WASHINGTON, D.C., August 18, 2014 – Platts – Surging U.S. oil production is sending ripples through the crude oil market -- in prices, trade flows and the downstream, the International Energy Agency's (IEA) top oil official said Sunday on Platts Energy Week.

WASHINGTON, D.C., August 18, 2014 – Platts – Surging U.S. oil production is sending ripples through the crude oil market -- in prices, trade flows and the downstream, the International Energy Agency's (IEA) top oil official said Sunday on Platts Energy Week.

U.S. production is expected to reach 8.5 million barrels per day (b/d) this year and 9.3 million b/d in 2015, almost double 2008's output of 5 million b/d, said Antoine Halff, the head of the IEA's oil industry & markets division.

"On prices, the surge in production has really offset the production [loss] we've experienced in places like Libya, Iran, and so on," he said. "So that's why prices have not risen more than they have. They've been fairly stable, remarkably stable, given all the turmoil in the Middle East and elsewhere."

Crude oil that had been imported into the U.S. can now be imported by other countries, Halff said.

"There's been a tremendous remapping of the oil trade flows, if you like," he said. "And now Asia is supposed to really become the magnet for global crude traded internationally. That's a big change. China is now importing more crude than the U.S., for instance."

Downstream, new refineries under development in the U.S., increased refinery runs and the installation of more and more modern processing units, have resulted in a surge in output of U.S. product exports, Halff said.

"In U.S. refining, it's really been a revolution in a way," he said. "But these changes have taken place against a background of changes elsewhere as well for other reasons. Rapid growth in refining capacity in the Middle East, in India, in China, and so on."

Upstream, about 60% of the Organization of Petroleum Exporting Countries’ (OPEC) incremental capacity growth over the next five years is supposed to come from Iraq, the cartel's second-largest producer, according to the IEA. But that growth is "seriously at risk" because of the uncertainty and political strife in Iraq, Halff said.

"We have to wait and see," he said. "We took down our forecast of Iraqi production even before the surge in violence started earlier last month. So we've reduced our forecast of Iraqi production for the next five years by about half a million barrels."

The forecast does not take into account jihadist group Islamic State's campaign in Iraq, but "reflects other problems that Iraq has -- red tape, corruption, bottlenecks, lack of infrastructure, and so on," Halff said.

Should the expected Iraqi output not materialize, Saudi Arabia could step in, Halff said, but noted the country's current plans for capacity development likely won't result in higher net capacity for OPEC's largest producer, Halff said.

"What we've seen, our assessment of Saudi plans at this point, is that all the new capacity that will come online will essentially replace capacity that's being mothballed or that's being allowed to rest," he said. "But if Saudi chose to increase capacity, it would be able to do so."

While the IEA sees "some growth" in the United Arab Emirates, "elsewhere in OPEC we see problems," Halff said. "We see flat production growth. Or we see even declines in places like Algeria and Kuwait."

The "real game changer" has been oil production from shale reserves, starting with the U.S., Halff said.

"I think the shale revolution could not have happened anywhere else than in the U.S.," he said. "It's no accident that this happened in the U.S. Because the U.S. has a unique combination of assets, not only geological resources, but also business culture, enterprising spirit, infrastructure in place, a lot of technological know-how, skilled labor, the right environmental structure, the right investment climate. All these factors could not be found in the same combination in any other country.

"But there's nothing that prevents other countries now that the technology has been developed to adopt it and to try to replicate the success of the U.S.," he continued.

"Chief among them is Canada, of course," Halff said. "Mexico is a candidate. But [that would] probably be more in the next decade than in the next five years. We see a little bit of growth in the next five years. But not so much. We see more growth probably in Argentina, more growth in Russia and probably a little bit of growth in Australia towards the end of the decade."

The IEA sees U.S. crude oil production hitting a plateau over the next five to seven years, Halff said, adding that the surge in U.S. production is not going to be the answer to the world's energy needs.

"There's a need for investment in OPEC," he said. "There's a need for investment in the Middle East. So there's no room for complacency. This surge in production is phenomenal. It's a game-changer in many ways. But that doesn't mean that we don't need the traditional suppliers anymore. We need them very much."

Other Program Highlights

Also on the program, Katherine Hammack, the U.S. Army’s assistant secretary for installations, energy and environment, joined the program for an extended discussion on the dramatic transformation of the U.S. Army's energy consumption. View part 1 here and part 2 here.

During Sunday’s “Market Spotlight” segment, Platts Senior Managing Editor Richard Capuchino Jr. discussed the growing popularity of Vasconia, one of Colombia’s top-exported crude oil grades.

Platts Energy Week airs at 8 a.m. U.S. Eastern time Sunday mornings on WUSA9 in greater Washington, D.C., and in Houston on KUHT, a PBS affiliate, as well as on other PBS stations in cities throughout the U.S., including Anchorage, Billings, Houston, Juneau, Las Vegas, Minneapolis, San Francisco, Raleigh and Wichita. For online viewing, the program is accessible at www.plattstv.com.

The program features interviews with leading figures from government, industry, markets, think tanks and the financial community. Host Bill Loveless is an editorial director at Platts who brings 30 years of energy journalism experience to the anchor chair. The program also features veteran energy news editor and Platts Energy Week Senior Correspondent Chris Newkumet.

