NYC-based PIRA Energy Group reports that Asia continues to drive global oil demand growth. In the U.S., product stocks drew. In Japan, crude runs are little changed; imports fell and stocks drew. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group reports that Asia continues to drive global oil demand growth. In the U.S., product stocks drew. In Japan, crude runs are little changed; imports fell and stocks drew. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

Asia Continues to Drive Global Oil Demand Growth

Oil markets remain structurally weak for the near term due to turnarounds and as Iranian crude oil exports increase and will take time to rebalance. Asia continues to drive global oil demand growth despite the economic slowdown in China. Asian refinery runs will increase this year with capacity expansions and higher runs in Chinese “tea kettle” refineries. Gasoline cracks will continue to outperform diesel cracks this year.

Gas Prices Collapse Underweight of Outsized Storage Inventories

After briefly breeching the former low set in late December, the NYMEX nearby contract went off the board at ~$1.71/MMBtu — setting the stage for a March Henry Hub Bidweek price that will be ~50¢ below February and also marking a low for the benchmark not seen since March 1999. Much is riding on the demand and supply response to such prices considering the fallout on U.S. and Canadian storage tied to the collapse in heating loads during February. The South Central will account for ~50% of this month’s overall expansion in the year-on-year U.S. storage surplus. The resulting end-February overhang is clearly an impediment standing in the way of a near-term price recovery, especially after considering the South’s increased exposure to Appalachia supply tied to pipeline capacity additions between the regions. Still, given the lack of any draw last March, that surplus is likely to start to contract. Moreover, the acute price weakness now in effect also stands to accelerate U.S. production weakness — even in Appalachian.

February Blows Warm and Is Gone with the Wind

German forward prices are no longer allowing the most efficient coal units to fully recover their fuel, transportation, and carbon costs. Hedging strategies are in part to blame, as power generators continue to sell to secure cash. French prices are more likely to firm, as France will see a heavier nuclear outage schedule this year, while draconian cost cutting measures will undermine nuclear output. Italian prices have been undermined by improving hydro (not only in Italy itself, but also Alpine region) and higher imports from both France and Switzerland. 3Q contract is trading with a €2-3/MWh risk premium.

Coal Pricing Mixed Despite Stronger Oil Market

A general increase in oil pricing helped give the coal market an uplift, although API#2 (Northwest Europe) prices actually lost ground last week. API#2 gave back some, but not all, of the sizeable gains made last week when the market surged on labor strike risk from Colombia. In the Pacific, some signs of stabilization in China’s buying activity along with the rise in oil prices allowed API#4 (South Africa) and FOB Newcastle (Australia) to rise modestly. PIRA continues to believe that API#4 prices remain too strong relative to FOB Newcastle, and we expect more downside for API#4 over the next 90 days, barring unforeseen supply disruptions.

California Carbon Auctions Undersubscribed

With CA/QC allowance prices having fallen below the auction floor in the secondary market, auction results released today indicate both the current and future vintage auctions were undersubscribed — a first for California. Demand was more than sufficient to allow for the sale of all allowances consigned to auction on behalf of CA entities. Unsold allowances will be offered at future auctions — generally when/if auction pricing exceeds the reserve price for two consecutive auctions.

Production Rises, But Stocks Fall

U.S. ethanol production has increased for three consecutive weeks, reaching 994 MB/D, the fifth highest level ever reported. Ethanol inventories dropped from a record high in the previous week, falling by 113 thousand barrels to 23.1 million barrels.

Pressure Continues

Late Friday afternoon saw the wheat short set a record in one COT category while Nidera registered 227 new certificates for delivery against the March soybean contract. No wonder that SRW made a new low last week while soybeans had five losing days in a row.

Currency Depreciation Offsetting Some, But Not All, of the Consumer Benefit of Low Crude Prices

PIRA’s analysis of retail fuel prices around the world shows that the decline in fuel prices is not keeping pace with that of Brent. On a demand-weighted average basis, we estimate that global gasoline and diesel prices are down 40% from July 2014 to January 2016 in U.S. dollar terms, compared to Brent’s 70% fall. Part of the discrepancy can be attributed to subsidy and pricing reforms, fixed taxes, relatively stable downstream margins, and tight gasoline supplies in some locations. But currency depreciation is also having a notable impact. Gasoline and diesel prices in local currency terms are down less than 30% over the period. We estimate that currency weakness versus the dollar is offsetting roughly a third of the price benefit of low crude prices for local consumers. Even so, realized fuel price declines are still substantial and, in our view, will continue to support global oil demand this year.

