NYC-based PIRA Energy Group believes that low crude price is impacting non-shale lower 48 production. In the U.S., demand recovers but stocks increase to new high. In Japan, crude runs and imports declined and stocks drew. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group believes that low crude price is impacting non-shale lower 48 production. In the U.S., demand recovers but stocks increase to new high. In Japan, crude runs and imports declined and stocks drew. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

U.S. Demand Recovers but Stocks Increase to New High

Reported demand increased after two weeks of holiday depressed demand. Commercial stocks still managed to build making a new all-time high and expanding the stock surplus to last year. It is hard for oil prices to go up despite how low they currently are while stocks are building, especially in the current fragile macro environment which weakens the demand for inventory.

Supply Delays Emerge, but Do Not Erase Price Weakness

PIRA is pushing back some start up dates on LNG production over the next 24 months due to weaker prices and a lack of buying enthusiasm from key contract holders. Sellers with take or pay contracts in hand to sell LNG or tolling will be more eager to fire up the liquefaction than producers with non-contracted volumes faced with a crowded spot market.

Spark Spread Renaissance: How Wide Can Spread Sparks Go?

The widening of the spark spreads is now a reality across the Continent, with Germany now seeing the most efficient gas units starting to move in the money. While fossil fuel requirements continue to shrink further, due to weak demand and growing renewable output, German gas profitability has the potential to rebound to 2010 levels, but this outcome will be entirely driven by the movements in gas prices.

LPG Rebounds With Crude, Natural Gasoline Slide Continues

U.S. Gulf Coast LPG prices rebounded strongly with the broader energy markets. February Mt Belvieu propane prices improved by 12% to 33.6¢/gal and butane settled 5 cents higher on the week at 47.8¢. Natural gasoline prices continued to underperform last week as the blendstock’s value sagged to just 93% of WTI, after weeks of trading at a premium.

Coal Prices Rebound, Limited Upside on China Risks

Coal pricing ended its string of weeks in which prices declined week-on-week last week, with Atlantic Basin prices leading the charge upward. For 1Q16, API#4 (South Africa) rose by the greatest extent, followed by API#2 (Northwest Europe) which also rebounded strongly. A notable jump in FOB Richards Bay physical pricing, where one buyer reportedly pushed the market higher perhaps on short covering, likely fed into the notable rise in API#4. FOB Newcastle (Australia) prices moved up modestly compared to the prior week. Over the short term, coal prices will remain under considerable pressure due to depressed oil pricing and weak coal demand from China.

Impressive Corn Exports

A nice jump in corn sales was credited as the reason for last week’s rally but there’s a bit more to the story. The export number of 1.157M MT was for the week ending January 14th, so all the buying theoretically could have taken place on the 11th and 12th when the corn market tested sub-$3.50 futures pricing. While interest in corn at that level is supportive, it does not indicate interest at current levels which are 20 cents higher than the lows.

U.S. Ethanol Output Drops, but Stocks Rise to a Three-Year High

Ethanol production declined to a four-week low 983 MB/D the week ending January 22, as manufacturing margins were the poorest since 2013. Ethanol inventories, however, built for the tenth time in twelve weeks, rising by 533 thousand barrels to a three-year high 21.9 million barrels.

Deterioration of Russia’s Reserve Fund Signals Trouble Ahead

Russia’s Reserve Fund, which helps cover federal budget deficits, deteriorated rapidly in recent months, falling by nearly 30% in the final quarter of 2015. But despite mounting economic pressures on the Russian government, domestic oil producers have flourished. A favorable tax structure and currency depreciation insulated Russian producers from weak oil prices over the past year. PIRA expects this momentum to carry into 2016. But the Russian government, which shouldered the burden of collapsing oil prices (along with consumers), may be running out of policy options. Collectively, these economic pressures are casting a shadow over our 2017 outlook.

Financial Stress Elevated

Financial stress remains elevated. The S&P 500 declined for the third straight week on a weekly average basis, though it was higher Friday-to-Friday. The other key indicators such as VIX, high yield debt (HYG) and emerging market debt (EMB) also continue to weaken. Total commodities continue to decline, and the U.S. dollar continues to generally strengthen.

