the U.S. dollar was mixed. It remains to be seen if the positive action this past week is sustainable or is merely a short-term rally from oversold positions.

Japanese Crude Runs and Imports Decline and Stocks Drew

Crude runs fell reflecting a turnaround that began. Crude imports dropped back such that stocks drew a strong 4 MMBbls. Product demands posted solid gains, and finished product stocks also drew about 4 MMBbls. Kerosene demand was very strong with an accelerating stock draw rate. Refining margins remain strong. Fuel oil cracks firmed further, while light product cracks were modestly changed.

Japan Nuclear Restarts Roll Out, with Big LNG Buyer Next in Queue

The confirmation that Kansai Electric has been cleared to restart its 870-MW Takahama No. 3 nuclear reactor is the first clear indicator for 2016 that the Asian LNG demand situation could actually get worse before it gets better. While fossil fuel demand losses have been built into Japan’s oil and gas outlook as a result of nuclear restarts, the first of which occurred last August and the second in October, these losses were weighted towards the middle to end of the year and continuing at a modest pace through 2018. Kansai, which is Japan’s largest consumer of oil in power generation and third largest consumer of LNG, was in PIRA’s reference case for early in 2Q; Kansai expects to begin generating power by early February, and the sister unit Takahama 4 will probably not be that far behind. PIRA forecasts a May start-up for the second unit.

Proposed OPEC/Non-OPEC Cuts Are Supportive to Price for Now

Saudi Arabia is reported to have proposed 5% OPEC/non-OPEC cuts to support faltering oil prices. This is not new because this was proposed over a year ago but what is new is that very low prices, and the fear of them going lower, have apparently caused enough pain that the most important non-OPEC oil producer/exporter in the world, Russia, is seriously considering Saudi Arabia’s proposal. Until the outcome of the current deliberations by Russian authorities is known, the oil market will have to take the possibility of OPEC/non-OPEC cuts more seriously, thus providing some support for oil prices. PIRA’s best guess is that the probability of OPEC/non-OPEC is less than 50%, but going from zero to something less than 50% has to be somewhat positive for prices.

Weather-Driven Storage “Roulette”

Following a seemingly endless bearish North American gas market, analysts have begun to struggle over how seriously to take the potential for sustainably more bullish prices. Only a month ago, bearish Henry Hub (HH) fundamentals looked like a carbon copy of the entire past year or so thanks to a December collapse of gas-weighted heating degree days (GWHDDs) and expectations of more mild weather to come, in part thanks to the “monster” El Niño.

High Gasoline Stocks in PADD II Hurting Margins — Runs Cuts Likely

PADD II refinery margins are under pressure from high gasoline stocks and local crude that has lost its prior discount to other regions. Some trimming of runs is likely to occur. This will weigh on WTI in Cushing, directionally widening crude differentials.

Holding Pattern until Greater Near-Term Weather Clarity

Recent swings in near-term weather forecasts have been largely behind the gyrations in NYMEX futures: the March contract fell below $2.10/MMBtu before reversing course and breaching the $2.20 mark. Meanwhile, storage withdrawals have increased for five consecutive weeks, handily topping 200 BCF recently, but preliminary balances suggest that the reliance on storage will be sharply reduced for the next two storage releases, partly reflecting less-than-normal GWHDDs predicted through the second week of February.

November Domestic Crude Supply Equal to a Year Ago, Even as Monthly Crude Stocks Set a New Record

Friday’s November 2015 Petroleum Supply Monthly reported that domestic crude supply (production plus balance item) continues to trend down, to a rate equal with November 2014. End-November monthly U.S. Crude Inventories, however, set a new record high. Crude runs were revised up about 140 MB/D to 16.49 MMB/D, a crude run rate usually seen during summer run peaks.

What Could an OPEC/Non-OPEC Output Cut Look Like?