Financial Stress Eases

Financial stresses eased again this past week. For the second straight week, the S&P 500 rose Friday-to-Friday and on a weekly average basis. All of the other indicators, such as volatility, high yield debt and emerging market debt, also staged varying degrees of improvement. The U.S. dollar has been increasingly mixed. Debate on a U.K. withdrawal from the EU has fed weakness in sterling. Commodities ex-energy are looking significantly better the last several weeks.

Gasoline Cracks Will Strengthen, But Not as Strongly as in 2015

Growing crude stocks continue to weigh on Brent structure for next few months, but fundamentals are starting to improve. Gasoline strength will return and will outperform diesel, partially echoing 2015. Product stock levels grow, but not uniformly as refiners shift yields from middle distillates toward gasoline. Refining margins will recover from recent decline and stay generally healthy, and runs stay reasonably high through the summer before weakening.

North American Gas Forecast Monthly

North American gas market fundamentals have assumed a much less bullish posture, starting with an end-March storage carryout now expected to be within striking distance of 2.3 TCF, ~0.2 TCF above our month-earlier Reference Case. A collapse of February gas-weighted heating degree days relative to normal was the principal cause, but other factors have played a role. Production, led by Appalachian Basin, has made a strong recovery of late, fostering doubts about a near-term Lower 48 rollover. PIRA’s Reference Case sees limited marketing opportunities and capital spending, making the region’s growth prospects even more vulnerable. Sequentially stronger western Canadian gas production of late, coupled with unusually flush inventories, also poses a greater perceived supply side threat to tighter U.S. gas balances.

European LPG Prices Pulled Higher by Broader Markets

European LPG prices firmed, but mostly due to the strength in crude and naphtha prices and not as a result of a tightening supply and demand situation. The region remains well supplied, particularly as larger fully refrigerated cargoes are now loading in Marcus Hook, Pennsylvania, and will be increasingly pointed at the region due to proximity. March propane futures added $22/MT to $256/MT, while cash butane cargoes were called a somewhat narrow $20 higher.

Outlook Forum Mission Accomplished

On paper, the USDA was able to keep carry-outs below 2 billion, 500 million, and 1 billion, its goal going into the Outlook Forum. The questions remains, however, can it last? Without a major weather disruption during the upcoming growing season, prospects for a price recovery seem bleak.

U.S. Ethanol Prices Increase

Ethanol prices rose last week despite record inventories. Manufacturing margins were steady and sufficient for most plants to operate at high rates.

Global Equities Post Another Positive Week

Global equities posted a second straight week of gains, rising 1.1%. The Americas continue to outperform. In the U.S, almost all the tracking indices were higher on the week. Retail, housing and materials all outperformed, while utilities lagged and were neutral on the week. Internationally, the tracking indices were more mixed. Japan, Latin America, and BRICs all outperformed.

Dry Bulk Shipping Market in Crisis Mode

Last month, we discussed the unprecedented collapse in dry bulk freight rates highlighting the breadth, speed, and extent of the rate declines. It is much the same story this month. Hopes that the Chinese, on returning to work after their Lunar New Year holidays, would provide some market momentum have been all but dashed. While Chinese economic data have been delayed by the holidays, the dry bulk freight market has provided its own measure on China’s faltering physical demand for raw materials and it remains ugly. As hopes of a demand-led shipping recovery dwindle, the focus is shifting to supply-side responses. The sheer scale of the dry bulk shipping crisis is starting to have some significant consequences.

U.S. Commercial Stocks Draw

Strong product demand was reflected in a product stocks draw for the week of February 19, while lower crude runs contributed to a crude stock build. This build in crude stocks occurred in spite of mounting evidence that the pace of declines in domestic crude supply has quickened. Gasoline production has begun to transition to a lower RVP content, and this will be reflected by lower butane use and lower gasoline yield. Next week we expect flat crude runs to contribute to another crude stock build, but low runs also contribute to product stock draws.