Fracking Policy Monitor

Federal focus has moved to making sure already announced regulations are finalized and implemented. Regulation of activity on federal lands (fracking, methane emissions, changes to leasing) are expected to have limited impact on overall production volumes. Oklahoma legislators may soon be forced to address the impact of wastewater disposal. North Dakota continues to be responsive to industry concerns, relaxing regulations where production or profits are threatened. Limits on local control remain a key issue in Colorado where the state’s Supreme Court, new regulations, and submitted ballot initiatives will all soon collide.

Tepid Price Recovery Points to 2015 Weakness Transitioning to Even Weaker 2016

Over the past several months, Canadian dry gas production has been hammered by stiff competition in its traditional export markets, compounded by an extremely slow start to the traditional withdrawal season. Compared to the prior year, 4Q15 production declined, expanding the year-on-year losses experienced during the third quarter. More recently, a shift to colder temperatures across the U.S. and Canada seems to have alleviated fears of a record El Niño event, although PIRA still projects a milder-than-normal winter. The colder weather seems to have reinvigorated Canadian exports to the U.S. in the short term, but year-on-year production losses are expected to continue into 1Q16.

U.S. Ethanol Prices Rise/Margins Fall

Reversing a downward trend that pushed prices to a ten-week low the week ending January 22, ethanol prices rebounded driven by higher feedstock cost. Manufacturing margins declined as rising corn values overshadowed the increase in product assessments.

Global Equities Rebound

Global equities generally posted a positive week. In the U.S., energy and technology posted the strongest gains as energy prices staged a rally from multi-year lows. The banking and industrial tracking indices declined. Internationally, all the tracking indices posted gains. Emerging markets, BRICs, and China were the strongest. In the first three weeks of the New Year, global markets have declined about 8%.

Japanese Crude Runs Ease, Imports Fell and Stocks Drew

Crude runs eased fractionally, and implied imports fell back, such that stocks drew 0.92 MMBbls. Despite generally higher demand, finished product stocks rose 1.87 MMBbls. Refining margins remain strong, though they softened a bit on the week due to easing in all the cracks other than fuel oil. Other than middle distillates, all the cracks remain statistically strong.

Iran Cuts Gas Price for Petrochemical Producers

Iran's Oil Ministry cut the price of methane/ethane mix fed to the petrochemical industry by 38.5% on Saturday, sending most petrochemical stocks up. The price cut will boost petrochemical profits, though some industry managers say the pricing is still uncompetitive, putting Iran's sanctions-battered petrochemicals at a disadvantage vis–à–vis their foreign rivals, especially those in the Persian Gulf periphery.

Constructive Data from China, and Dovish Message from ECB

Recent Chinese data had a broadly constructive tone. Economic expansion remained solid, while receiving more contributions from the service sector. The labor market, meanwhile, generated a large number of new jobs. Some data were disappointing, however: the housing sector, for example, experienced a serious setback. The European Central Bank’s policy statements helped stabilize sentiments in financial markets. Global leading indicators for manufacturing remained weak.

Low Crude Price Impacting Non-Shale Lower 48 Production

PIRA estimates Lower 48 non-shale crude and condensate production decreased significantly through the course of 2015 primarily due to less drilling activity and less maintenance on base production. PIRA expects further declines in 2016 as drilling activity continues to decrease with depressed oil prices but does not expect material losses in stripper well production (a subset of non-shale Lower 48 production).

Iran Exports Increase Post Sanctions – Where Will They Go?

PIRA expects that Iranian production will increase by roughly 500 MB/D over the next couple of months. Although NIOC will try to quickly recover their former market export volumes into Europe that will initially be hindered by logistical and commercial issues. In addition, Iran will increase exports by drawing down some of their floating inventory, largely sour condensates, which are more likely to be placed into Asia. This all points to more initial incremental exports likely heading to Asia followed by a slower return to Europe.

Up, but Risk Premiums are Almost Gone, Will Storages Turn Off?

Absent the move up along with oil on Friday, European gas prices have been weakening in the face of quite a bit of added demand from power and heating. If a commodity is acting bearish to bullish factors, how can we expect gas to rise any time soon? The answer is sustainability. Pockets of short-term demand growth will not be enough to reverse course on spot prices. It's not exactly an issue of "too little too late;" at this point it's simply too little. Downward pressure on spot gas will remain due to emerging supply, economic uncertainty, and a lack of duration in weather-based increases in gas demand relative to a comfortable storage situation and relatively strong accessibility to gas imports.