While it is far from clear whether an OPEC/non-OPEC production cut will occur, PIRA thought it worthwhile to outline what such a cut could look like and which countries would likely be involved. If there are cuts, PIRA believes they will be modest as to not disrupt the oil market rebalancing process. Azerbaijan, Kazakhstan, Mexico, Norway, Oman, and Russia are likely candidates to join in coordinated cuts with OPEC. We also demonstrate what a potential agreement may look like, assuming a 4% reduction in OPEC and non-OPEC output. A gross headline cut of 2 MMB/D would amount to a 1 MMB/D net reduction in supply, which would begin to reduce the stock surplus in 2Q16.

January Weather: U.S., Europe and Japan Warm

January’s heating degree days came out roughly 4% warmer than the 10-year normal for the three major OECD markets with a composite net oil-heat demand effect of -239 MB/D. On a 30-year-normal basis, the markets were roughly 8% warmer.

U.S. November 2015 DOE Monthly Revisions: Demand and Stocks

DOE released its final monthly November 2015 (PSM) U.S. oil supply/demand data last week. November 2015 demand came in at 19.19 MMB/D, which is 86 MB/D higher than what PIRA had carried in its monthly balances. Compared to the DOE weeklies, total demand was lowered 511 MB/D. Total demand for November 2015 versus November 2014 (PSA) declined 182 MB/D, or 0.9%, less than the decline posted in October of 1.7%. End-November stocks stood at 1,326 MMBbls, which were 8 MMBbls higher than PIRA's assumption for end-November, with products higher by 11 MMBbls, but crude lower by 3 MMBbls. Compared to the weekly preliminary data, DOE raised commercial stocks 18.8 MMBbls, with products being raised 19.3 MMBbls, 10 MMBbbls being distillate which fed back into weak demand.

The information above is part of PIRA Energy Group's weekly Energy Market Recap, which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

BP

BP Aker Solutions' maintenance, modifications and operations (MMO) business in Norway secured two contracts for work at North Sea fields operated by ConocoPhillips.

Aker Solutions' maintenance, modifications and operations (MMO) business in Norway secured two contracts for work at North Sea fields operated by ConocoPhillips. Image Credit: Bristow Group

Image Credit: Bristow Group Chukar Waterjet, Inc. will unveil its new SUB-JET 3000™ ROV-attachable waterjet system at the OTC Offshore Technology Conference, May 2-5 in Houston. Look for Chukar in outdoor booth 546.

Chukar Waterjet, Inc. will unveil its new SUB-JET 3000™ ROV-attachable waterjet system at the OTC Offshore Technology Conference, May 2-5 in Houston. Look for Chukar in outdoor booth 546. UTEC Survey

UTEC Survey Pipeline technology company,

Pipeline technology company,  Block 14 is located in the Pelotas basin of the South Atlantic Ocean, approximately 200 kilometers off the coast of Uruguay. It covers an area of 6,690 square kilometers in water depths of 1,850 to 3,500 meters.

Block 14 is located in the Pelotas basin of the South Atlantic Ocean, approximately 200 kilometers off the coast of Uruguay. It covers an area of 6,690 square kilometers in water depths of 1,850 to 3,500 meters. Oceaneering’s Maritime Business Systems

Oceaneering’s Maritime Business Systems Event attendees will see live PortVision 360 demonstrations and learn about enhanced alerting and reporting capabilities that can be customized for information sharing and collaboration. Oceaneering will also host exclusive sessions with key customers and industry stakeholders during the day, focused on critical issues facing marine terminal management and marine pipeline protection.

Event attendees will see live PortVision 360 demonstrations and learn about enhanced alerting and reporting capabilities that can be customized for information sharing and collaboration. Oceaneering will also host exclusive sessions with key customers and industry stakeholders during the day, focused on critical issues facing marine terminal management and marine pipeline protection. Zupt, LLC

Zupt, LLC Subsea 7 S.A. (Oslo Børs: SUBC, ADR: SUBCY) announces the award of a sizeable(1) three-year frame agreement, with four one-year options, for six North Sea clients: Chevron North Sea Limited, Dana Petroleum (E&P) Limited, Hess Denmark APS, Nexen Petroleum U.K. Limited, Talisman Sinopec Energy UK Limited and TAQA Bratani Limited.