The Tug of Oil and the Weight of Supply/Demand

Gas is continuing its search for demand as it sets to enter the last month of the winter. February has been another warm month across major gas-consuming markets in Europe. Temperatures are up significantly over last month and are quite high historically.

California Allowances Can Be a Source of Cash for Challenged Oil Producers

California carbon allowance prices dropped dramatically, crashing through the auction floor, indicating expectations that the current vintage auction was undersubscribed — a first for CA. Environmental commodity markets well beyond California have also been sliding over the past two months. For California carbon, financially challenged oil producers that receive free allowance allocations but do not face immediate allowance surrender requirements could sell allowances to raise cash, in turn boosting near-term supply — a phenomenon observed in the EU ETS in the past.

Japanese Crude Runs Little Changed; Imports Fell and Stocks Drew

Crude runs showed very little change for the second straight week. Imports fell back and stocks posted a draw. Finished product stocks drew due to declines in naphtha, fuel oil, and jet-kero more than offsetting lesser builds in gasoline and gasoil. Demands were broadly lower and considered soft. Margins continued to weaken, extending their decline from peak December levels.

The U.S. Is Better, but It Can’t Carry the World Economy Alone

U.S. economic growth is picking up pace, powered by strengthening consumer spending. GDP growth for the fourth quarter was revised up, and households significantly increased their spending during January. Manufacturing-related activity data (such as industrial production and durable goods orders) were constructive in January. But based on a historical pattern, the U.S. strength is probably not sufficient by itself to lift the slumping global manufacturing sector. Important economic events pack the calendar for the next few weeks.

U.S. Exports Debut Amid Unstable Arbitrage Outlook

The recent plunge in Henry Hub prices, combined with some support for NBP prices at current levels, has made this U.S.-Europe trade look quite appealing — so appealing that it is hard to make a case for the U.S. LNG to go anywhere else other than to South America, which is typically looking at paying the netback equivalent that would be captured by sending the cargos to Europe. Europe also has several buyers in the Mediterranean gauging the relative value of LNG versus oil-indexed prices.

Gulf of Mexico Production to Demonstrate Short-Term Resilience, Medium-Term Weakness

Gulf of Mexico crude production has grown at a 7% CAGR since 2012 and is expected to continue to grow at this pace until 2017. The resilience is the result of the ramp-up of recent projects and the start-up of new projects already under construction. However, low prices will have medium-term impacts as project sanctioning has slowed, causing few projects to come online in the 2018-2020 period. PIRA expects GOM crude production to grow from 1,550 MB/D in 2015 to 1,800 MB/D in 2017, then decline by 200 MB/D to 1,600 MB/D in 2020. Longer term, we expect production to breach its 2017 highs by 2023 as projects currently in the appraisal/definition stage come online.

Supply Growth Becomes Increasingly Unaffordable

While March signals the approaching official end of the heating season, the dearth of degree days in February has seemingly convinced the market that the winter has already concluded — given the improbability of clearing excess seasonal inventories. Thursday’s extraordinarily light 117 BCF draw, relative to expectations pinned ~20 BCF higher, likely represents the final triple-digit draw of the season. The fundamentals for the week-in-progress suggest that withdrawals have plummeted to a historically bearish seasonal level in the low-30s, with only three other sub-40 weekly readings ever recorded in February (1995, 2006 and 2009). Thereafter, milder weather and the transition to spring will significantly limit the call on storage through end March.

Oil Substitution Re-Enters the Debate as U.S. LNG Turns South Before East

PIRA sees every reason for the deterioration of bids in Asian spot markets to continue in the month ahead. Regional gas markets will be entering the lowest period of the year for seasonal gas demand and, additional LNG supply from Gladstone, APLNG, and Gorgon is scheduled to emerge from Australia alone. Buyers may not be in too much of a hurry to lock down spot volumes given the circumstances and the position of buyers to lift more contract LNG as the new trains emerge.