Mild February Weather Forecasts Sustain Bearish Concerns

While Thursday’s pull from storage was the highest thus far this heating seating, it did fall below expectations in the mid-to-high 180s leading to an initial ~10¢ pullback of the nearby month NYMEX contract. Yet, the ~$2.14 settlement price (up ~2¢ D/D) underscored the resiliency of gas futures since the last week’s striking downturn. The explanation appears to reflect the market already pricing in prospects for mild February weather, the strength of HH daily cash prices, and growing expectations for tighter post-winter gas balances.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Companies serving the offshore energy sector must accept that crude oil prices are not going to bounce back anytime soon and look to diversify into other market areas in the same way the commercial shipping industry does when high crude oil prices squeeze its profit margins.

Companies serving the offshore energy sector must accept that crude oil prices are not going to bounce back anytime soon and look to diversify into other market areas in the same way the commercial shipping industry does when high crude oil prices squeeze its profit margins. This week, we look at some of the key takeaways from an event held last Thursday in London, hosted by the Society of Underwater Technology. Douglas-Westwood (DW) presented its outlook for the offshore energy sector, including outputs from its latest, soon to be published studies, in the context of a highly-turbulent start to the year that saw oil prices on the day of $27/bbl.

This week, we look at some of the key takeaways from an event held last Thursday in London, hosted by the Society of Underwater Technology. Douglas-Westwood (DW) presented its outlook for the offshore energy sector, including outputs from its latest, soon to be published studies, in the context of a highly-turbulent start to the year that saw oil prices on the day of $27/bbl. The second edition of Seawork Asia will open its doors 29 November in Shanghai. It is the fastest growing commercial marine and workboat exhibition in the East Asian region, located at the heart of this fast growing industry sector.

The second edition of Seawork Asia will open its doors 29 November in Shanghai. It is the fastest growing commercial marine and workboat exhibition in the East Asian region, located at the heart of this fast growing industry sector. The JIP will develop a set of guidelines to be incorporated into DNV GL

The JIP will develop a set of guidelines to be incorporated into DNV GL A desire to capitalize on distressed situations, grow international market share and acquire new technology will drive a surge in M&A activity in the oilfield services sector during 2016, according to major new research from international law firm

A desire to capitalize on distressed situations, grow international market share and acquire new technology will drive a surge in M&A activity in the oilfield services sector during 2016, according to major new research from international law firm  Seatronics, an Acteon company, is the first to sign up to enhanced accreditation as a supplier of third party calibrations to the ROV and survey communities, globally. The enhanced accreditation is provided by

Seatronics, an Acteon company, is the first to sign up to enhanced accreditation as a supplier of third party calibrations to the ROV and survey communities, globally. The enhanced accreditation is provided by  InterMoor, an Acteon company, has appointed Folabi Bolatiwa (photo) as general manager in Nigeria. Bolatiwa will be responsible for overseeing the company’s continued growth in the region.

InterMoor, an Acteon company, has appointed Folabi Bolatiwa (photo) as general manager in Nigeria. Bolatiwa will be responsible for overseeing the company’s continued growth in the region. Tidewater Subsea charters the Jones Act compliant MV

Tidewater Subsea charters the Jones Act compliant MV  A new research report published by

A new research report published by  Aker Solutions

Aker Solutions Harding

Harding Jez Averty, senior vice president for NCS exploration in Statoil. (Photo: Ivar Langvik)

Jez Averty, senior vice president for NCS exploration in Statoil. (Photo: Ivar Langvik) NYC-based

NYC-based  Churchill Drilling Tools

Churchill Drilling Tools Taranaki Sunset Oil Rig

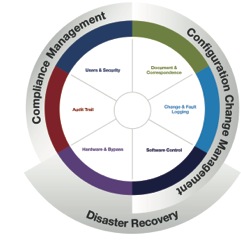

Taranaki Sunset Oil Rig Asset Guardian Solutions Ltd (AGSL)

Asset Guardian Solutions Ltd (AGSL)