Platts Energy Week is produced by Platts, the world’s leading source of information and intelligence on energy and related commodities and a division of McGraw Hill Financial [NYSE: MHFI] and WUSA TV, the Washington, D.C., CBS affiliate and flagship television station of Gannett Company. [NYSE: GCI]. While the program is U.S. focused and produced in Washington, it reflects the global vantage point of Platts, whose correspondents are stationed in such major capitals as London, Dubai, Singapore, Tokyo and Moscow.

Guest booking for Platts Energy Week and related inquiries should be addressed to this email: This email address is being protected from spambots. You need JavaScript enabled to view it.. Additional information about Platts and the energy sector can be found at www.platts.com.

The Bureau of Ocean Energy Management (BOEM) issued an Advanced Notice of Proposed Rulemaking (ANPR) on Risk Management, Financial Assurance, and Loss Prevention to seek public input as it considers modernizing its risk management program and bonding regulations for offshore oil and gas operations on the Outer Continental Shelf. This first step initiates a dialogue about BOEM’s existing regulations, which are approximately 20 years old and have not kept pace with offshore infrastructure developments, including deepwater operations, current industry practices, and the growing costs of decommissioning.

The Bureau of Ocean Energy Management (BOEM) issued an Advanced Notice of Proposed Rulemaking (ANPR) on Risk Management, Financial Assurance, and Loss Prevention to seek public input as it considers modernizing its risk management program and bonding regulations for offshore oil and gas operations on the Outer Continental Shelf. This first step initiates a dialogue about BOEM’s existing regulations, which are approximately 20 years old and have not kept pace with offshore infrastructure developments, including deepwater operations, current industry practices, and the growing costs of decommissioning. HOUSTON (Aug. 6, 2014) – Artificial Lift Company (ALC) has changed its name to

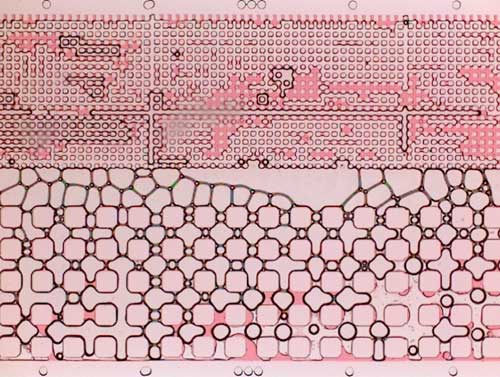

HOUSTON (Aug. 6, 2014) – Artificial Lift Company (ALC) has changed its name to  Foam sent through a microfluidic model created at Rice University shows its ability to remove oil (pink) from low-permeability formations. Rice scientists conducted experiments to see how foam would compare with water, gas or combinations of the two for use in enhanced oil recovery. (Credit: Biswal Lab/Rice University)

Foam sent through a microfluidic model created at Rice University shows its ability to remove oil (pink) from low-permeability formations. Rice scientists conducted experiments to see how foam would compare with water, gas or combinations of the two for use in enhanced oil recovery. (Credit: Biswal Lab/Rice University)

WASHINGTON, D.C., August 18, 2014 –

WASHINGTON, D.C., August 18, 2014 –  Multiple contracts awarded with a total value of approx. NOK 830 million.

Multiple contracts awarded with a total value of approx. NOK 830 million.

2H Offshore,

2H Offshore, Hoover Container SEA SDN BHS, a subsidiary of Hoover Group, Inc., has opened a new regional distribution center in Port Klang, Selangor, Malaysia, and relocated its Southeast Asia (SEA) office to Petaling Jaya, Selangor, Malaysia.

Hoover Container SEA SDN BHS, a subsidiary of Hoover Group, Inc., has opened a new regional distribution center in Port Klang, Selangor, Malaysia, and relocated its Southeast Asia (SEA) office to Petaling Jaya, Selangor, Malaysia.

Woods Hole Group

Woods Hole Group Recent news headlines on the LNG sector in Australia seem to be centered around its unsustainable rising costs. Woodside Petroleum had to ditch plans last year for its Browse LNG plant, which had gone way over budget at an estimated cost of US$80bn. In the interest of continuing the development, Woodside and its partners have now turned to FLNG vessels as a practicable alternative. More recently, Santos and GDF Suez have also scrapped plans to build gas plants off the Northern Territory Coast of Australia. Projects that have gone ahead have seen significantly increased costs. At approximately 80% completion, the Gorgon LNG project is now estimated to cost US$54bn – a sharp contrast to the original budget of US$37bn (46% over-budget).

Recent news headlines on the LNG sector in Australia seem to be centered around its unsustainable rising costs. Woodside Petroleum had to ditch plans last year for its Browse LNG plant, which had gone way over budget at an estimated cost of US$80bn. In the interest of continuing the development, Woodside and its partners have now turned to FLNG vessels as a practicable alternative. More recently, Santos and GDF Suez have also scrapped plans to build gas plants off the Northern Territory Coast of Australia. Projects that have gone ahead have seen significantly increased costs. At approximately 80% completion, the Gorgon LNG project is now estimated to cost US$54bn – a sharp contrast to the original budget of US$37bn (46% over-budget). NYC-based PIRA Energy Group reports that there was the largest 2Q stock build in the last 10 years. In the U.S., there was a modest U.S. stock build. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group reports that there was the largest 2Q stock build in the last 10 years. In the U.S., there was a modest U.S. stock build. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following: The project will feature the construction of a normally unmanned platform together with corresponding subsea infrastructure, a first for

The project will feature the construction of a normally unmanned platform together with corresponding subsea infrastructure, a first for  Successful sea trials of

Successful sea trials of NYC-based

NYC-based