Russia and Turkey’s Gas Price Dispute Leaves Gas Flows Lower

Russian Gazprom reduced daily natural gas supplies to Turkey by around 50% from Feb. 10 along the western line. The company decided to reduce its natural gas flow after a price dispute with private buyers in Turkey. Earlier it was reported that Gazprom, which was in discussions with six Turkish private companies on Jan. 29, cancelled the 10.25% discount applied on natural gas supplies from Gazprom from Jan. 1 this year.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets. To read PIRA’s Market Recap first, subscribe to PIRA Perspectives here.

Seatronics

Seatronics The Brave Tern, a vessel used for the installation of wind turbines at sea, dominated the Rotterdam skyline on February 23rd. The 132 meter long ship was jacked up to a height of about seventy meters to test its extended legs.

The Brave Tern, a vessel used for the installation of wind turbines at sea, dominated the Rotterdam skyline on February 23rd. The 132 meter long ship was jacked up to a height of about seventy meters to test its extended legs. Fugro has been awarded an inspection, repair and maintenance (IRM) contract by Petrobras in Brazil.

Fugro has been awarded an inspection, repair and maintenance (IRM) contract by Petrobras in Brazil.

The exploration rig Deepsea Atlantic. (Credit: Statoil. Photo: Marit Hommedal)

The exploration rig Deepsea Atlantic. (Credit: Statoil. Photo: Marit Hommedal) Total E&P UK’s Elgin - Franklin development in the North Sea

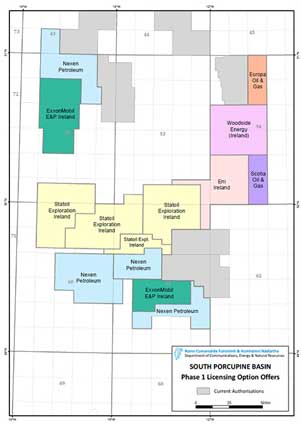

Total E&P UK’s Elgin - Franklin development in the North Sea Statoil Exploration (Ireland) Limited has been awarded six Licensing Options in Ireland’s 2015 Atlantic Margin Licensing Round.

Statoil Exploration (Ireland) Limited has been awarded six Licensing Options in Ireland’s 2015 Atlantic Margin Licensing Round. Sentinel manufactured Rudder Feedback Unit.

Sentinel manufactured Rudder Feedback Unit. Global inspection, repair, maintenance (IRM) and light construction company

Global inspection, repair, maintenance (IRM) and light construction company  Gibdock has confirmed its role as one of the offshore industry’s pre-eminent shiprepair and conversion yards through its selection for the afloat mobilization of Seajacks Scylla, the largest and most advanced windfarm installation jack-up ever built.

Gibdock has confirmed its role as one of the offshore industry’s pre-eminent shiprepair and conversion yards through its selection for the afloat mobilization of Seajacks Scylla, the largest and most advanced windfarm installation jack-up ever built. Subsea 7 S.A.

Subsea 7 S.A. NYC-based

NYC-based  Situated approximately 80 kilometres off the east coast of Trinidad and Tobago, this unmanned gas platform holds a special place in one major oil operator’s family. Since it went into production in 2009, it has become one of the largest net producers of natural gas in the operator’s global portfolio.

Situated approximately 80 kilometres off the east coast of Trinidad and Tobago, this unmanned gas platform holds a special place in one major oil operator’s family. Since it went into production in 2009, it has become one of the largest net producers of natural gas in the operator’s global portfolio. Falck Safety Services

Falck Safety Services Offshore worker with drone

Offshore worker with drone Saudi Arabia and Russia agreed to freeze production at January levels on February 16th in the first coordinated effort to stabilize prices for 15 years. Expectations of an output cut were rife in the days leading up to the meeting in Doha, with Brent gaining 10.9% on February 12th. However, traders were left disappointed, given January’s near-record production levels and any output freeze contingent on other producers following suit. Consequently, there has been little change in day-to-day commodity price volatility.

Saudi Arabia and Russia agreed to freeze production at January levels on February 16th in the first coordinated effort to stabilize prices for 15 years. Expectations of an output cut were rife in the days leading up to the meeting in Doha, with Brent gaining 10.9% on February 12th. However, traders were left disappointed, given January’s near-record production levels and any output freeze contingent on other producers following suit. Consequently, there has been little change in day-to-day commodity price volatility.