Subsea 7 S.A. (Oslo Børs: SUBC, ADR: SUBCY) announces the award of a sizeable(1) three-year frame agreement, with four one-year options, for six North Sea clients: Chevron North Sea Limited, Dana Petroleum (E&P) Limited, Hess Denmark APS, Nexen Petroleum U.K. Limited, Talisman Sinopec Energy UK Limited and TAQA Bratani Limited. TENAGA rig crew gathered on the helideck

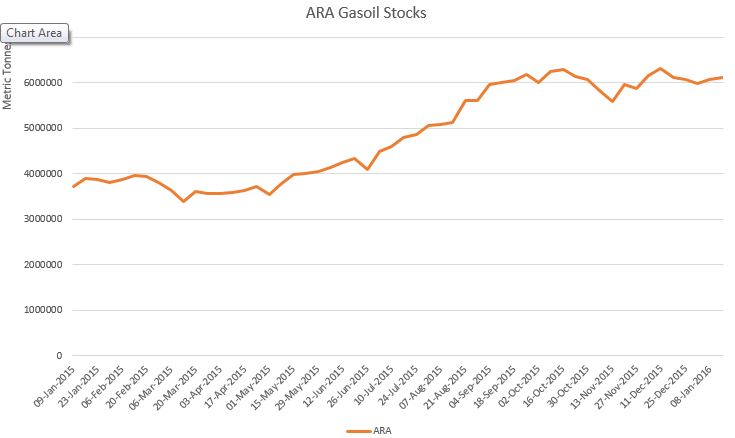

TENAGA rig crew gathered on the helideck ARA gasoil/ULSD stocks have trended upwards over the past 12 months.

ARA gasoil/ULSD stocks have trended upwards over the past 12 months. Some product tankers have brought gasoil and ULSD from the Mideast Gulf to Europe via the longer Cape route.

Some product tankers have brought gasoil and ULSD from the Mideast Gulf to Europe via the longer Cape route. The contracts awarded on behalf of the license partners include marine operations, marine construction, engineering, procurement and construction (EPC) of an unmanned wellhead platform as well as modifications at the Oseberg Field Centre.

The contracts awarded on behalf of the license partners include marine operations, marine construction, engineering, procurement and construction (EPC) of an unmanned wellhead platform as well as modifications at the Oseberg Field Centre. ABB, a leading power and automation technology group, will provide the technology that will help three vessels safely carry out construction and maintenance tasks up to 5 kilometers under water. The vessels will be equipped with ABB’s OCTOPUS software that uses sensors and the Internet of Things, Services and People (IoTSP) to interpret weather conditions, allowing the crew to make informed decisions during sensitive operations. The ships will be built for Ultra Deep Solutions at CSIC Huangpu Wuchang Shipbuilding Company Limited and China Merchants Heavy Industry.

ABB, a leading power and automation technology group, will provide the technology that will help three vessels safely carry out construction and maintenance tasks up to 5 kilometers under water. The vessels will be equipped with ABB’s OCTOPUS software that uses sensors and the Internet of Things, Services and People (IoTSP) to interpret weather conditions, allowing the crew to make informed decisions during sensitive operations. The ships will be built for Ultra Deep Solutions at CSIC Huangpu Wuchang Shipbuilding Company Limited and China Merchants Heavy Industry. GE Oil & Gas (NYSE: GE) has announced the creation of its new Oil & Gas Digital Solutions business, appointing Matthias Heilmann as head of the organization and Chief Digital Officer. GE also announced the development of a pilot program with BP and a business partnership with subsurface software company Paradigm.

GE Oil & Gas (NYSE: GE) has announced the creation of its new Oil & Gas Digital Solutions business, appointing Matthias Heilmann as head of the organization and Chief Digital Officer. GE also announced the development of a pilot program with BP and a business partnership with subsurface software company Paradigm. NYC-based

NYC-based