Final touches have been made to the Damen Walk 2 Work vessel , a completely new and innovative design for the offshore support vessel market. Damen also decided to start building the vessel on speculation, This is marked with the start of the basic and consequently detailed engineering of the vessel. The vessel will support and accommodate turbine maintenance crews at sea. Not only provides the vessel on-site work facilities and accommodation for voyages of up to one month, the vessel also comes with a helicopter platform, daughter crafts and has an 80% weather operability in the Central North Sea Area.

Final touches have been made to the Damen Walk 2 Work vessel , a completely new and innovative design for the offshore support vessel market. Damen also decided to start building the vessel on speculation, This is marked with the start of the basic and consequently detailed engineering of the vessel. The vessel will support and accommodate turbine maintenance crews at sea. Not only provides the vessel on-site work facilities and accommodation for voyages of up to one month, the vessel also comes with a helicopter platform, daughter crafts and has an 80% weather operability in the Central North Sea Area.

Since the 'E3' are becoming more and more important these days, Damen started about a year ago with the search for a way to create and design a vessel which is Environmentally-friendly, Economic viable, and Efficient in operation (E3). The key design criteria for the vessel were the result of extensive discussions Damen held with the industry. Staff retention was a growing issue in the offshore market. Therefore a fourth requirement was given: comfort for crew and its passengers.

Features

The vessel is a monohull with bridge located amidships. It has a length of 90m and a beam of 20m. The Damen WSV will feature 500m2 of deck space, approximately 400 m2 internal storage space, a helicopter platform and a motion and heave compensating crane and gangway. Its shallow draft optimizes comfort, while also conferring significant power savings.

North Sea sea state

The Walk-to-work WSV is especially designed for the North Sea area of operation. The vessel is is capable of gaining access up to 80% of the time in the worst case scenario in the Central North Sea area. This result can also be achieved when the worst single failure is occurring, a main switchboard failure, on board the vessel. This performance results in an accessibility of more than 95% in many areas were offshore wind farms are being built.

The effects of this new and innovative design are: greater turbine availability, less lost production and less direct O&M costs against a higher profitability of the wind farm. This vessel is contributing to about 25% reduction of O&M cost of an average large size wind farm.

Optimal comfort for crew and passengers

The optimal comfort for crew and passengers is determined by designing the right hull form and the right positioning of the accommodation. Damen has been able to reduce vertical and horizontal accelerations significantly. A significant reduction of accelerations has been achieved throughout the vessel up to 30% in the , accommodation. This achievement highly improves the level of comfort, safety and workability on board.

The vessel, as a result of this design effort, performs well within the motion criteria as set by the industry.

When considering noise and vibrations, bow thrusters noise emission can be mitigated, but it is relatively expensive to do so. Many of these considerations has been input for the design-phase of the vessel, resulting as well into easily complying within the industry set criteria at limited cost.

Adding up to the level of comfort is the extensive ergonomic studies carried out resulting in crew and turbine technician cabin dimensions of well above the minimum set requirements by law.

Of course the vessel has a fitness center and internet/movie services.

Optimal efficiency and economics

By extensively analyzing the flow of personnel with all their different tasks on board the vessel and the flow of spare parts and other equipment, Damen was able to map the public spaces for efficient workflows and storage.

Having an optimized design based on the right Ocean conditions results in the fact that expensive compensation systems are not needed.

The hull-form resulted in an average of 25% less installed power to reach the same speed. When considering DP operations and power output, significant less thrusters output (20%) is required because of the positioning of the accommodation. .

Damen also developed a fuel consumption tool in which total fuel consumption of the vessel in various operational conditions in a specific area can be calculated. This tool gives a good indication of what can be expected on a yearly basis given a certain operational profile.

So altogether, every effort has been made to reduce the vessels total cost of ownership.

Transfer Positioning System (TPS)

The transfer of maintenance personnel and equipment is one of performance determining functions of the entire ship. Being able to continue the work flow in the prevailing wind conditions and waves, forms the biggest challenge. The design questions are based on the selections of the components like the access systems and, the choice of the DP system, the positioning of these systems on board and a smart integration. Characteristic for these systems for crew and cargo transfer on offshore vessels is that they operate independently of the control systems for the dynamic positioning of the vessel. This innovation, the TPS, aims to increase employability by design integration and share system integration at the heart of the design.

Greene's Energy Group, LLC

Greene's Energy Group, LLC  The Bureau of Safety and Environmental Enforcement (BSEE) published an Advanced Notice of Proposed Rulemaking today in the Federal Register Reading Room soliciting public comments on improving the safety of helideck and aviation fuel operations on fixed offshore facilities. This notice is the most recent step in BSEE's continued efforts to strengthen safety on the Outer Continental Shelf (OCS).

The Bureau of Safety and Environmental Enforcement (BSEE) published an Advanced Notice of Proposed Rulemaking today in the Federal Register Reading Room soliciting public comments on improving the safety of helideck and aviation fuel operations on fixed offshore facilities. This notice is the most recent step in BSEE's continued efforts to strengthen safety on the Outer Continental Shelf (OCS).

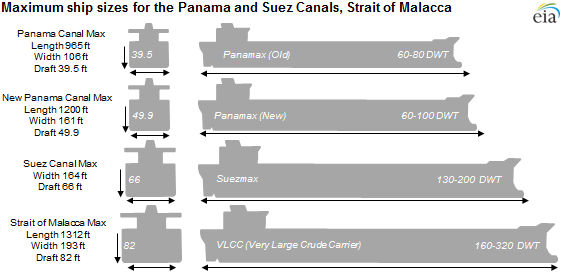

Ships carrying crude oil and petroleum products are limited by size restrictions imposed by several of the main thoroughfares of maritime navigation: the Panama Canal, the Suez Canal, and the Strait of Malacca. These size restrictions provide another way to classify the large tankers that carry most of global crude oil and petroleum product trade.

Ships carrying crude oil and petroleum products are limited by size restrictions imposed by several of the main thoroughfares of maritime navigation: the Panama Canal, the Suez Canal, and the Strait of Malacca. These size restrictions provide another way to classify the large tankers that carry most of global crude oil and petroleum product trade.

Leading oil and gas experts are lined up to present at the 20th

Leading oil and gas experts are lined up to present at the 20th  Patricia Vega is the new president and CEO of

Patricia Vega is the new president and CEO of  Illustration: The Aasta Hansteen platform will be the largest SPAR platform in the world. (Illustration: GeoGraphic / Statoil)

Illustration: The Aasta Hansteen platform will be the largest SPAR platform in the world. (Illustration: GeoGraphic / Statoil) Vard Marine

Vard Marine At present we are seeing lower oil prices as a function of softer demand growth in both Europe and China combined with recent output increases from OPEC, particularly Libya, together with the ongoing surge in US production.

At present we are seeing lower oil prices as a function of softer demand growth in both Europe and China combined with recent output increases from OPEC, particularly Libya, together with the ongoing surge in US production. Rowan Companies plc (

Rowan Companies plc ( McDermott subsea construction vessel NO102 installed umbilicals totaling 65 miles along with other related subsea structures. (Photo: Business Wire)

McDermott subsea construction vessel NO102 installed umbilicals totaling 65 miles along with other related subsea structures. (Photo: Business Wire) Final touches have been made to the Damen Walk 2 Work vessel , a completely new and innovative design for the offshore support vessel market.

Final touches have been made to the Damen Walk 2 Work vessel , a completely new and innovative design for the offshore support vessel market. NYC-based

NYC-based  Alex Imperial has taken over as

Alex Imperial has taken over as  PMI Energy Services

PMI Energy Services